Shutter2U

Tectonic Therapeutic, Inc. (NASDAQ:TECX) is a pioneering biotechnology company dedicated to discovering and developing therapeutic biologics targeting G-protein-coupled receptors (GPCRs) through its proprietary platform, GPCRs Engineered for Optimal Discovery (GEODe). TECX emerged after a recent merger with Avrobio, Inc. (AVRO), combining AVRO’s gene therapy expertise with Tectonic’s GPCR-targeted protein development. Currently, TECX’s leading drug candidate is TX45, a Fc-relaxin fusion protein in Phase 1 for pulmonary hypertension due to heart failure with preserved ejection fraction (HFpEF). I believe TECX trades at a relatively cheap valuation compared to peers, but its early-stage research tempers my optimism. I ultimately lean neutral on the stock because I see the pros and cons offsetting each other.

TX45: Business Overview

Tectonic Therapeutic is a biotechnology company that discovers and develops therapeutic biologics targeting G-protein-coupled receptors (GPCRs) using its proprietary platform, GPCRs Engineered for Optimal Discovery (GEODe). Tectonic Therapeutic is headquartered in Watertown, Massachusetts. The company was founded in 2018 and went public after it closed a reverse merger with AVRO on June 20, 2024. Following the merger, the new entity began trading under the ticker TECX. The merger combined Avrobio’s gene expertise with Tectonic’s innovative GPCR-targeted proteins. The company also did a $130.7 million private placement to finance clinical trials.

In total, the reverse merger split AVRO stock at a ratio of 1:12 and changed its name to Tectonic Therapeutics, Inc. However, the company retained TECX’s legacy operations, assets, and research programs. More recently, on July 30, 2024, TECX received FDA authorization for its Investigational New Drug [IND] application for TX45. Since then, TECX has been working on TX45 for pulmonary hypertension [PH] due to heart failure with preserved ejection fraction [HFpEF]. It’s worth mentioning that this severe condition affects over 600,000 people in the US, and there are no currently available approved treatments.

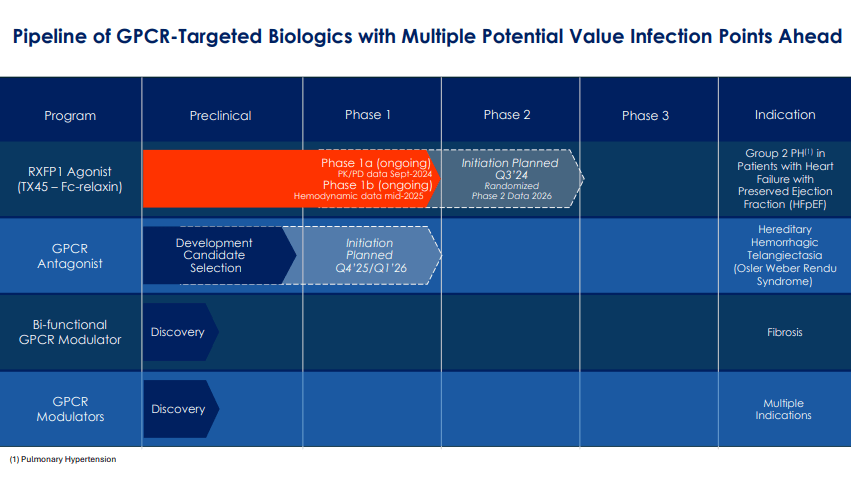

Source: Corporate Presentation. July 2024.

