Buena Vista Images

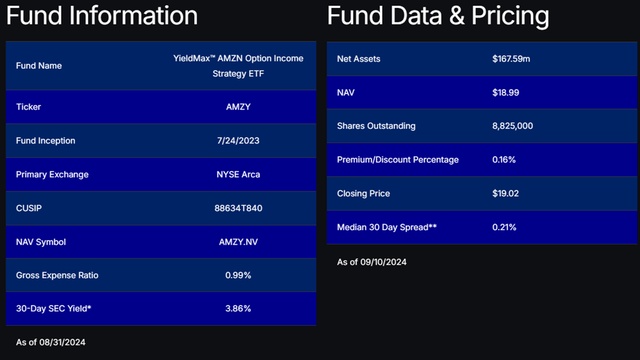

YieldMax AMZN Option Income Strategy ETF (NYSEARCA:AMZY) is an actively managed, single-name investment strategy that invests in options strategies in Amazon (AMZN). The core objective of the strategy is to generate and distribute income to shareholders as a result of income-generating options strategies. Given the consistent 1-year performance of the distribution and the high correlation to the underlying asset, I recommend AMZY with a buy rating with a recommended allocation of 1-2% in a tax-efficient portfolio.

How AMZY Works

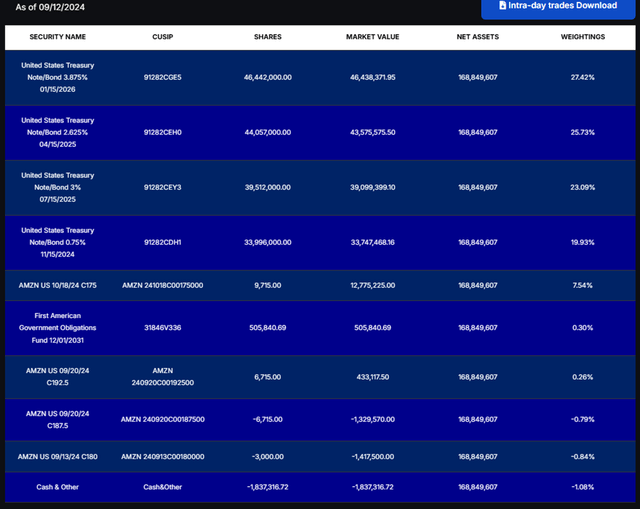

The core objective of AMZY is to generate income through underwriting call & put options. The portfolio may take short-short & short-long and long-short & long-long positions in the underlying equity in order to generate income for distribution. Where it stands, the portfolio is currently short and long September 20, 2024, call options at a strike price of $187.5 & $192.5, respectively. The strategy is also short on November 15, 2024, $185 puts. In addition to the derivatives strategy, AMZY holds short-term US treasuries with a portfolio allocation of 96.4% and 2.71% allocated to cash & money market funds.

These two components, the options and the treasuries, are positioned to generate income for the investor. AMZY currently holds a forward distribution rate of 41.46% based on its recent distribution of $0.6561/share. On the income side of the strategy, AMZY pays out a monthly distribution rate based on the performance of the underlying assets.

Given that the portfolio’s objective is to generate income through options, the distribution can vary significantly from month to month. In the last year of performance, AMZY has returned as low as $0.3682/share and as high as $0.9726/share. Considering the TTM distribution rates, the portfolio has averaged $0.6409/share. I believe the income component alone makes AMZY an appealing investment candidate. Given the high income distribution rate, I recommend investing in AMZY in a tax-efficient portfolio.

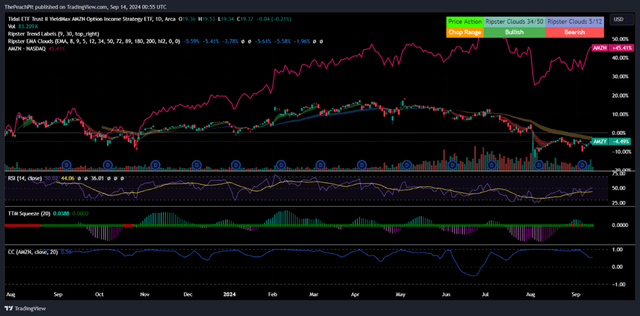

From a price-performance perspective, AMZY is highly correlated to the underlying asset, AMZN, to alleviate the tax burden.

Though there has been significant price dispersion from the launch of AMZY, the price performance has been relatively highly correlated to AMZN shares. I believe that this factor provides another appealing argument for investing in AMZY if considering Amazon as an investment candidate.

One major differentiator between AMZY and AMZN shares is the management fee. Given that AMZY is an actively managed portfolio strategy, AMZY commands a 99bps gross expense ratio, significantly higher than passively managed strategies. This could potentially be a deterrent for investors seeking sole exposure to the underlying asset. Despite the high fee, I believe that the distribution rate compensates the investor enough to outweigh the high fee.

There are a few additional components to consider before executing an investment in AMZY. Liquidity may be a challenge for the portfolio strategy if an investor is seeking to enter and exit the position frequently. AMZY has an average trading volume of 83k, significantly below AMZN shares’ 26.5mm in average daily trading volume. To its benefit, AMZY’s NAV is $19.37 as of September 13, 2024. This compares to AMZN’s share price of $186.49/share for the same period. This factor may make investing in Amazon more accessible to smaller investors who are seeking exposure to the company.

Given the directional correlation and the income component, AMZY offers an appealing case for an investment for those seeking to invest directly, or indirectly, in Amazon.

Considering AMZY’s use of derivatives strategies to generate income, there is a risk of loss of value in the instance of high volatility. Given that AMZY is primarily long US treasuries, I believe much of the exposure is abated, resulting in a more stable income strategy when compared to other leveraged strategies. For example, a 33% decline or appreciation for the NASDAQ Index when considering TQQQ (TQQQ) & SQQQ (SQQQ) can result in a total loss of the assets. AMZY does not hold this level of risk in the portfolio.

Conclusion

AMZY offers investors an investment strategy that attains exposure to Amazon with the addition of a robust income component. Despite the high 99bps fee, the distribution rate far outpaces the cost of ownership and provides a significant directional correlation to the underlying asset. For investors seeking exposure to Amazon with the addition of income, I recommend AMZY with a buy rating with a recommended allocation of 1-2% in a tax-efficient portfolio.