Thank you for your assistant

Nike stock crashed almost 20% after the company reported solid results for Q4 FY 2024, but offered weaker than expected guidance: The world’s leading sports apparel and footwear company said that it expects sales for FY 2025 to be down by about mid single digit. On a long-term basis, however, I think the sell-off creates an attractive opportunity for investors to buy a high quality franchise at bargain prices. In my view, Nike is poised to remain a winner in the sports industry, due to unparalleled brand strength, global market presence, and a best-in-class athlete endorsement strategy. As a function of valuation anchored on a residual earnings model, I assign a “Buy” rating to Nike shares and set my target price at $91.

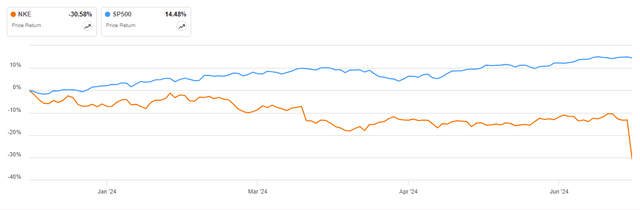

For context: Nike stock has significantly under-performed the broader U.S. stock market this year. Since the beginning of the year, NKE shares are down by approximately 31%, compared to a gain of nearly 15% for the S&P 500 (SP500).

Nike’s Q4 FY 2024 Results Solid; But With Disappointing Guidance

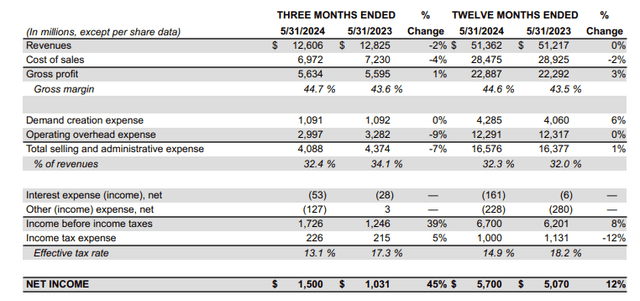

On Thursday, June 27th, after market close Nike released its financial results for the latest quarter, topping Wall Street’s expectations on both revenue and earnings: During the period from March to the end of May, the global leader in sports apparel and footwear reported sales totaling approximately $12.6 billion, marking a 2% decline YoY compared to $12.8 billion for same period one year earlier, but beating analyst consensus by approximately $150 million, according to data collected by Refinitiv. On a channel basis, NIKE Direct revenues were down 8% YoY, reported at $5.1 billion. Wholesale revenues came in at $7.1 billion, up 5% YoY. This represents a negative mix shift because NIKE Direct, which typically commands higher margins, saw a decrease in revenue YoY, while Wholesale, with generally lower margins, experienced an increase.

In terms of profitability, there was some good news for investors, as gross margin expanded by about 110 basis points, to 44.7%, while total selling and administrative expenses fell 7% YoY, to about $4.1 billion. On that note, operating income came in at $1.7 billion, up 39% YoY compared to $1.2 billion for the same period one year earlier. Net income was reported at $1.5 billion, up 45% YoY.

Looking at Nike’s Q4 FY 2024 report, it is evident that the numbers were actually quite solid; what scared investors, however, was management commentary surrounding the FY 2025 outlook. In the conference call with analysts, Nike CFO Matthew Friend said that revenue in the new fiscal year will likely be down mid-single digit. To justify the weak guidance, he highlighted quite a few notable headwinds (emphasis mine)

We are managing a product cycle transition with complexity amplified by shifting channel mix dynamics. A comeback at this scale takes time. With this in mind, we’ve considered a number of factors and scenarios in revising our outlook for fiscal 2025. Most importantly, this includes timelines and pacing to manage marketplace supply of our classic footwear franchises, lower NIKE Digital growth, especially in the first half of the year due to lower traffic on fewer launches, plan declines of classic footwear franchises given Q4 trends, as well as reduced promotional activity, increased macro uncertainty, particularly in greater China, with uneven consumer trends continuing in EMEA and other markets around the world, and sell into wholesale partners as we scale product innovation and newness across the marketplace and finalize second half order books.

