bjdlzx

Bonterra Energy Corp. (OTCPK:BNEFF) reported results that held up rather well because oil sales dollars now dominate the results. If natural gas prices recover as expected, then this former natural gas producer will definitely benefit. But the future is becoming more and more attached to oil. This continues the discussion that began with the last article. The difference is that now a natural gas pricing recovery appears to be a certainty in the near future. That would give this company extra money to repay debt which would lower the debt ratio. An initial dividend may be in the intermediate future as well. The new management is performing as expected and reporting much improved results.

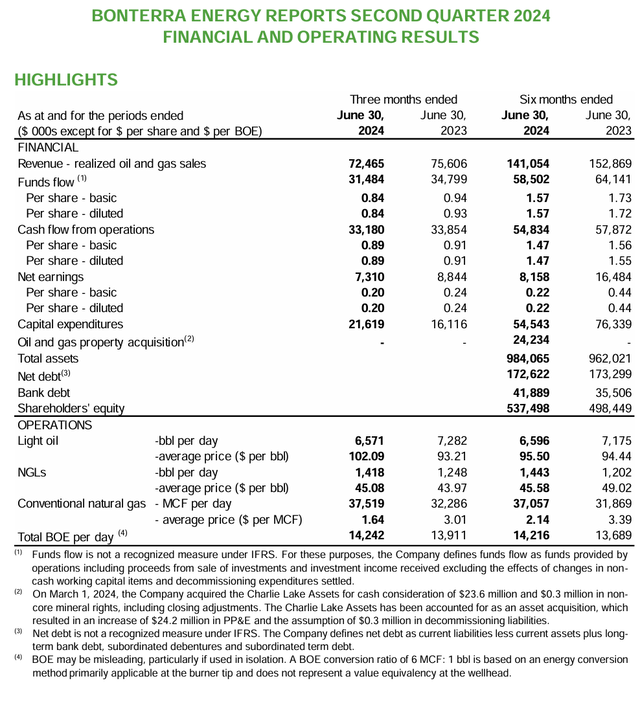

Second Quarter Highlights

Despite the sizable decline in natural gas prices (which in the past would have been a near disaster for cash flow) results held up rather well. This confirms that the management strategy of adding liquids to production is a wise move.

(Note That Bonterra Energy is a Canadian Company That Reports Using Canadian Dollars Unless Otherwise Noted.)

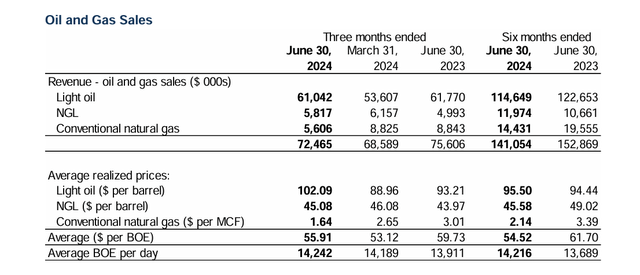

Bonterra Energy Summary Of Revenue Sources (Bonterra Energy Second Quarter 2024, Results Filed With Sedar)

Even though oil itself is less than half of the total production, it is now most of the sales dollars. Natural gas is now in the position of making the situation better, but no longer doing the damage it did in the past when it was the focus of production. The latest Charlie Lake acquisition will likely edge that production percentage of oil and liquids up a little more to continue the trend of more oil sales dollars.

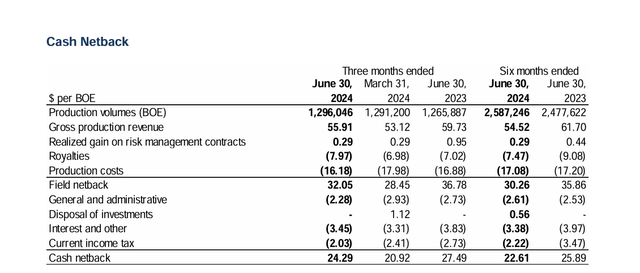

Bonterra Energy Operating Netback Comparison (Bonterra Energy Second Quarter 2024, Results Filed With Sedar)

The field netback and the cash netback actually increased over the first quarter to follow oil prices despite the weakening natural gas prices. The netback held up rather well due to nonoperating reasons like a lower royalty rate and a lower income tax provision. In this business, a little luck like that counts as much as operating prowess.

As management drills more profitable wells, the field netback should gradually become a greater percentage of the production revenue to show that the corporate breakeven could well drop. Some things that should decrease over time would be interest expense per barrel and (if production grows) general and administrative per barrel.

Should the company successfully grow by acquisition, the process could speed up.

Portfolio Choices

The portfolio now has a wider variety of attractive choices that should enable the company to thrive under several different scenarios.

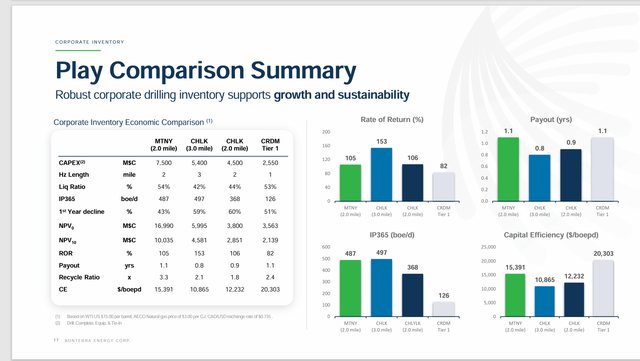

Bonterra Energy Summary Of Canadian Plays (Bonterra Energy Second Quarter 2024, Corporate Presentation)

The trend in the industry towards longer wells is clearly demonstrated here. Charlie Lake’s 3-mile-long wells are the most profitable of the portfolio given current assumptions about prices.

