gorodenkoff

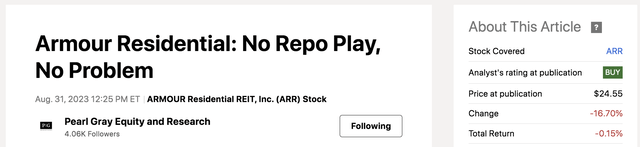

We last covered ARMOUR Residential REIT, Inc. (NYSE:ARR) a year ago, stating that it would benefit from favorable spreads and lower prepayment rates. Although the mortgage REIT (mREIT) delivered solid dividends in the past year, its price performance was sub-optimal.

Latest ARR Rating (Seeking Alpha)

With Armour’s year-over-year performance and our previous rating in mind, I decided to update our thesis. Moreover, a changing mortgage rate environment and shifts in Armour Residential’s fundamental attributes have emerged, providing additional talking points.

Without further ado, here’s my latest take on Armour Residential REIT.

Recent Performance

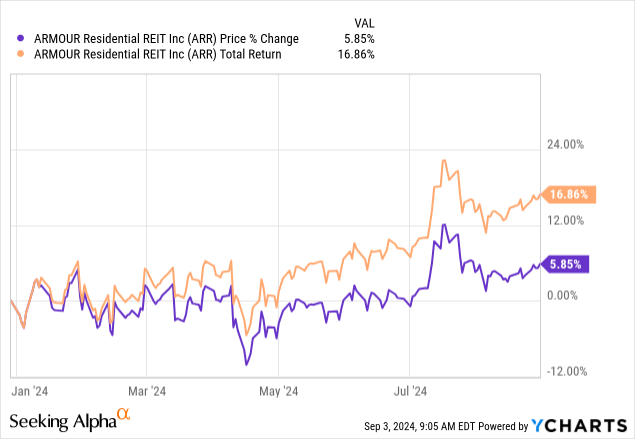

I reported the fund’s year-on-year performance in the introduction. However, the following diagram provides a time series observation by illustrating Armour Residential’s year-to-date performance.

The REIT’s solid year-to-date performance likely derived from peak mortgage rates and better economic profitability. However, I outline that Armour Residential surpassed its normalized earnings-per-share estimates in July (by eleven cents) but hasn’t gained market value ever since. Therefore, the question becomes: Do investors think Armour Residential is overvalued?

Let’s move into a fundamental analysis to address the central question.

Key Talking Points

Systematic Analysis

The mortgage rate environment is a growing concern for Armour Residential’s asset base.

According to the St. Louis Fed, 30-year fixed-rate mortgage rates have tapered by about 85 basis points year-over-year amid talk of an interest rate pivot in the United States. Moreover, the U.S. yield curve suggests lower implied interest rates are en route, which raises the possibility of additional mortgage rate declines.

30-Y Fixed Rates (St. Louis Fed)

Let’s expand on the abovementioned to explain why lower mortgage rates might be bad for Armour Residential.

Lower mortgage rates can introduce refinancings, lower variable rates, and compressed entry-level trades. Therefore, we have what’s called “negative duration,” which is a fancy word to describe a positive relationship between mortgage valuations and mortgage rates. In addition, interest components on mortgages might be less lucrative than in a high-rate environment.

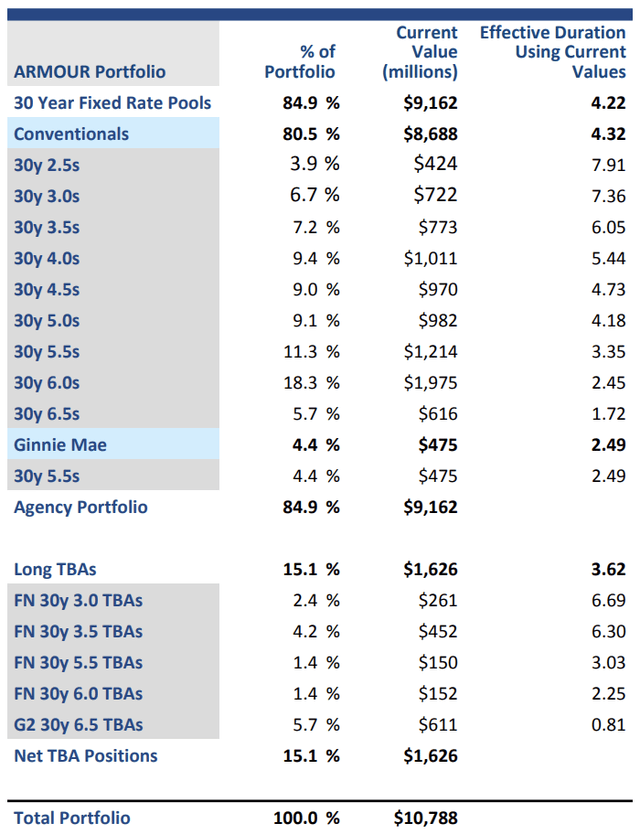

Approximately 84.9% of Armour Residential’s portfolio are agency fixed-rate assets. Therefore, in isolation, the portfolio’s interest component is largely secured at high rates and insured by federal agencies. Sounds perfect, right? Not entirely; a discussion follows the next diagram.

