damedeeso/iStock via Getty Images

A brief look back

I last covered Airbnb (NASDAQ:ABNB) in November 2023 (time flies!). The article put a hold rating on the stock, with a price target of buying near $100. Here is my rating history:

The first two buy ratings worked well, with quick gains of 26% and 32%, and the sell rating was timely. However, I missed out on more gains with the hold in the center of the graph.

At that time, I wrote the following:

Let’s face it. We know that consumers can’t keep up this frenetic pace forever. Something will give. This was evident in management’s tepid tone after Q3.

Given the economic situation, I need a significant discount to take the plunge back into a long position.

I said I would buy shares once the stock got close to $100 per share during the summer, and that remains my target. However, combining a desired price with dollar-cost averaging is a strategy I use to buy shares slowly as the price closes in on the target.

Why did Airbnb stock drop?

The expectation for a pullback in consumer spending was early, but it may finally be here.

Here is a snippet from the Q2 earnings release:

However, we are seeing shorter booking lead times globally and some signs of slowing demand from U.S. guests.

In other words, people aren’t planning vacations as far in advance, a sign of consumer weakness.

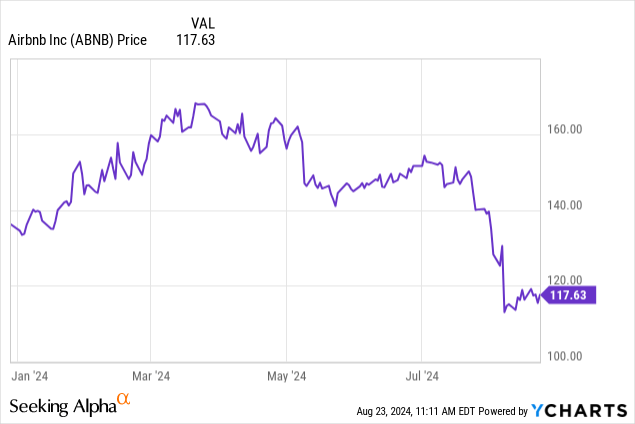

The stock dropped off a cliff when this news broke:

Why is U.S. demand falling?

The Federal Reserve’s aggressive campaign to tame inflation with “higher for longer” rates is working. The consumer price index fell to 2.9% in July, its first time under 3% since the campaign began.

Notably, the cost of “food at home” only rose 1.1%, while “food away from home” rose 4.1%. Overall energy costs also rose less than the top-line CPI. This tells me two things. One, inflation is waning on necessities. Second, plenty of people still spend on luxuries, like restaurant meals, which is encouraging for Airbnb.

Help is on the way.

The Federal Reserve chair signaled Friday that rate cuts are coming soon. This will boost economic growth; however, it takes time. Still, it bodes well for long-term investors in stocks like Airbnb.

Airbnb is a cash cow.

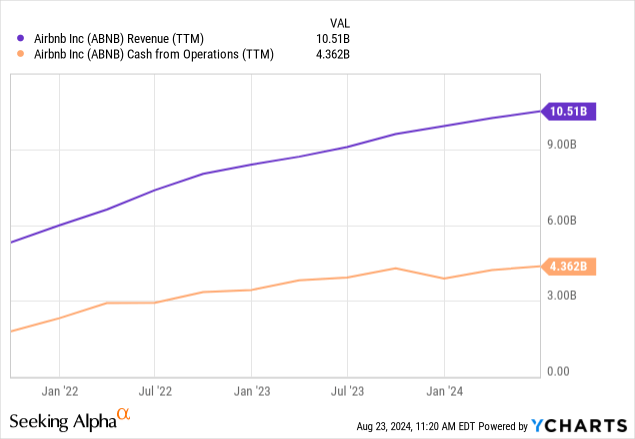

Even though growth was slower, Airbnb’s Q2 results were still impressive. I’m a sucker for cash flow, which is why I love the company’s business model, which is capital-light, lean, and highly profitable.

Management went lean during COVID-19 out of necessity as revenue plunged. But this was a blessing in disguise for the company’s long-term trajectory. They found they could do more with fewer employees, as less bureaucracy made the company more agile. Airbnb still has fewer employees than before the pandemic, while revenues have more than tripled.

Cash from operations rose 140% over the past three years as revenue increased 97%, as depicted below.

The free cash flow margin is over 40%, which allows the company to fund growth, maintain a fortress balance sheet, and buy back tons of stock.

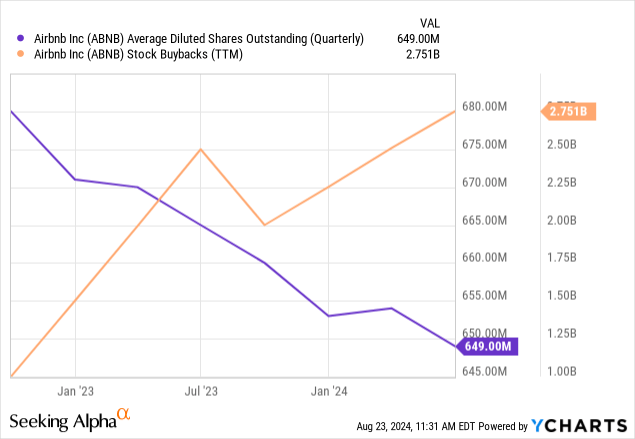

As of Q2, Airbnb had $11.3 billion in cash and investments and less than $2 billion in long-term debt. Another $6 billion stock repurchase authorization was announced, representing 8% of the current market cap.

