Orbon Alija/E+ via Getty Images

Dear readers/followers,

I’m a pretty prolific and heavy investor in forestry, wood, and packaging products. So it didn’t surprise me when I got a request to look at Boise Cascade (NYSE:BCC). I have heard of the company before, but I haven’t had the opportunity or time to look it over. But when someone asks me to look at a business where they work (which this subscriber does), I’m happy to give it a once-over and give my view from the perspective of a valuation investor.

Investing in timber, wood, and wood products, as well as packaging, has been tricky. I’m out of most of these investments at this time, after seeing good returns in the past few years. Their correlation to the forest/wood commodity space is significant. In this article, I will look at what the company does, its fundamentals, and what it could achieve.

I like wood companies. Out of the building materials space, wood is a favorite material of mine, in no small part because most houses in Sweden are built using wood rather than concrete or brick (unless we’re talking city centers).

So let’s see what BCC offers, and if we can see a good upside here, justifying an investment.

Boise Cascade – Plenty of upside, but only at the right price.

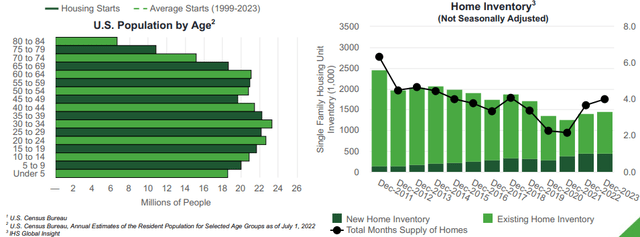

It doesn’t take a genius to understand that BCC is also heavily correlated to building and construction. The company could be called, in part, a reflection of multifamily housing starts and trends, and the long-term trends and prospects based on this and the US housing market (given that the company is primarily US-based), aren’t that superb.