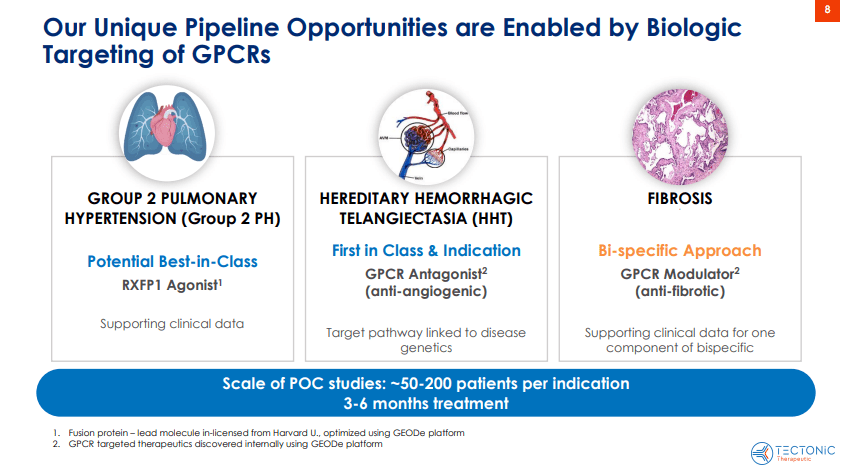

Therefore, TECX’s pipeline currently includes TX45, a potentially best-in-class Fc-relaxin fusion protein that activates the relaxin/insulin-like family peptide receptor 1 (RXFP1). This receptor is part of the GPCR family and is related to vasodilation and anti-fibrotic effects. TX45 targets this receptor and induces its vasodilatory and anti-fibrotic effects, theoretically treating cardiovascular and fibrotic conditions. It’s worth noting that the Fc region enhances the stability and duration of relaxin’s effects, also enabling less frequent dosing and improving efficacy.

Main Value Driver: TX45

Currently, TX45 is a Phase 1 drug candidate for PH in patients with HFpEF. In this condition, the heart’s left ventricle retains its ability to pump blood but cannot relax and fill with blood during diastole, leading to symptoms such as shortness of breath and fluid retention. TECX’s Phase 1a trial results on pharmacokinetic/pharmacodynamic (PK/PD) effects are expected by September 2024, and TX45’s Phase 1b results will show proof-of-concept data by mid-2025. TECX plans to start a Phase 2 trial, with topline data expected by 2026. From a technical perspective, TX45 leverages insights from prior clinical trials on serelaxin’s potential benefits and challenges in treating acute heart failure [AHF]. Since TX45 is an Fc-relaxin fusion protein, it builds on previous AHF data. However, this research on AHF showed challenges, mainly regarding pharmacokinetic limitations such as a short half-life.

Source: Corporate Presentation. July 2024.

