Sundry Photography

QOE Capital: Co-Authored by Analyst Antonio Mello

Investment Thesis

Atlassian Corporation (NASDAQ:TEAM) proposes a compelling long opportunity in the rapidly developing enterprise software market. As a leading provider of collaboration and productivity tools, Atlassian has generated consistent growth, strong market positioning, and a drive and commitment to innovation. The company’s unique business model, along with its strategic focus on cloud migration and artificial intelligence, positions it well to capitalize on the growing demand for digital workplace solutions. Atlassian Corporation is a buy with considerable upside for the following reasons:

Market Leadership with Substantial Growth Potential: Atlassian is a leader in collaboration and workflow management software, serving over 300,000 customers in various industries. With around a $67 billion serviceable addressable market growing at a CAGR of 12% annually and large room for expansion within existing accounts, Atlassian has untapped growth.

Cloud-First Strategy Driving Long-Term Value: Atlassian’s cloud transition is transforming its business model and growth strategy. The shift to cloud is expanding Atlassian’s market opportunity and improving customer lifetime value through higher net expansion rates, increased adoption of premium offerings, and enhanced cross-sell opportunities.

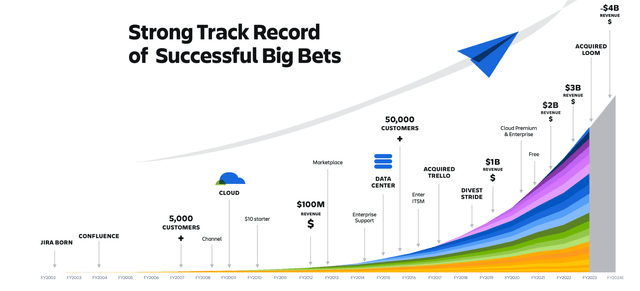

Innovation-Led Growth with New and Efficient Business Model: Atlassian’s commitment to innovation, particularly in AI, positions it to capitalize on emerging workplace productivity trends. This innovation is supported by an efficient, product-led growth strategy and strong financial outlook, targeting $10 billion in annual revenue within five years.

Company Background

Atlassian Corporation is an Australian software company that has pioneered and led change in team collaboration and productivity tools. The company was founded in 2002 by Mike Cannon-Brookes and Scott Farquhar. Headquartered in Sydney, the company has grown from a small startup to a global scale, known for its variety of popular products including Jira, Confluence, and Trello. Atlassian’s success has been driven from its innovative approach to software development, a low-touch sales model, and a strong corporate culture and atmosphere that thrive on teamwork and creativity. The company went public in 2015 and has continued to expand its market presence through organic growth and inorganic growth, strengthening its position as a key player in the enterprise software industry.

To breakdown Atlassian Corporation’s positioning in the market, we can break down Porter’s Five Forces to determine their economic moat and competitive advantages:

Threat of New Entrants

While the software industry’s high development costs and Atlassian’s established position create high barriers, the rise of cloud computing and low-code platforms has lowered entry barriers, allowing innovative startups to challenge Atlassian’s position with niche or specialized collaboration tools.

Bargaining Power of Suppliers

Atlassian’s suppliers, which include skilled tech workers and cloud infrastructure providers, have limited bargaining power due to Atlassian’s strong brand recognition and the availability of multiple cloud service options. While there are substitutes, the competitive market for top tech talent can sometimes drive up costs.

Bargaining Power of Buyers

Atlassian’s diverse customer base generally has moderate bargaining power. While they have numerous software options, the high switching costs that the buyers would incur from migrating data, retraining staff, and disrupting workflows often lead to customer loyalty and recurring revenue. Bargaining power is usually higher within the smaller customers due to lower switching costs, more alternatives tailored to their needs, and Atlassian’s self-service model. However, overall bargaining power of buyers is moderate as Atlassian has different pricing and retention strategies across different market segments.