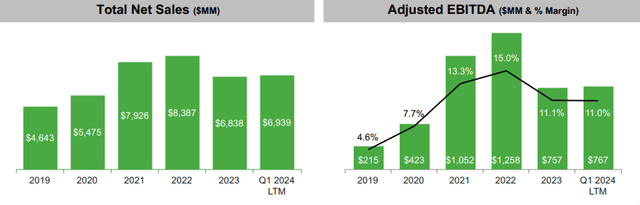

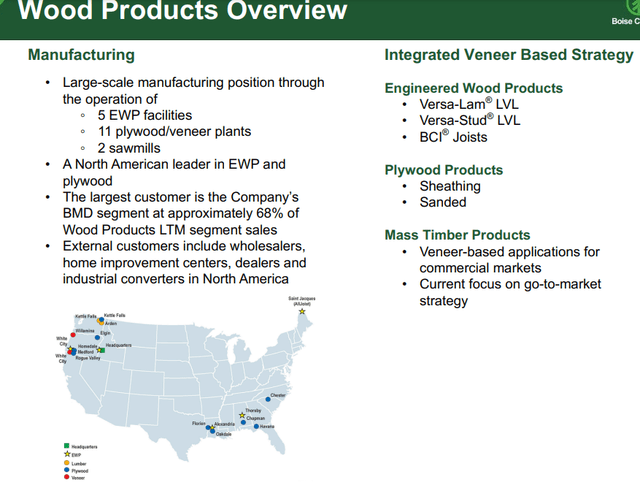

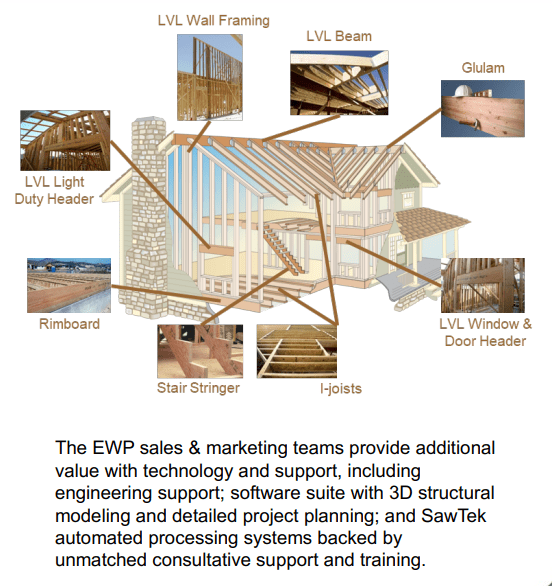

The company works in a market with a sales mix of 24% wood products and 76% building materials. As such, it’s fair to say that wherever the building materials market goes, the company goes. EBITDA is more balanced, along a 50/50 mix, with some variance here – which means that the wood product margins are far better than the building material margins. The company’s wood product markets are the company’s shining beacon that’s also less correlated to commodities, and it works with engineered wood products as well as Plywood.

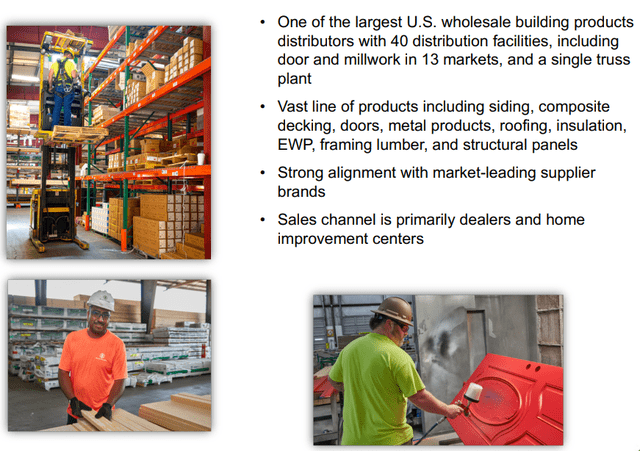

The company is also the leading national wholesaler of wood building materials, with LTM sales of $6.3B and an EBITDA of $375, at a 5.9% margin. To give you a picture of how insane the margin difference is between these two segments, we have a 22.3% margin for the wood product segments – that’s over 3x the margins for building materials.

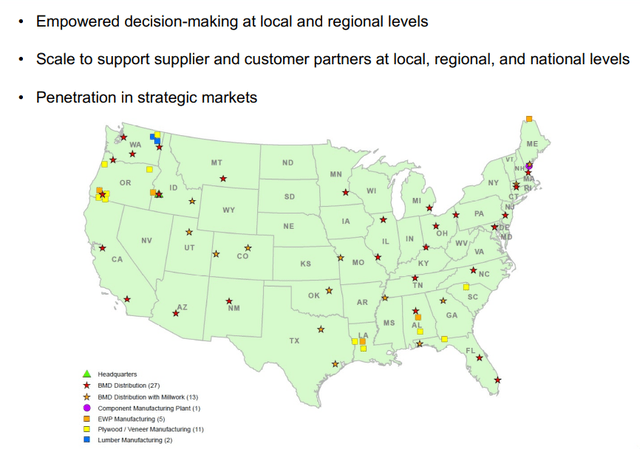

The company, being nationally leading, has representation in close to every state in the US. It also has a multitude of manufacturing sites across the nation.

