choness

Introduction

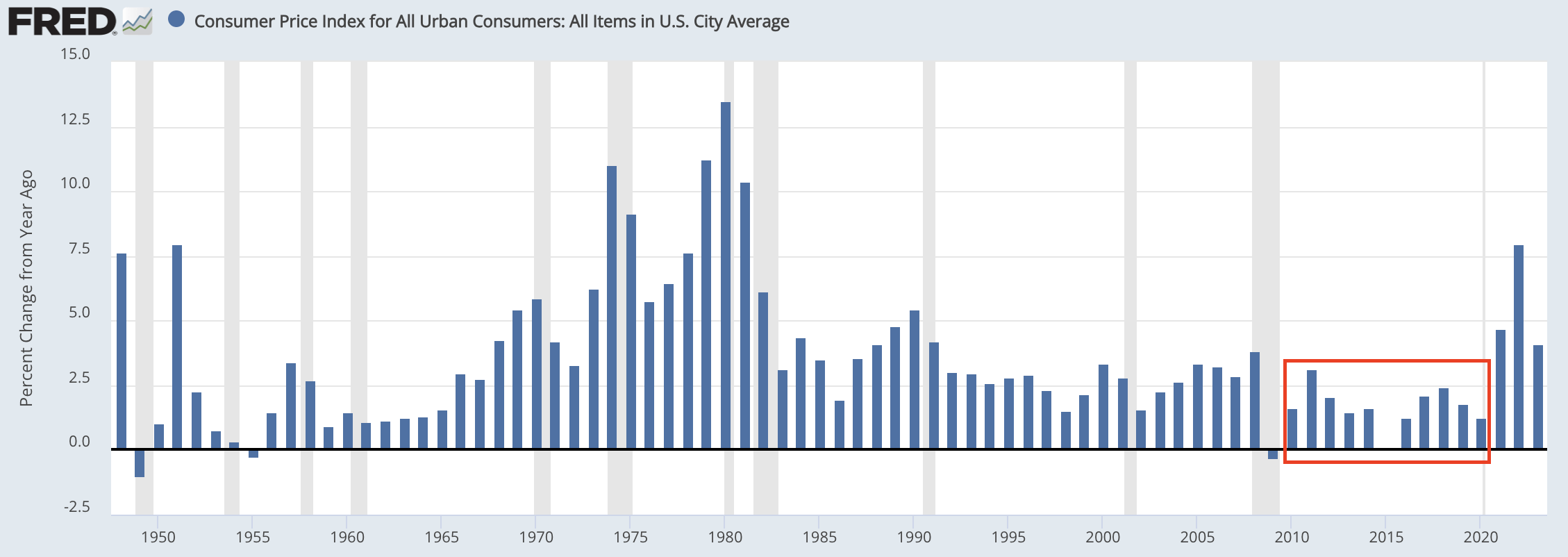

Earlier this year, I sold the only utility stock in my dividend growth portfolio, Duke Energy (DUK). I didn’t do it because I disliked the company but because of my view on interest rates and inflation.

I’m in the camp that believes in prolonged elevated inflation and interest rates – at least compared to the favorable risk environment between the Great Financial Crisis and 2021.

During this period, inflation was subdued, supported by secular tailwinds, including cheap energy prices, strong globalization, and favorable labor market dynamics – among other factors.

Federal Reserve Bank of St. Louis

Now, a lot of these factors are reversing, including the supply tailwinds from the fossil fuel industry.

