Andrii Yalanskyi

Written by Nick Ackerman.

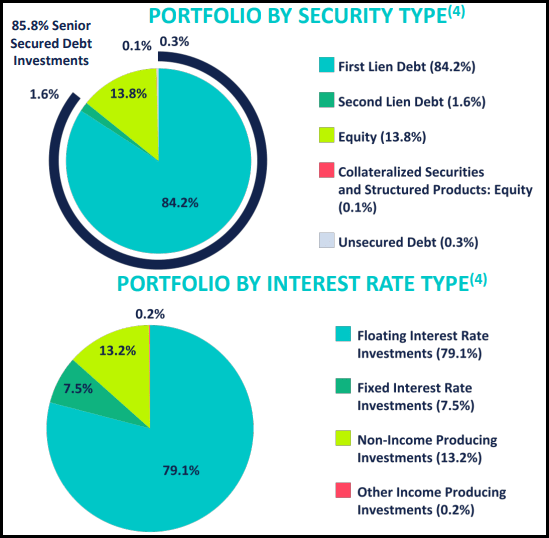

CION Investment Corp. (NYSE:CION) is a debt-focused business development company (“BDC”). They primarily focus on floating rate senior secured debt investments. They are invested across 109 portfolio companies and manage $2 billion in total assets. While they are a debt-focused BDC, it still leaves a sleeve open for some equity investments as well. They are also externally managed, which investors generally view as a negative as there can be some conflicts of interest.

CION trades at a massive discount relative to its peers and on an absolute basis. This seems to be related to going through a rather ‘rough patch’ in 2023. It also delivers a strong dividend yield of nearly 12% based on the regular quarterly dividend. Being in a position to pay some supplemental helps to juice the actual yield a bit further.

Perhaps even more importantly, besides the yield itself, the dividend coverage here leaves a lot of room for things to go wrong. In other words, the dividend coverage for this BDC is incredibly high.

Taking A Look At CION

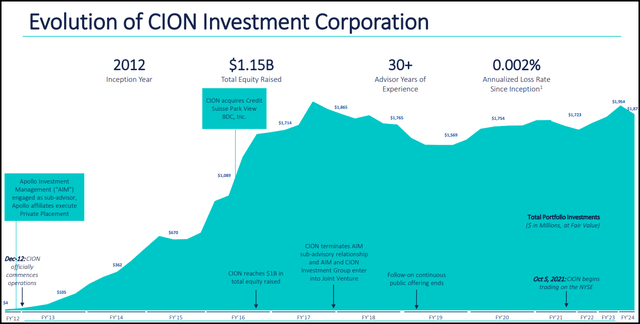

While CION may have only begun trading publicly near the end of 2021, the history here goes back much further. They started operations going back to December 2012.

CION Investment History (CION Investment)

Through the years, this BDC helped to deliver significant dividends along the way to accumulate a total of $16.01 in distributions paid out. Admittedly, returns here were partially offset by a decline in net asset value per share through this period.

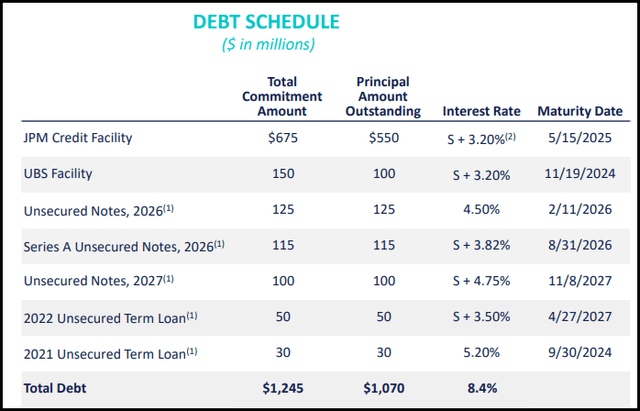

CION is a bit more unusual in that most of its leverage is based on floating rates rather than fixed rates, which most other BDCs had been able to lock in during a zero-rate environment. That meant that many BDCs were able to benefit significantly during a higher rate environment, as a meaningful portion of their borrowings were fixed at lower rates while the underlying yields started to rise. In the case of CION, it appears that of their total outstanding $1.07 billion debt at the end of Q1 2024, only about 14.5% of this was at fixed rates.