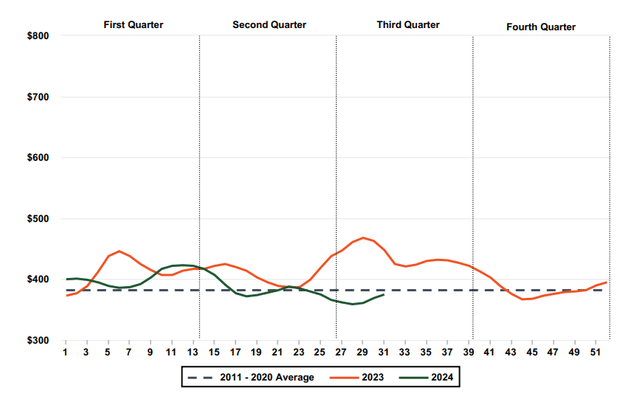

The main problem for BCC is the housing market. Since the 2007-2009 GFC, the housing market starts have been below the 20-year averages of around 1M, at its lowest coming in the 500k’s or even slightly below. There was a brief resurgence during ZIRP, but now we’re back below average. While the current demand indicators remain productive and constructive (no pun intended), with strong wage growth/low supply/good demographics, there are arguments against why this won’t surge back up quickly-including the cost of building. The home inventory as it stands now, unfortunately, as I see it, isn’t a strong enough argument for a positive potential here.

Instead, we see a lot of increases in remodel spending and improvements – which also correlates positively with company sales, just not as much. There’s an increase in home equity levels, as well as an overall median age of existing homes, but there’s also a lock-in effect of the high mortgage rates we’re currently seeing.

BCC’s operational priorities are as follows.

It seeks to leverage its vertically integrated model by tapping into its superior market access as a major EWP producer. The supply chain and sales visibility in the wood products segment work to offset the downside in the construction materials segment. The company is also working to improve and capture EBITDA margins, as well as improve on both organic and inorganic growth.

It’s really the wood products segment that I like the most here.

This is the differentiator segment that I like seeing in a business, and this is where the company “wins”. Building materials is an okay segment, but it won’t win the company any awards in profit, where it’s not among the higher profitability percentiles – many European players have better margins for their segments. Segment revenue does track building activity fairly closely as well – it peaked in 2022 and has trended down, only to slightly recover LTM (but we’ll have to wait and see for the full-year results to see where it’s really going). But more importantly, company segment EBITDA growth is absolutely superb – since 2019, the company’s EBITDA is up almost 300% in this segment, despite only a 10% improvement in housing starts.

This proves that the trend is somewhat de-correlated – and that’s what I am looking for when investing like this. Kind of like UPM Kymmene (OTCPK:UPMMY), which is also into biofuels. This is diversification I like. That’s why it’s not strange that the company’s focus is on EWP, not on building material growth.

BCC IR (BCC IR)

Why is BCC more attractive in context? Because the products, as my subscriber noted, are used in single-family housing starts and projects.

The company is currently therefore investing fairly heavily into its southeast assets to increase production capacity and efficiency to improve EWP top-line. It has been noticed that this is a 20%+ margin segment, and it makes sense to grow this margin segment. The company is also looking to expand EWP sales into multifamily and light commercial construction.

That’s also why it’s making moves exactly in this segment to improve its capacity – like with BMD. The company has key supplier partnerships and also works with national pro chains, home centers, and others like Home Depot (HD), Lowe’s (LOW), and others.

The BMD strategy has allowed it to grow profitably in each market, adding products and services to its footprint. It’s slowly growing its physical presence in currently underserved markets, including attractive Sunbelt ones in Texas, and the SA coast.

The company has showcased, over the past few years, impressive restraint on capital allocation. Net debt of below 2x is the target while maintaining plenty of liquidity and cash to enable M&A growth and asset base investing, as well as an attractive dividend supplemented by special dividends and buyback.

The current dividend level for BCC is at 4.36%, which is about the average for this segment and where it’s going.