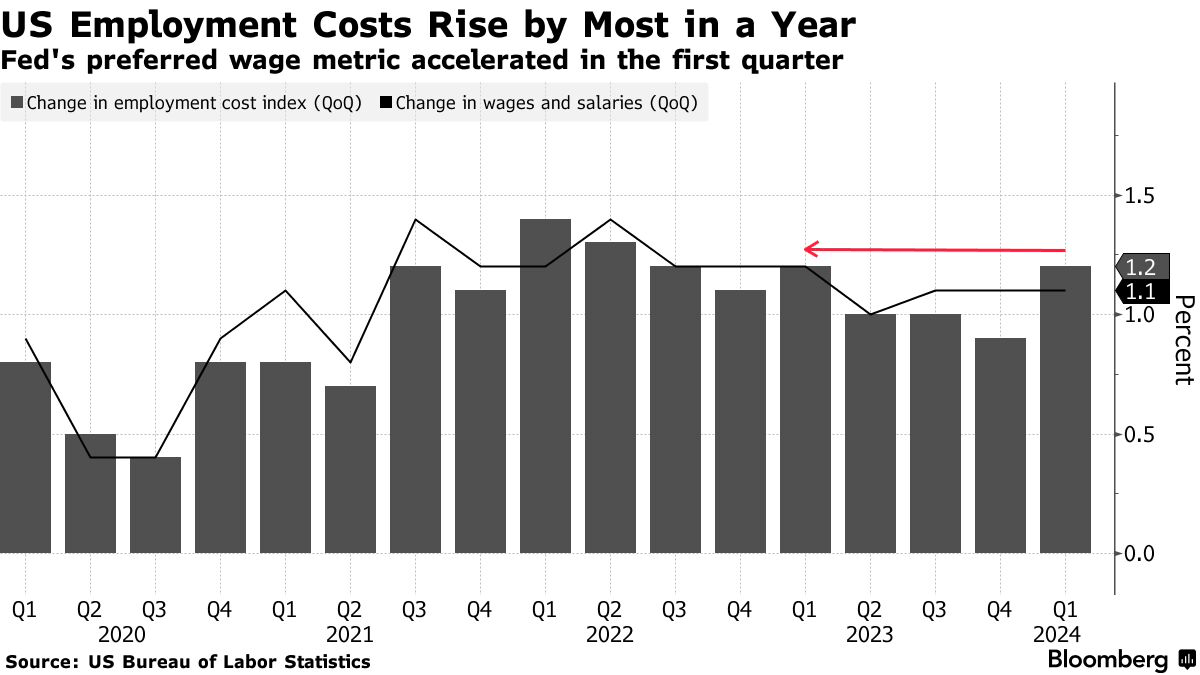

Hence, after the market expected the Fed to cut rates six times this year, we’re now in a situation where market participants have to re-evaluate the situation, as new indicators point at continued headwinds for the fight against inflation.

For example, minutes before I started writing this article, Bloomberg reported that the employment cost index, which is a broad gauge of U.S. labor costs, had come in higher than expected. It’s up 1.2%, the most in a year after rising by 0.9% at the end of 2023.

Bloomberg

Hence, I believe this gentleman is hitting the nail on the head:

“This is a challenging print for the Fed,” Robert Sockin, senior global economist at Citigroup Inc., said on Bloomberg Television. “Coming in at 1.2 is just evidence that the inflation data, the wage growth data, is moving in the wrong direction to be consistent with their target.” – Bloomberg

Generally speaking, this is bad news for utilities, which is why I opted for yield plays in other areas, including the much more cyclical energy sector.

Utilities perform better when inflation is low.

- They have limited pricing power due to oversight from Public Service Commissions, which typically follow a cost-based approach.

- Most regulated utilities are investing billions in the energy transition and are, generally speaking, often sitting on a lot of debt. Lower rates make it easier to maintain a healthy balance sheet.

Nonetheless, this article is about a utility company I have started to like a lot. In fact, I owned it in 2020 before I restructured my dividend growth portfolio. Not keeping it back then was a mistake.

