10’000 Hours/DigitalVision via Getty Images

Cintas Corporation (NASDAQ:CTAS) is a stock that we have traded at our service and have covered publicly, most recently calling for another buyback in March of this year. The stock continues to edge higher, and today is rallying on the back of a positive Q2 earnings report. We continue to like this stock in the long term and believe any weakness is an opportunity for investors to add to.

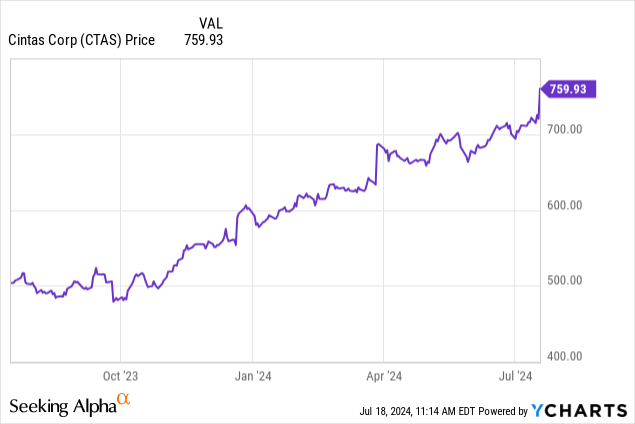

For our followers who may not be familiar, Cintas is a company that provides products and services to help businesses maintain clean and safe work environments. They offer uniforms, floor mats, cleaning supplies (like mops, disinfectants, and restroom essentials), first aid kits, fire extinguishers, and safety training for both employees and employers. The company has seen significant growth in its stock price, as illustrated by the above chart. We think Cintas Corporation stock still has the potential to head higher, despite risks that we may be past peak employment and heading into weaker economic times. In this column, we discuss the just-reported earnings and the outlook for the year.

Valuation and growth

First, the valuation is certainly getting stretched here, so we are not suggesting to dive in and buy today, but the growth, metrics do suggest the company and stock can grow into this valuation. Still, like in our last coverage, it is our opinion that new money should wait for a breather in shares to start buying. While we do rate shares a buy, you have to pick your spots, this is wise investing. Simply put, the price you pay definitely matters. We submit the valuation is stretched here because while growth is strong, it is not overwhelming.

Beating expectations

Turning to the just reported earnings, we saw a top line that was about in line with estimates but a bottom-line beat against consensus expectations. This was the company’s fiscal Q4, and revenue was $2.47 billion, rising 8.2% compared to $2.28 billion a year ago. This was also $60 million higher than the sequential quarter. The company provided an estimate of its organic revenue growth rate, which controls for moves like impacts of acquisitions and foreign currency exchange, plus accounts for the number of “workdays.” This organic growth was 7.5%. Further, margins are expanding.

Expanding margins

We are always a fan of expanding margins, and once again, Cintas saw expanding margins. Gross margin was $1.22 billion in Q4, versus $1.09 billion a year ago. This was an overall increase of 11.6%. Gross margin was 49.2%, as a percent of sales, which was up 150 basis points from 47.7% in the year ago quarter. Despite growing sales, the company has effectively controlled operating expenses, and we note impressive operating income growth continues.

Operating income widened another 16.3% to $547.6 million, rising from $470.8 million last year. Operating margins also expanded from last year. The operating margin was 22.2% rising 160 basis points from 20.6% a year ago. On the bottom line, we continue to see earnings growth. Net income was $414.3 up 19.7% from last year. Overall EPS hit $3.99, surpassing estimates by $0.19, compared to $3.33 a year ago.

Cash flow expansion, dividends, and repurchases

Just about every key metric continues to improve. Cash flow from operating activities was $2.08 billion in the fiscal year, rising 30% compared to $1.60 billion last year. Cintas paid cash dividends of $530.9 million this fiscal year, an increase of 18.0% over last year. And Cintas purchased and retired 1,623,870 shares of its common stock at an average price of $609.04 per share, for a total purchase price of $1.0 billion.

Looking ahead

As we look ahead to fiscal 2025, we expect ongoing growth. Management provided guidance expectations for revenue of $10.16 billion to $10.31 billion, which would translate to a rise of 5.9% to 7.4% over the just reported fiscal year 2024. The company sees organic revenue growth of 6.4% to 8.0%. What is more, this company has been inorganically growing through acquisitions, and this guide does not account for what Cintas may use its bountiful cash flow in the future for picking up more accretive companies.

As for earnings, the EPS guide was $16.50 at the midpoint, which, yes, means shares are not cheap at 46X, but with the consistent growth and repurchases, we believe shares grow into it. While the growth is strong, and we think Cintas Corporation shares are a buy, we suggest taking advantage of any corrective behavior in shares for long-term investment.