JamesBrey

As the calendar turns to September, two major narratives are increasingly driving Mr. Market’s behavior. First, the market has fully priced in interest rate cuts for this month, and in fact, gives a one-third chance of a 50 basis point rate cut this month. Additionally, the market is fully pricing in at least two rate cuts by the November meeting, with a near 70% chance that the Fed will cut by at least 75 basis points by the November meeting. By year-end, the market says the odds favor a total of 125 basis points in cuts. This means the market fully expects interest rates to move materially lower in the near future.

The other big concern is an economic slowdown, as weakness in the jobs market and high levels of consumer and credit card debt signal that a slowdown, if not a recession, is imminent. As a result, investors may want to get ahead of these impending macro shifts by positioning their portfolio to profit from lower interest rates while also being better able to withstand an economic downturn.

In this article, I will discuss two high-yield blue-chip stocks that should withstand an economic downturn with flying colors while also benefiting from lower interest rates. Both of these stocks are attractively priced at the moment, providing an attractive risk-reward profile for investors who buy them at current prices.

High-Yield Blue-Chip #1

The first high-yield blue-chip I’d like to mention is Enterprise Products Partners (EPD). It is a K-1 issuing master limited partnership that provides energy midstream infrastructure. EPD arguably has the highest quality midstream infrastructure business today, with a sector-leading A- credit rating, a very low 3x leverage ratio, solid long-term growth potential across its fully integrated, strategically positioned, and well-diversified portfolio of assets, and an expected 5% distribution CAGR for the foreseeable future.

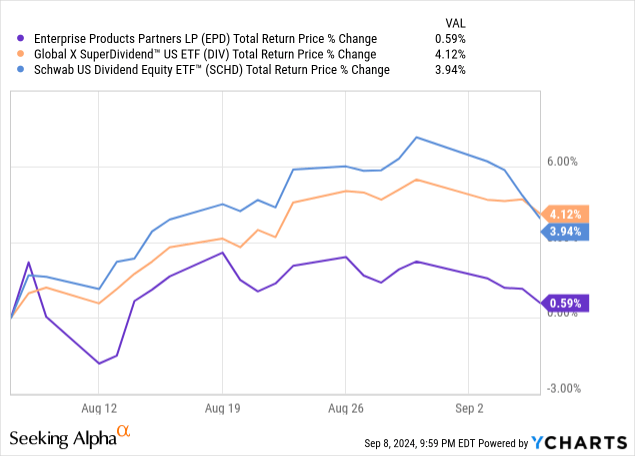

EPD’s units have lagged the broader midstream sector (AMLP) in recent months, with total returns over the past month largely nonexistent even as the high-yield space (DIV)(SCHD) has shot meaningfully higher.

As a result, its forward distribution yield is now 7.5%, which is covered 1.7x by distributable cash flow, and its enterprise value to EBITDA multiple is a mere 9.4x, which is very attractive compared to its historic average of 12.4x.

When you consider its impressive long-term track record, including a quarter-century of consecutive distribution hikes, the ability to consistently generate double-digit returns on invested capital, and market-crushing total returns since going public, it looks like a highly compelling time to buy into EPD. On top of that, insiders own about one-third of the equity, and in a few years, EPD’s large current growth pipeline will largely be coming online, which will cause capital expenditures and leverage to drop meaningfully. This should give management significant capacity to return a lot of capital to unitholders via buybacks and/or distribution increases, providing a strong upside catalyst for the unit price.

High-Yield Blue-Chip #2

Another high-yield blue chip I like right now is triple net least REIT (VNQ) Realty Income (O). While the stock has rallied sharply of late, it still offers a very attractive 5.1% dividend yield, trades at just a 12% premium to its net asset value (compared to its historical 20% premium), and trades at a price-to-FFO ratio of 14.7x, well below its historical average of 17.6x. As a result, it offers investors an attractive combination of current income and the potential for valuation multiple appreciation, especially as interest rates drop.

Moreover, Realty Income’s triple-net lease business model is well-positioned to withstand an economic downturn, particularly given that it has one of the highest-quality portfolios in the sector. Realty Income boasts vast diversification across its over 15,000 properties, with 36% of its rent coming from investment-grade clients. Additionally, 90% of its rent is resilient to economic downturns and/or resistant to e-commerce pressures. With an A- credit rating from S&P and 29 consecutive years of dividend growth without ever cutting its dividend, Realty Income is a defensive and reliable income generator.

Moreover, Realty Income’s conservatively structured triple-net leases have lengthy terms remaining on them, with fixed contractual rent increases, driving very stable cash flow per share growth regardless of broader economic conditions. Combined with its retained cash flow and opportunistic equity issuances, the company should be able to grow its cash flow per share and dividend per share at a recession-resistant pace. Analysts expect Realty Income to grow its FFO per share at roughly a 4% CAGR through 2028 and to grow its dividend at a 4.5% CAGR over the same period. As a result, even without valuation multiple expansion, Realty Income should still deliver a compelling risk-adjusted total return of 9-10% per year, and with valuation multiple expansion, it could deliver 12%+ total returns for several years to come.

Investor Takeaway

For defensive investors looking for low-risk bets with a high probability of at least meeting, if not exceeding, historical market average returns at a time when the market itself trades at nosebleed valuations and is likely to underperform due to economic headwinds and a correction in AI bubble stocks, Realty Income and Enterprise Products Partners look like compelling buys for stable, defensive passive income. By loading up on blue-chip, high-yield stocks like EPD, O, and others, we have positioned our portfolio to thrive during a period of Federal Reserve rate cuts and economic weakness.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.