CION Leverage Stats (CION Investment)

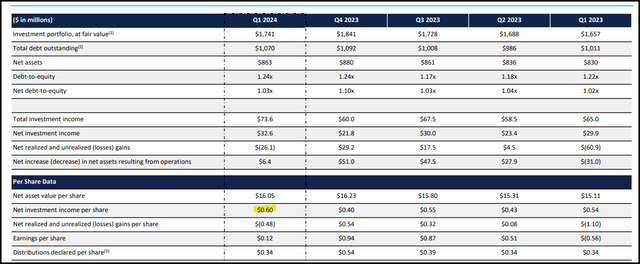

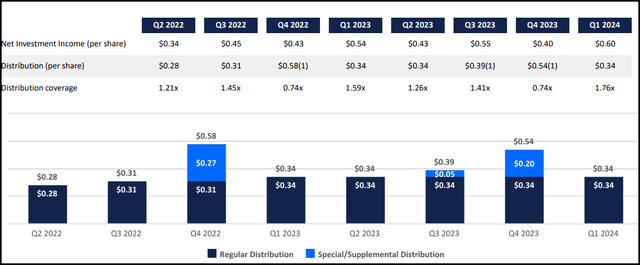

Despite that being the case, the BDC was still able to deliver some net investment income growth year-over-year. 2022 saw NII per share come in at $1.56, while 2023 saw $1.92. Perhaps even more impressively, Q1 2024 showed an even higher NII per share at $0.60.

CION Financial Highlights (CION Investment (highlight from author))

In the above, we can also see that net asset value per share has been rising materially over the last year, and that’s helped to push the name to trade at an attractive discount. The share price has not kept up with the NAV per share recovering from a year ago. On the other hand, it did decline from Q4 2023’s $16.23 based on some realized/unrealized losses.

Being able to see higher NII is thanks to the focus on a senior secured debt that comes with floating rates, primarily first lien, but they also carry a bit of equity exposure.

CION Portfolio Breakdown (CION Investment)

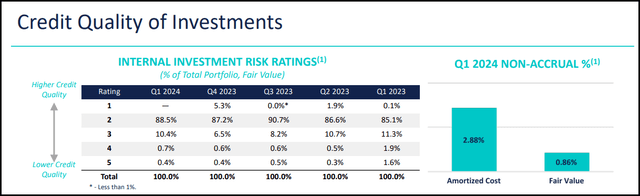

They were running into some issues with non-accruals and lower credit quality investments, but that seems to be clearing itself up.

CION Portfolio Credit Quality (CION Investment)

They provide a comparison between peers, and at least they are honest in admitting that non-accruals based on cost are above their BDC peers.

CION Non-Accruals (CION Investment)

The real question is if we are heading into a tougher economy. Currently, these watchlist names and non-accruals could be due for an increase once again. The reason is that BDCs do not lend money to companies with sterling balance sheets; they invest in companies that are less financially secure.

That’s why they are paying such high yields in the first place for these loans. That’s to balance the risk with the reward. They are the first types of companies that start to show cracks in a weaker economy, and that’s why we’ve been seeing some blowups in terms of non-accruals spiking from various BDCs over the years.

CION is one of those. If we look back at Q1 2023, they had 6.8% non-accruals on cost and 3.47% based on fair value. While they are getting over those previous mistakes previously, some suggest we could be due for some economic weakness after such a strong and resilient U.S. economy. NAV per share for CION has increased back to $16.05, but it is still down from the $16.26 Q3 2022 levels prior to its rough patch.

Of course, in Q4 2023, it came close to recovering completely when it touched $16.23. They noted that this decline was based on “unrealized mark-to-market adjustments in the equity portion of our portfolio.”

That rough patch was caused by a few different investments they had put money to work in as they discussed in Q2 2023. These were restructured and that is why the non-accruals decreased.

Our non-accruals decreased from 3.5% of fair value at 3/31/23 to 1.7% at 6/30/23. We removed Sequoia Healthcare, Independent Pet Partners and United Road from non-accrual status this quarter as we successfully utilized our secured loan positions to restructure our investments in these companies.

Big Discounts, Big Dividend Coverage

Where I believe there is some safety for CION now is in two different areas. That is the dividend coverage and the massive discount that CION sees itself trading at now.

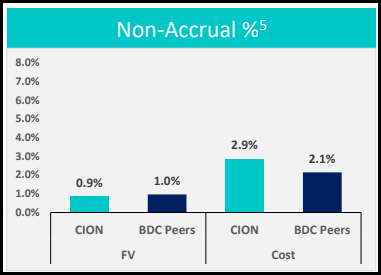

Relative to peers, CION is trading at a massive discount of nearly 25% based on the last reported NAV. As most investors who are familiar with BDCs know, they only report NAVs quarterly, and that can leave some guessing on where the NAV may have moved since. However, the deep discount has been a consistent feature of this BDC, but it has narrowed from where it was trading.

