J. Michael Jones

Minneapolis-headquartered Ameriprise Financial, Inc (NYSE:AMP) – itself spun out of American Express which then went on to acquire the long-term asset management business of Bank of America, among others – specializes in long-term financial planning services for affluent clients. Its earnings release for Q2 made on the 25th of July beat the Zack’s Consensus Estimate of $8.51 per share by $0.02. However, revenue missed estimates by 0.35, posting revenues of $4.17 billion for the quarter.

It isn’t exactly straightforward to analyze a company that tends to structure its services/products in the form of annuities linked in different ways to market indicators, instruments and indices. Broadly, it operates four divisions:

- Advice & Wealth Management, which delivers services to households with half a million to 5 million in investible assets;

- Asset Management, which manages investments on behalf of individuals as well as institutions;

- Retirement & Protection Solutions, which offers clients annuities, life insurance and disability income insurance products

- Corporate & Other, which consists of closed business groups such as Long-Term Care insurance from the company’s RiverSource networks, as well as investment income from subsidiaries.

It should be immediately evident that there is substantial potential for overlap, given how a single client can ostensibly be in one division’s care while availing services from others. While a measure of division-wise performance is presented in the form of revenues and earnings, the total of, say, revenues across divisions would be greater than consolidated revenues minus “eliminations”; it suffices to understand that these are presented to indicate performance and not actual dollar values.

Finally, “Corporate & Other” is essentially the warehouse of past activities without any substantial business activity in the present. This will be excluded in all analysis, except for the examination of Assets Under Management (or “AUM”).

Trend Drilldown

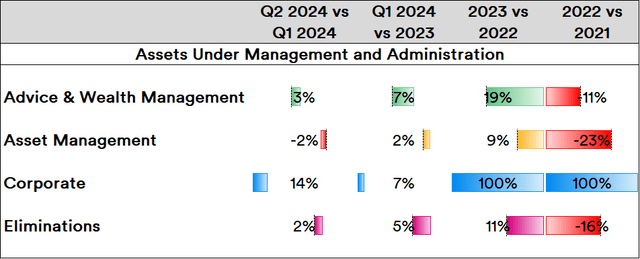

In terms of the value of the assets being managed by the company on behalf of its clients, the latest quarter has seen a general increase:

Source: Created by Sandeep G. Rao using data from Ameriprise’s Financial Statements

In the present day, Advice & Wealth Management and Asset Management essentially run neck-and-neck (with the latter ahead by about 17% and the former massively picked up the slack since 2021). However, the value of assets managed by the latter are showing early signs of decline in the present year.

While corporate AUM continues to grow and potentially weigh down on expenses in the years to come, it is 0.04% of the total AUM held by the two main divisions.

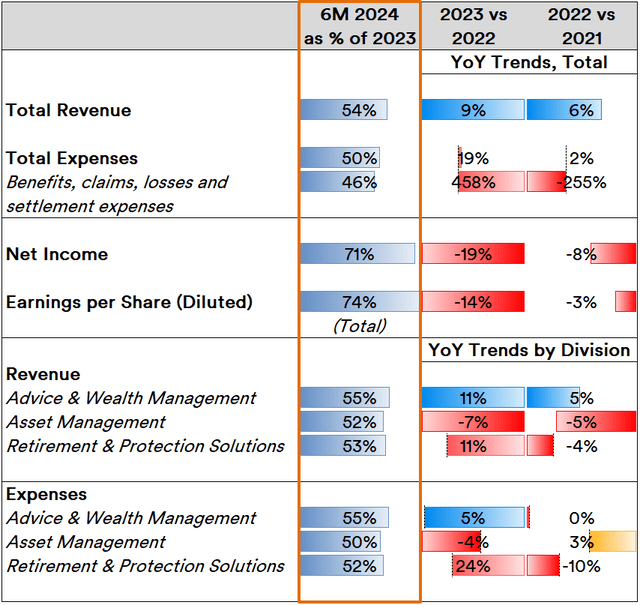

In terms of trends in overall line items versus key divisions, the company’s performance is something of a mixed bag:

Source: Created by Sandeep G. Rao using data from Ameriprise’s Financial Statements

Overall revenue is trending to close 8% above that of the previous year, implying that revenues are expected to rise for three straight years. However, Net Income is climbing its way out of the hole it dropped into in 2023, which means that 2024’s net income might run close to par with that seen in 2022.

Overall line item performance in total terms is driven by Structured Variable Annuity (SVA) products offered by the company that are linked to market performance in that purchases are protected from the downside and exposed to a greater range of the upside. Benefits-driven expenses in 2023 were driven by a 458% increase from 2022 levels, which were predominantly driven by SVA valuations relative to market movements. In the year so far, benefits expenses are running on par with those seen in the previous year.