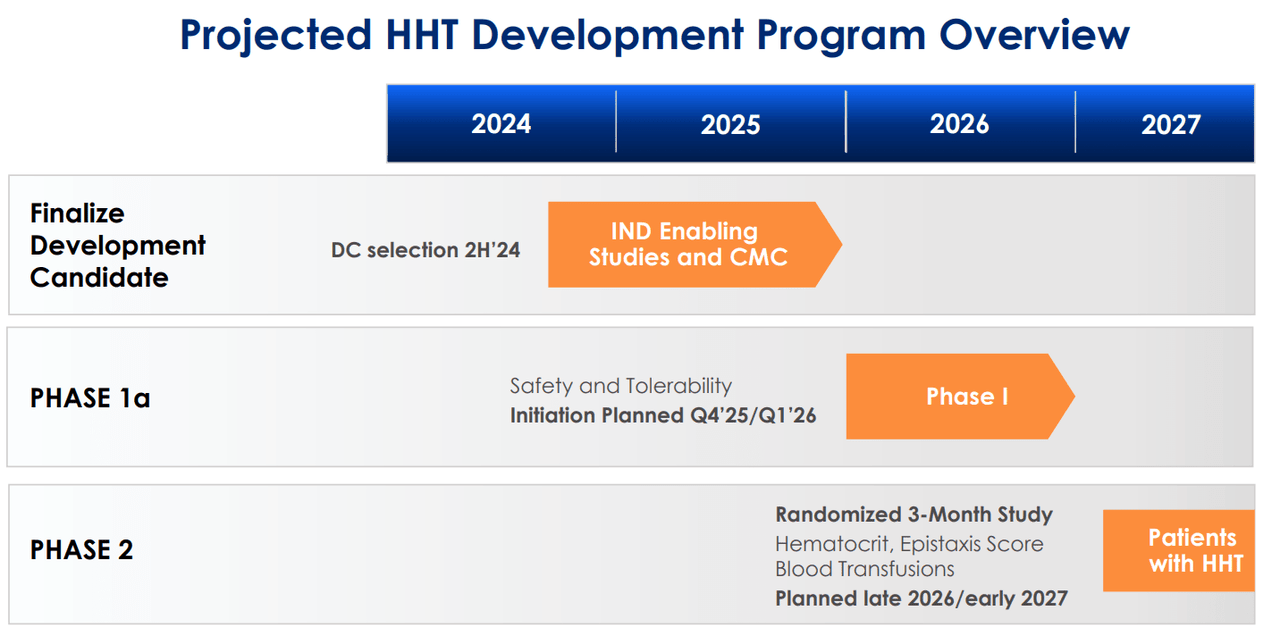

Furthermore, TECX’s pipeline also includes a GPCR antagonist for hereditary hemorrhagic telangiectasia [HHT], also known as Osler-Weber-Rendu Syndrome. HHT is a genetic disorder that affects blood vessels and is characterized by developing dilated blood vessels in the skin or mucous membranes, which can cause bleeding. HHT typically causes larger abnormal blood vessels in the lungs, liver, brain, and intestines, which can lead to serious complications. Thus, TECX is working on a Phase 1 trial for a GPCR antagonist planned for Q4 2025 or Q1 2026. The company is also developing a bifunctional GPCR modulator for fibrosis and other GPCR modulators that could target multiple diseases. However, these GPCRs are still in the discovery stage.

TECX’s Science: Potential and Challenges

Therefore, TECX’s underlying approach centers around GPCRs, which are cell-surface receptors involved in cellular communication and signal transduction. GPCRs convert extracellular signals into functional responses. Thus, TECX’s GEODe platform discovers and optimizes proteins and antibodies targeting these GPCRs. The GEODe platform includes a receptor engineering and purification system and an in-vitro yeast display library that screens antibody interactions against GPCRs. It also provides a protein reengineering method that optimizes protein pharmacology and modifies antigen structures for agonists and antagonists. This way, the GEODe platform discovers and develops biologics specifically targeting GPCRs.

However, TECX’s research faces key challenges: 1) keeping the GPCR structure, 2) purifying the target receptor sufficiently, 3) inducing an immune response, and 4) stabilizing the receptor for drug discovery. However, it’s key to note that GPCRs are highly complex and dynamic proteins embedded in cell membranes. Replicating them reliably in vitro is incredibly complex, so I think this research approach is prone to mixed trial results or ineffective drug candidates. After all, the candidates are generated based on in vitro GPCRs, not GPCRs in cell membranes.

While it’s true that TECX purifies its GPCRs, the purification process is tricky because it must maintain the GPCR’s native structure outside the cellular environment. The goal is to use these GPCRs to elicit specific immune responses without triggering adverse effects. However, this requires stable GPCRs, which are inherently highly unstable outside cellular membranes. I believe this adds a risk layer to TECX’s investment thesis, especially for a company with only one Phase 1 drug candidate.

