Studio-Annika/iStock via Getty Images

Introduction

Aedifica (OTCPK:AEDFF) is a Belgian REIT focusing on healthcare real estate with nursing homes as main asset class. The REIT has also been building exposure to childcare which currently represents a high single digit percentage of the portfolio. Helped by its historical decision to lock in low interest rates on its fixed rate debt, Aedifica’s earnings remain robust although increasing interest rates will likely result in very little growth on a per share bases. That being said, with a healthy dividend and balance sheet, I still have a long position in this REIT. And as it has been over six months since I last discussed Aedifica, I figured the H1 financials are a good reason to have another look to see if I need to fine-tune my investment thesis.

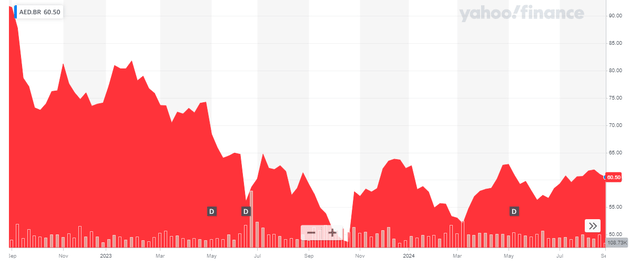

Aedifica’s primary listing is on Euronext Brussels, where the company is listed with AED as its ticker symbol. The average daily volume in Brussels is 54,000 shares, and one of the advantages of the main listing is that there are options available. There are currently 47.55M shares outstanding, resulting in a market capitalization of approximately 2.88B EUR based on the current share price of 60.50 EUR. The share price has increased by approximately 14% since my previous article was published, while the REIT also paid a 1.884 EUR gross dividend for a total return of almost 18% in the past six months.

The EPRA earnings are still consistently increasing

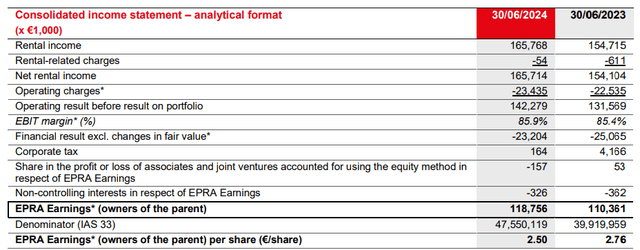

When looking at real estate entities, the FFO and AFFO are the most important metrics in North America. In Europe, the EPRA earnings are a similar metric used to determine how much money a REIT actually makes. In Aedifica’s case, the REIT generated just under 166M EUR in rental income, which also was the net rental income considering Aedifica focuses on triple net leases. After deducting the net operating expenses and the net finance expenses, the total EPRA earnings came in at almost 119M EUR.

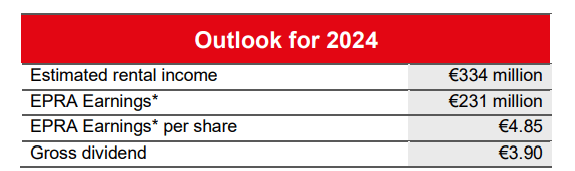

This represents an EPRA EPS of around 2.50 EUR per share. For the entire financial year, Aedifica’s management expects to see a total rental income of 334M EUR and 231M EUR in EPRA earnings which should translate into an EPRA EPS of 4.85 EUR.

Aedifica Investor Relations

The dividend is expected to be 3.9 EUR per share, representing a yield of 6.45% based on the current share price. This represents a payout ratio of approximately 80% based on the 4.85 EUR per share earnings guidance, and the payout ratio of Aedifica has been relatively stable in the past few years. This allows Aedifica to retain 20% of its earnings representing in excess of 45M EUR per year, and that cash is used to fund a portion of its development pipeline.

Also note how the estimated rental income of 334M EUR implies a 168-169M EUR rental income in the second semester, implying a 2%-2.5% increase compared to the first six months of the year.

Are the looming dividend tax increase and cost of debt increase a deterrent?