Current Portfolio (Armour Residential)

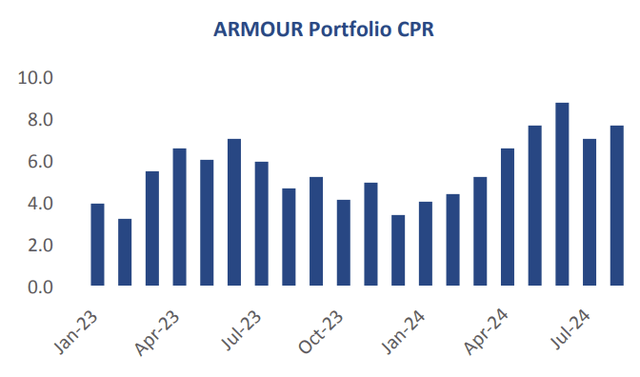

Although much of the mREIT’s portfolio is fixed-rate and insured, prepayment risk remains. Armour Residential’s current conditional prepayment rate (“CPR”) is below 10%, likely due to elevated mortgage rates. However, like interest rates, CPR can be a cyclical metric.

Below is an illustration of CPR, showing prepayments below 10%.

Current CPR (Armour Residential)

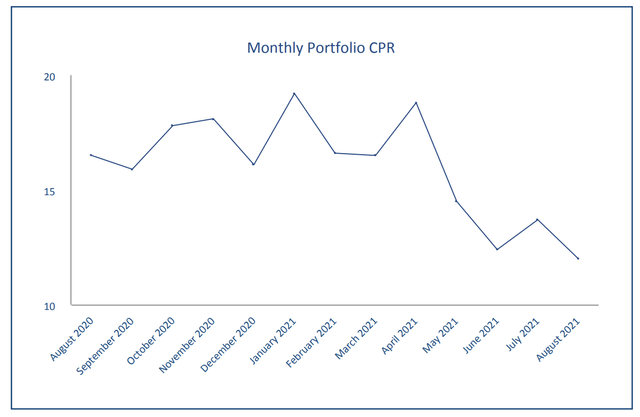

The next diagram looks back to 2021 when the targeted Fed Funds Rate was about 5.25% lower than today. Notice how Armour Residential’s prepayments were above 10% during that stage. I believe prevailing sentiment and bond yields suggest that lower interest rates are imminent, which might inflate Armour Residential’s CPR to around 10%.

CPR in 2021 When Fed Funds and Mortgage Rates Were Low (Armour Residential)

Higher prepayment risk can deflate Armour Residential’s portfolio. However, other components must be considered. Therefore, I conducted a deeper analysis of Armour Residential; onto the next section!

Portfolio Hedges/Liability Level

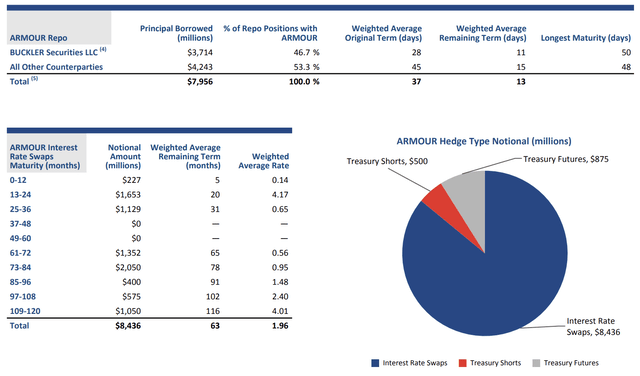

Armour Residential uses a reverse repo methodology. The strategy involves shorting a set of securities to finance the acquisition of others. To my knowledge, Armour typically shorts ten-year treasury bonds and interest rate swaps for a few months then rolls the short over to maintain its exposure to longer-maturity mortgages.

I think shorts on the swaps is a clever strategy as it might allow Armour to lock in profits when interest rates decline (If Armour shorts pay-floating, receive fixed swaps). However, I foresee problems using treasuries as lower bond yields might enhance treasury prices, concurrently increasing repurchasing rates.

Aside: Repurchasing rates are calculated as (repurchasing price/selling price) – 1

Liability Level (Armour Residential)

In essence, potential losses on repurchase agreements are a risk. However, I see potential in the vehicle’s swap strategy, which may lead to a lower funding cost base. Nonetheless, I still foresee lower net interest income and asset valuations occurring; let’s examine Armour Residential’s latest earnings report and valuation multiples to see why.