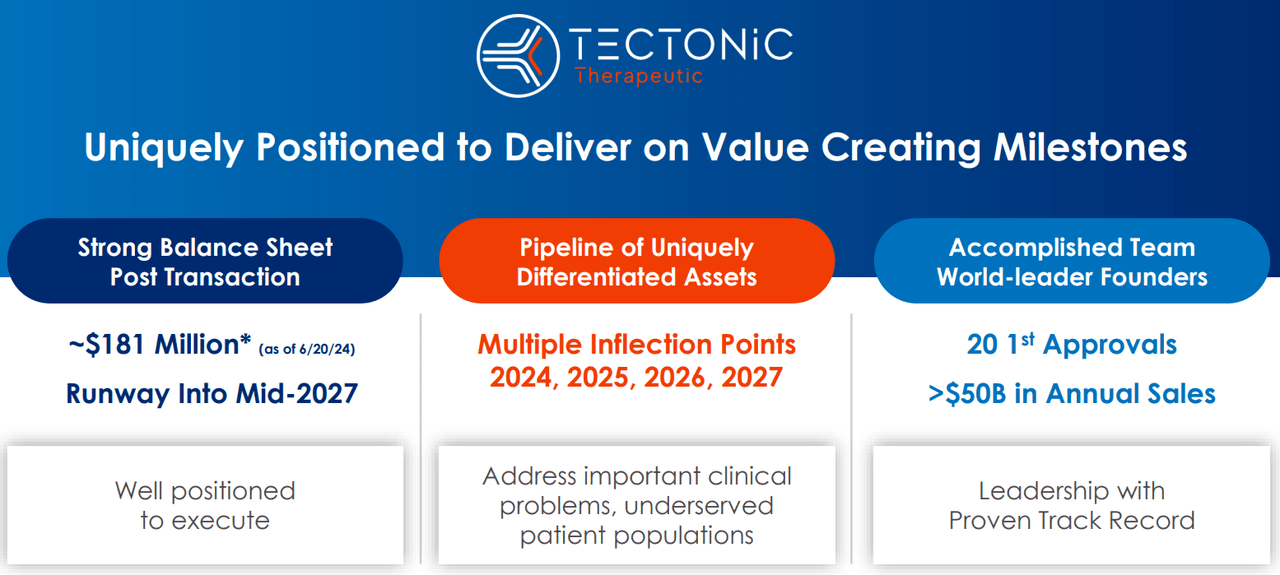

Mixed Picture: Valuation Analysis

From a valuation perspective, there are roughly 14.7 million shares outstanding. TECX’s current stock price is $17.15, so the implied market cap is $252.7 million, making it a microcap biotech. On March 31, 2024, its post-merger balance sheet held $203.4 million in cash and equivalents. The combined entity had no financial debt, and its total liabilities amounted to $33.8 million. Its book value was $179.2 million, indicating a reasonable P/B multiple of 1.4. For comparison, its sector median P/B is 2.4, so TECX seems cheap from that viewpoint. Management recently mentioned that they have $181.0 million in resources and anticipate having enough cash runways by mid-2027.

Source: Corporate Presentation. July 2024.

That’s not extraordinarily good, but it should be enough to get TX45 into Phase 2 trials, assuming everything goes according to plan. Until then, I understand the market’s seemingly conservative appraisal of TECX’s prospects. Nevertheless, it’s clear that TECX doesn’t have enough resources to fund its research all the way to an FDA approval, so it’ll likely tap the capital markets again in the next few years. If it shows better-than-expected data by then, the stock might be favorably priced to mitigate dilution risks.

However, management’s cash runway expectations signal a relatively high cash burn. If it doesn’t yield exciting results, the stock might simply decline slowly over time. Since TECX’s valuation is already quite depressed, it could result in a capital raise at a relatively unfavorable valuation. After all, if $203.4 million in cash and equivalents lasts three years, that’s roughly $67.8 million in cash burn per year. Typically, biotech companies raise 2 to 3 years’ worth of cash runway, so if TECX hits the capital markets again at its current $252.7 million valuation or worse, the dilution would be considerable.

Source: Corporate Presentation. July 2024.

Moreover, getting its research up to Phase 2 is still somewhat early-stage, especially for this complex GPCR approach. Therefore, I remain skeptical about its price appreciation prospects, even if it obtains promising Phase 2 trial data. Moreover, the timeline for this investment would still require many years until meaningful progress is seen. Consequently, I think it is prudent to lean neutral on the stock, which is why I rate TECX a “hold” for now.

Caveats: Risk Analysis

Naturally, the downside risks mostly focus on its GPCR-targeted research and cash burn. As I previously noted, GPCR research appears relatively complex and might be prone to mixed trial data. Even if it is ultimately proven effective, it might still take longer and be costlier than initially expected. If any of these risks materialize, they would likely translate into a higher cash burn or force TECX into a capital raise under unfavorable conditions.

Source: TradingView.

However, there is a potential upside for TECX at this juncture. In particular, its valuation multiple appears favorable relative to its peers. Moreover, if its research is successful and catches the attention of larger pharma players, it might make TECX a good takeover candidate. Therefore, I think the positives and negatives offset each other, so I ultimately lean neutral on the stock. However, I believe TECX is worth adding to your watchlist in case its investment profile changes.

Neutral Stance: Conclusion

Overall, I think post-merger, TECX has an intriguing approach with its GPCR research. However, there are simply too many variables at play to make a definite call either way on the stock, so I think it’s prudent to lean neutral on it for now. While I recognize its upside potential through its research and relatively cheap valuation, I also have concerns about its early-stage research and potential long-term dilution risks. TECX is worth adding to your watch list, but not your investment portfolio.