Nikolaeva Elena/iStock via Getty Images

Co-authored by Treading Softly

How’s your New Year’s resolution going? Have you been able to maintain it all the way until May? Or did it crash and burn in the first few weeks of the year?

It’s not surprising that a large number of people who make a New Year’s resolution fail to see it through because they fail to make any adjustments to their lifestyle. When you’re full of the vigor of the New Year, it is easy to purposefully do something, even if it means you have absolutely no follow-through whatsoever.

The wonderful thing about spring weather (and with summer rapidly approaching) is that we’re able to get outdoors more. This means that we can be more physically active, enjoy the sun on our skin, and hopefully see some improvements in our overall health.

When it comes to the market, May always brings to my memory the need for healthcare investments. The healthcare sector is heavily regulated and heavily required. The older we get, the more we rely on prescription drugs, treatments, medical devices, and physicians – the more healthcare spending climbs. Medicare is one of the largest budget items in the entire U.S. government spending budget. The reason for this is that as we get older, we need more medical attention.

The Silver tsunami is raging as more Americans are about to be 65 years old than ever before. A record 4.1 million Baby Boomers will reach the traditional retirement age in 2024, marking the greatest surge in the retirement age population in the nation’s history. Health spending often increases with age, as we generally have more health conditions and need more care as we grow older.

Around 95% of patients age 65 or older have a minimum of one chronic condition, and 80% have two or more. As humans live longer, the costs associated with these statistics become even more significant.

Global pharmaceutical and medical device companies perform cutting-edge research to discover drugs and treatments for critical illnesses and conditions and maintain exclusivity for decades, giving them a solid moat to keep competition at bay. We like this industry and its prospects in an aging America. However, it is difficult to cherry-pick winners due to the complexities and uncertainties involved in clinical trials.

As an income investor, I look at the market through the lens of how I can get paid. Billions of dollars flow through the market every single year. Record amounts of money are paid out to people willing to collect it in the form of dividends and distributions. My portfolio is fine-tuned to tap into the income flowing through the market and siphon off a portion to enrich my portfolio and fuel my lifestyle.

Today, I want to look at two highly diversified healthcare funds that will pay you handsomely going forward.

Let’s dive in!

Pick #1: HQH – Yield 11.7%

abrdn Healthcare Investors (HQH) is a CEF (Closed-End Fund) formerly known as “Tekla Healthcare Investors”. Aberdeen acquired Tekla, along with all of its funds. Importantly, the management of the Tekla funds has remained unchanged. The skill of Tekla’s staff is one of the reasons Aberdeen wanted to buy the company, as it lacked expertise in the healthcare segment.

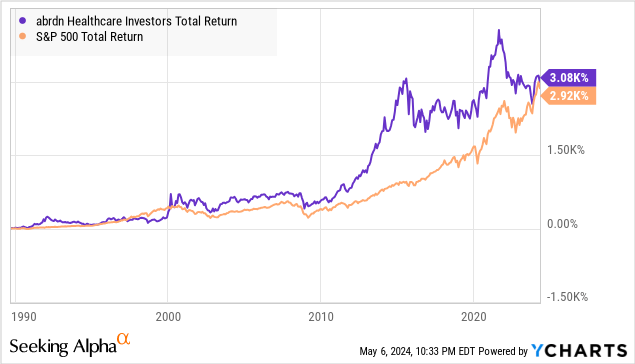

HQH is a CEF that has withstood the test of time. Since its inception, HQH has outperformed the S&P 500, even though healthcare has recently been an underperforming segment.

The healthcare sector is a highly regulated sector, and most of the money flows either through Medicare or private insurance companies. As a result, it is a sector where the impacts of inflation are uneven, as prices are usually negotiated well in advance of a patient receiving the treatment or the product. Most businesses in the sector can’t unilaterally decide to raise prices. There is a process, and that process takes time. As a result, there has been pressure on margins for many healthcare businesses as costs go up, but revenues haven’t kept up. However, it is a pressure that will continue to diminish with time.

Fundamentally, the demand for healthcare is extremely strong, and will only continue to rise. The healthcare sector has faced challenges and dramatic changes in the past, including significant cuts from the government with the “balanced budget” in the late 1990s and the passage of the Affordable Care Act, which dramatically changed the playing field. Yet despite challenges, the sector has proven to be a long-term winner for investors. HQH has been through it all.

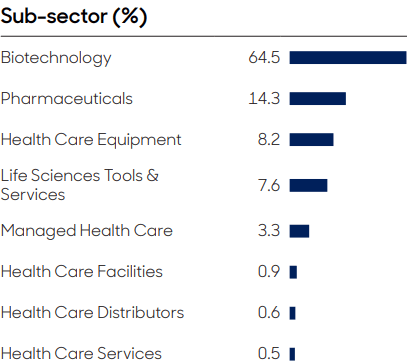

The CEF is primarily invested in biotechnology and pharmaceuticals: Source

HQH Fact Sheet

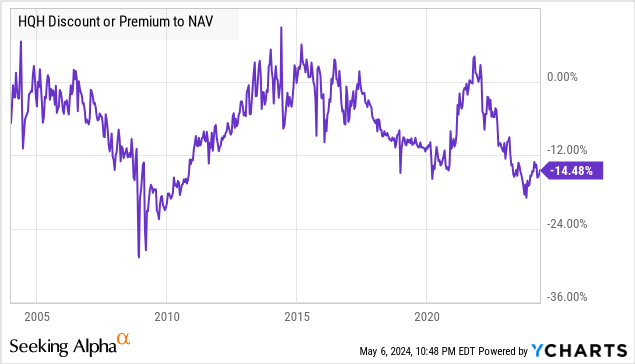

In addition to the healthcare sector being down, HQH, in particular, is trading at a larger-than-normal discount to NAV. In the past 20 years, the only time HQH has traded at a larger discount was during the Great Financial Crisis. Currently, it is trading close to the same discount it traded at during the early days of the global pandemic.

