lithiumcloud/iStock via Getty Images

Carter’s (NYSE:CRI) is the US’s leading baby and toddler apparel brand. The company operates in a large retail channel, coupled with wholesale relationships with all major retailers.

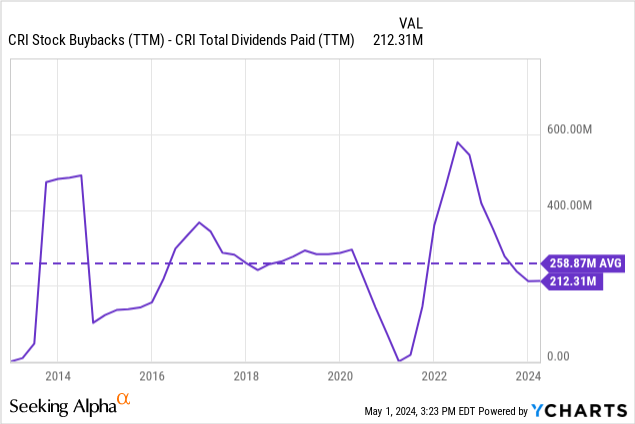

Carter’s is an operationally excellent company that dominates a relatively commoditized, stable, and mature market. Thanks to high shareholder payback ratios (dividends plus buybacks), it has maintained great returns on capital and equity.

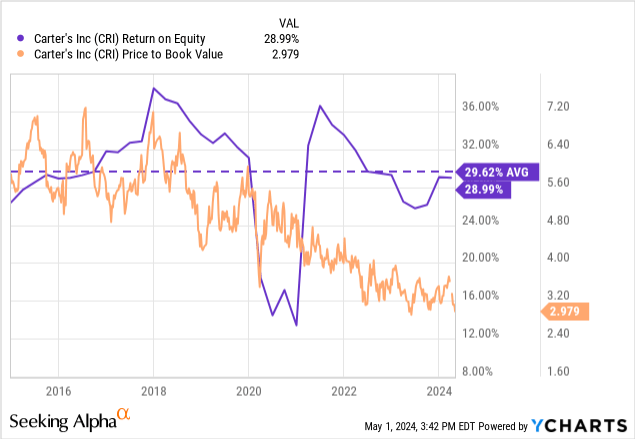

Given Carter’s stability, the company can be valued based on returns on capital compared to P/B ratios. I would recommend purchasing the stock whenever the P/B is below 3. Coupled with an average long-term ROE of 30%, this yields an expected return on reinvested earnings of about 10%. Carter’s trades at about a P/B of 3, which I consider fair but not an opportunity.

Company intro

Baby leaders: Carter’s occupies the leading position in the apparel market for babies, toddlers, and young children. The company believes it represents a 10% market share, with that share advancing to 20% when talking of babies and toddlers (up to 2 years).

Value focus: The company’s strategy has been to compete on value, meaning a good relationship between quality and price. Its main products are baby apparel essentials at prices well below $10. These prices are very competitive, even with private-label brands from large retailers.

Complete channel strategy: Carter’s has an established, directly operated store presence in the US, with close to 800 stores, generating about $1.5 billion in revenues.

Its wholesale segment is also strong at $1 billion in revenues in the US. The company has deep relationships with most mega-retailers like Walmart, Target, and Amazon, plus more niche retailers like Kohl’s, Macy’s, and off-price retailers. For Walmart, Target, and Amazon, Carter’s even designs exclusive brands for them.

The company also operates directly in Canada (about 190 stores) and Mexico (about 60 stores) and via partners in Brazil and other markets, generating close to $430 million in revenues outside the US.

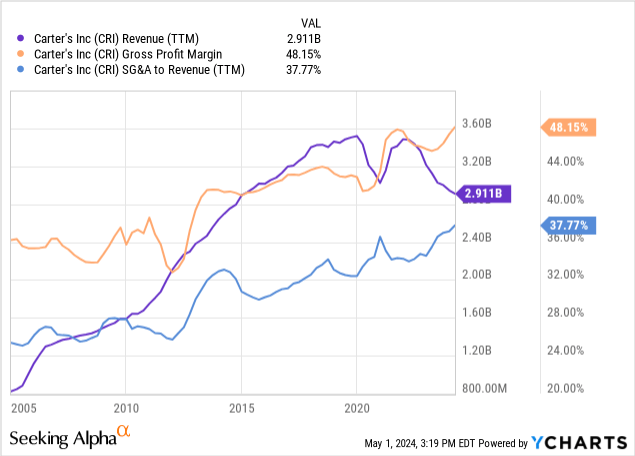

Operationally excellent: Carter’s has passed through several challenging periods, including the latest post-pandemic consumption boom and supply chain constraints, followed by a consumption retreat and inventory glut. The company has shown significant resilience throughout these periods, with stable margins. This was also true during the GFC.

