monkeybusinessimages/iStock via Getty Images

Summary

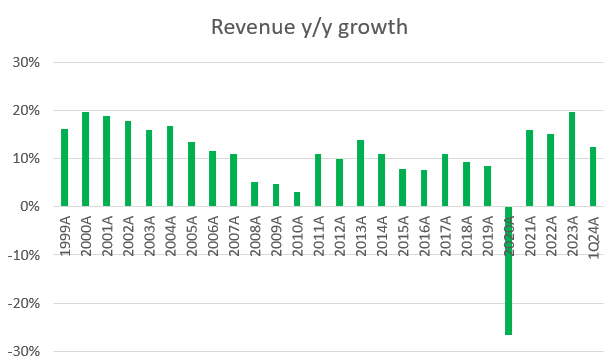

I am positive on Bright Horizons Family (NYSE:BFAM). My summarized thesis is that BFAM will benefit from the increased demand for childcare services as more women participate in the workforce (leading to more dual-parent working households). BFAM is well positioned to benefit because of its scale and reputation advantage, which is hard to replicate. Concerns over near-term growth pressure from macro tailwinds should go away once BFAM shows the market it can continue to grow at 10%.

Company overview

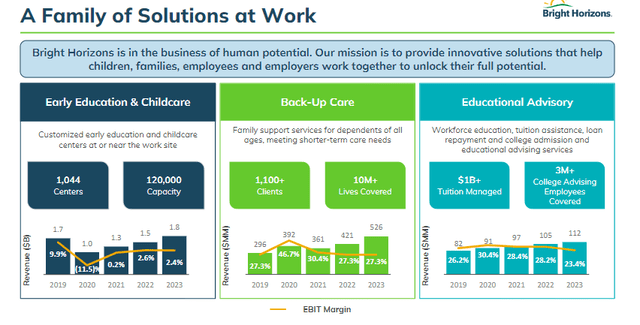

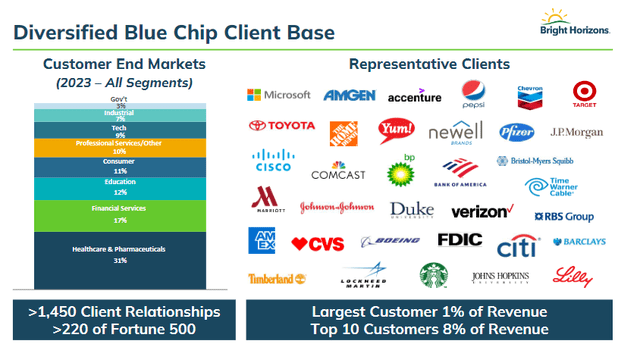

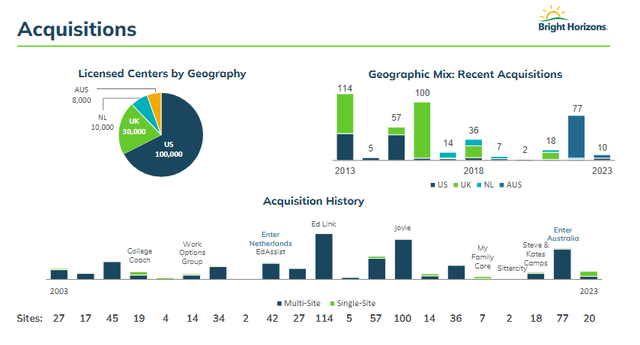

BFAM is a childcare services provider to parents on behalf of employer sponsors, and it has a long operating history of more than 25 years. So far, BFAM has served more than 1,400 clients, with more than 200 of them being Fortune 500 companies. As of 1Q24, BFAM has 1,044 centers that can cater for up to 120,000 children. BFAM operates in the US (~73% of revenue), Europe (including the UK and Netherlands), and Australia, which account for 27% of total revenue in FY23.

Growing need for childcare services

There are various secular tailwinds that are driving more demand for childcare services. In particular, there is a growing number of women who are pursuing full-time careers. This is in line with the report from the Bureau of Labor Statistics, where there are more working-age women employed than ever before (this report, while dated, gives a good perspective on this trend). Accordingly, this has driven the percentage of families with both parents working up to 67%. To make things worse, according to a study by The Pew, a large portion of these parents have a living parent (age > 65) that they need to attend to. If we combine all these various dynamics together, naturally, this means that there is less time available for parents to take care of their children, and they need a solution to address this.

