Zolak/iStock via Getty Images

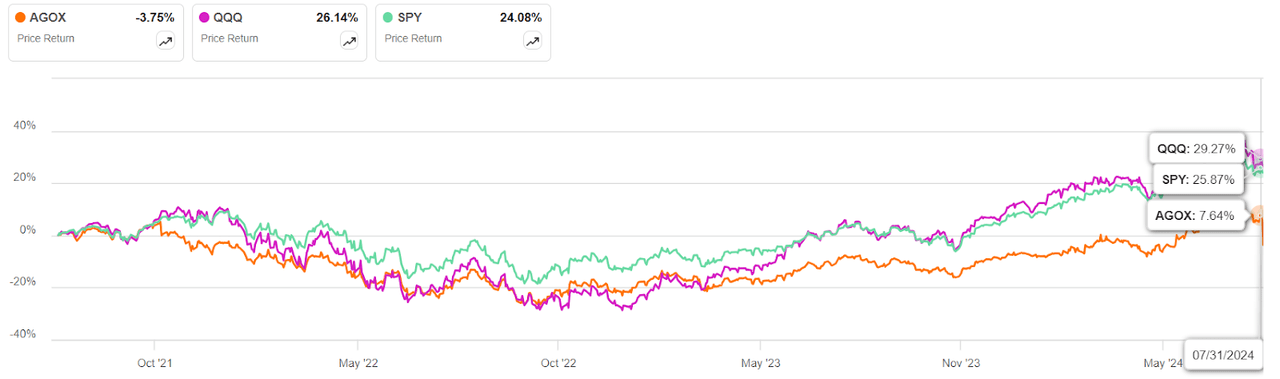

Incepted in 2012 as an open-ended mutual fund and trading as an ETF as of May 7, 2021, the Adaptive Alpha Opportunities ETF (NYSEARCA:AGOX) seeks capital appreciation by gaining exposure to index ETFs, individual securities, fixed income assets, and derivatives. That might seem like a complicated mix to manage, and it would appear that this strategy would find the ideal mix to generate alpha over the broader market, but that’s not been the case thus far.

Let’s look at the ETF, its holdings, and its performance on various time frames to see whether such a strategy might be effective in a specific macro scenario or for a specific type of investor. The spoiler is that this doesn’t seem to be a good investment vehicle, no matter what your investment preferences or how the macroeconomic drama plays out over the next several months to a year. For now, let’s dive in.

About AGOX

The ETF has an AUM of a little under $300 million but isn’t all that liquid, with average daily dollar volume at under $780,000. That doesn’t compare well against the general ETF median of about $1.4 million, but since there are so many smaller ETFs cropping up regularly, the AUM is a little above the median. As a side note, 2023 was a record year for ETF launches, and one source pegs that at 543 new funds, while also stating that Morningstar data revealed that 3 out of 4 of these are actively managed.

ETFs are also very competitively priced in terms of expense ratios, but some outliers are still on the higher side, like AGOX, as a matter of fact, which has an expense ratio of 1.39% against a sector median of 0.49%. Investors shouldn’t mind paying that much out of their returns, but it starts to look more and more expensive once the returns start coming in as suboptimal, and with negative alpha against broad-market ETFs.

That brings us to the fund’s holdings and how it’s performed over the past three years since its inception as an ETF.

Historical Performance Isn’t Impressive, and the Holdings Reveal Why

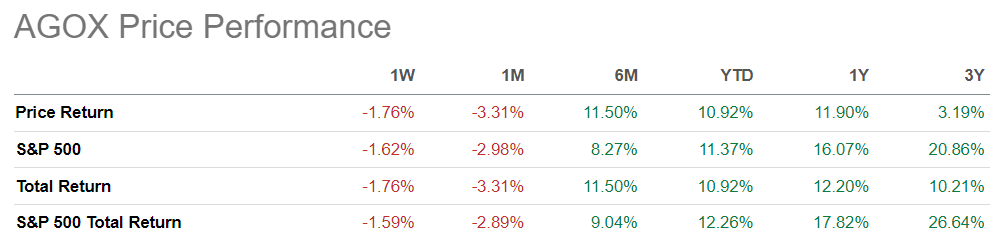

AGOX doesn’t have an impressive track record, as we briefly saw at the top. Looking a little closer at recent time frames, it doesn’t seem to offer any sort of downside protection, either. The price and total return on a 1W and 1M basis clearly show this, and for longer time frames as well, the fund has been unable to offer superior returns. The 6M period seems to be an outlier here, so I wouldn’t put much value on that.