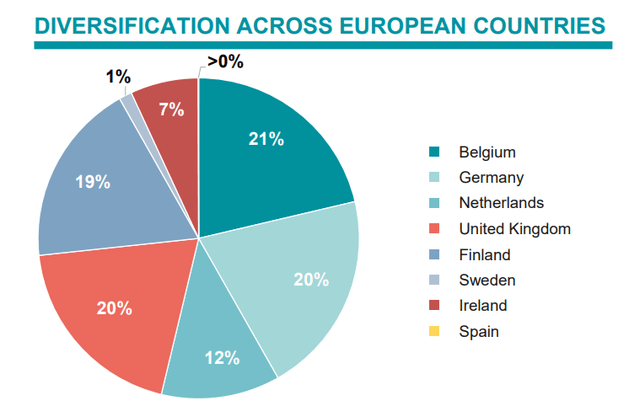

Right now, Aedifica is subject to a preferential treatment from the Belgian government when it comes to its dividends. The standard dividend tax in Belgium is 30%, but there’s a special reduction to 15% applicable to REITs which have invested at least 80% of its portfolio in European healthcare real estate assets. Aedifica handsomely meets this requirement. However, as part of the Brexit agreements, the healthcare assets owned in the UK will no longer count as “European assets” which means that based on the current situation Aedifica will no longer meet the 80% threshold and will thus no longer be able to benefit from the preferential dividend tax treatment and the 15% dividend tax would double to 30% (obviously still subject to the impact of double taxation treaties with other countries).

As shown above, the UK accounted for exactly 20% of the healthcare portfolio, and Aedifica could solve this issue by selling some UK assets and using the proceeds to buy more mainland EU assets in order to meet the 80% requirement. There are possibilities and Aedifica has 16 more months to figure it out, but it all comes down to how much Aedifica cares about the preferential dividend treatment.

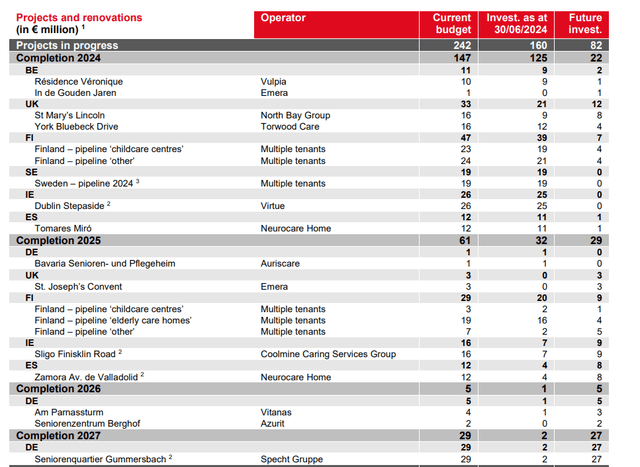

The current development pipeline (shown above) may also be helpful: Of the 208M EUR Aedifica plans to invest in 2024 and 2025, only 36M EUR (18%) is earmarked for the UK with no new completions after 2025.

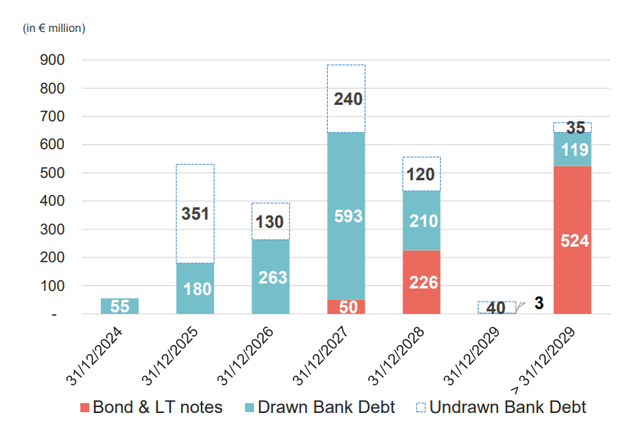

A second risk is a faster than expected increase in the average cost of debt. Aedifica’s finance team did a great job in locking in low interest rates but the current average cost of debt of 1.9% is obviously untenable. An increase of 200 bps to 3.9% would result in an increased interest expense of around 50M EUR, representing about 1.05 EUR per share on EPRA earnings. The net impact would be lower as A) we can expect rent increases as the refinancing cycle progresses and B) as shown above, it will take several years for the REIT to cycle through the interest increases so the annual increase of the interest expenses should remain manageable.

Investment thesis

I have a long position in Aedifica mainly thanks to the reduced dividend withholding tax rate and I may have to reassess my investment should the REIT no longer benefit from the reduced rate in 2026. That being said, it still has plenty of time to figure out a solution, while earnings will likely remain at least stable and may show a low single-digit percentage growth rate as I expect the majority of the rental income increase will have to be spent on increasing interest expenses.

Upon weakness, I may also decide to write additional (out of the money) put options, but due to the relatively low volatility levels, the option premiums currently aren’t great.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.