Nikada/E+ via Getty Images

Note: All monetary values are in Hong Kong Dollars unless noted otherwise

The Conglomerate

Hong Kong based conglomerate, CK Hutchison Holdings Limited (OTCPK:CKHUY) has a presence in 50 countries and operates four businesses.

The Businesses

Seeking Alpha – Getty Images

Ports and Related Services: CKHUY runs 53 ports across 24 countries and also provides related services such as distribution centers, ship repair facilities and cargo and container handling, to name a few. The wingspan of this business spans Asia, Middle East, Africa, Europe, Americas and Australasia. This segment has the distinction of being the world’s leading port network.

Seeking Alpha – Getty Images

Retail: CKHUY’s subsidiary, AS Watson Group is the largest health and beauty retailer globally. It has a presence in 28 markets and has a portfolio that includes health & beauty products, supermarkets, consumer electronics, electrical appliance chains, beverages and luxury perfumeries. This segment is operational in Hong Kong and Mainland China, Asia, and Europe.

Seeking Alpha – Getty Images

Infrastructure: CKHUY has investments in energy, water transportation and household infrastructure. It also has its hands in waste management, waste-to-energy and other infrastructure related businesses. This arm operates in Hong Kong and Mainland China, United Kingdom, Europe, Australasia and North America. CKHUY’s exposure to these diverse businesses is courtesy of its majority interest in CK Infrastructure Holdings Limited, a global operator in this field.

Seeking Alpha – Getty Images

Telecommunications: CKHUY meets the mobile and wi-fi needs of over 175 million customers across Europe, Asia and its homeland.

But Wait, There is More:

CKHUY Website

These investments provide CKHUY exposure to various businesses, including, but not limited to, management, maintenance and engineering of aircrafts, manufacture and sale of household and industrial products, logistics services, biopharmaceuticals and E-commerce. A special shout out to CKHUY’s 16.69% interest in Cenovus Energy Inc. (CVE), one of our personal holdings and also one that we have covered on this platform a few times. Our last public review of it was in December of last year.

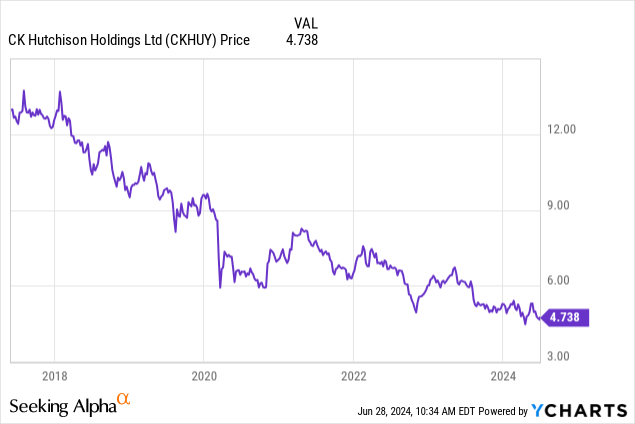

The Value Trap Chart

As a conglomerate with a long standing history, the first thing you have to notice about the stock is the slide lower.

Above is the OTC chart, but the one in Hong Kong Dollars, which goes back to 2000, is not exactly inspirational either.

Google Finance

While there has been some poor decision making by management, some of this is at least a valuation compression ride. Let’s look at that and see why we bought some today.

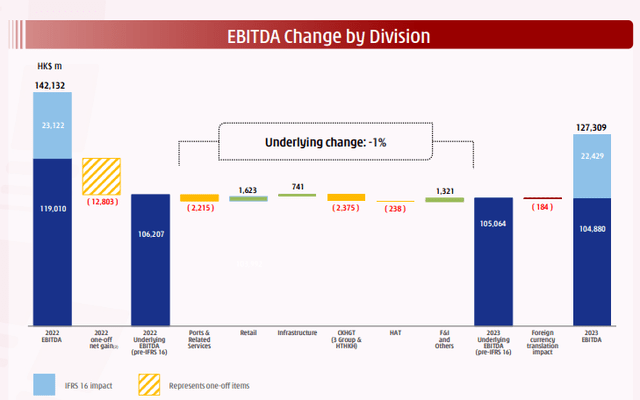

2023 Annual Numbers (all in HKD)

We will start off with their EBITDA and its change in 2023. This was fairly steady with infrastructure, retail and finance, investments & others, offsetting declines in ports & related services. You can see the dance around IFRS 16 which is a change in accounting standards related to leases.

CKHUY March 2024 Presentation

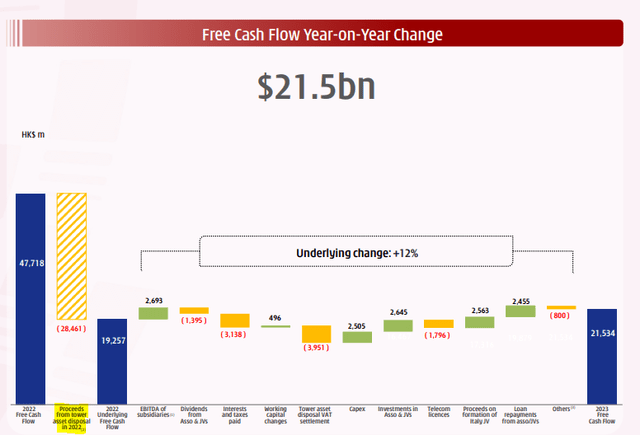

Next, we move on to the free cash flow. Two things to note here. First that there is a large delta in these numbers from the IFRS 16 impact. Second, there is a big impact from the tower asset disposal which skewed the 2022 numbers up.