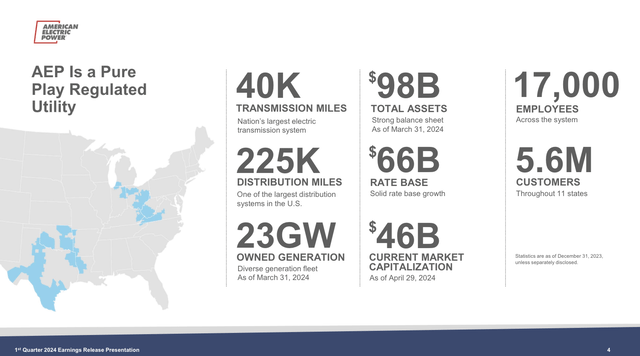

That company is the American Electric Power Company (NASDAQ:AEP), a giant with a $45 billion market cap.

My most recent article on this company was written in November when I went with the title “A Path To Over 11% Annual Returns – Why 4.5%-Yielding American Electric Power Is Attractive.”

Since then, shares have been up 12.6%, slightly beating the 12.0% return of the S&P 500.

While I’m not extremely optimistic about the utility sector, AEP has figured out how to consistently generate elevated returns, backed by strong EPS growth, a solid balance sheet, and a well-covered 4% dividend yield.

In this article, I’ll walk you through the details using its just-released quarterly earnings.

So, let’s get to it!

Why 1Q24 Was Such A Success For AEP

American Electric Power is a giant. The company has the largest distribution system in the United States, including 225 thousand distribution miles. It also has the largest network of transmission lines and close to $100 billion in total assets.

This asset base provides services for 5.6 million customers in 11 states, including Texas, Oklahoma, West Virginia, Virginia, and Ohio.

American Electric Power

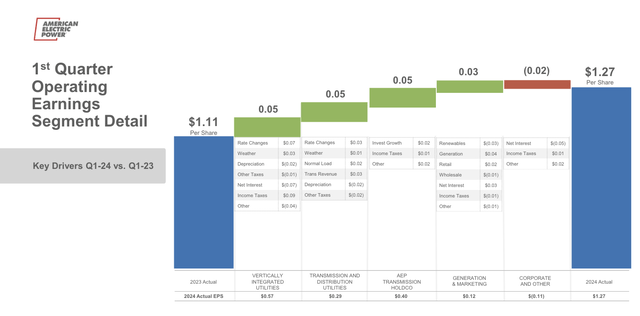

In its just-released quarter, the company generated operating earnings of $1.27 per share, which represents a $0.16 increase compared to the prior-year quarter.

As we can see below, this increase was driven by a number of factors, including a one-time positive adjustment related to the remeasurement of a regulatory liability for excess deferred taxes, as advised by the IRS.

Moreover, operating earnings were impacted by rate changes and favorable weather (a $0.57 impact).

American Electric Power

Adding to that, the company noted a notable acceleration in overall retail load, especially in the commercial sector, boosted by elevated demand from data centers.

I have heard these comments from countless utilities and energy providers. I added emphasis to the quote below.

A couple of great examples of new commercial commitments can be evidenced by last week’s announcements from both Amazon Web Services and Google to build large data centers in I&M’s Northern Indiana service territory.

At AEP, we have the largest transmission system in the United States with a high-voltage backbone in the Midwest. We expect more transmission investment possibilities driven by this data center growth, specifically in substations and customer connections. – AEP 1Q24 Earnings Call

To add some color, the commercial load saw a 10.5% increase, driven by the growth of AI and other technologies.

Meanwhile, the industrial load remained stable despite national manufacturing softness, with increased activity witnessed in specific manufacturing sectors such as plastics, tires, and paper.

The company also used “my” higher-for-longer phrase (emphasis added):

We are keeping a close eye on our industrial customers, given the higher interest rates for longer environment. However, the number of large new loads anticipated to come online in the next 2 years, provides us with confidence that demand will remain steady in the face of any economic challenges for our existing customers. – AEP 1Q24 Earnings Call

So, what does this mean for shareholders?

