Fotofantastika

Bayer (OTCPK:BAYRY) stock is down 41% since I argued for a “Strong Buy” recommendation. Indeed, Bayer may have been my worst investment recommendation over the past 18 months. That said, I apologize to readers who may have felt encouraged to trade on my writing. Today I understand that my enthusiasm for the German Life Science giant may have been too strong, underestimating the intense weight of the Monsanto litigation headwinds. However, I still feel that there is value in Bayer, especially after the latest re-rating. Indeed, while Bayer’s Q2 2024 results delivered a mixed performance, the company’s reiteration of its full-year guidance offers some reassurance to investors. Despite challenges in the Crop Science division, the strength of the Pharmaceuticals division and steady performance in Consumer Health are encouraging. Moreover, Bayer recently scored an important win “Schaffner vs. Monsanto” case, an outcome that may necessitate a review from the Supreme Court (after the Supreme Court rejected a review in 2022). Still, potential litigation costs and ongoing market pressures in Crop Science remain critical factors to monitor in the coming quarters. On valuation, I update my residual earnings model for Bayer and now calculate a fair implied share price of €44. (BAYN.DE reference, Germany Xetra listing). I downgrade Bayer stock from Deep Value to Speculative Value.

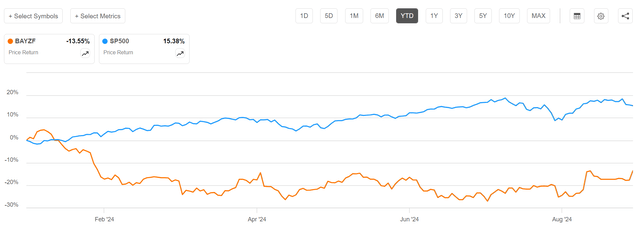

For context, Bayer stock has significantly lagged behind the broader market this year. YTD, Bayer shares are down about 14%, while the S&P 500 has risen by roughly 15%.

Bayer’s Q2 2024 Report: Pharma Beats, Crop Science Misses, Consumer Health Stable

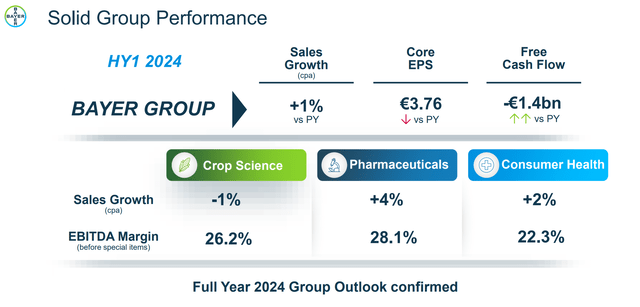

Bayer reported mixed Q2 2024 results, with the company beating analyst consensus on Pharmaceuticals but missing on Crop Science profitability. For the quarter ending in June, Bayer generated total revenues of €11.1 billion, reflecting a 3% increase from the consensus of €10.8 billion. However, the company’s profitability showed mixed signals. EBITDA before special items was €2.1 billion, a modest 2% increase over the consensus estimate of €2.08 billion, and core EPS from continuing operations rose 13% to €0.94, outperforming expectations.

Within the group segments, Pharmaceuticals division led the performance, posting a 4% increase in sales to €4.6 billion, which exceeded the consensus estimate by €191 million. The division’s EBITDA before special items increased by 12% YoY to €1.32 billion, with a margin improvement to 28.7%. The growth was primarily driven by the strong performance of newer drugs, such as Nubeqa, which grew by 21%, and Kerendia, which increased by 11%. Additionally, legacy products like Eylea, Aspirin, and Mirena also showed growth, while Xarelto saw a slight decline of 2%. However, the Crop Science division presented challenges, with sales of €4.98 billion, just 1% above consensus estimates, but a significant 25% miss on EBITDA at €524 million. The negative impact was due to an unfavorable product mix and higher incentive provisions, which outweighed the positive growth in glyphosate-based herbicides (up 42%). The division’s EBITDA margin shrank from 14.3% to 10.5%. The Consumer Health segment performed relatively stably, reporting a 1% increase in sales to €1.46 billion, but a 6% decline in EBITDA to €314 million. The margin contraction was primarily due to continuous investments in new brands and product launches, partly mitigated by cost management efforts.

Costs In Focus

Bayer’s Q2 2024 report highlights notable developments in its cost and restructuring efforts: Bayer is pushing for a cost-cutting strategy aiming for over €2 billion in structural savings by 2026. This plan includes a reduction in headcount, with the workforce down by approximately 1,500 positions in Q1 and continuing through Q2. So far, headcount has been reduced by nearly 5% YoY. The restructuring is primarily targeting bureaucratic layers and unproductive segments of the organization, particularly in Germany.

Guidance

Looking ahead, Bayer reiterated its FY24 guidance for the group. While the guidance was upgraded for the Pharma division (from -4% to 0% growth, to 0% to 3% growth), the Crop Science division is now expected to perform at the lower end of the sales guidance (-1% to +3%) and EBITDA guidance (20-22%). The company expects group sales to be around €47.6 billion, with an EBITDA margin between 22.5% and 22.6%. For context, Bayer is currently trading at around €30 billion market cap.

