Morsa Images/DigitalVision via Getty Images

Since my last article was published on April 29, AbbVie’s share price (NYSE:ABBV) has risen more than 16%, hitting new multi-year highs.

This article will focus not only on the company’s Q2 2024 financial results but also on other factors that make me believe it is becoming an increasingly attractive stock among Big Pharma despite the lack of significant progress in developing its oncology franchise.

AbbVie’s Q2 2024 financial results were beyond praise

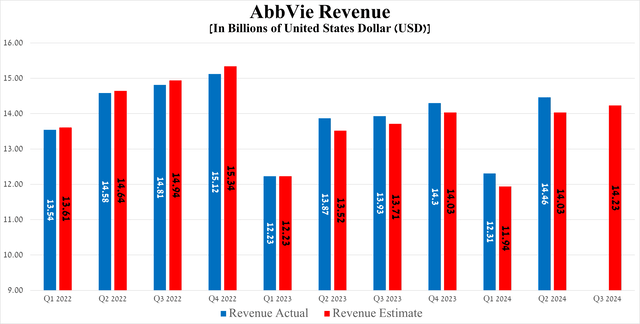

AbbVie’s revenue was $14.46 billion in the second quarter of 2024, up 17.5% quarter-on-quarter and beating the consensus estimate by $430 million.

Source: Seeking Alpha

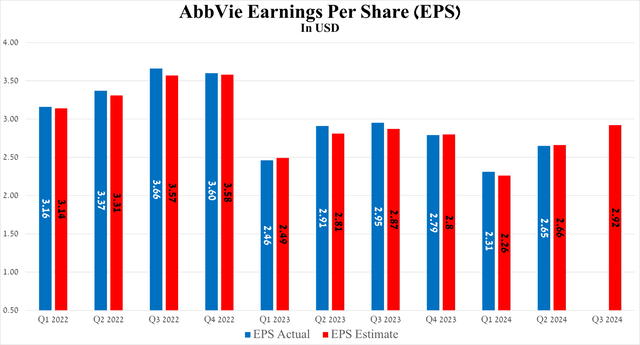

Meanwhile, the results of another equally important financial metric, namely earnings per share, although it fell slightly short of analysts’ expectations, increased by 34 cents quarter-on-quarter, amounting to $2.65 for the three months ending June 30, 2024.

Source: Seeking Alpha

So, what are the reasons for the success of the Illinois-based healthcare giant?

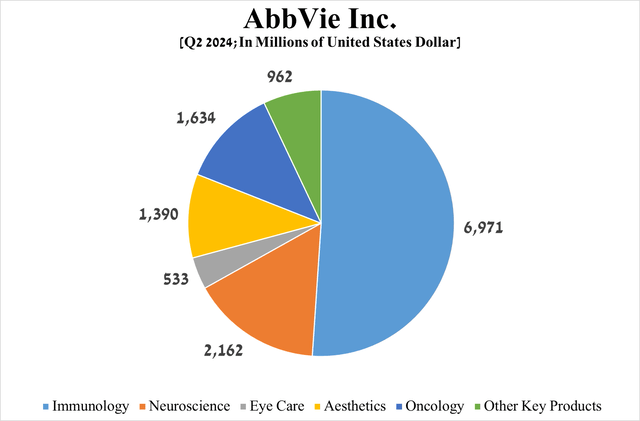

To answer this question more objectively, I would like to focus your attention on AbbVie’s immunology, oncology, and neuroscience franchises, whose total sales account for about 75% of its revenue.

Source: graph was made by Author based on the AbbVie press release

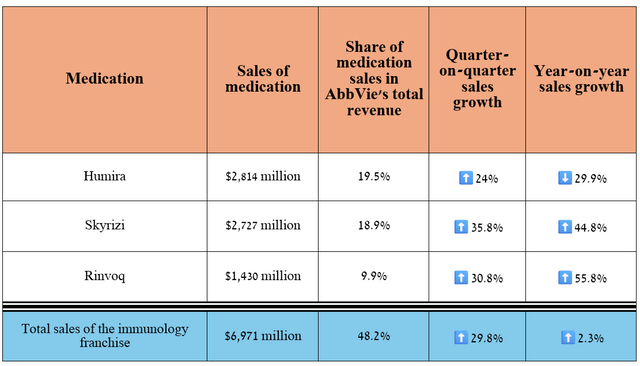

In recent quarters, AbbVie’s financial position has strengthened significantly, mainly due to its immunology franchise, which includes Humira, Skyrizi, and Rinvoq, which are used to treat a broad range of immune-mediated inflammatory diseases, including plaque psoriasis, rheumatoid arthritis, Crohn’s disease, and others.

Its revenue was $6.97 billion for the three months ended September 30, 2024, representing an increase of 2.3% year-over-year and 29.8% quarter-over-quarter.

Source: graph was made by Author based on 10-Qs and 10-Ks

Let’s move on to discussing the most significant FDA-approved medications for AbbVie’s financial position.

