Lari Bat/iStock via Getty Images

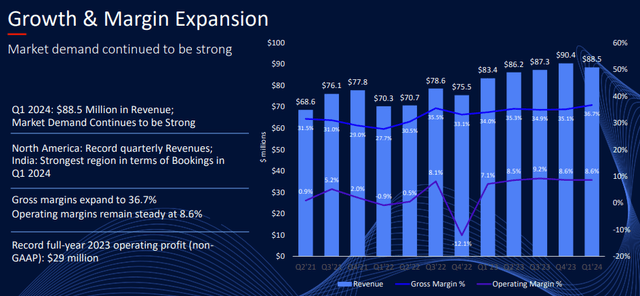

Ceragon Networks (NASDAQ:CRNT) is a leading specialist in wireless transport solutions providing innovative, high-capacity wireless connectivity solutions mainly for mobile network service providers in the US and India, but also increasingly for private networks, for instance in the energy sector. Growth has returned:

This is promising as the company hasn’t even started to deliver on the $150M order from a new Tier 1 operator from India which it won late last year. That will start in Q2 and run for 2 years, during which roughly 75% of the project value is expected to be recognized. The remaining 25% is for managed services and maintenance and will run much longer.

Products

The main products are the IP-20 and IP-50 platforms.

- IP-20 Platform: This platform offers various solutions for diverse networking scenarios, employing multi-technology nodes and integrated radio units operating at frequencies ranging from 4GHz to 86GHz. This platform accommodates both indoor and outdoor configurations, ensuring high-capacity solutions with flexibility for various site deployments.

- IP-50 Platform: The IP-50 Platform leverages disaggregated wireless transport, utilizing a single radio type for all configurations and installation scenarios. It supports microwave or millimeter-wave frequencies and offers IP/MPLS and segment routing capabilities over merchant silicon hardware options. This approach prioritizes scalability and versatile deployment options.

- FibeAir IP-50E: A universal E-Band radio that provides ultra-high capacity of up to 20Gbps per link. It supports a pay-as-you-grow strategy and is designed for fiber-like capacity in fronthaul, backhaul, or wireless access applications.

- Netmaster (NMS Network Management System): Providing comprehensive network monitoring, control, and management capabilities. This system supports all of Ceragon’s microwave and millimeter-wave products through a unified interface, simplifying network administration.

- Ceragon Insight: An AI-based Intelligence and Management Software Suite launched in 2023, Ceragon Insight offers a broader, more advanced suite of tools for managing and optimizing multi-vendor wireless transport networks with AI-driven capabilities.

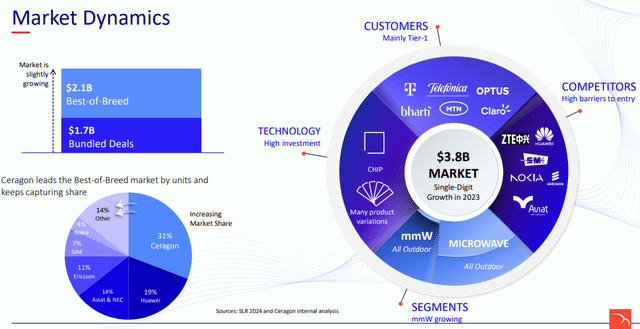

Ceragon operates mostly as a supplier of best-of-breed solutions (solutions tailored to client-specific needs) instead of bundled deals (end-to-end solutions).

New products

- Ceragon’s acquisition of Siklu Communication in December 2023 added the EtherHau and MultiHaul platforms to its offerings. These platforms focus on millimeter-wave technologies, particularly in the 60GHz and 70/80GHz spectrum, catering to the increasing demand for high-capacity, short-range connectivity solutions in urban environments and private networks.

- The high capacity and short-range multi-hall or fixed wireless access family of point-to-multi-point solutions that operate in the V-band frequency, using unlicensed spectrum.

- IP-50CX, “the most compact universal microwave radio in the industry… significantly simplifying network architecture, reducing costs and accelerating time to revenue.” (Q1CC)

- IP-50EX, an ultra-compact, high-capacity, E-band radio.

- Digital Twin solution

-

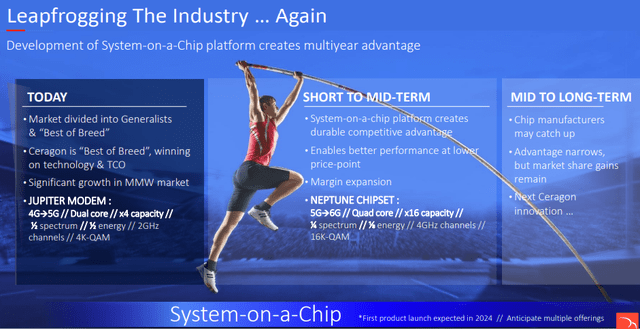

IP-100 Platform: Ceragon is developing the IP-100 platform. Utilizing a new multi-core chipset (Neptune) slated for release this year, the IP-100 platform aims to deliver enhanced capacity, lower latency, and a smaller physical footprint than existing products.

