JHVEPhoto

Shares of the Baker Hughes Company (NASDAQ:BKR) have been a disappointing performer over the past year, trading essentially flat despite a buoyant equity market, given concerns about the longevity of the LNG cycle and subdued drilling environment. Since recommending shares as a “buy” in January, BKR has returned 15%, essentially in-line with the market’s 14% gain. With updated financials and political activity on LNG, now is a good time to determine if BKR can outperform the market or if investors should sell shares after its market-like performance this year.

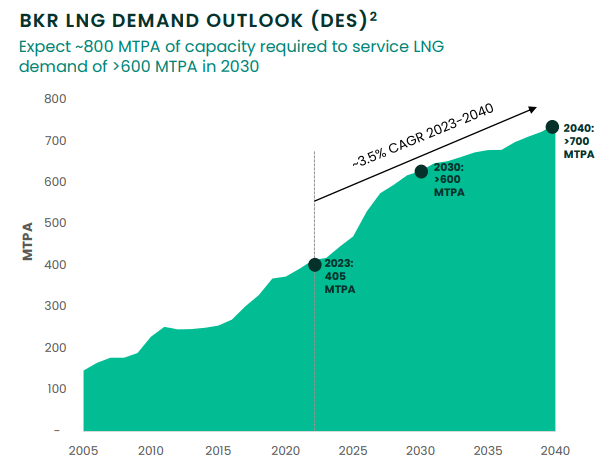

Before turning to financials, one reason shares have rallied in recent weeks, in my view, is an improved political risk environment. A concern I had in January was that the Biden Administration was taking action to pause LNG export development. Now, given the long-term nature of LNG projects, this was a longer-term growth risk rather than a 2024-2025 risk. Moreover, given the goal of isolating Russia, reducing US LNG export growth does not seem too likely. Still, this has added an overhang. Recently, a District Court Judge has halted this freeze. This should alleviate some concern over LNG permitting, even if President Biden wins re-election.

Should Donald Trump win the election, I would expect his administration to remove this freeze and take a laxer approach to LNG construction. Based on current polling, it appears likelier than not that Trump wins the election, but given the legal fight, a Biden victory may not prove negative for LNG activity either. To be abundantly clear, I am not commenting on whom would be a better President, or what is the better policy stance, simply that an easier LNG construction regulatory environment would likely be a positive for a LNG project supplier like Baker Hughes. In this regard, political developments over the past six months have been favorable for BKR.

Baker Hughes will be reporting Q2 results after the market closes on July 25th. Baker Hughes has beaten estimates over the past five straight quarters, and analysts currently forecast it to earn $0.49 on $6.8 billion of revenue in Q2. For the full year, analysts are looking for $2.08. Predicting quarterly results is difficult, but I would note analysts have been increasing estimates in recent weeks, coinciding with the recent rise in the share price. This has increased my concern that expectations are getting elevated, particularly for the full year.

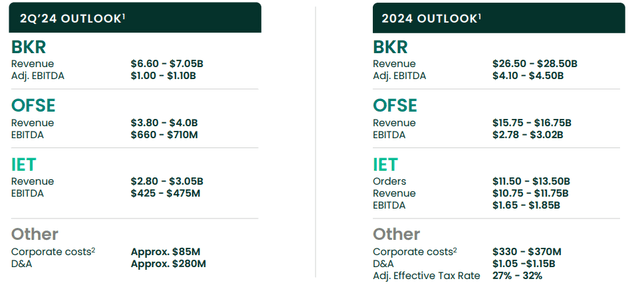

Back in January, I forecast the company would earn $1.90-$2.05 this year. After Q1, I do expect results to be in the top half of my range, but consensus now exceeds my range. Alongside Q1, BKR reiterated guidance, which you can see below. Implicitly, the analyst community appears to be positioning for a potential guidance increase. Given some of the trends we are seeing, this appears ambitious and is adding to my concern about the attractiveness of shares at current levels.