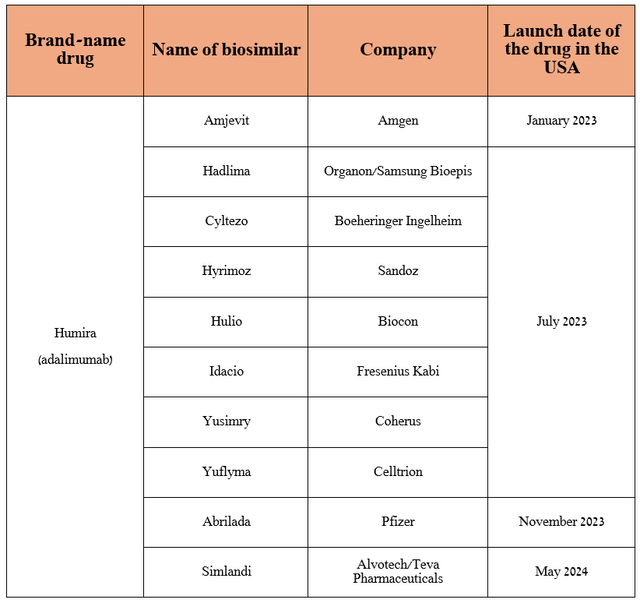

As I already noted in the article “Unveiling AbbVie’s Winning Strategy In Pharmaceutical Innovation (Rating Upgrade),” Skyrizi is a key drug in the company’s immunology portfolio, which continues to offset the decline in Humira sales due to the appearance on the market of an increasing number of its biosimilars, including those produced by such giants of the pharmaceutical industry as Teva Pharmaceutical (TEVA), Pfizer (PFE), Amgen (AMGN).

Source: table was made by Author based on press releases of pharmaceutical companies

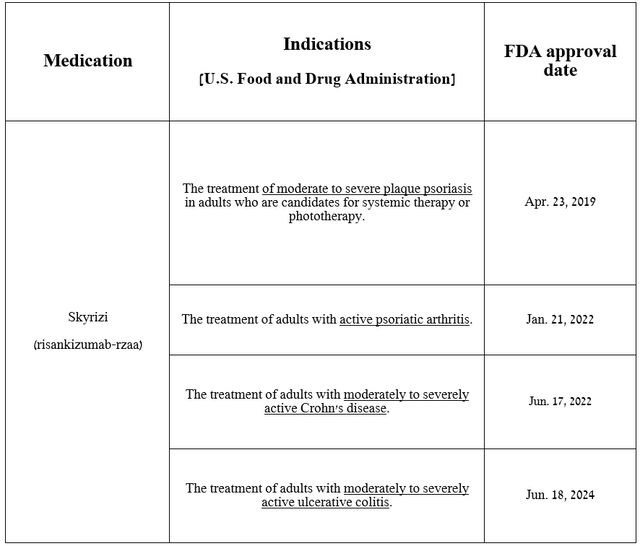

So, Skyrizi is an anti–interleukin 23 monoclonal antibody used to treat patients with Crohn’s disease, ulcerative colitis, active psoriatic arthritis, and plaque psoriasis.

Source: table was made by Author based on AbbVie press releases

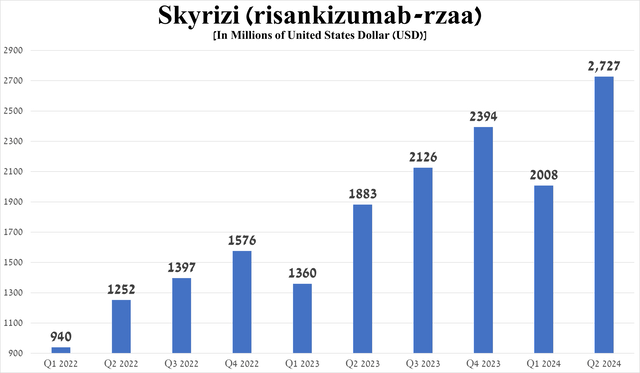

Its total sales were about $2.73 billion in the second quarter of 2024, up 44.8% year-on-year, driven by patients switching from Humira, as well as its superior efficacy in treating the above-mentioned conditions relative to Johnson & Johnson’s Stelara/Remicade (JNJ), Bristol-Myers Squibb’s Sotyktu (BMY), Novartis’ Cosentyx (NVS), Amgen’s Otezla, ultimately reflecting in Skyrizi’s wider adoption in medical practice.

Source: graph was made by Author based on 10-Qs and 10-Ks

In addition, I believe that with the FDA’s approval of Skyrizi for the treatment of people with moderate-to-severe ulcerative colitis on June 18, 2024, its sales growth rate will accelerate starting in the third quarter, which will also once again ease the concerns of some financial market participants who were critical of the prospects for the development of AbbVie’s immunology franchise after the loss of Humira’s exclusivity.