Again, the ‘rough patch’ for CION during this period pushed the discount to nearly 50%. A brave investor putting capital to work in this name at that time certainly would have paid off. That said, the over 24% discount today still represents a huge discount relative to peers and on an absolute basis.

CION Discount/Premium History Vs. Peers (CEFData)

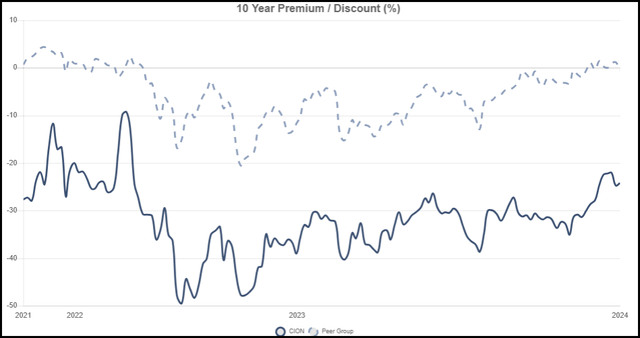

Now, turning to the dividend. CION is sporting a yield of nearly 12%, and that coverage is incredibly strong. In Q4 2023, it dipped briefly below 100%, but that was also the case in Q4 2022. That seems to be more about timing rather than a serious issue, as the other three quarters are showing more than enough to make up for the shortfall.

$0.60 itself was a bit of an outlier, but even if it drifts back to the $0.45 to $0.55 NII area, that shows more than enough coverage of its $0.36 quarterly dividend-which was just increased last quarter. Based on the annualized rate of this latest dividend, it would work out to $1.44. Against the rolling four-quarter NII, that works out to dividend coverage of 1.375x.

CION Distribution and Coverage Breakdown (CION Investment)

Despite the tumultuous period for this name, they did not cut their regular dividend to investors. Further, they once again declared a supplemental to be paid in July of $0.05. I believe that helps reinforce the confidence that management has in their current dividend being more than sustainable as well.

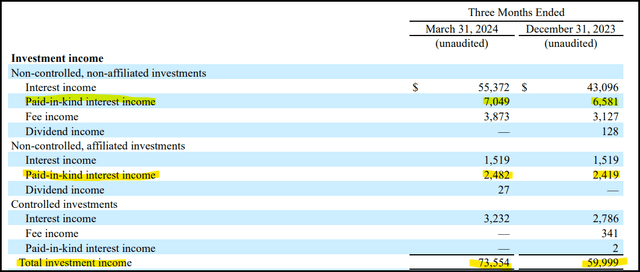

Another factor to consider is that the NII dividend coverage is strong, but being aware of the paid-in-kind interest income. Of total investment income, nearly 13% was PIK income in the latest quarter. Fortunately, that was down from the 15% seen in the previous quarter, primarily driven by a meaningful increase in TII. The bad news is that it was up from the ~10% level it was in Q1 2023.

CION Total Investment Income (CION Investment (highlights from author))

Fitch Ratings noted that PIK income averaged 8.3% of interest and dividend income in 2023. When measuring CION’s PIK income against interest and dividends alone, PIK comes in at nearly 13.7% in the latest quarter.

For some further context, taking what could be considered the blue-chip BDC, Main Street Capital (MAIN) was well below these levels.

For the three months ended March 31, 2024 and 2023, 3.2% and 2.4%, respectively, of our total investment income was attributable to PIK interest income not paid currently in cash. For each of the three months ended March 31, 2024 and 2023, 0.3% of our total investment income was attributable to cumulative dividend income not paid currently in cash.

Given that the Fed is expected to cut rates, such strong coverage can be an envious position to be in. Most BDCs should experience a decline in the spreads they are earning above their cost of leverage. As we touched on above, this is because they primarily lend at floating rates but have costs of capital at fixed rates.

For CION, we already saw that most of their borrowings are based on floating rates; they may not see as much of a decline in terms of NII. Still, as we saw NII increase during the higher rate environment, there was clearly some benefit there that would likely be reversed in a lower rate environment. The good news is that rates aren’t expected to go back to zero.

So, between not expecting to go back to a zero-rate environment and having a huge downside buffer before coverage becomes pressured, CION appears to be in a rather great position.

Conclusion

CION went through a rather rough period with higher non-accruals, but they’ve been on the mend now, with non-accruals coming down. PIK could be a concern for investors and is something worth keeping a closer eye on. At the same time, the dividend coverage here is quite strong, and that can help provide some cushion for the regular payout. At the very least, the management team was confident enough to pay another supplemental.

CION offers investors a buying opportunity with its huge discount. However, like all BDCs, there are risks here to consider. The ~12% yield here based on the regular is also looking quite enticing for income-focused investors.