Division-wise, Asset Management has been in a downtrend over the past three years, and trends indicate that revenues from this division in 2024 will run about par relative to the previous year. This is true for the other two divisions as well.

Note: Another point of complexity in the company’s reporting standards is that the AUM for “Retirement & Protection Solutions” seems to be ostensibly divvied between “Advice & Wealth Management” and “Asset Management”.

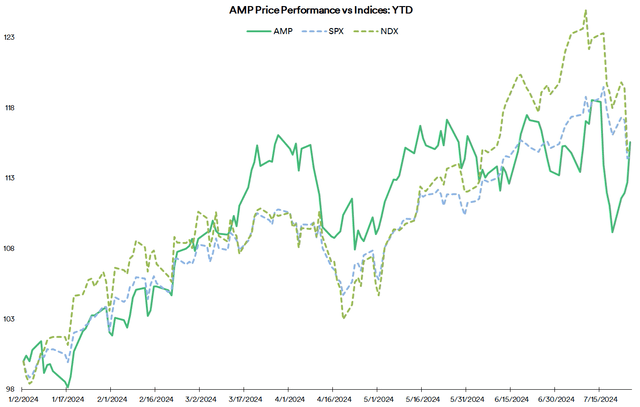

Investor Conviction & Stock Performance

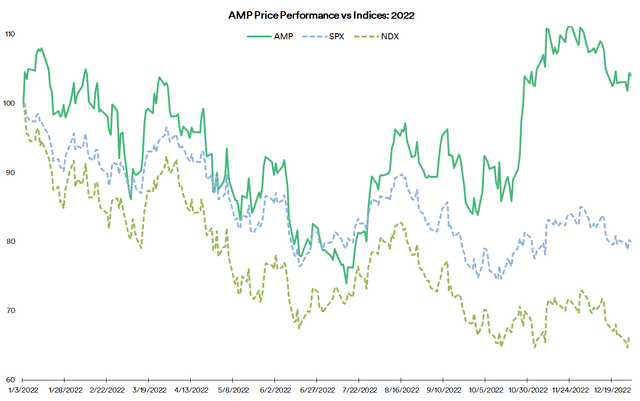

In 2022, a period of time when SVA-driven expenses and markets were bearish, the company’s stock sought new highs – particularly in H2 2022 – and exhibited significant outperformance relative to both the broad-market S&P 500 (SPX in index form; SPY in ETF form) and the tech-heavy Nasdaq-100 (NDX in index form; QQQ in ETF form):

Source: Created by Sandeep G. Rao using data from Yahoo! Finance

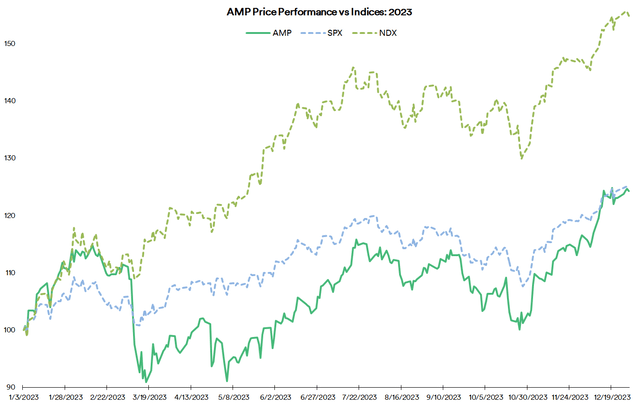

In 2023, when SVA-driven expenses were much higher and markets were bullish, the company’s stock substantially underperformed relative to the Nasdaq-100 and barely pulled up to the performance of the S&P-500:

Source: Created by Sandeep G. Rao using data from Yahoo! Finance

In 2023, the inverse relationship between market trajectories and stock valuation is largely missing, with the stock largely rising along with the rest of the banking and financial services sector.

Source: Created by Sandeep G. Rao using data from Yahoo! Finance

Given that the “Advice & Wealth Management” division has been consistently racking up AUM, the strong net income trends indicate that there are signs of product diversification in play. However, the level of SVA-related expenses in H1 2024 relative to a rather modest changes in both AUM, and revenues, indicates that this didn’t come with a significant degree of cost savings.

In Conclusion

If the company is stepping deeper into advisory services as opposed to retirement products, it will be hard-pressed to continually build momentum in attracting clients and AUM, given the level of competition that top banks are already at. On the other hand, it will be interesting to see if new products can help ameliorate the deep furrows being caused by SAV-driven expenses.

At this stage, it’s not entirely clear what the forward outlook is. Indicators, in general, are indicating a performance on par with a prior year rather than a new high. Q3 would likely produce a clearer picture.