The Neptune chipset was demonstrated at the MWC 2024 last February:

an unparalleled 4000 MHz channel bandwidth, 16K QAM, which when paired with XPIC and MIMO technologies, enables a mmW link capable of 100 Gbps, far surpassing competitor capabilities.

The chipset uses only 1/4 of the spectrum and 1/8 of the energy compared to earlier solutions, making it highly efficient in terms of both spectrum and power usage.

Siklu’s product and the upcoming IP-100 platform based on the Neptune chipset improve Ceragon’s competitive position and increase its TAM.

AI

Ceragon Insight capabilities are enhanced by AI in several key ways:

- Predictive Maintenance: Identifying problems before they manifest.

- Autonomous Real-Time Improvements: The software can autonomously implement various real-time improvements, such as network utilization optimization and energy-saving adjustment, reducing the time and expertise required for network management tasks.

- Advanced Analytics: Helping network operators proactively run, analyze, and maintain network health, leading to better decision-making and operational efficiency

- Troubleshooting and Root Cause Analysis: AI speeds up troubleshooting by correlating alarms and incidents, identifying root causes, and mitigating bottlenecks and outages.

- Customizable Configuration: AI simplifies the installation and commissioning of new links with easy-to-implement customizable configuration files, reducing the complexity and time required for these tasks.

- Operational Efficiency: Automating routine tasks and providing real-time network awareness.

Competitive advantage

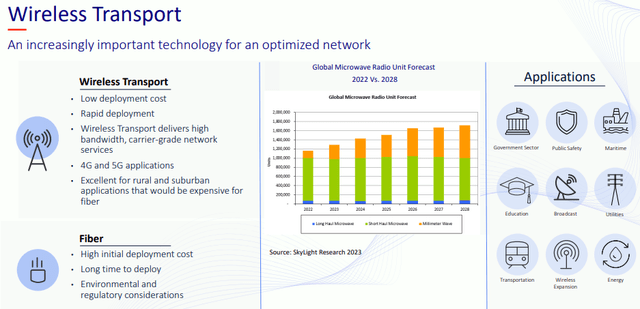

The company’s wireless backbone solutions provide several advantages:

- Cost-effectiveness: Wireless solutions are significantly cheaper to deploy than laying down new fiber optic cables.

- Rapid Deployment: Wireless links can be set up much faster than fiber, requiring no trenching or extensive infrastructure work.

- Scalability and Flexibility: Wireless capacity can be easily scaled up or down based on demand, offering greater flexibility than fiber.

- Resilience: Wireless links can act as reliable backup options for fiber connections in case of cuts or network failures.

Ceragon’s multicore technology is a key differentiator in the wireless transport market. This proprietary technology uses multiple baseband cores within their modems, enabling:

- Efficient Spectrum Use: It allows for higher capacity transmission using less radio spectrum, crucial in congested areas.

- Network Densification: It enables massive network densification, accommodating the growing number of devices and data demands.

- Simplified Deployment: It eliminates the need for multiple antennas in certain scenarios, speeding up deployment and reducing costs.

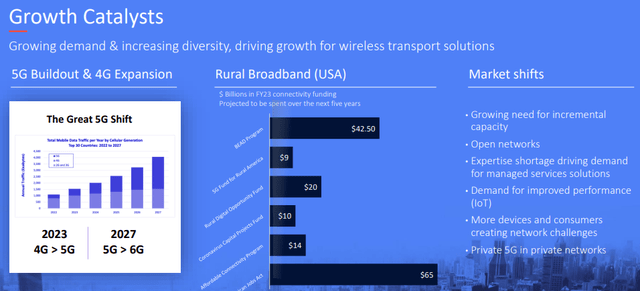

Growth drivers

There are several growth drivers:

- Increased Mobile Data Usage.

- 5G Network Rollout.

- Growth of Private Networks: The increasing need for private, high-bandwidth communication networks in various sectors, including education, utilities, and government, presents growth opportunities for Ceragon.

- Demand for High-Capacity Long-Haul Solutions: There is a growing demand for high-capacity, IP-based long-haul solutions in emerging markets with limited fiber infrastructure. This demand is driven by service providers’ need to connect more communities and bridge the digital divide, particularly as they transition to 4G and 5G networks.

Ceragon’s opportunity with private networks (FWZ0 has been given a boost through the acquisition of Siklu acquisition:

Needham 25th Annual Growth Conference

Private networks are a growth area, with the company scoring $40M in bookings in 2023 and subsequently raking in new deals ($10M in the energy sector alone). This is a promising growth area for the company, as we know from Inseego (INSG). Management aims for $80M+ bookings from private networks this year, and the Siklu acquisition should bring that within reach.

Finances

The gross margin is a little difficult to discern, so:

Ceragon achieved a non-GAAP gross margin of 34.8% in 2023, up from 31.8% in 2022 (10-K):

With the goal of streamlining all manufacturing and assembly processes, we have implemented an outsourced, just-in-time manufacturing strategy that relies on contract manufacturers to manufacture and assemble circuit boards and other components used in our products and to assemble and test indoor units and outdoor units for us. The use of advanced supply chain techniques has enabled us to increase our manufacturing capacity, reduce our manufacturing costs and improve our efficiency.

