Hiroshi Watanabe

Earlier this year, in July, I issued a bullish thesis on Bain Capital Specialty Finance (NYSE:BCSF) indicating a clear buy given the robust state of the underlying fundamentals and a presence of a ~ 10% discount to NAV. In other words, I saw no meaningful justification as to why BCSF should trade at such a discount.

The only reason what could theoretically push down the multiple here were the exposures beyond the first lien assets, which together accounted for roughly 33% of the total asset base. However, if we dissect further the exposures that come through the joint venture vehicles, we will arrive at a first lien portion that explains about 84% of Bain’s assets. While this is not the highest level what one could find in the BDC space, it is certainly not below the sector average or in any shape or form a notable aspect, which should drive down the P/NAV to 0.93x (based on the current statistic).

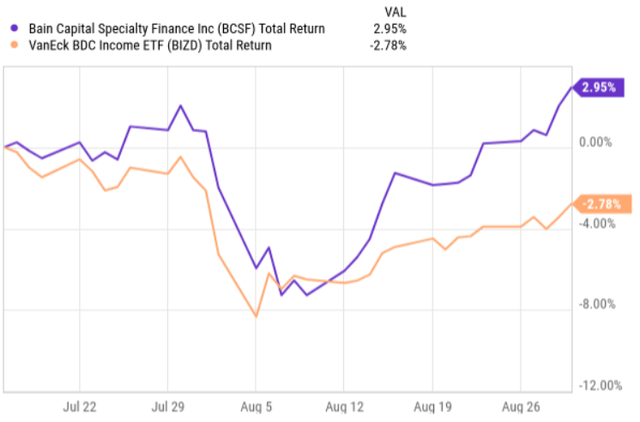

Since the publication of my previous piece, BCSF has clearly outperformed the BDC index.

The main reason behind the alpha is purely related to the strong Q2 2024 earnings report, after which the Stock price assumed a strong and favorable momentum.

Let’s now dissect the Q2 2024 earnings deck and see what have been the key data points that are worth considering in the context of my current investment case.

Thesis review

As stated above, the Q2 2024 performance brought positive results, especially in relation to BCSF’s P/NAV metric, which continues to indicate a meaningful discount.

The total investment income for the quarter landed at $72.3 million, which marks a slight drop compared to $74.5 million result in the prior quarter. Because of this decrease in the top-line figure, the net investment income per share contracted accordingly, reaching $0.51 per share (i.e., $0.02 per share below the Q1, 2024 metric). However, here I would like to underscore the key reason behind this dynamic, which was that Bain Capital recorded smaller revenues from other income categories that is per definition more volatile and not that critical in the context of core underlying performance.

As a result of the achieved NII generation levels in Q2, the base dividend coverage remained solid at 121%, which ranks among one of the most conservative coverage levels in the BDC space. Given the surplus of ~ 21%, the Management decided to add supplemental dividends to the equations, thus increasing the total dividend paid for the quarter to $0.45 per share. On an annualized basis, this translates to a yield of ~ 10.5%, which could be deemed attractive considering the conservative coverage level.

An additional layer that renders BCSF’s business relatively safe is its leverage profile, which as of Q2 2024 stood at 1.03x (i.e., well below the sector average of 1.16x). It is also below the BDC’s target range of 1.1x to 1.25x, implying that there is a notable room for accommodating portfolio growth. Furthermore, during Q2 2024 period the Management enhanced the debt structure by increasing the commitment under its secured revolving credit facility by nearly 30%, while at the same time extending the maturity to mid-2029. What is surprising here (in a positive way) is that even with the extended maturity and strengthened liquidity, the weighted average interest rate on the outstanding debt dropped by 10 basis points to 5.1%.

A final thing that is worth underscoring in terms of the improvements in Q2 is related to BCSF’s portfolio credit quality. Importantly, the non-accruals decreased to 1.0% (measured on a fair value basis), which is both significantly below the sector average and indicative of a healthy portfolio (which has not been the case for many BDCs in Q2 period). Plus, looking at Q2 2024 data points, we will notice that 97% of the portfolio investments continue to perform in line with the projections that were incorporated in the underwriting process.

Having said that, there is an element of a potential concern stemming from the Q2 2024 data points. Namely, the net investment activity for Q2 landed at negative $167 million, which will make it more difficult for BCSF to grow and/or shield the current levels of net investment income generation. This is also the largest drop over the past 5-quarter period.

However, here I would like to emphasize several mitigating factors.

First, the gross origination amount during Q2 was $307 million, implying an increase of 55% on a year-over-year basis. The momentum on the gross origination front seems to have strengthened, which sends an encouraging signal for the overall transaction activity going forward.

Second, 86% of the new investments came in the form of first lien senior secured loans and 9% was unwritten through joint ventures, which carry a notable bias towards senior loan instruments. Namely, the portfolio is gradually becoming more first lien focused, which should neutralize the key argument for having the discount to NAV in place.

Third, by making these investments, BCSF has maintained strict underwriting standards without sacrificing the yield (the weighted average yield on the investments is 11.6%). The median leverage levels have landed at 4.6x, which in combination with the presence of documentation containing financial covenants tied to management’s forecasts (relevant for 95% of investments) allows to further de-risk the portfolio.

Key risks

From all of the prevailing headwinds in the BDC space such as spread compression, shallow M&A activity, and increased non-accruals, the transaction market component is something that we have to be cognizant of.

As elaborated above, this quarter BCSF registered quite a negative figure on the net investment funding front, which means that the asset base during Q3 will most probably be lower than in Q2. This, in turn, will cause the net investment income to contract a bit or, in a positive scenario, remain where flat. Given that the portfolio quality is rock solid and the dividend coverage indicates a high margin of safety, the risks of a dividend cut are very limited. However, in case the M&A statistics continue to come in at a negative fashion for several quarters in a row, the margin of safety would obviously quickly disappear.

Yet, once again, looking at the broader interest rate dynamics, the odds seem to be stacked in favor of experiencing dividend cuts in the near-term. This should stimulate buyers and sellers to transact and LBO activity to gradually revert back to more normalized levels.

The bottom line

All in all, the Q2 2024 earnings deck confirms that the investment case is still there and attractive for investors, who seek defensive income streams. The base dividend coverage remains strong, and the portfolio quality embodies the right dynamics that are necessary to further de-risk the business profile. The only concern could be related to the depressed net investment activity. However, if we put things in the perspective of the overall BDC sector statistics, where most BDCs have suffered from inactive M&A markets, this should not serve as a reason to avoid the BCSF. Instead, the new investment fundings allow Bain Capital Specialty Finance to slowly but surely improve the portfolio quality without sacrificing the yield potential.

As a result of this, I remain bullish on this BDC and continue to believe that the discount to NAV of ~7% is unjustified.