SA

So, why has this fund underperformed the market despite being relatively expensive and following a blended securities strategy with even a little bit of leverage through options on some of the bigger names like Nvidia Corp (NVDA)?

My guess would be that it’s because the ETF uses a quant-based selection process for its securities, and the past three years haven’t really been conducive to a rules-based strategy. For example, the Magnificent 7 have seen their valuation multiples skyrocket, raising the entire market’s aggregate valuation with them. Therefore, holding a broad-market ETF – two of them, in fact – wouldn’t help generate alpha because of the drag from most sectors other than the ones that the Mag 7 cover – communications, technology, and consumer discretionary.

Indeed, the deputy chief investment officer at Morgan Stanley Investment Management reportedly told Reuters that:

The market valuations on a standalone basis look extended, and therefore an annual drawdown or correction of 10% to 13% is very possible

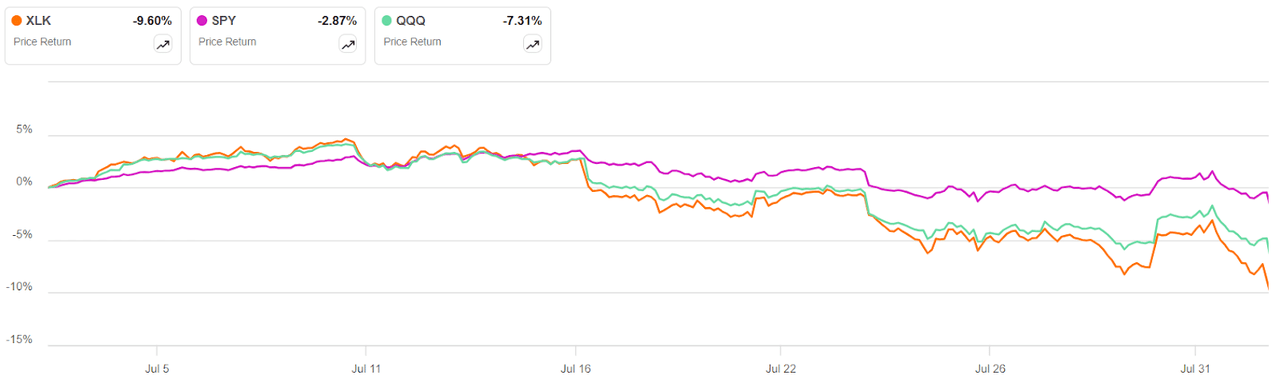

That correction began around July 10, ahead of the June CPI report, which didn’t look very encouraging and thereby acted as a catalyst for a further decline right through the month and into August.

SA

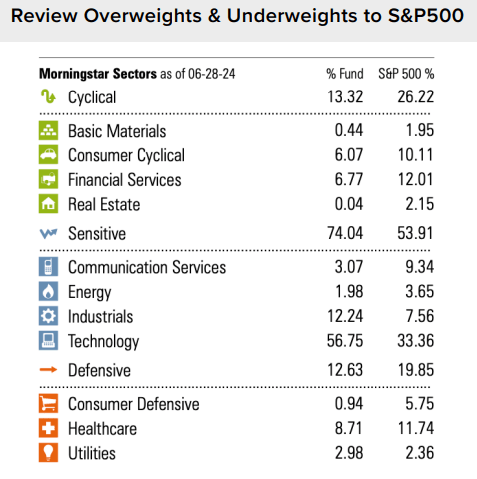

And it’s getting worse. If Jitania Kandhari, the senior executive quoted above, is right, then the 12% YTD gain that (SPY) saw could very well end up flattening out through the rest of the year. That would be unfortunately for an ETF like AGOX, which is about 12.6% weighted to defensive sectors like healthcare, utilities, and consumer defensive, but highly weighted to ‘Sensitive’ sectors to the extent of 74% of its holdings.

