alvarez

DSGR: What Lies Ahead

I have discussed Distribution Solutions Group (NASDAQ:DSGR) in the past, and you can read the latest article here, published on April 12. Through various acquisitions, the company now more intensively covers Eastern and Western Canada. I expect sales synergies from the merger to strengthen its margin in FY2024. Cross-selling and in-sourcing should help improve its operating margin, which has been under pressure due to supply chain issues and customers’ budget discipline.

The MRO market has been stifled in recent times and inundated by steep competition. So, I expect growth to emerge in select patches. In this environment, the company’s cost reduction measures can become important. Its recent increase in borrowing capacity will boost liquidity as the company plans to finance growth through liquidity. The stock is reasonably valued, with a positive bias, compared to its peers. I recommend investors continue to “hold” the stock.

Why Do I Retain My Call?

In my previous iteration, published on April 12, I discussed how DSGR expanded its product categories and entered new geographies through recent acquisitions. Despite merger synergies, project deferrals and a leveraged balance sheet pose challenges to its growth prospect. On a relative basis, its valuation was reasonable. I rated it a “hold.” I wrote:

Integrating Hisco and TestEquity expanded its geographic reach, while it added over $400 million in revenue. The Instrumex acquisition expanded the company’s capabilities in the European market. The Emergent Safety Supply acquisition strengthened the safety category product line. The company ramps up its key product and private label categories through robust cross-selling.

Since my last publication, the industry environment has been mixed. DSGR focused on strengthening select regions in Canada through M&As and organic growth. Its strategies involved generating higher structural margins through scale and synergies and leveraging the tech and automotive sector end-market growth. However, macroeconomic headwinds related to the industrial end markets can hinder growth and margin in the near term. Given the relative undervaluation, I maintain my rating to a “hold.”

Acquisitions Direct DSGR’s Strategies

In July, DSGR agreed to acquire Source Atlantic, which supplies industrial MRO products, safety products, fasteners, and related products in Canada. The transaction will combine Source Atlantic’s Eastern Canadian operation with Bolt Supply’s Western presence positions. It will expand DSGR’s offerings and leverage its specialty services capabilities, representing 25% of its revenues. It will offer a high-touch, specialty distribution platform. In FY2023, Source Atlantic’s sales totaled Canadian $250 million.

The acquisition will supplement DSGR’s Bolt Supply House and the Lawson VMI Canadian team. Because Bolt Supply House operates from Western Canada, it will complement the scale and geographic expansion potential in Eastern Canada. They have minimal customer overlap and will expand their capabilities and offerings.

Investors may note that Bolt customers are concentrated in British Columbia, Alberta, Saskatchewan, and Western Manitoba. They represent about 28% of the Canadian MRO market. Source Atlantic, on the other hand, is based out of Ontario and Quebec and represents 67% of the MRO market in these regions. So it has more intensive greater penetration. DSGR plans to grow faster with the combined MRO solutions and specialty services.

Canadian Opportunities And Other Strategies

Growing beyond MRO, the company sees an expanding Canadian marketplace for its offerings. It aims to generate higher structural margins through scale and synergies in Canada. DSGR’s M&A activity is an ongoing process. As I discussed in my previous article, in 2024, DSGR focuses on integrating Hisco and TestEquity.

Cross-selling opportunities are the other growth factors. DSGR’s switch from relying on third-party manufacturers to internal manufacturing through Gexpro Services. This in-sourcing initiative appears to have streamlined the company’s supply chain and significantly reduced lead times.

I expect the merger’s sales synergies to strengthen its margin in FY2024. TestEquity Group and Measurement division’s sales volume increased by “double-digit” sequentially in Q2, led primarily by growth in the tech and automotive sectors.