Threat of Substitute Products

The collaboration software market faces a high threat of substitutes due to high competitiveness, with numerous alternatives like project management tools, communication platforms, and even general-purpose applications. Atlassian must continuously innovate and differentiate its offerings to say ahead of substitute products as the market is increasingly competitive.

Rivalry Among Existing Competitors

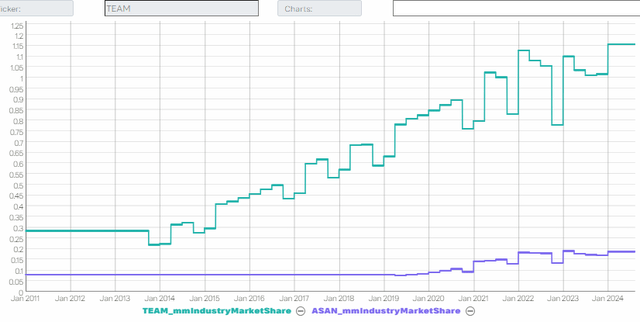

Atlassian operates in a competitive landscape, facing off against both tech giants, like Microsoft (MSFT) and Google (GOOGL), as well as more specialized companies like Slack and Asana (ASAN), leading to a high and intense rivalry being driven by rapid feature development, competitive pricing strategies, and a race to capture market share in the growing collaboration software sector.

Currently, Microsoft and Google dominate market share due to their long-standing reputation and ability to package workflow management products with legacy products. However, focusing more on its immediate competitor Asana, we can see Atlassian is significantly outperforming when it comes to market share and growing that share.

Summary of Forces

Atlassian operates in a highly competitive collaboration software market with significant obstacles and opportunities. While established brand recognition and a complex product ecosystem have reduced the threat against new entrants, cloud technologies have lowered entry barriers. Atlassian benefits from low supplier power yet still faces varying degrees of buyer bargaining power across its diverse customer base. The most threatening challenges stem from the high threat of substitute products and intense rivalry among competitors, demanding constant innovation and price competition to stay ahead of competition. Despite these pressures, Atlassian’s strong market position, diverse product offerings, and unique corporate culture allow it to maintain a competitive edge. To sustain growth, the company must continue innovating, differentiating its offerings, and adapting to rapidly changing market dynamics as this market is growing and inviting more and more competition.

Main Investment Points

The first growth driver of the company is the fact that their market opportunity is even larger than initially believed. Atlassian has stated that it estimates its total serviceable addressable market to be $67 billion, growing at a 12% CAGR annually. This breaks down into their segments as:

$17 billion in software development (9% annual growth)$15 billion in service management (13% annual growth)$35 billion in work management (14% annual growth)

Atlassian also has large potential to increase wallet share within their existing customer base in addition to the growth through the markets. Atlassian sees an $18 billion opportunity, emphasizing the high potential for expansion among their over 300,000 paid customers. Particularly, the company has a strong presence in enterprise markets, with 84% of Fortune 500 companies and 61% of Global 2000 companies being Atlassian customers. However, these segments only represent 9% and 23% of Atlassian’s business respectively, indicating substantial room for growth in these high-value markets.

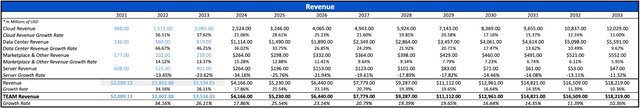

Secondly, Atlassian’s cloud-first strategy is driving long-term value and showing impressive progress thus far. Cloud revenue now represents 61% of Atlassian’s total revenue, which represented a significant increase from 43% when server end-of-life was announced in October 2020. During this period, paid seats in the cloud have increased by more than tripling.

Moreover, these customers are twice as likely to adopt additional products like Jira Service Management after migrating to the cloud. And their total annual spend is, on average, more than double their previous on-premises expenditure.

The company also continues to launch new products from its Point A incubator program, including Jira Work Management, Jira Product Discovery, Compass, and Atlas. These innovations have been incredibly successful, as demonstrated by Jira Work Management’s ARR growing at 50% year-over-year. The recent acquisition of Loom also further enhances Atlassian’s product portfolio by expanding their offering capabilities.