Latest Earnings

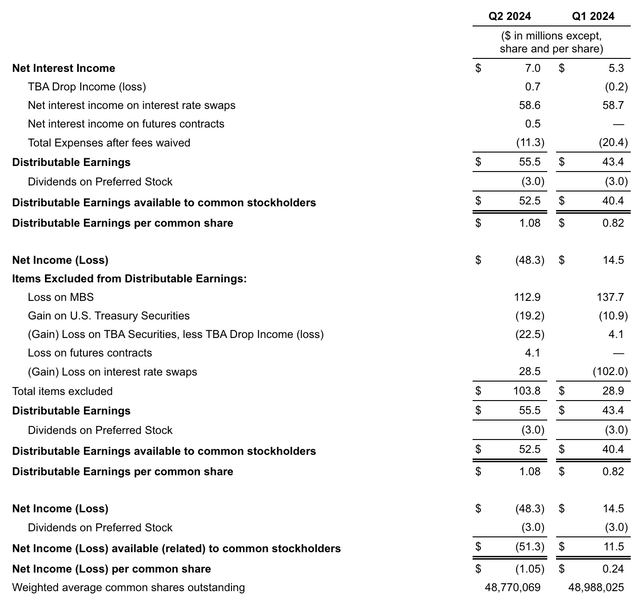

Armour Residential released its second-quarter earnings report in July, revealing an earnings-per-share of $1.08, beating estimates by eleven cents. Moreover, the vehicle achieved an economic net interest spread of 2.05% and a book value per common share of $20.30, suggesting a positive quarter overall.

I think Armour’s results reflect a cyclical peak. As previously mentioned, I anticipate lower asset-level income and book values. Although I foresee funding opportunities through swap sales, I think a rapid decline in mortgage rates will be challenging to contend with.

Furthermore, Armour incurred losses on MBS security values during Q2, which diminished the fund’s accounting income. I anticipate this trend to resume amid the negative duration effect on mortgages (discussed in the previous section).

Armour’s economic profits were more robust than in Q1. However, as already mentioned, the sustainability thereof is questionable as lower mortgage rates and a demanding repo rate environment might take charge.

Comprehensive P&L (Armour Residential)

Valuation Metrics and Dividends

Price Returns

I used an intraday price on September 3rd and Armour Residential’s second-quarter book value to calculate its common equity price-to-book ratio. The variables provided me with a ratio of 1x, which implies the asset is priced in.

Furthermore, I reiterate that I anticipate that lower net interest income and a compressed book value will emerge. Therefore, I don’t see a value opportunity in this instance.

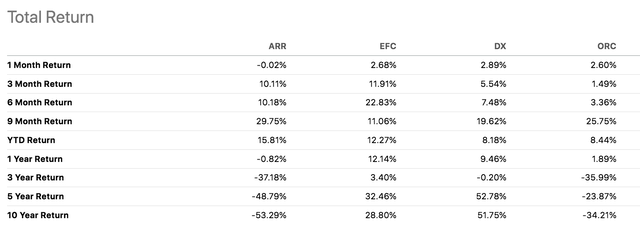

The following diagram illustrates Armour Residential’s market-based performance against some of its peers, including Dynex Capital (DX), Orchard Island Capital (ORC), and Ellington Financial (EFC). Although the disparity in peer-based market performance is evident, I don’t see enough to justify a pair’s trade.

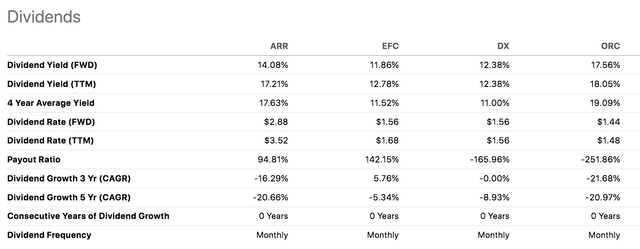

Dividends

A peer-based and isolated observation of Armour Residential’s dividend conveys that it is a solid income-producing investment. However, as witnessed in the past year and throughout its trading history, Armour Residential’s lackluster price performance has canceled the benefits of its dividend distributions. Moreover, the mREIT has a negative throughout-the-cycle dividend growth rate, which worries me, especially considering the mREIT’s fundamental headwinds.

Concluding Thoughts

I’m wary of Armour Residential as lower mortgage rates will likely introduce prepayment risk and influence the REIT’s asset value. Although Armour can lower its funding base by shorting fixed-rate swaps, I think its asset base is of primary concern.

Furthermore, I see little in Armour Residential’s valuation. Sure, it has a compelling dividend yield. However, let’s remember that the mREIT has lost over 90% of its market value since its inception.

I fear Armour Residential might incur losses in the next twelve months. Therefore, I decided to downgrade my outlook.