In the company’s first quarter, BKR earned $0.43 on an adjusted basis. EBITDA rose by 21% to $943 million, outpacing 12% revenue growth to $6.4 billion as it makes progress recapturing margin, which is encouraging. We are seeing benefits of cost management discipline and the operating leverage inherent in its business, as it builds scale.

While revenue rose, I would note that orders fell by 14% to $6.5 billion, for a 1.02x book to bill ratio. While a book-to-bill above 1.0x is positive, we have seen a significant slowdown in order activity, which does raise my concern about how fast the business will grow, particularly in LNG, where activity is slowing as Europe has been able to replace Russian gas imports more easily than hoped. Based on projects already launched, LNG capacity is set to grow significantly between now and 2028 and then decelerate. With Europe unlikely to be clamoring for more gas, order growth may continue to slow, even with a more hospitable US regulatory environment.

Baker Hughes

In its legacy oilfield services & equipment (OFSE) unit, revenue grew by 6% from last year to $3.8 billion with North America flat and International up 8%. About 70% of this business comes from overseas, so this geographic breakdown is favorable in the current environment. Offshore rig activity overseas has been slower to ramp up, and I will want to see Q2 acceleration. It had $3.6 billion in orders for a book-to-bill was just 0.94x with subsea particularly weak at 0.8x.

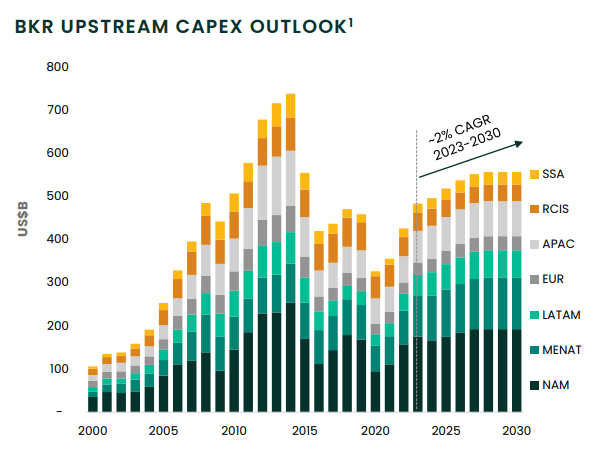

Interestingly, Baker sees “robust” offshore activity, which should persist for 2-3 years, which makes the slower ramp in Q1, alongside weak orders particularly surprising. Given BKR’s leading position in offshore projects, it will be imperative to see sequential improvement in Q2 to validate this outlook. As you can see below, over the medium-term, BKR expects modest increases in upstream capital spending.

Baker Hughes

With spending still running below last decade’s peak level, I view this outlook as reasonable, particularly as oil and gas consumption is still rising given growth in the developing world. Management believes that international is growing by high single-digits while the US is subdued given a pullback in natural gas activity. With Henry Hub back below $2.50, I do see ongoing downside risk in US drilling activity. Indeed, some natural gas drillers are already delaying completion activity. Given it is more focused overseas, this should be just a modest headwind for BKR, but it is likely to still be a headwind.

More encouragingly, we have seen oil prices rise over the past month from recent lows as global economic activity has remained positive. If we do see the Federal Reserve cut rates as I expect starting later this year, that could help to weaken the dollar and support oil prices. Offsetting this, OPEC+ aims to begin phasing out a production cut later this year, which likely limits how much upside the commodity has. I have viewed $75-$85 as a reasonable range for oil over the past year. Given these dynamics, I view that as still the central case. That should support ongoing cap-ex demand but not likely spur significant new spending.