Encouraging Update Glyphosate Litigation

Bayer’s litigation issues remain a focal point for investors. As of Q2, the company reported settling 114,000 out of 172,000 glyphosate-related claims. However, there was no significant update on the PCB litigation front since the last settlement with the City of Seattle in July 2024.

As a major important development, I highlight Bayer recently won an appeal in the “Schaffner vs. Monsanto” case, which is a positive outcome for the company. The U.S. Third Circuit Court of Appeals ruled in favor of Bayer (Monsanto’s parent company) by stating that state-level “failure to warn” claims regarding glyphosate (the active ingredient in Roundup herbicide) are preempted by federal regulations under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA). This decision creates a “circuit split” with the Ninth Circuit’s decision in the Hardeman case, where the court had ruled that such claims were not preempted. This circuit split increases the chances that the U.S. Supreme Court (SCOTUS) might review the case. A favorable ruling for Bayer by SCOTUS could potentially end much of the ongoing glyphosate litigation against the company. Thus, Bayer’s legal win may positively influence investor sentiment, but risks remain. Specifically, it is uncertain whether the Supreme Court will accept the case or rule in Bayer’s favor if it does. The legal situation remains complex, and potential resolution could take a long time.

Long-term Outlook Holds Promise

Under all the litigation noise, Bayer is still a strong, innovative business. In fact, the company plans to launch ten blockbuster agricultural products in the next decade, each expected to generate over 500 million euros in sales, bringing the total revenue potential of the agriculture business to over €32 billion. The company’s innovative R&D pipeline focuses on new herbicides, insect protection, and crop systems like the Preceon Smart Corn and Hybrid Wheat. Moreover, the company also plans to leverage AI and digital tools to accelerate R&D, improve decision-making, and support sustainable farming. In that context, partnerships and new technologies will help Bayer double its accessible market to 200 billion euros by expanding into biofuels, crop fertility, and digital platforms. At the same time, Bayer’s Pharma division has several promising products in its pipeline that could become blockbusters. The prostate cancer drug Nubeqa (darolutamide) is projected to exceed €1 billion in sales in 2024, driven by strong growth in the U.S. Bayer expects Nubeqa’s peak sales to potentially reach $3 billion between 2027 and 2029, especially if clinical trials support label expansions for broader use. Other key products include Kerendia (finerenone) for chronic kidney disease and Eylea (8mg) for eye conditions.

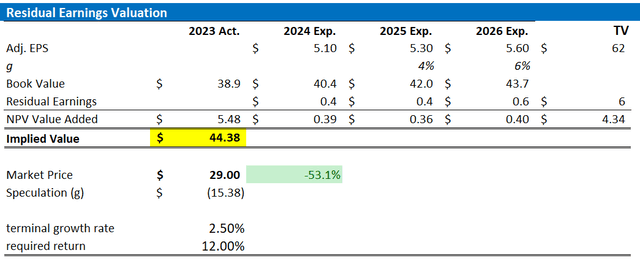

Valuation Update: Target Price At €44

Following Sea’s Q2 2024 report, I have updated my EPS expectations for the company through 2026. I now estimate Sea’s EPS for 2023 will likely be around €5. Additionally, I have adjusted my EPS expectations for 2025 and 2026 to €5.3 and €5.6, respectively, which aligns closely with analyst consensus. While I continue to anchor my estimates on a 2.5% terminal growth rate, which is roughly in line with the estimated nominal global GDP growth and therefore quite conservative, I have increased my cost of equity assumption by 175 basis points to 12%. This adjustment mainly reflects the heightened litigation risks in the agriculture business. Based on these revised estimates, I now calculate a fair implied share price for the SE listing to be €44.4.

Refinitiv; Company Financials; Author’s EPS Estimates and Calculation

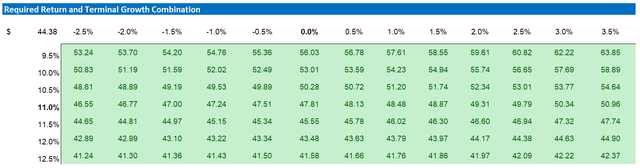

Below also the updated sensitivity table.

Refinitiv; Company Financials; Author’s EPS Estimates and Calculation

Investor Takeaway

Bayer’s Q2 2024 results presented a mixed picture, but the company’s reaffirmation of its full-year guidance provides some comfort to investors. Despite facing difficulties in its Crop Science division, the robust performance of the Pharmaceuticals division and stable results in Consumer Health are positive signs. Additionally, Bayer recently secured a significant victory in the “Schaffner vs. Monsanto” case, a development that could prompt a Supreme Court review. In my view, this could be a major turning point in the multi-year litigation headache. Based on my updated residual earnings model, I now estimate a fair value share price for Bayer at €44, considering its listing on the Germany Xetra exchange under BAYN.DE.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.