However, things could shift somewhat when natural gas prices begin the expected recovery. North America is expected to gain a lot of export capacity this year and the next fiscal year for natural gas. That may enable the continent to join the usually far stronger world pricing market. If that happens, the relationship between oil and gas pricing could change enough to make the profitability a little bit different.

In the meantime, the company has some profitable choices that it never had before while it waits to see if natural gas prices recover and how long that recovery lasts.

Return Of Capital Framework

The resurgence of cash flow, even with more debt has allowed this former income-modeled company to begin to talk about shareholder returns probably beginning in the next fiscal year. Of course, commodity prices need to cooperate a bit for that to happen. But the overall management assumptions seem to be reasonable.

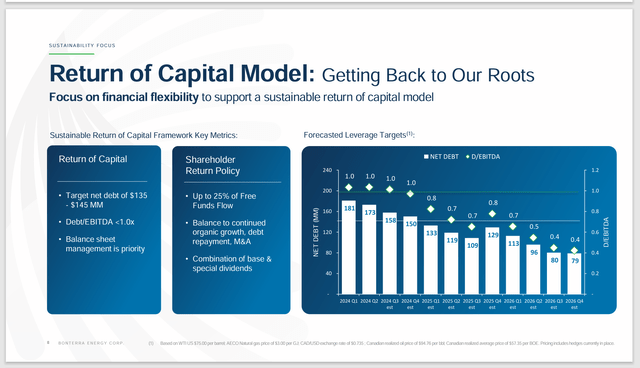

Bonterra Energy Summary Of Return Of Capital Guidance (Bonterra Energy Second Quarter 2024, Corporate Presentation)

Despite all the acquisitions, the company has been able to keep the debt ratio reasonable. That means that shareholders can finally think about returns that used to be routine for this company.

The difference this time around is that the payout ratio is going to be a lot lower, and the company is likely to continue to acquire acreage in places like Charlie Lake in the future.

As was the case for many companies, the income model did not work particularly well and left the company poorly placed to face future challenges. New management appears to have largely fixed the situation. But the future is far more likely to be a growth and income model with a defensible basic dividend. Then there is flexibility to accommodate cyclical downturns.

The market is likely to wait for a track record under the “new regime” before revaluing the stock as finances were squeezed for a while. But Canada has some very cheap acquisition prices which enabled a rather quick solution.

Earnings

Right now, Charlie Lake is the most profitable part of the portfolio. But do not be surprised if the technology that enabled 3-mile wells at Charlie Lake spreads to other areas as time moves forward. The result is that earnings will likely continue to demonstrate a drop in the corporate breakeven price.

Bonterra Energy Summary Of Financial Results Second Quarter 2024 (Bonterra Energy Second Quarter 2024, Results Filed With Sedar)

The important part of the results is that cash flow is holding up unexpectedly well for those used to a company that was highly dependent upon natural gas. The interesting thing to note is that despite the acquisition, the debt is roughly at the same level it was in the previous fiscal year. Hence, production is a bit higher for the same debt level.

While that production difference is currently made of lower value liquids and natural gas, the company is clearly going to be drilling for more light oil production in the future.

Much of the acquired acreage has been produced by using older technology that resulted in a less profitable production mix. However, that will not be true of new wells drilled.

Summary

Management had noted that several new wells had come online. This company is small enough that each well is likely material to the reported production mix. However, given that new wells came online and were cleaning up, I would expect that production mix to head towards a higher overall percentage of light oil and maybe some condensate in the production mix. Other liquids may climb as a percentage of production as well. Along with this would be a slight outperformance expectation that may lead to a little production growth.

Charlie Lake is an emerging play due to the advancement of technology that has allowed the play to become very cost competitive with other established parts of the Canadian industry.

The second quarter did have some maintenance and other issues that influenced production as well. This is typical during the Spring Breakup in Canada.

This company is a strong buy consideration in that new management has reinvigorated a company that badly needed a turnaround from an idea that was just not working very well anymore. The result has been a company with a robust production mix that should enable the company to thrive under various situations. I would also expect more acquisitions in the future for this to become a growth and income play.

Bonterra Energy had a good reputation among investors for quite some time. It would appear that will again become the case in the future thanks to the efforts of the new management.

Risks

Any upstream company is subject to the risks of volatile commodity prices that have extremely low future visibility. A severe and sustained downturn could change the outlook for the company.

Clearly, the new management has been a factor in the company’s turnaround. A loss of services of any of the new senior officers could have a material effect on company prospects in the future.

The technology advances that continue to periodically sweep the industry could make another basin not in the portfolio (or interval) the most cost-effective in the industry. That would require some portfolio adjustments by management which current management appears to be able to do. However, there is always some risk until the company “gets where it needs to go”.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.