The diluted share count dropped 5% since the program started in mid-2022, as you can see below.

Not risk-free

Wall Street reacted negatively to earnings because of slowing revenue growth and tepid guidance.

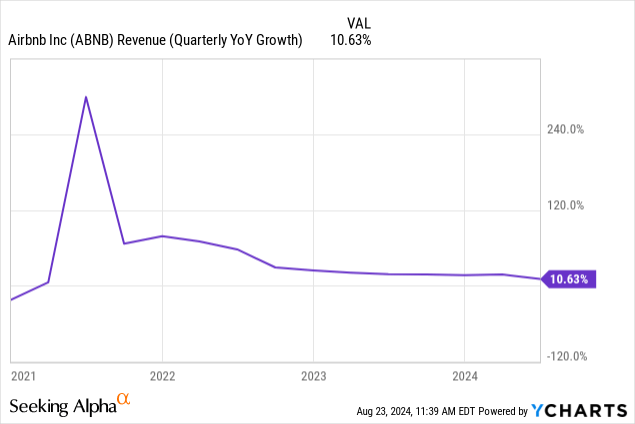

The long-term sales growth trend post-COVID is concerning:

However, employment rates and wages are strong, and the FED could be coming to the rescue.

Airbnb also faces pushback on short-term rentals in major cities. Some have banned them altogether, while others limit them by issuing a set number of permits or creating red tape. Many homeowner associations also do not allow short-term rentals.

This will be a constant headache for Airbnb, which is why I own Booking Holdings (BKNG) now, and not Airbnb. They are similar business models, but Booking has less regulatory risk. Still, Airbnb is a buy at the right price, and we are getting close.

Is Airbnb a buy now?

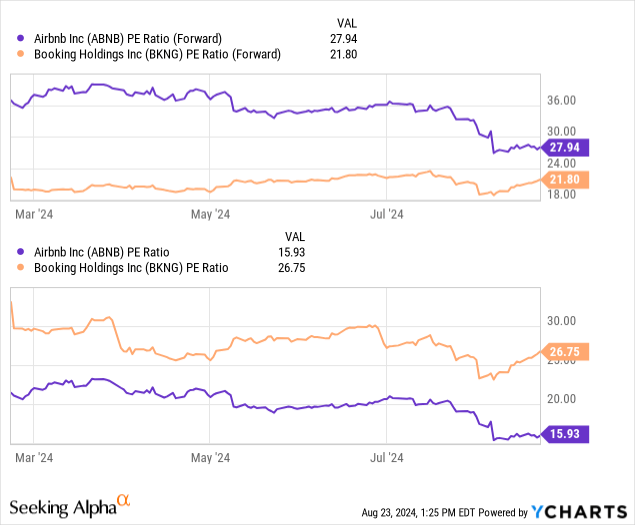

Airbnb’s forward price-to-earnings (P/E) ratio is still higher than Booking, even though the current P/E is lower:

The forward P/E is more important.

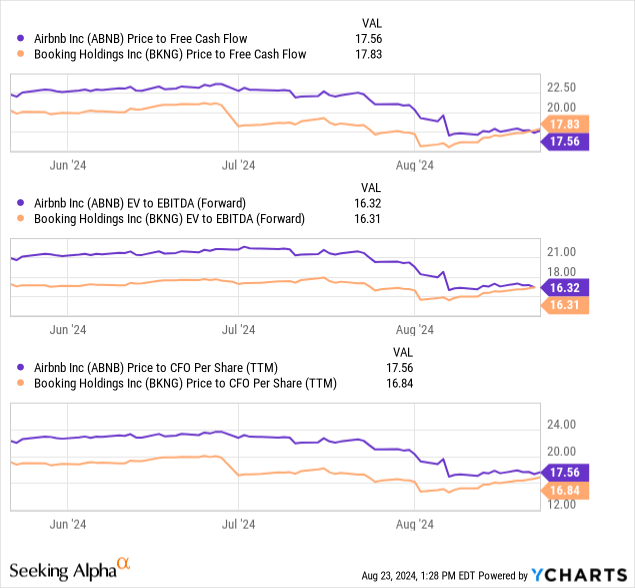

However, I prefer valuing both companies on cash flow. On these metrics, the stocks are remarkably similar:

All things being equal, I prefer Booking Holdings because it has less risk; however, Airbnb probably has more upside.

My ideal entry point is still ~$100 per share; however, that doesn’t mean we should sit on our hands until then. I begin to scale in as the price approaches the target. This ensures we don’t miss out completely if the stock doesn’t quite reach the target price and mitigates short-term risk.

Also, selling cash-secured puts is a compelling option. A November $110 put will fetch around $500 per lot. If the stock doesn’t drop below $110, you keep $500 free and clear. If it does, then you have a purchase price of $105. This is more risky, of course. If the stock crashes, there will be significant paper losses.

“The stock market is a device for transferring money from the impatient to the patient.”

Warren Buffett

I am not rushing to buy Airbnb, but I am watching closely for another dip.