Industry Outlook

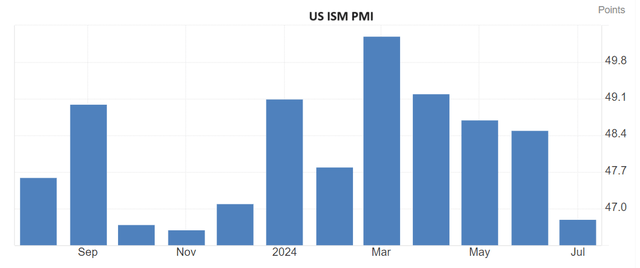

The ISM Manufacturing PMI decreased to 46.8 in July from 48.5 in the previous month. Lower US factory activity and high interest rates on goods demand adversely affected the index. In July, the unemployment rate was 4.3%, or 0.2 percentage points higher than in June. The US real GDP growth rate, on the other hand, expanded to 2.8% in Q2 2024, up from 1.4% a quarter earlier.

Challenges And Outlook

In the MRO industry, DSGR’s management sees softness in the shorter-cycle business. It also expects a recovery in the OEM and industrial technology verticals. The company’s competitors will likely underperform in 2H 2024. In 2H 2024, it expects organic sales growth to be “flat to slightly positive.”

By the end of 2025, management expects Bolt Source Atlantic to achieve a “low double-digit range” EBITDA margin and be “significantly accretive” to its earnings. The company expects to fund this acquisition through its existing liquidity. Capital-related project spending can recover, while various end markets can normalize before the end of the year. Because of the end market traction, the margin profiles of its verticals can expand.

The company’s verticals can face challenges due to macroeconomic headwinds. The industrial distribution businesses can adversely weigh on the industrial end markets in the U.S. In 1H 2024, competition in the market was under pressure, and it could ease in 2H 2024. Customers appear to be avoiding purchases and stocking SKUs for growth. Despite the challenges, it sees patchy growth in many pockets in the market.

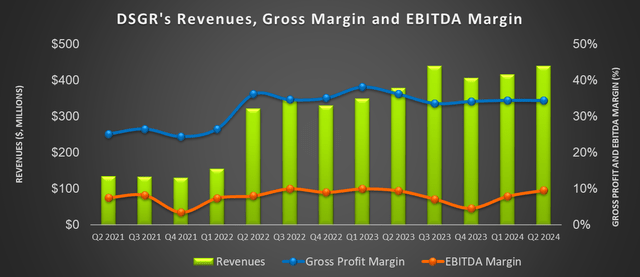

My Estimates

Over the past three years, the company’s adjusted EBITDA increased by 21%. I expect the US manufacturing index to remain steady but not see much upside in 2024. Given the company’s initiatives to improve its margin in the recent quarters, its adjusted EBITDA should increase moderately, by 8% to 12%, in FY2024.

Looking Through Q2 Results

In Q2 2024, DSGR’s Gexpro Services segment saw the most remarkable revenue growth (46% up) year-over-year, as announced in the Q2 earnings press release on August 1. Revenues from Lawson remained steady in Q2, while TestEquity declined marginally. Adjusted EBITDA in Gexpro Services turned positive in Q2 but remained relatively weak in the other segments. The acquisition-related revenue push mitigated the market sluggishness for the last several quarters.

DSGR has initiated process improvement and structural optimization in all businesses. It will likely improve operational efficiencies while driving margins higher in the medium-to-long term.

Cash Flows And Debt Level

In 1H 2024, DSGR’s cash flow from operations (or CFO) remained nearly unchanged compared to a year ago, despite higher revenues. Free cash flow (or FCF), excluding acquisitions, also ticked up marginally.

DSGR’s leverage (debt-to-equity) was 0.93x and deteriorated compared to FY2023. In the past year, its long-term debt inflated significantly after it made various acquisitions. In August, the company amended its credit agreement and increased its borrowing capacity from $805 million to $1.06 billion. The agreement also enhanced its revolving credit facility, improving the company’s liquidity. Its debt-to-EBITDA of 3.2x by June 30 was well within the stated range of 3x-4x. Its management appears confident of lowering it to below 3x by 2024-end.