American Electric Power’s Path To +10% Annual Returns

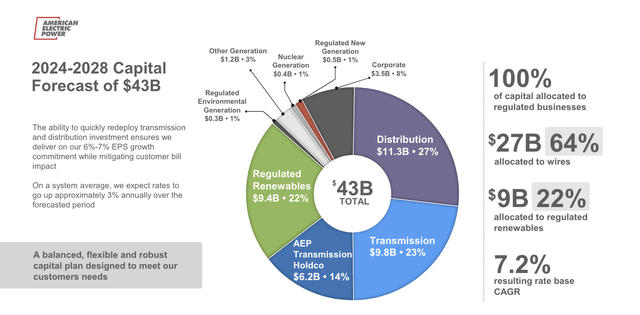

In addition to investing in the capacity for secular growth, AEP is transitioning to net zero, which comes with billions in required capital.

During its 1Q24 call, the company noted it is advancing its 5-year, $9.4 billion regulated renewable capital plan, with $6.6 billion already approved by state commissions.

These investments are part of a $43 billion five-year plan, which consists of even bigger investments in distribution and transmission capabilities.

American Electric Power

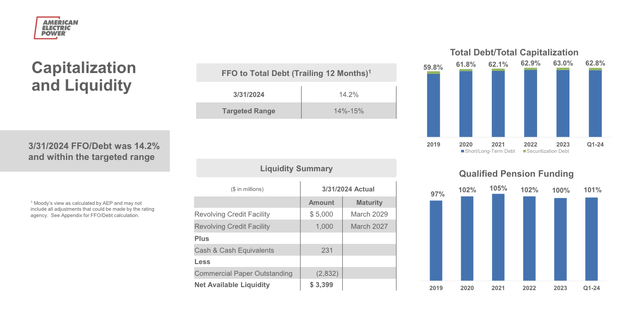

The good news is that the company is not expected to run into any balance sheet issues – not even in this environment.

- The company has an FFO-to-debt ratio of 14.2%, which is 100 basis points higher compared to the end of 2023. The higher the better, as it means it has more funds from operations to cover its debt. It’s also well within the company’s 14-15% target range. The company believes it can keep the ratio in its target range in the years ahead.

- The company has well-covered pension funding and $3.4 billion in liquidity, including a $6 billion credit facility that was recently boosted by $1 billion.

Even better news is that these investments are expected to result in a 7.2% annual base rate growth, part of the company’s plan to grow its earnings per share by 6-7% per year during this period.

American Electric Power

Going back to the company’s outlook, it is confident in its ability to grow EPS by 6-7% on a long-term basis.

We remain committed to our long-term growth rate of 6% to 7% and FFO to debt solidly in the 14% to 15% range. – AEP 1Q24 Earnings Call

This bodes well for shareholders. After all, assuming its valuation does not change, we can expect at least 6% annual returns.

Bear in mind that annual returns come from a mix of EPS growth, valuation changes, and dividends. The stock price is EPS X the P/E multiple. These two numbers impact capital gains. Dividends are income, which completes the total return picture (capital gains + income).

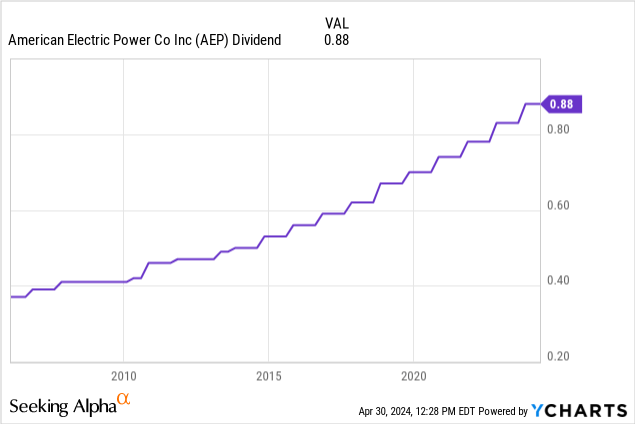

In the case of AEP, we’re dealing with a $0.88 per share per quarter dividend. This translates to a yield of 4.0%.