Finally, Artificial Intelligence has also become a major focus area for Atlassian. The company’s AI offering, Atlassian Intelligence, launched a year ago and has already drawn in over 30,000 customers, with monthly active users tripling since December 2023. The introduction of a new AI-powered product for enterprise search and knowledge discovery called Rovo displays Atlassian’s commitment to leveraging AI to enhance workplace productivity.

Atlassian’s go-to-market strategy balances a product-led growth model with a developing enterprise sales motion. The company maintains one of the most efficient sales and marketing models in software and continues to expand its enterprise focus through Solution Partners, Enterprise Support, and Enterprise Advocates.

Financially, Atlassian presents a strong profile and a clear path to achieving $10 billion in annual revenue within the next five years. As management has outlined, the company’s Cloud ARR has surpassed $2.8 billion with a net expansion rate of 120%, while Data Center ARR has exceeded $1.2 billion with a net expansion rate of about 130%. Atlassian projects total revenue growth at a 20%+ CAGR over the next three years and aims to return to operating margins of over 25% by the fiscal year of 2027.

The company’s increased focus on enterprise customers and Data Center to Cloud migrations is yielding great results. 94% of Data Center migrators are opting for Premium or Enterprise editions in the Cloud, and enterprise customers boast a high logo retention rate of over 98%. Atlassian has identified a $14 billion opportunity within its existing enterprise customer base and is continuing to target it.

The priorities and direction the company is headed in reinforces Atlassian’s strong market position, successful cloud transition, commitment to innovation, and clear growth strategy. The company’s focus on enterprise customers, AI-driven products, and efficient go-to-market approach positions it well to capitalize on the growing demand for digital workplace solutions and achieve its ambitious revenue targets in the coming years. Overall, we believe management’s strategy is well-placed and that the interconnectivity of their products along with their AI investments will provide tremendous value to customers and therefore investors.

Valuation Analysis

As Atlassian offers a variety of products and has different segments, we broke down revenue growth by the expansion of their segments individually. We assumed growth in line with estimates and management’s strategy and trajectory, which achieved an overall revenue CAGR aligned with expectations, particularly over the next few years.

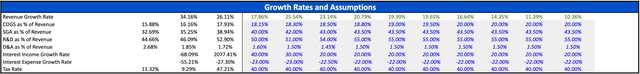

With our topline projections, we then forecasted the income statement with the expenses as a % of revenue. For the majority of the expenses, we began following historical trends as the company has already begun implementing the thesis and thus should see similar trends in the near future.

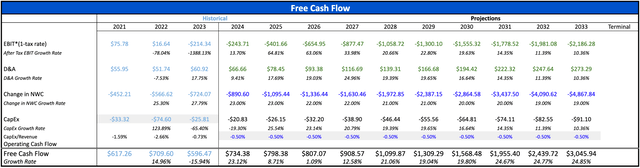

Then, to forecast the company’s future free cash flows, we used the calculated EBIT figures, the forecasted tax rates, and the forecasted depreciation & amortization figures from the income statement. To calculate the change in Net working capital, we tapered this down to match close to their recent average. For their capital expenditures, we determined it to be -0.50% of the revenue, which is, again, tapered down as it follows the trend of their capital expenditures as a % of revenue.

