Sundry Photography

Baidu (NASDAQ:BIDU) (OTC:BAIDF) may be one of the most underrated, underappreciated, and most undervalued AI companies globally. Baidu’s primary fault is that it is a Chinese company suffering from a transitory image problem because of a shift to negative sentiment and temporary growth issues in China-specific stocks.

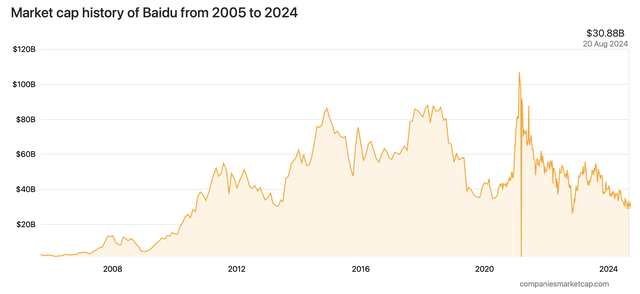

Baidu’s Market Cap Decline

Market cap (companiesmarketcap.com)

After peaking at over $100 billion in 2021, Baidu’s market cap recently dropped to just $30 billion. Also, Baidu has amassed a solid cash position, and the company’s enterprise value is only around $20 billion. This is ludicrous because Baidu will bring in around $20 billion in sales this year, placing its EV-to-sales ratio at about one.

Baidu has become accustomed to surpassing consensus estimates and could beat its upcoming earnings announcement on 8/22/24. Baidu’s trend of beating sales and EPS estimates could persist, and the company can continue to surpass the forecasts moving forward.

Moreover, Baidu has a leading position in search, AI, cloud, autonomous driving, and other lucrative segments that should translate into increased sales growth and higher profitability. This dynamic of improving growth and higher profitability metrics should enable Baidu’s stock to go much higher in future years.

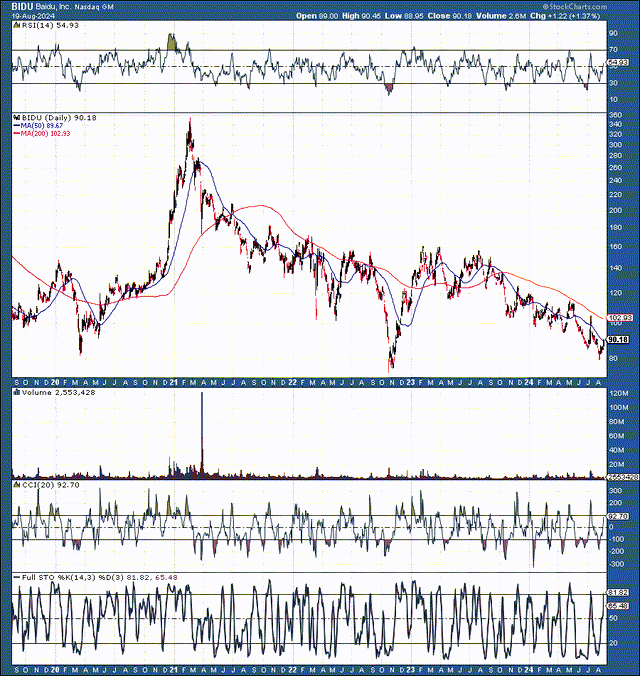

Baidu 5-Year Chart

Baidu is likely going through a long-term bottoming process. We see a low at around $80 after the coronavirus crash. Then we saw the epic recovery transitioning into a bubble, bursting in early 2021, making the ultimate low around $70-80 in late 2022 and, more recently, retesting support around $80 again.

Baidu’s stock is in a wide range from around $80-150. Therefore, the downside is likely minimal, and the upside is considerable, to around $150 in just a trading-like scenario. There may be substantially more upside in a longer-term investment scenario where Baidu’s stock could increase to $200-300 or higher in the long term.

Autonomous Driving Could Be Massive For Baidu

In China, it’s possible to travel six miles in a driverless taxi for just about 50 cents. Of course, this dynamic is causing anxiety in the broader taxi industry. However, for companies like Baidu, the “robotaxi” business represents the potential for a significant revenue stream.

While putting an exact number on it is challenging, the initial evidence shows that the robotaxi segment could be highly lucrative for Baidu, leading to considerable sales and profitability in future years.

Another crucial factor is that Baidu is not a struggling EV startup. It’s a highly successful internet company, a leading search business in China that can build one of the most successful and profitable robotaxi fleets, especially provided its advantage of operating on its home turf in the most promising car market in the world. And we can’t forget about its massive $10B plus cash position.