SA

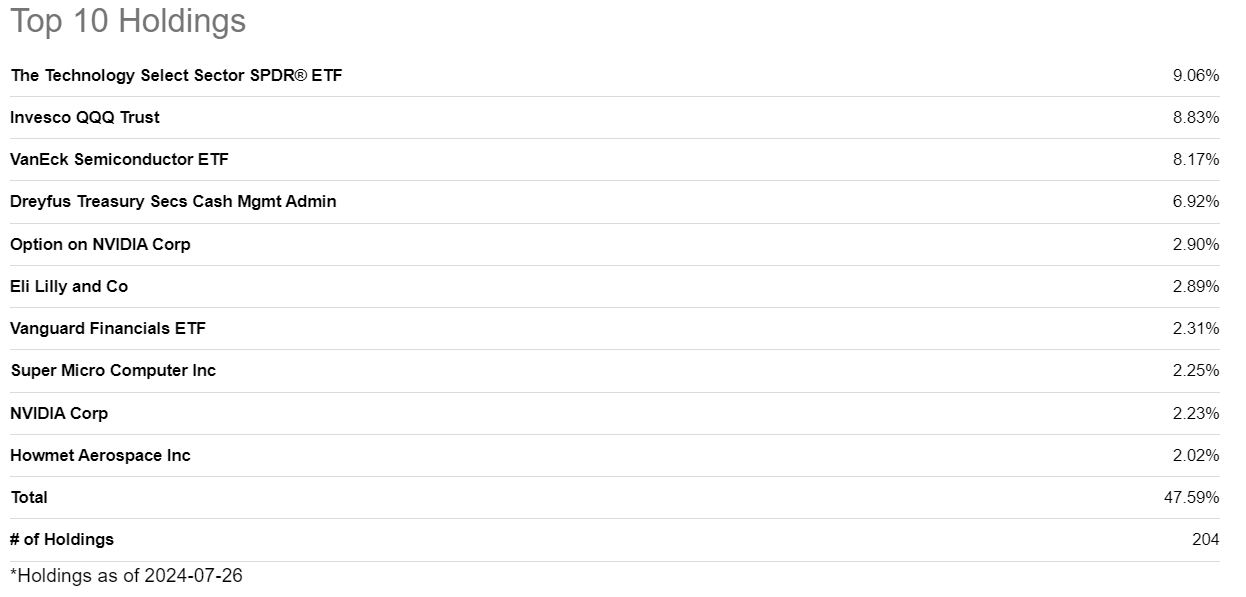

That’s not the ideal securities mix in a market downturn. So far, the fund’s “Global Go-Anywhere Strategy” hasn’t really gone anywhere. That brings us to the holdings themselves, and when you look at the top ten, you’ll immediately see why the portfolio hasn’t been able to generate any alpha.

SA

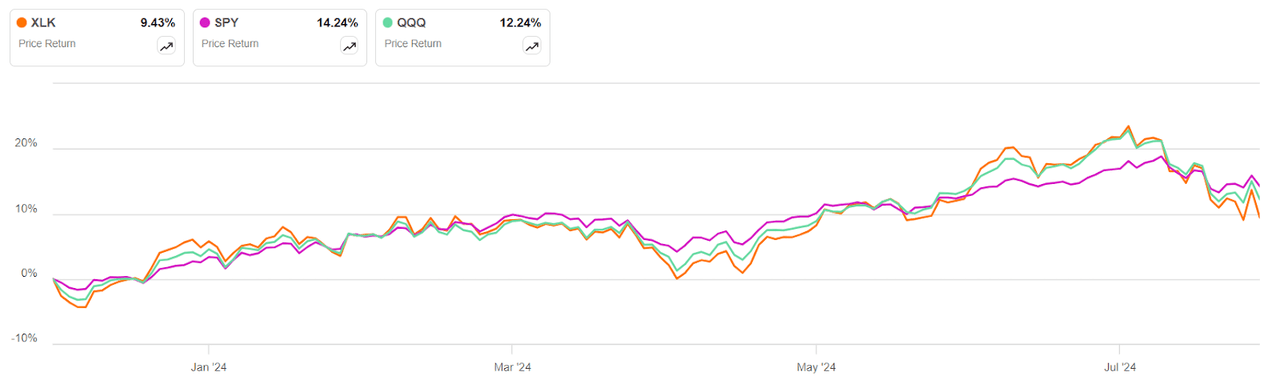

After the losses last month that many of the Mag 7 went through, The Technology Select Sector SPDR ETF (XLK) gave up most of its YTD gains and is now underperforming both SPY and (QQQ) by a significant margin.

It might not look that bad on a YTD timeline, but zoom into the last month, and you’ll see a stark underperformance from XLK. That’s one of the reasons AGOX has been dragged down on those time frames.

Conclusion

My take is that this is not an ideal investment vehicle for any type of investor. In my opinion, it tried to take advantage of the rapid price appreciation in tech mega-cap stocks by concentrating its investments, but failed to foresee that valuations became so high that they’re now showing signs of weakness.

Your money could be put to better use elsewhere. For instance, you could sell off your AGOX holding and put that into 2Y treasuries, which aren’t as sensitive to interest rate changes as longer-duration bonds and are still yielding well above 4% despite the decline from April highs around 5%. For comparison’s sake, AGOX has yielded 0.24% in the TTM period. As such, I’d rate this a Sell and encourage you to quickly remove it from your portfolio and put those proceeds to better use.