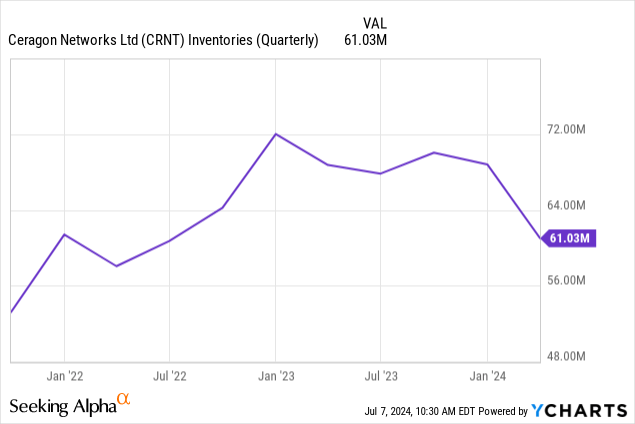

Higher inventory write-offs partially offset this.

Non-GAAP gross margin increased to 36.7% in Q1/24, compared to 34% in Q1 2023, driven by strong revenue in North America (where margins tend to be higher) and a favorable product mix. Ceragon expects its non-GAAP gross margin for 2024 to be around 36%. There is some operating leverage:

And some in R&D:

Ceragon’s non-GAAP operating expenses are expected to increase in 2024 due to the full consolidation of Siklu. However, Ceragon is targeting operating margin expansion for 2024 based on its growth plan and the additional business from Siklu.

Ceragon’s goal is to achieve a non-GAAP operating margin of at least 10% in 2024 at the midpoint of its revenue guidance.

The company has really turned a corner in terms of cash flow, which we think is an underappreciated element:

This is in part due to a reduction in receivables (from $104.3M at the end of Q4 to $97.4M at the end of Q1) but also due to inventory reductions now that supply chain problems have moved into the rearview mirror:

Management thinks this can be reduced further as they build up inventories for new products, which are now materializing.

Management expects to utilize its strong cash flow to invest in strategic initiatives to expand its addressable market and target private network customers. Management believes these investments can better position it for further growth in these segments in 2024.

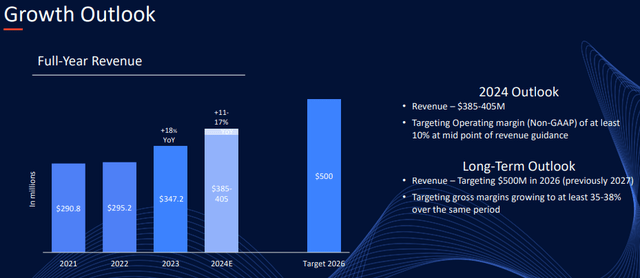

Guidance

Valuation

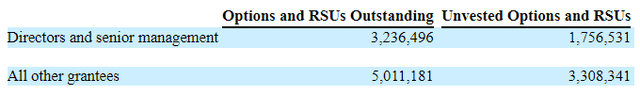

There is more to come:

From the 10-K:

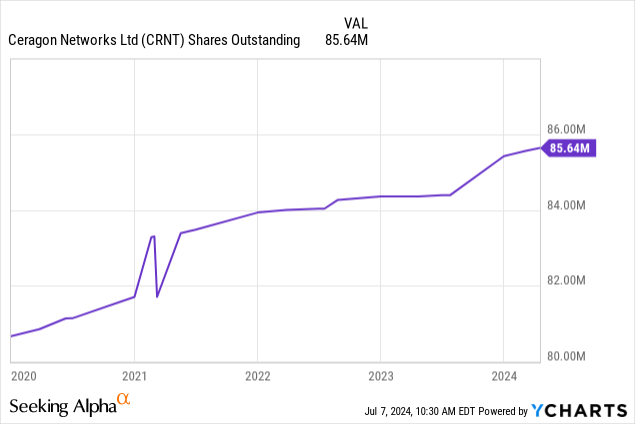

So fully diluted there are 88.8M shares outstanding, at $2.5 per share that’s a market cap of $195.3M, and an EV of $197M (the company has $28.8M in cash and $30.5M in debt).

With an expected FY24 revenue of $395M (midpoint of guidance) the shares trade at 0.5x EV/S. With expected earnings of $0.31 per share this year and $0.41 the next, the shares trade at single-digit earnings multiples.

Conclusion

The company has several things going for it:

- Growth has returned and is likely to continue, driven by a large new Tier 1 carrier starting the build-out lasting several years, the rise of private networks, and the introduction of several new products with the Neptune chipset slated for yearend.

- The acquisition of Siklu increased its presence in the private networks segment, where it raked in $40M in bookings last year, expecting to double that this year.

- Revenue, bookings, and the pipeline are all rising.

- Margins are trending up, although are liable to be volatile quarter-to-quarter.

- The company is increasing cash flow on the return of growth, margin expansion, and a reduction of receivables and inventories.

- The shares are really quite cheap.

The upshot: We think the shares are a buy at $2.50.