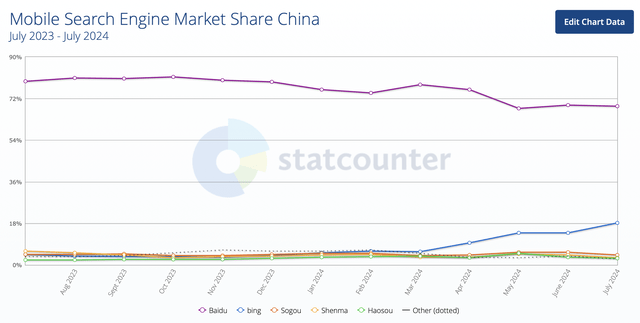

Still Number One In China Search

Search share (gs.statcounter.com)

While Baidu has given up some market share to Bing primarily, it’s still the leader in China search, and the market share declines could be temporary. Baidu remains in an advantageous position in China search and may continue benefiting from its relationship with the CCP government, which helps it remain atop the search engine market in China. Also, despite the decrease in market share, Baidu’s search-related revenue increased to 18.5B RMB in its latest quarterly announcement, vs. 18B in the same quarter the previous year.

Remarkably, with Baidu, you get China’s leading search engine and app developer for an enterprise value of only about $20 billion. Moreover, you get one of China’s leading cloud businesses with Baidu AI Cloud. Additionally, you get massive AI, robotaxi, and autonomous driving potential. Furthermore, you get Netflix/YouTube-like content and an entertainment platform via Baidu’s iQiyi.

Therefore, with Baidu, we receive an excellent internet conglomerate with one missing ingredient: growth. Fortunately, this is likely only a temporary setback.

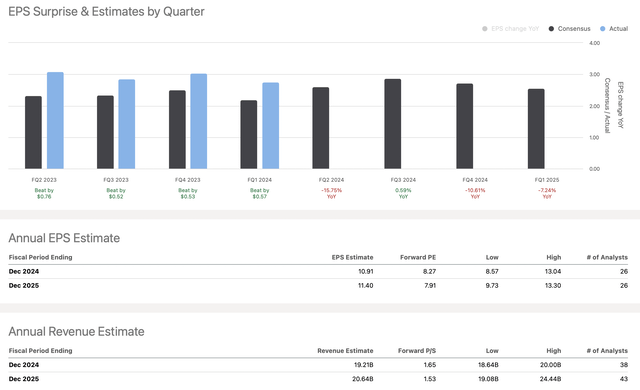

EPS vs. estimates (seekingalpha.com )

Despite the projections for very little growth, Baidu surpassed the consensus estimates handsomely over the last year. It’s not just the previous year, as Baidu has exceeded every one of its quarterly EPS announcements in the last five years. Moreover, Baidu only missed revenue estimates once during these five years, illustrating the company’s stability and ability to outperform the consensus analysts’ figures. Yet, the stock gets no respect.

The TTM EPS consensus estimate was $9.37, but Baidu reported $11.75 instead, a hefty 25% outperformance rate. This dynamic illustrates how lowballed Baidu’s estimates have become and that the market is likely overly negative on China, particularly Baidu. Furthermore, the underlying dynamic suggests that Baidu could continue substantially surpassing analysts’ EPS figures.

Baidu’s fiscal 2024 and 2025 consensus EPS estimates are about $11 and $11.50, respectively. However, provided Baidu’s tenacity to surpass consensus estimates, it can outperform the lowballed marks. Even if it beats by a modest 15%, we could see about $12.50 in EPS this year and $13.25 in 2025.

Given that its stock is at about $90 here, Baidu’s forward P/E ratio may only be approximately 6.7, which is incredibly cheap for stock in Baidu’s market-leading position, and prospects for more growth and profitability increase as we advance.

Where Baidu’s stock may be in the future:

| The year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $19.8 | $22.5 | $24 | $26 | $29 | $32 | $34 |

| Revenue growth | 6% | 14% | 7% | 9% | 10% | 9% | 8% |

| EPS | $12.50 | $13.25 | $14 | $16 | $18 | $20 | $23 |

| EPS growth | 11% | 6% | 6% | 14% | 14% | 12% | 11% |

| Forward P/E | 10 | 12 | 14 | 15 | 16 | 17 | 18 |

| Stock price | $132 | $168 | $224 | $270 | $320 | $390 | $455 |

Source: The Financial Prophet

A 6-7 P/E ratio is too cheap for Baidu, and this low valuation may be temporary, as such a low P/E ratio may be unsustainable. It could expand substantially when evidence of increased growth materializes. Baidu’s growth could improve as its AI monetization increases and growth returns to the Chinese economy.

Lower rates in the U.S. and globally should also help alleviate some of China’s growth issues. As Baidu’s P/E ratio expands to the 10-20 range, its stock could appreciate considerably, especially as its earnings will likely continue to increase due to growth and profitability improvements in future quarters.

Risks to Baidu

Baidu faces risks, and a primary risk is a continuous assault on its core bread-and-butter search business. Microsoft’s and Google’s search increases in China are a concern, and Baidu must keep its leading search position to enable a healthy business dynamic. Also, we must see continued cloud growth as Baidu faces increased competition in the cloud segment. Furthermore, geopolitical risks and general China tensions are a continuing concern. Baidu faces AI competition and growing competitors in other segments. Investors should consider these and other risks before investing in Baidu.