Historically, buying HQH at a discount greater than 10% has worked out extremely well for investors.

The best part is that HQH pays a variable distribution based on 2.5% of NAV each quarter. So, while we pay the discounted market price, we receive our distribution based on NAV.

The healthcare sector is facing challenges, but it has successfully faced challenges in the past. Healthcare will forever be a highly politicized sector, and companies that operate in it will always face challenges keeping up with regulations. This is because it is very important to people.

As income investors, we want to own companies that produce things people use every day. With HQH, we gain access to companies that produce drugs and treatments that are essential for people to continue living. We are gaining exposure to a sector that will always have very strong demand. When the market lets us buy it at a huge discount, we are happy to seize the opportunity.

Pick #2: THQ – Yield 10.8%

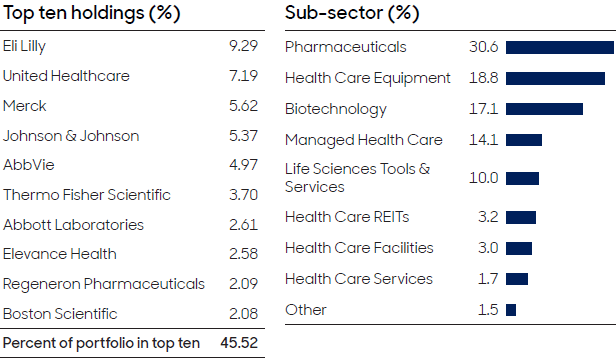

abrdn Healthcare Opportunities Fund (THQ) is a CEF holding some of the largest and most prominent U.S.-based pharmaceutical and biotechnology companies. Source

THQ Fact Sheet

THQ is actively managed, so fund managers will look to make portfolio changes to orient the fund to the best-performing picks. Consider a few of the CEF’s top holdings, notably Eli Lilly (LLY) which has appreciated by nearly 300% in price over the past three years, while Merck (MRK) has risen nearly 70%. AbbVie’s (ABBV), blockbuster drug Humira (used to treat certain types of arthritis or inflammation-related disease) has enjoyed patent exclusivity for years. Even with the introduction of biosimilars into the market several months ago, the biopharma giant continues to uphold an impressive 96% market share. This achievement underscores the potency of drug patent exclusivity and the enduring value of brand recognition.

In February, THQ’s monthly distribution was raised by 60% to $0.18/share, which calculates to a 10.8% yield.

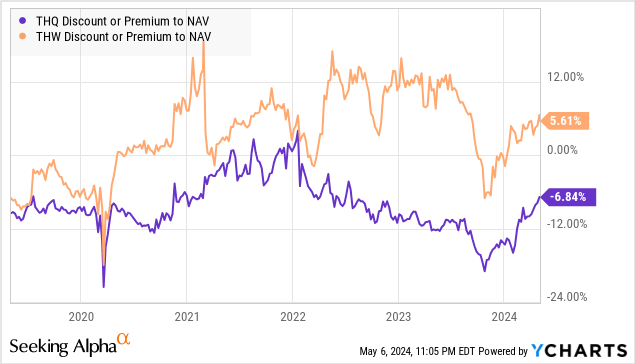

Consider the valuation of abrdn World Healthcare Fund (THW), another CEF from the same management sporting a high yield. THQ has always traded at a rich premium. Given THQ’s distribution raise, the yields of both these CEFs match, and THQ still trades at a deep discount.

This makes THQ an excellent bargain for solid total returns.

Conclusion

From aspirin to emergency rooms, from retirement homes to convalescent care, healthcare is a wide-reaching sector. It covers everything from your local hospital to mega pharmaceutical corporations that are researching the next drug or treatment to try and improve our lives while boosting their profits. It can be difficult to try to pick the next big winner in new innovations. It is also a sector that is usually low on dividends and high on capital gains. It also can feel a little bit like playing roulette at a casino, hoping to pick the number where the ball will land. This is why I like to utilize the expertise of skilled portfolio managers to enjoy strong income from this critical sector, allowing them to do the research and due diligence and make the right investment decisions. I like to be able to sit back and collect the income that pours into my account from the diligent hard work of others.

When it comes to retirement, you don’t want to be working; you want to be enjoying your free time and pursuing new hobbies or spending time with loved ones. For many, investing can be a wonderful hobby, but it shouldn’t become a full-time job. This is why having an income portfolio that pays you regularly regardless of what the market is doing is essential. Today, we discussed two funds that leverage the skill of experienced portfolio managers to allow you to have more free time as well as a solid income stream. Put your money to work. Don’t let it sit idle and lazy in your portfolio. Your future will thank you for it.

That’s the beauty of my Income Method. That’s the beauty of income investing.