The company’s overhead is low, with unallocated corporate expenses at 4% of revenue, advertising at 2/3%, and store rent costs at less than 8%. The company has a small supplier structure, with ten suppliers representing 55% of sales and a minimal distribution center structure of less than 2 million square feet.

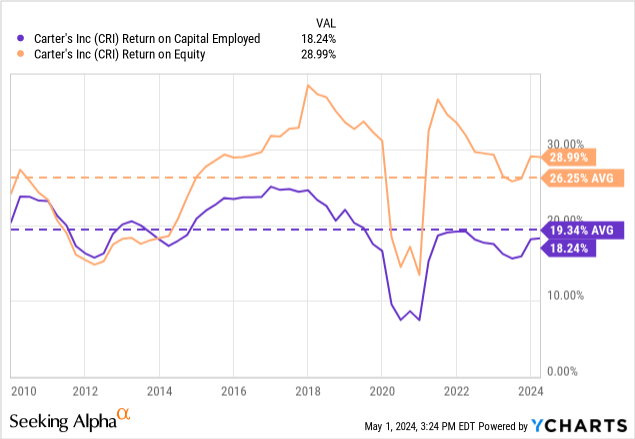

Good returns on capital: As we will see later, Carter’s has already matured its market, so the brand’s growth potential going forward is small. Its revenues and profitability have been pretty stagnant since 2015. However, the company has maintained elevated returns on capital employed and equity by returning profits to shareholders through share buybacks and dividends.

Unlevered: Carter’s has total debts of $500 million in convenient notes, maturing in 2027 and paying a fixed 5.6%. This debt is cheap compared to current SOFR rates. The company also has a credit facility for up to $800 million, paying SOFR + 1.5%.

Tenured management: Carter’s CEO has been with the company since 1993 and CEO since 2008. The majority of the management team has been with the company since the late 2000s, and the rest since the mid 2010s.

No strong shareholder: The company’s management team owns only 3% of shares, and the largest shareholders, at 10% of shares, are passive investors like Vanguard, Blackrock, and JPM (from the latest proxy).

End market characteristics

Fashion stability: Baby and toddler apparel is much more stable than adult apparel because babies don’t care about fashion. The products change very little from year to year, with segmentation happening more in price/quality ranges. An example of this was that Carter’s was able to sell part of its (bloated) 2022 inventories in 2023 without the need to promote it with heavy discounts.

Commoditized: This lack of variability also generates more commoditization. Although Carter’s has an established brand, thanks to its long history (founded in 1865) and market share, it cannot charge much more for its products than private labels. The company is trying to elevate the brand via top-of-the-funnel initiatives and developing more premium-priced lines (like the organic/sustainable Little Planet). Still, this effort has yet to prove fruitful.

Mature market: The US fertility rates have been fairly stable for the past 50 years, going back to the 1970s. They grew a little into the 2010s, and then decreased into the 2020s, even more after the pandemic. This means the baby market is not growing much.

Based on demographic data, there are 12 million babies and toddlers in the US, with 3.6 million born last year. Suppose we apply a 40% CoGS margin to the US wholesale revenues. In that case, we arrive at US end sales of about $3.5 billion for Carter’s, which means that each baby already represents close to $300 of revenue per year for the company. It seems difficult to grow much more going forward.

The company’s growth initiatives involve elevating the brand with premium-priced product lines, capturing more retail sales (which grows the top line but is pretty inert on the bottom line), and expanding abroad.

Valuation by ROE and P/B

Carter’s is easy to value. It’s a very stable, excellently managed company with a mature, difficult-to-grow market that pays most of its net income back to shareholders through buybacks and dividends.

In such cases, the long-term return to be expected is the return on equity divided by the P/B paid for the shares purchased. This is because, for each $1 of shares, we are buying 1/PB pieces of equity, which will generate 1/PB * ROE returns over the long term. If the company buys back shares at the same rate, it increases our equity ownership by 1/PB for each $1 of buybacks. The same applies to (pre-tax) dividends in the company’s shares.

I believe the fair post-tax return for a stable, mature company is 10%. Above this return, I can consider the stock an opportunity. In the case of Carter’s, we can see that since it stopped growing in 2015, the company’s return on equity has averaged 30% and that it currently trades at a P/B of 3, meaning an expected long-term return of 10%. Similarly, the company’s P/E ratio is 10x, representing an earnings yield of 10%.

In my opinion, this means the company is fairly valued and not an opportunity at these prices. However, I would maintain an alert on Carter’s stock price in the current volatile context. If the P/B ratio fell below 2.5, the stock would be an opportunity.