CKHUY March 2024 Presentation

What we can see is that after these adjustments, underlying free cash flow was up 12% year over year. Nothing remotely here suggests there is any kind of distress. With all this cash gushing in what did CKHUY do? It reduced its debt further and strengthened its already strong balance sheet further.

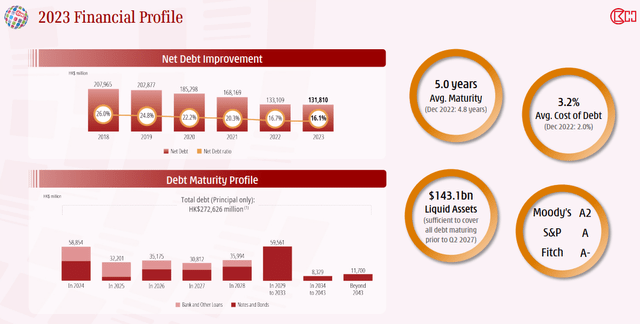

CKHUY March 2024 Presentation

There was some related commentary on this from a previous earnings call which was interesting as well.

Healthy free cash flow profiles tend to translate as they do on Slide 11, into pretty healthy financial profiles. And so, the first and most obvious positive movement was the very significant reduction in our net debt to net total capital position, which I’ve talked about, but I haven’t talked about how much gross debt was reduced. And that goes to the impact of rising interest rates, right, and it also goes to managing refinancing risks and so on. So we actually reduced gross debt by $41.7 billion, while reducing net debt by $35 billion. So this is the year where the reduction in the gross debt exposure, I think matters. So that $284.6 billion is literally $41.7 billion less than it was at the end of 2021.

Source: CKHUY Conference Call Transcript

The company did increase its dividend but it remains at a low percentage of free cash flow and a low percentage of earnings (about 40%).

Our EPS, the same 10%, obviously, and our dividend, we’ve just announced that will be increased by the same 10% that is consistent with the promises that we made in 2015 to maintain our payout ratio steady and to have dividends increase as earnings increase and also the corollary. But fortunately for 2022, we had a very healthy increase of earnings and an increase in dividends.

Source: CKHUY Conference Call Transcript

Valuation & Verdict

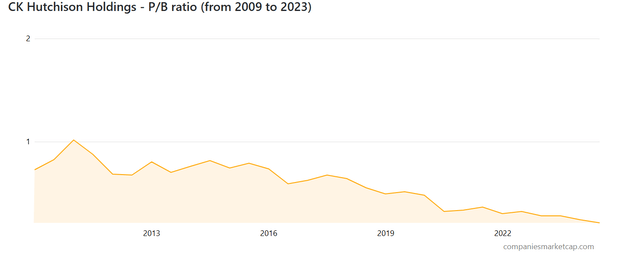

Here is the price to book value chart from 2009. The stock once traded at book value and now is at a fifth of that valuation.

Companies Market Cap

The stock is trading at a trailing P/E ratio of close to 6.0. The dividend yield is 6.8% with a payout ratio of 40%. It is fairly rare that you can get those kind of metrics on an A rated company. The credit rating also appears to be on the cusp of an upgrade. According to Fitch, EBITDAR of 3.1 or lower gets them to a higher rating.

CKHH’s ratings are supported by its business diversification by geography and segment, which provides stable cash flows and underpins its strong business profile. A solid record of conservative and prudent financial management and a coherent strategy also support the business profile.

Factors that could, individually or collectively, lead to positive rating action/upgrade:

Provided CKHH’s business profile remains unchanged:

– EBITDAR net leverage of 3.1x or less on a sustained basis; and

– Positive free cash flow after acquisitions and dividends for a sustained period.

Source: FitchThey ran 3.3X last year and with their constant debt reduction, you might see a sub 3.0X ratio.

So there is nothing fundamentally wrong here except that management is showing zero regard for the stock price. There are no serious attempts to increase it. Yes, there is that lazy dividend policy linked to the earnings, but beyond that they seem to be hunkering down further despite a phenomenal balance sheet. Ideally they could commit to buying back stock with all remaining earnings or free cash flow after dividends. That could certainly jolt this sick puppy into action. But there is really none of that taking place. The key metrics show the stock as incredibly undervalued. Some of the port and infrastructure multiples seen in today’s capital markets are quite wild and we think that area alone could justify almost the entire stock price. There have been various sum of the parts numbers, like this one, and this one, and they all suggest the stock would need to triple to come around fair value. From our perspective, this is likely to remain a value trap with a 7% yield. In fact, it could go even lower. But there is some serious upside optionality here. Looking out a decade, it seems highly probable that an investor makes at least 7% a year. For that to happen, the company would have to waste the remaining 9% of earnings yield year after year. On the upside, the stock could really fly if management decides this stock price makes no sense. We bought some at $4.85 USD and we plan to add more around $4.40 USD.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.