This dividend comes with a low-60% payout ratio, a 5.8% five-year CAGR, and 14 consecutive annual hikes.

Assuming the company achieves the lower bound of its EPS growth rate, we get a 10% annual return based on an unchanged valuation (6% EPS growth + 4% dividends).

That would be a great result, as generating 10% with any anti-cyclical investment allows investors to build a lot of wealth without losing sleep.

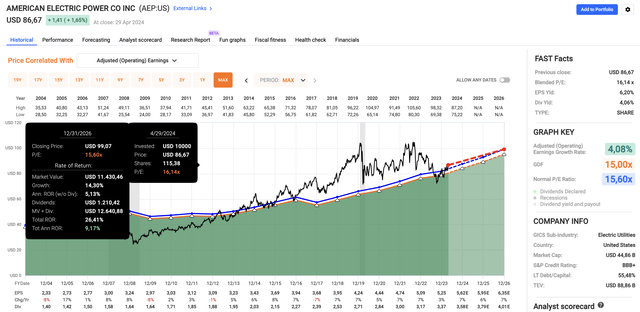

It would also be better than the 7.3% annual return investors have enjoyed since January 2004.

Moreover, it helps that analysts agree.

Using the FactSet data in the chart below, we see that analysts expect between 6-7% annual EPS growth through at least 2026.

Moreover, AEP currently trades at a blended P/E ratio of 16.2x, which is just slightly above its long-term normalized P/E ratio of 15.6x (the blue line).

FAST Graphs

Hence, combining EPS growth expectations, its 4% yield, and its normalized valuation, we get a base case of 9% annual EPS growth.

Needless to say, this return can be impacted by market fluctuations, unexpected rate changes, and economic factors.

Nonetheless, and all things considered, I believe AEP remains one of the best utilities on the market, thanks to its ability to deal with elevated capital requirements and economic challenges while capturing growth in secular trends like data center electricity demand.

If I had a more conservative investment profile, I would be a gradual buyer of AEP shares.

Takeaway

American Electric Power presents a compelling case for investors seeking stable returns amidst economic uncertainties.

With a robust infrastructure, strategic investments in renewable energy, and a solid balance sheet, AEP is positioned for steady growth.

Despite market fluctuations, AEP’s consistent earnings per share growth, supported by a healthy dividend yield, offers the potential for over 10% annual returns.

Meanwhile, analysts project continued EPS growth, reinforcing AEP’s long-term outlook of 6-7% annual EPS growth.

Pros & Cons

Pros:

- Steady Growth: AEP’s consistent EPS growth, backed by strategic investments in renewable energy, offers investors stable returns even in uncertain economic climates.

- Solid Infrastructure: With the largest distribution system in the U.S. and substantial assets, AEP is well-positioned to meet growing energy demands.

- Healthy Balance Sheet: AEP’s strong FFO-to-debt ratio and strong liquidity profile provide confidence in its ability to fund future growth initiatives without compromising financial stability.

- Attractive Dividend: AEP’s 4% dividend yield, supported by a low payout ratio and a history of consecutive annual hikes, provides investors with a steady income stream.

- Favorable Outlook: Analysts project continued EPS growth and AEP’s current valuation suggests potential for attractive returns in the long term.

Cons:

- Market Fluctuations: Like any investment, AEP’s stock price can be affected by market volatility, potentially impacting short-term returns.

- Regulatory Oversight: As a regulated utility, AEP faces oversight from public service commissions, which may limit pricing power and require adherence to cost-based approaches.

- Economic Factors: Economic downturns or unexpected rate changes could influence AEP’s performance and shareholder returns.

- Sector Sensitivity: The utility sector’s performance is often tied to interest rates and inflation levels, which may affect investor sentiment towards AEP.