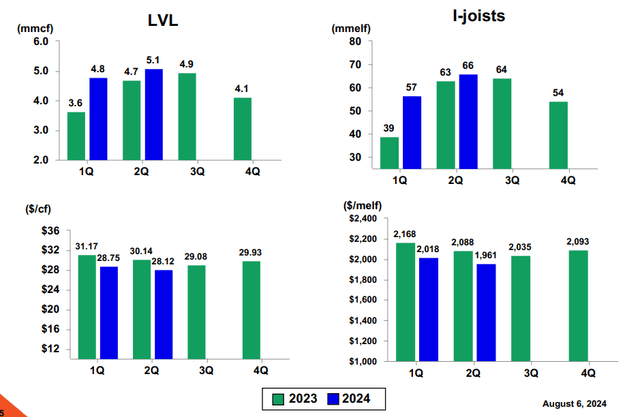

Recent company performance was so-so. The problem here is pricing. Despite a 27% increase in housing starts which did help, some company negatives and challenges do remain – because the road back is quite a long trek here. 2023 was a bad year, with declines in the double digits, and we’ve seen some recovery from this. Both businesses did fairly well in 2Q24, and organic growth projects are moving forward. Consolidated sales were slightly down and net income was down, though, showcasing exactly the pricing issues we’re seeing here.

These trends and this slight expansion were visible mostly across the board, but with muted sales prices in EWP, made up for by volume.

But what this does to valuation is that it makes it more unattractive to invest, since earnings seem quite unlikely to significantly recover this year. How could they, with net sales prices below the levels of last year? EBITDA margins are slightly improved from trough levels, but I doubt we’ll see 6.5% in building materials this year again. BMD also acknowledges that trends for 3Q are likely to be even below the 2Q numbers, or the same as 2Q (or comparable to 2Q). A near-term recovery is, therefore, not currently in the cards. And while lumber is slightly recovering, it’s nowhere near a convincing trend yet.

That makes this a value play – nothing else. And we’ll see what we have here.

Boise Cascade – Long story short, I want $125 or below

So, as the subheading indicates – what I want here is $125/share for the company or below – then I’d be willing to look closer. At a valuation of 12.5x, the company is at a premium to most international peers and only sports a BB-rating. This is also below par compared to others. Furthermore, a 40-50% negative forecast accuracy together with a growth rate, when taking 2024 into account, of almost zero, less than 2.5% per year.

This means that if we expect the company to keep up its trading at its normalized P/E multiple of 13x P/E for the 7-10 years, we get all of 7.9% per year, and that’s inclusive of dividends. If we cast any glance to the short term, we’re at 6-7x P/E for the average, but I believe the company does deserve a more long-term timeframe here. Like most commodity-tethered businesses, the company has upside potential if the commodity or the tied market reverses – in this case, housing.

But I do not see this happening in the near term, and if it does, we’ll have the potential to get in at that time – we do not have to do it now. This is neither the time nor the valuation to buy Boise Cascade, as I see it. I would be very surprised at these forecasts to see anything above 9% per year here in the next 2 years, even including dividends (Source: F.A.S.T Graphs Paywalled link).

I believe there are significantly better plays in this space to be made here – even with better upsides and more stability. My favorite in this space is UPM Kymmene, which offers a better yield, better upside, and BBB+ credit rating.

That is the one I currently go for, and where I am actually buying more at this time.

Thesis

- Boise Cascade is a market leader in EWP and building materials. The company does have an impressive sales presence and national scale in a way that really impresses me, and leads me to say that the company could definitely be attractive at the right sort of valuation.

- However, Boise Cascade also remains firmly tethered to the US housing market – and such a tether needs to be discounted for. We want to pay below top dollar for such a company, and certainly with the way both the market and the business is forecasting the next few years to be. At this time, I’d want a conservative 15% annualized before I went in.

- That’s not something we have here – and for that reason, I consider the company at best a lukewarm “Hold” with a potential for the watch list. That’s also where I have put it, and I wait for investing here.

- My PT for the company currently comes to $125 for the BCC ticker, which would allow a 15% annualized upside to a conservative P/E of 13-14x, rather than the 7-9% we have today.

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

This company is overall qualitative.

This company is fundamentally safe/conservative & well-run.

This company pays a well-covered dividend. This company is currently cheap. This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company lacks upside and is not cheap – for that reason, I say the company is not that attractive here, and I say it’s a “Hold”.