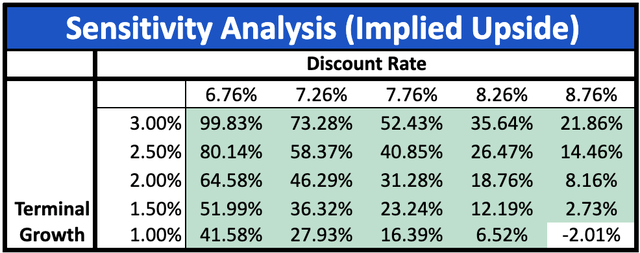

Given that two of the biggest drivers for this valuation are the trajectory of this industry and its growth as well as the discount rate, our sensitivity analysis covers these two figures. The terminal growth of the company will likely not fall to a figure as low as 1%. The more likely risk in sensitivity would be the discount rate increasing. However, given that the equity weight is so significant, it is more likely that the change in the discount rate would cause it to fall barring any severe changes in the company like its equity beta. Thus, a look at the sensitivity analysis tells us that there is low risk in our forecasts via terminal growth and the discount rate, yet there is still implied upside in many downside scenarios.

Due to the difference in size of Atlassian and competitors that fit in our comparables analysis, we chose not to weight our multiples valuation as we do not see the multiples calculated as fit to project an implied price. Given that some of its closest competitors include tech giants like Microsoft and smaller companies like Asana, we chose to only consider our Discounted Cash Flow Model.

Our Discounted Cash Flow Model determined a fair share price of $221.33 with an implied upside of 32.05%.

Earnings Expectations

With earnings coming out this week, we’ll briefly review what we will be looking at. The market is expecting 20.4% YoY revenue growth with strong margin expansion. Last quarter, Atlassian crossed the profitable mark final reaching a net income margin of 1.1%. Management guided to a strong Q4, expanding margin to 13.9%, hitting on this number will be important for valuing the stock going forward. Next and probably most important is their full year 2025 guidance. Many analysts looking at SaaS businesses have revised forward revenues down due to the expectation that automation calls for less seats on software packages and therefore less revenue. We’d like to see them guide to 18%+ revenue growth; “mid-teens” would be bad for the stock in the short term, although over the long-run we still believe Atlassian has differentiated themselves enough to be a buy.

Risks

One of Atlassian’s primary risks is the shape of the overall economy. In times of economic downturn, customers may reduce seat expansion or delay upgrades, directly impacting Atlassian’s revenue growth and potentially slowing its path to the $10 billion revenue target. This is particularly dangerous as Atlassian is completely vulnerable to this risk and has no ability to completely diminish this risk.

Another risk that Atlassian faces, is at the center of its strategy of cloud migration. The ongoing transition of large, complex enterprise customers from Data Center to Cloud is critical to Atlassian’s strategy and growth. Any significant delays or complications in this process could slow cloud revenue growth, impact customer satisfaction, and eventually lead to customer churn and a diminished reputation. This is particularly important as Atlassian aims to migrate its substantial Data Center customer base to Cloud in the coming years and has emphasized this as a point of growth.

Finally, as the software market continues to grow, inviting more and more competition and demanding innovation, there is always a risk of losing differentiation and competitive advantage. One of the important trends that will be necessary to execute on is the development and deployment of AI technologies. Risks within this trend could include issues with accuracy, data privacy concerns, and the challenge of effectively integrating AI into existing products.

Conclusion

Atlassian Corporation stands out as a compelling investment in the enterprise software market. With a $67 billion serviceable addressable market and a cloud-first strategy with a proven track record, the company is well-positioned for more growth. Atlassian’s focus on innovation, particularly in AI, and its efficient go-to-market approach have been successful in driving strong financial performance, with an outlined path to $10 billion in annual revenue within the next five years.

The company’s cloud transition has provided positive results, primarily from increased customer adoption and expansion. While risks such as economic sensitivity and cloud migration challenges exist, Atlassian’s strong market position and strategic focus on enterprise customers limit these risks compared to competitors.

Our valuation analysis suggests a fair share price of $221.33, implying a 32.05% upside. Given Atlassian’s leadership in collaboration software, its commitment to innovation, and its clear growth strategy, the company presents a “buy” opportunity for investors seeking exposure to the expanding digital workplace solutions market. As Atlassian continues to execute its strategy and capitalize on emerging trends like AI, it is well-equipped to maintain its competitive edge and deliver value to shareholders in the coming years.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Growth Idea investment competition, which runs through August 9. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today