CHUNYIP WONG

By Lynn Song

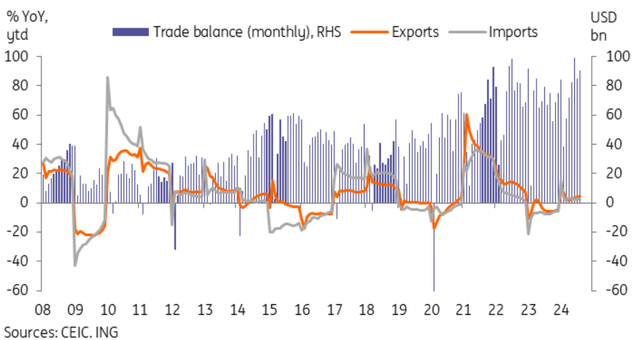

Trade balance beat forecasts as export growth accelerated while import growth slowed

Export growth unexpectedly accelerated to a 17-month high

China’s August export growth accelerated to 8.7% YoY, up from 7.0% YoY in July, which came in above market expectations for a slowdown to 6.6% YoY and narrowly beat June’s growth to reach a 17-month high. While trade data is difficult to forecast, the upside miss is still notable as the direction was different than expected. We have had several months of PMI surveys showing slowing new export orders as well as shrinking orders on hand. This would typically flag gradually weaker exports as well. Official data has managed to buck this trend for at least August, as exports picked up at a 2.7% MoM pace.

An encouraging and somewhat surprising development was the pickup of auto exports in August, bringing YoY ytd growth to 20% from 18.1% in July. Given the momentum of the last few months and tariff action, it is possible that this could be a blip driven by some front-loading of exports.

Steel exports came under increased scrutiny last month as well. But although year-to-date steel exports remained negative in value terms at -6.8% YoY, this was a smaller contraction than last month’s -8.4% YoY ytd. It is worth highlighting that despite this negative value growth, there was rapid export volume growth of 20.6% ytd, which is likely to further raise overcapacity and dumping concerns. Despite some supply cuts, the significant decline in domestic steel demand amid the ongoing property market downturn has led steel producers to increase exports.

Semiconductor export growth edged down to 22.0% YoY ytd from 22.5% YoY ytd but remained one of the best-performing categories as the sector continues to experience rapid growth thanks to the technology self-sufficiency drive.

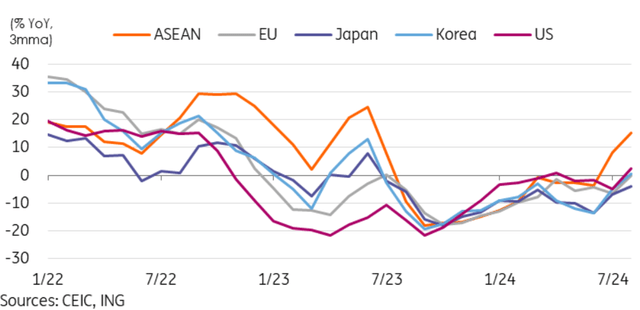

By region, August’s data showed an uptick of exports to the EU which hit a 25-month high of 13.4 YoY in August, bringing year-to-date growth into positive territory at last (0.7% YoY ytd from a -1.1% YoY ytd decline through the first seven months of the year).

Exports to the US slowed slightly in August at 4.9% YoY, but the year-to-date growth also continued to recover, up to 2.8% YoY ytd from 2.4% YoY ytd. Export growth to the ASEAN region, which has been the main area of growth so far this year, actually slowed to 9.0% YoY in August, bringing year-to-date YoY growth to 10.6%, a little weaker than the 10.8% in the first seven months of the year.

Additionally, there were some revisions to prior data, which also contributed to the better-than-expected YoY growth level. Year-to-date, export growth is now at 4.6% YoY, which is better than most had been expecting this year.

Recovery in exports to EU and US supported overall exports, though ASEAN remains the main area of growth

Imports slowed due to weak domestic demand

A less surprising development was on the side of imports. Import growth came in a little lower than forecast, slowing to a tepid 0.5% YoY growth level, down from 7.2% YoY in July. Year-to-date import growth slowed to 2.5% YoY, down from 2.8% YoY.

As we have covered in previous months’ reports, import growth remains very uneven. The categories seeing strong year-to-date YoY growth are primarily tied to national strategic priorities, with automatic data processing equipment (58.8%), semiconductors (11.5%), and hi-tech (12.2%) imports leading the way. Copper import growth slowed to 11.2% YoY ytd from 13.0% YoY ytd in the first seven months but is still outpacing most other categories this year.

Other categories have been fairly weak throughout the year. As mentioned earlier, weak domestic steel demand translated to a -9.7% YoY ytd growth rate for steel imports. Weak consumer confidence has also translated to cosmetics imports, which have seen a double-digit contraction of -10.8% YoY ytd as domestic consumers shifted toward lower-cost domestic alternatives. Agricultural imports have also declined -8.1% YoY ytd.

Trade surplus beat forecasts but it remains uncertain if the momentum can persist

The faster-than-expected export growth and larger-than-expected slowdown of imports led to a larger trade surplus of USD 91.0bn in August. This positive news comes after disappointing data releases in the last month.

However, it is still uncertain if this momentum can last. Aside from incoming tariffs and the sluggish export orders data of the last few months, if global growth momentum begins to slow too, this could also drag export momentum.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.