JamesBrey/E+ via Getty Images

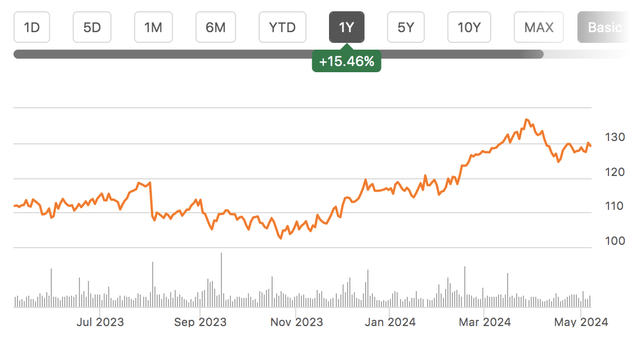

Shares of American Financial Group (NYSE:AFG) have been a moderate performer over the past year, rising 16% and paying out $4 in special dividends on top of its regular 2.2% dividend. After some underwriting missteps last year, it has pushed premiums up and improved results. With strong capital generation and exposure to a recovery in multifamily rental units, AFG is poised for a strong year after a solid Q1. Since recommending shares of AFG in November, it has returned over 23%, beating the market’s 18% rally. I remain bullish.

In the company’s first quarter, AFG earned $2.76, beating consensus by $0.03 as revenue grew by 10% to $1.91 billion. The company wrote $1.6 billion of net premiums, up 8% from last year. This was primarily due to price increases, rather than writing more policies. Excluding workers’ compensation, renewal rates rose by 8%; workers compensation was a 2% drag. It believes it is raising prices faster than claims inflation, which should boost margins. As I have written about previously because insurance policies are 6-12 months long, they tend to lag inflation, leading to narrower margins when inflation spikes and then a catch-up in the ensuing year or two as they raise prices and inflation moderates. We are in that period now.

Overall, AFG’s specialty P&C combined ratio was 90.1%, up 0.9% from last year. As a reminder, a 100% combined ratio means an insurer’s costs match its premiums. In this case, AFG is making nearly $10 on every $100 in policies. This is a strong ratio, and the reason for the increase was that this year had 3.3% of favorable developments vs 4.5% last year. Favorable developments mean prior years’ policies have proven to be more profitable than originally expected, allowing it to reduce reserves. $43 of this $50 million reserve benefit was in property and transportation, whereas there was modest degradation in intellectual property policies.

It is always encouraging to see that past policies were more profitable than modelled. Given AFG’s conservative financial stance and reserving policies, we tend to see favorable developments. While prior year developments were 1.2% lower YoY, its combined ratio only rose by 0.9%, meaning current policies improved by 0.3%, a sign that its higher pricing is beginning to improve results, which is an encouraging sign to start the year. In aggregate, AFG’s $154 million underwriting profit was flat from last year’s Q1.

Specialty casualty is AFG’s largest unit, and in Q1 this unit accounted for 46% of net written premiums. The unit generated underwriting profits of $74 million from $88 million last year due to weakness in excess and surplus liability. It has been raising E&S premiums given more severity here, which should help to improve results as the year progresses. This increased severity of claims was tied to the fact that catastrophe losses jumped to $16 million from $3 million. Still even with this headwind, the combined ratio was a solid 89.8% from 87.5% last year. Thus far, weather patterns indicate we will have a favorable crop season, which should support margins this summer.

Next, property and transportation accounts for 36% of net written premiums. Its underwriting profits rose to $56 million from $43 million, primarily due to inland marina strength. There were just $8 million of cat losses vs $19 million last year, and it had no material exposure to the Francis Scott Key Bridge and associated Baltimore Port challenges. The unit had an 89% calendar year combined ratio, down 200bps. We are seeing its underwriting margin improve because it is taking action on segments with the most inflation exposure. Most notably, commercial auto rates rose 21%, an acceleration from Q4’s 15% gain. Despite this increase, it still had a small loss. Auto margins do tend to be lower, but I would expect AFG to continue to take price here to right-size results, which should support incremental profit gains.

Finally, its smallest unit is Specialty financial, which accounted 14% of net written premiums. Its underwriting profits rose to $33 million from $26 million. Given its niche nature, it tends to have wider margins as there are fewer players. Its 86.3% combined ratio was down 0.2%. As noted above, there have been some adverse developments on intellectual property protection. These are likely discrete items, but it bears watching in prior quarters.

Overall, AFG reported solid underwriting results, and past policies continue to prove more profitable than previously expected. I was also encouraged to see that its premium growth is almost entirely driven by pricing, not by writing more policies. Essentially, it is being paid 6% more to take the same risk. As a consequence, if we see a similar loss content, its combined ratio should continue to trend lower as more and more policies roll over into this higher pricing environment.

The other big driver of an insurer’s earnings is on its investments. Excluding alternatives, net investment income rose by 16% thanks to higher rates as it rolls maturing fixed income securities at higher yields. Offsetting this, alternatives returned $44 million vs $62 million last year. Alternative returns tend to lag public markets by one-quarter, given reporting delays. AFG had a 9% return on AI vs 14% last year. This is still a strong return; it was just that Q1 2023 was extremely strong. AFG budgeted for a 6% AI return this year, so this was still a solid result.