Relative Valuation And My Price Forecast

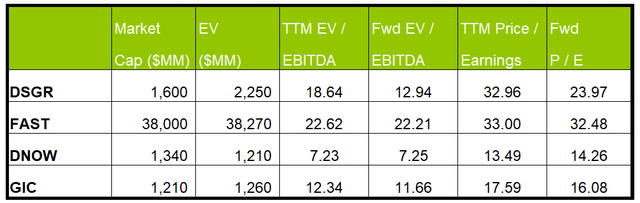

Author Created and Seeking Alpha

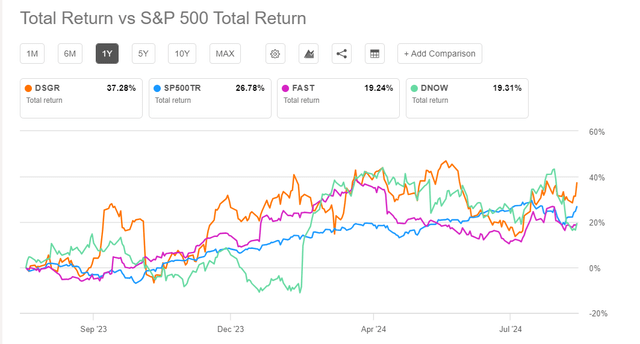

DSGR’s forward EV/EBITDA multiple contractions versus the current EV/EBITDA is much steeper than its peers. This should typically result in a higher EV/EBITDA multiple. Its current EV/EBITDA multiple (18.6x) is higher than its peers’ (FAST, DNOW, and GIC) average. So, the stock is reasonably valued with a positive bias.

DSGR’s average EV/EBITDA multiple for the past five years was 16.6x. If the stock trades at the past average, it can decrease by 11% from the current level. The average EV/EBITDA multiple for DSGR’s peers (FAST, DNOW, GIC) is 14x. If the stock trades at this average, the stock price can decrease by 31% from the current level.

I think the company’s current challenges can depress the company’s bottom line in the short term. However, it can overcome the issues and produce moderately positive results in the medium term. As I discussed earlier in the article, I expect 8%-12% adjusted EBITDA growth in the next four quarters. Feeding these values in the EV calculation and assuming the sell-side current EV/EBITDA multiple of 18.6x, I think the stock should trade between $39 and $41, implying a 14%-19% upside.

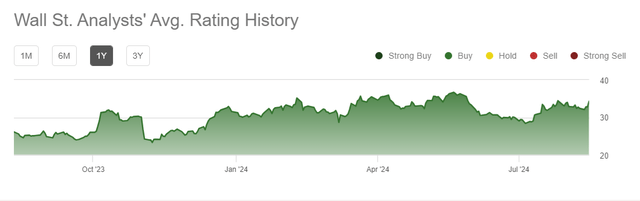

Wall Street Rating

Two analysts rated DSGR a ” strong buy” in the past 90 days. None rated it a “sell,” while one rated it a “hold.” The consensus target price is $41, suggesting a 19% upside at the current price. Given the current value drivers, Wall Street analysts are reasonably close to a fair return estimate.

Risk Factors

The ongoing geopolitical uncertainty remains DSGR’s key risk factor. US manufacturing activity is not robust. I think global economic slackness can increase the company’s risk factors in 2024. The other risk related to softness in its shorter-cycle MRO business. Plus, my previous article discussed the financial risks related to high debt and indebtedness.

What’s The Take On DSGR?

DSGR’s acquisition of Source Atlantic will help spread its operations in Eastern Canada. It will leverage its specialty services capabilities in that region, as Bolt Supply House and the Lawson VMI already have a strong presence in the Western part. The company plans to grow faster with the combined MRO solutions and specialty services. The company’s recent M&A activity includes TestEquity Group, where sales volume increased significantly in 2024. So, the stock outperformed the SPDR S&P 500 ETF (SPY) in the past year.

Another key part of its growth strategy is cross-selling opportunities. However, the slowness in US manufacturing activity and the rise in unemployment can hinder growth. Customers’ disciplined capital deployment strategy inhibited the company’s gross and operating profit margins. DSGR addressed this issue in Q2 with a focus on improving margin. It enhanced its liquidity to finance growth in the medium term. Given the relative valuation multiples, I think returns from the stock can improve marginally in the near term. So, I will continue to find a “hold” rating that is appropriate for now.