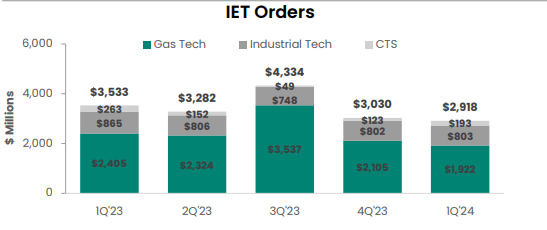

The bigger question for me is in Industrial & Energy Technology (IET), where revenue rose by 23% to $2.6 billion, due to a 46% jump in gas tech equipment. Given scaled up volumes, margins rose to 14.7% from 13.9% last year. I had flagged IET orders falling below $3 billion as a sign of concern for me in January. Its LNG-tied business is housed in IET, and ongoing growth here is critical for Baker’s long-term growth profile.

As you can see below, orders did fall further in Q1, just below the $3 billion level. Gas technology equipment book-to-bill was just 1.0x. IET’s $29.3 billion of backlog was down $600 million sequentially. After the surge in growth in 2022-2023 as the world prepared to supply Europe with more LNG, it increasingly feels like activity is normalizing.

Baker Hughes

Now, this new normal level of activity is quite strong with revenue up substantially from a year ago. But with orders now below $3 billion, revenue growth is likely to continue to decelerate towards 11-14% by year-end. IET still has a large backlog, and these are multiyear projects. If we see orders stay below $3 billion in Q2, that is likely to add to concerns about the pace of growth in this business.

Alongside these challenges, I would emphasize that Baker Hughes has a stellar balance sheet with$2.7 billion of cash and $6 billion of debt. That leaves it with just 0.8x net debt/EBITDA. Additionally, its free cash flow profile continues to improve. It generated $502 million of free cash flow in Q1 up from $197 million a year ago.

Most of these gains came from improved working capital management thanks to supply chain improvement. It had $209 million of working capital favorability vs a $63 million draw last year. It continues to target 60-80% of capital returns from free cash flow. Accordingly, it did $158 million of Q1 buybacks, and in February, it raised its dividend by 11% to $0.21.

BKR’s core oilfield service business should continue to generate modest growth, given rising cap-ex spending, curtailed by weaker US natural gas drilling. While its LNG business is set to keep growing, it appears IET is likely downshifting into a slower pace of growth, and while the political environment may have improved, that likely is reflected in shares.

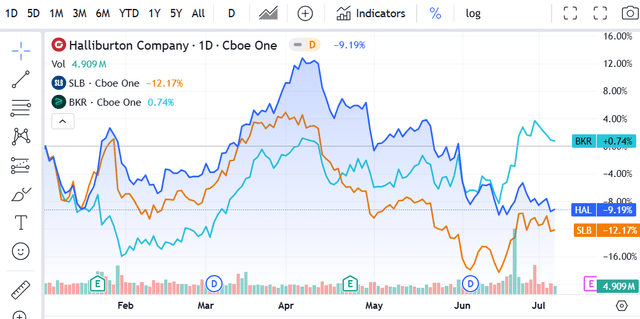

Given these headwinds, I do not view a guidance increase as likely and see BKR earning about $2/share this year, a bit below consensus. Shares are about 17x earnings, which is not particularly expense, nor cheap, given a slowing growth profile. SLB (SLB) trades at 13x, and it does not have the same LNG exposure, so BKR is enjoying a meaningful premium given the perceived growth in this unit. Halliburton (HAL), which has more North America exposure, is less than 10x estimates. As you can see below, BKR has materially outperformed over the past three months.

Given my concerns IET orders may stay muted and the need to see improvement in offshore activity, BKR shares appear relatively expensive and potentially vulnerable to anything but a beat in Q2. As the business is still growing, I do not see a need to sell shares, but would not be a buyer here, especially ahead of earnings. I am moving shares to a “hold” given slowing growth. For very tactical investors, I also see an argument for reducing positions ahead of earnings in two weeks, given elevated expectations. If we saw shares trade down closer to $30 or 15x earnings, I would be a buyer, given its solid balance sheet, but for now, I would remain on the sideline