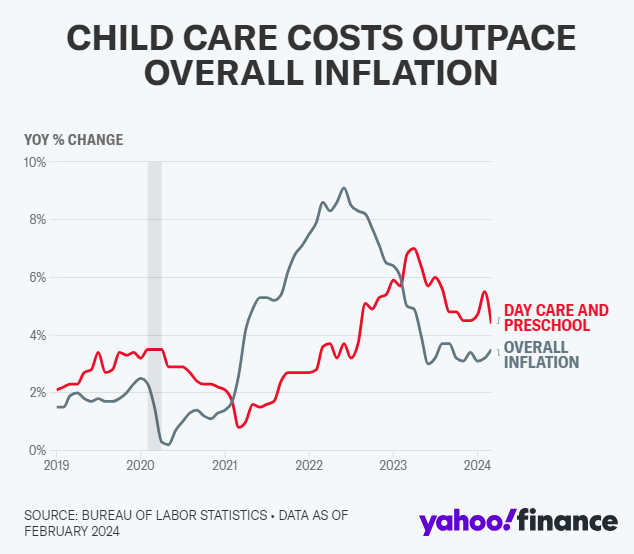

The macro tailwind has also allowed childcare providers to continuously raise prices in the same direction as inflation, and I expect this pricing power to continue to sustain itself moving forward, especially for large players like BFAM.

Yahoo

Scale and reputation are key competitive advantages

There are two main competitive advantages that I see in BFAM: scale and reputation.

Scale is an advantage for various reasons. First and foremost, having scale (wide regional coverage) enables BFAM to address demand from large corporations that require childcare solutions in all their footprints, given that it is easier to deal with one player than multiple small players. Secondly, it means more financial capacity to address the biggest constraint to growth in the industry: labor. To run a center, one needs to have enough labor, and given that labor in this industry is still not back to pre-covid levels, the one that can afford to pay more will be able to retain or attract employees. Also, having more financial capacity enables BFAM to better tide through economic cycles (covid forced a lot of childcare providers to close down).

Reputation is arguably just as important as scale advantage (I think they go hand in hand). Reputation is extremely important because BFAM is dealing with children, and parents are very mindful of who is handling their kids while they are away. As such, I believe parents will prefer reputable providers. This dynamic pushes employers to partner with reputable players, as they do not want to risk facing any backlash from children getting mistreated. BFAM wins in this area because of the blue-chip client base that it has built over time. This forms a virtuous cycle for BFAM, as employers that are looking for a solution provider would assess the client base of BFAM. I believe the natural thinking process would be, “Since these large players trust BFAM, BFAM should be trustworthy,” and as BFAM partners with more clients, it becomes “more reputable.” The thing about reputation is that it cannot be replicated within a short period of time.

All in all, with these two competitive advantages, I believe new entrants or subscale players will not be able to easily disrupt BFAM’s market position.