Building on the lower topline outlook, paired with a guided 10 -30 basis points gross margin expansion, I estimate that Nike’s operating income for FY 2025 will likely fall somewhere between $5.2 and 5.4 billion, which suggests that Nike’s forward P/EBT is trading closely in line with the broader S&P 500, at about 22x.

Nike Is Poised To Remain A Winner In Sportswear

Looking beyond short term growth headwinds, in my view, Nike is poised to remain a long-term winner in the sports industry due to the company’s unparalleled brand strength (ranked 9th for the world’s most valuable brands), extensive global market presence, and top-tier athlete endorsement strategy.

Although the product cycle for Nike is currently a concern, it mustn’t be long-term. In fact, Nike is focusing on accelerating its pace of innovation and scaling new products across its portfolio. This includes introducing new performance and lifestyle models such as Pegasus Premium, Vomero 18, and new iterations of Dynamic Air. On that note, the upcoming Paris Olympics presents a major opportunity for Nike to highlight its innovations and enhance brand distinction through storytelling and retail activation. On operational efficiency and cost management, it is important to note that Nike is doing a good job unlocking savings through reducing fulfillment costs, consolidating supplier and optimizing technology spending, This is highlighted by the 100 basis point gross margin expansion in FY 2024, and guided 10-30 basis point expansion expected for FY 2025.

Valuation: Fair Value Likely At $91 Per Share

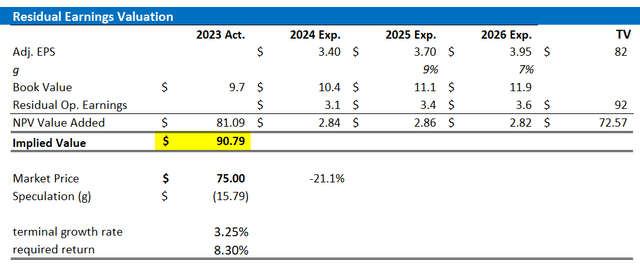

To find a valuation anchor for stocks, I am a great fan of using the residual earnings model approach. This model is based on the principle that a company’s valuation should equal its discounted future earnings after accounting for the capital charge. According to the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

For my valuation model of Nike stock, I make the following assumptions:

EPS Forecast: I use the consensus analyst forecast from the Bloomberg Terminal through 2026. Beyond 2026, I consider estimates too speculative to be reliable. However, the 2-3 year analyst consensus is typically accurate.

Capital Charge: I use the CAPM model to estimate Nike’s cost of equity, which suggests a rate of 8.3%.

Terminal Growth Rate: I apply a terminal growth rate of 3.25% post-2026, which, I believe, is reasonable (around 50 – 100 basis points above nominal GDP growth to reflect franchise strength).

Based on these assumptions, I calculate a base-case target price for Nike of approximately $90.79 per share.

Company Financials; Bloomberg & Author’s EPS Estimates; Author’s Calculation

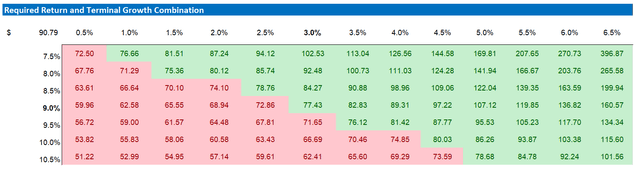

For investors with different assumptions relating to Nike’s cost of equity and terminal growth rate, I highlight enclosed sensitivity table.

Company Financials; Bloomberg & Author’s EPS Estimates; Author’s Calculation

Investor Takeaway

Nike stock plummeted nearly 20% after the company reported strong Q4 FY 2024 results but provided weaker-than-expected guidance. The world’s leading sports apparel and footwear company indicated that it expects sales for FY 2025 to decline by about mid-single digits. Despite this short-term setback, I believe the sell-off presents an attractive buying opportunity for investors seeking a high-quality franchise at a discounted price. In my assessment, Nike is well-positioned to remain a dominant force in the sports industry due to its unparalleled brand strength, extensive global market presence, and exceptional athlete endorsement strategy. Whenever Mr. Market offers you a top 10 global brand for a 20% discount, you should probably take the deal. This time should be no different. Based on a valuation anchored on a residual earnings model, I assign a “Buy” rating to Nike shares and set my target price at $91.