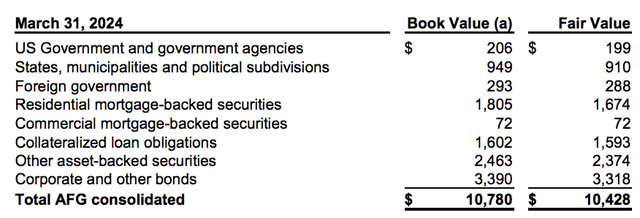

AFG has a portfolio of $15.3 billion of cash and investments. As with most insurers, the majority of this portfolio sits in fixed income. It has $10.4 billion of fixed maturities and $1.1 billion of cash and equivalents. Together, these cover about 90% of its insurance reserves of $13.05 billion, with the remainder of the portfolio in more growth-oriented securities. Given premium growth, reserves are up from $11.76 billion last year, a positive, as a growing float increases AFG’s interest-earning portfolio.

This fixed income portfolio is high quality and diversified across sectors. 43% of the portfolio is AAA, while just 3% is high-yield, meaning there is minimal credit risk. There is a 4.93% fixed income yield, down 6bp sequentially due to portfolio mix shift. Given higher yields, it is up 53bp from last year. AFG is investing new money at 6%, so I expect yields to rise modestly from here. The portfolio has a 3.1 year duration, so I expect a peak in yields around Q4 2024, assuming a gradual Fed rate cutting cycle with 0-2 cuts this year. Because AFG bought bonds at lower yields, there is a $315 million loss in accumulated other comprehensive income (AOCI). Given its liquidity and premium growth, AFG can hold these securities to maturity rather than take losses.

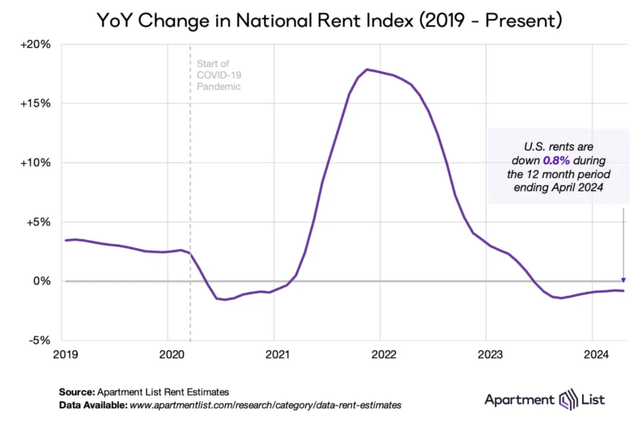

Outside of its fixed maturity portfolio, it has $600 million of stocks and $1.8 billion of private investments. $1.2 billion of this is in ownership of multifamily properties. Rent growth has turned negative, which has reduced returns and why AFG budgeted just 6% AI returns for the year. Multifamily operating income has been strong, but valuations are weaker given rates. It expects headwinds in multifamily to persist this year but improve longer term.

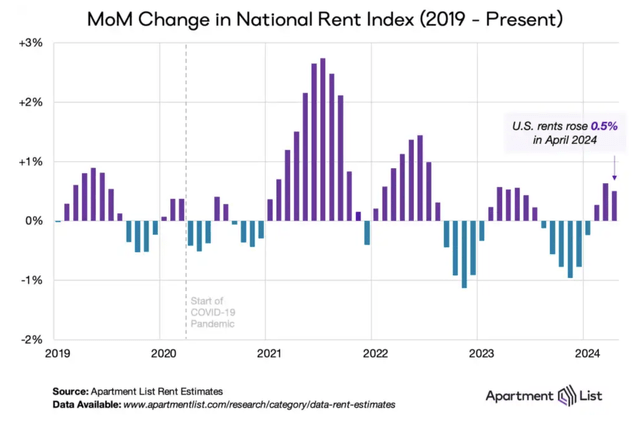

Importantly, we are now seeing rents rise on a sequential basis, and companies like AvalonBay (AVB) are even seeing improvement in the troubled San Francisco Bay Area. Higher rates and lower rents have reduced new construction, which should alleviate localized excess supply. I have written positively on the US housing & rental market, as minimal building in the 2010s have left the market materially undersupplied. As we move past the recent supply surge, I expect this fundamental to support ongoing rental growth in excess of overall inflation, making multifamily an attractive asset class. I view AFG’s exposure here as a long-term positive.

During February, it paid a $2.50 special dividend in February. Management expects more buybacks or special dividends this year given ongoing capital generation. AFG also has a pristine balance sheet, with just $1.5 billion of debt and no maturities before 2030. Due to buybacks, its share count is down by 1.9% from last year. AFG is on track to meet or exceed my 90% combined ratio target for this year. That said, alternative returns may be a bit lower than I initially assumed as rates staying higher for longer reduce real estate valuations, though given rental dynamics, I view this as a transitory challenge.

As such, I see AFG with $11.50-12 in earnings power in 2024. It generally can return nearly 2/3 of that to shareholders while retaining some capital to support growth. As such, it is on track for $7 in capital returns. With a $2.84 dividend, we should see some buybacks and at least $2 in special dividends this year, for an overall capital return yield of 5.5%.

With upper single-digit growth and multifamily upside beyond 2024, a starting yield of 5.5% is attractive. Recovering multifamily returns should offset any headwinds from lower rates, providing a unique differentiator for AFG within the insurance sector. With 5-8% premium growth, AFG can generate long-term returns in the 10-13% range, making shares attractive, even assuming no further underwriting improvement, which may prove conservative given the magnitude of premium increases. Similar to Chubb (CB), given this profitability, I view a 12.5-13x multiple as appropriate, which can push shares toward $150, or 15% higher. As such, I continue to view AFG as a buy.