Attractive operating model

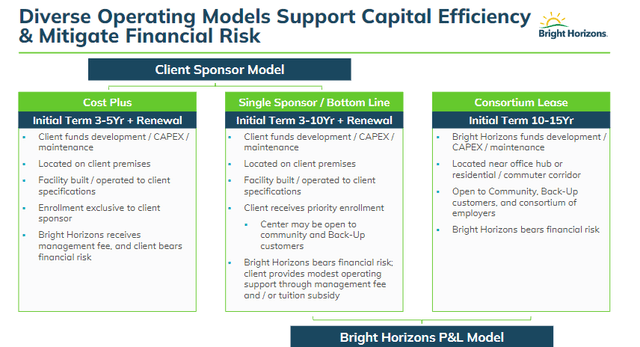

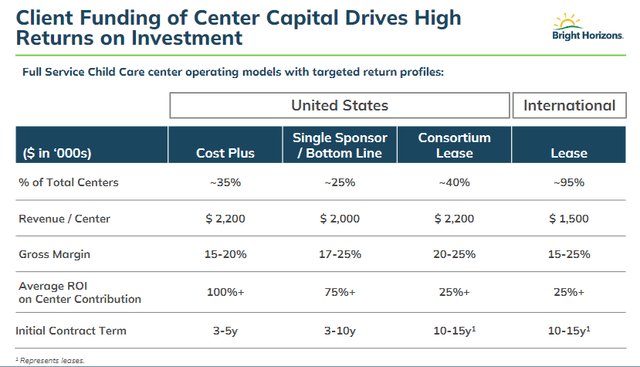

BFAM also has an asset-light operating model that frees up cash to fund its M&A strategy. In the US (majority of revenue), BFAM operates a client-sponsor model, where the required CAPEX of new centers is funded by employers. In turn, BFAM will operate the centers and earn a corresponding revenue from offering the services. Because of the nature of this partnership, the relationship has historically been very sticky (95% retention rate), and this makes sense since the center is built with the intention that BFAM will operate it.

The beauty of this model is that BFAM has little cash outlay and is able to convert a large portion of each earnings to free cash flow (FCF], which is being used to fund its M&A strategy. Since 2009, BFAM has generally converted more than 100% of its adj. net income into FCF. With this cash, BFAM has executed its M&A strategy aggressively, acquiring a few hundred centers over the past two decades. As you can see, BFAM’s entire business model benefits from an inherent virtuous cycle: Asset light operating model: frees up cash to fund M&A; > provides scale > increases reputation > attracts more clients > increases scale > and the cycle repeats.

Valuation

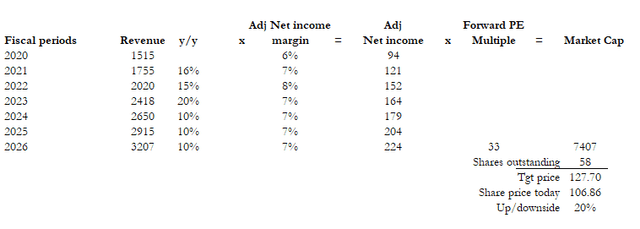

Source: Author’s calculation Source: Author’s calculation

I believe BFAM is worth 20% more than the current share price. My target price is based on FY26 adjusted net income of $224 million and a forward PE multiple of 33x. Post-subprime period, BFAM has historically grown at high single-digit to low-teen growth rates, and I am assuming similar growth over the next 3 years. I believe 10% is easily achievable considering the secular tailwinds and BFAM’s competitive advantage. Management is also guiding FY24 revenue growth of 10%. In a normalized environment (pre-covid), BFAM operates at around ~7% adj net income margin, and I assume this level of margins will continue forward.

One major variant view that I have vs. the market today is that I expect BFAM to trade at 33x forward PE (BFAM historical average) vs. the 30x that it is trading today. In my view, the recent pressure on multiples is likely due to the market being worried about the macro environment, where many employers are firing staff, and this would mean less near-term demand for childcare services. I don’t disagree that this is a near-term macro headwind, but 1Q24 results already show signs of recovery. Full service center occupancy rates averaged >60% in 1Q24, an improvement from 55–60% in 1Q23, with healthy enrollment trends in the US, Netherlands, and Australia. Furthermore, 44% of full-service centers have occupancy rates above 70%, a 900-bps improvement vs. 35% in 1Q23. In the US, despite the macro headlines, enrollments grew by high single-digits year over year, with solid performance across all age groups and center models and notable double-digit growth among infants and toddlers. Regarding labor, BFAM has made healthy progress in shoring up center staffing levels through improved recruitment and retention rates.

As BFAM shows the market that it is able to grow as it did historically, the market should re-rate BFAM back to its normalized (average) multiple of 33x.

Investment Risk

BFAM UK full-service business, which accounts for around 13% of sales, is still facing difficulties due to a low occupancy rate caused by a combination of an unfavorable macro environment and personnel shortages. In addition, BFAM’s education advisory business continues to underperform expectations, and the full-year guidelines have been reduced to low-single-digit growth from mid-single-digit growth. This was mainly caused by low client uptake and employee participation. While these segments are small on a standalone basis, they still make up a sizeable amount on a collective basis. If the macro headwinds worsen in these areas, it may drag down growth to below 10% levels.

Conclusion

My positive view on BFAM is because of its strong position in a growing market for childcare services. I expect BFAM to benefit from the macro tailwinds and be able to capture share given its strong competition advantage (scale and reputation). BFAM’s asset-light model also enables it to convert earnings to FCF at a high rate, providing it capital to fund its M&A strategy, which further strengthens its competition advantage.