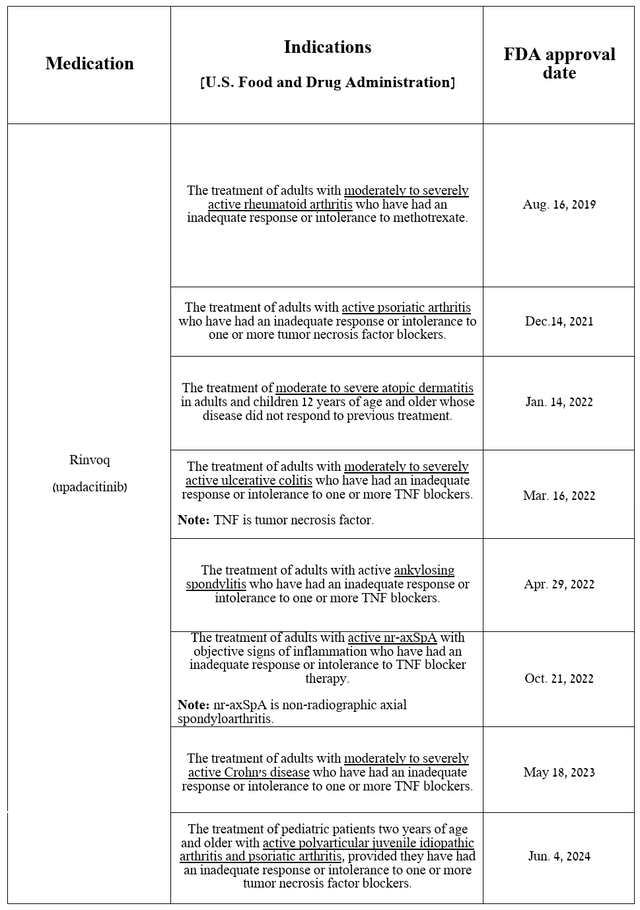

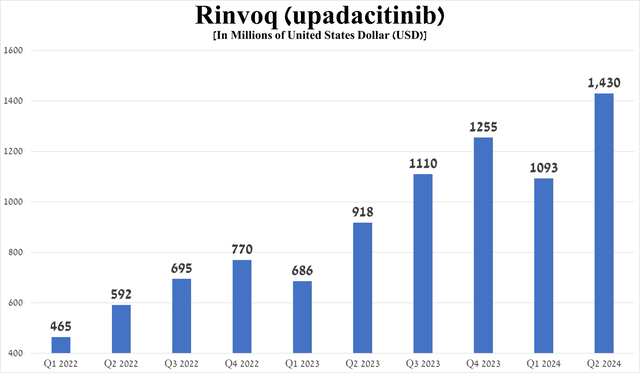

Equally important to discuss is the progress in commercialization and development of Rinvoq, AbbVie’s other key drug because, unlike Skyrizi, it has been approved by the US regulatory agency for a much wider range of indications.

Source: table was made by Author based on AbbVie press releases

Rinvoq (upadacitinib) is a second-generation JAK1-selective inhibitor that had total sales of $1.43 billion in the second quarter of 2024, up 30.8% quarter-on-quarter, driven in part by increased demand in the U.S., excellent data from a Phase 3b/4 clinical trial in which it outperformed Sanofi/Regeneron’s Dupixent (SNY) (REGN) in treating patients with moderate-to-severe atopic dermatitis, and its FDA approval in early June for the treatment of children aged two years and older with psoriatic arthritis and polyarticular juvenile idiopathic arthritis.

Source: graph was made by Author based on 10-Qs and 10-Ks

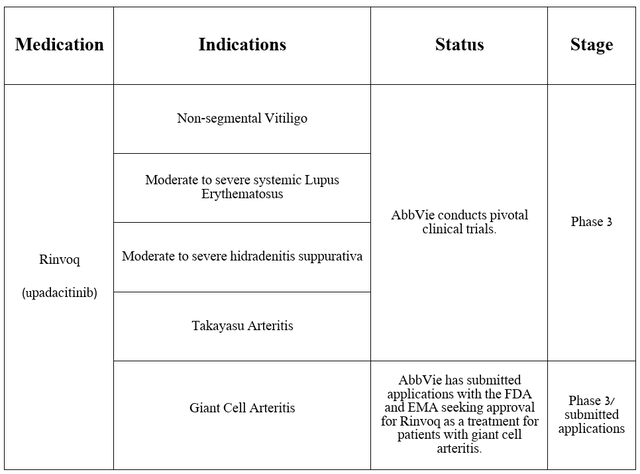

AbbVie is not resting on its laurels and is seeking to expand the label of Rinvoq, conducting several pivotal clinical studies aimed at determining its efficacy in combating the diseases noted in the table below.

Source: table was made by Author based on AbbVie press releases

As I reported in a previous article, on April 18, 2024, the company announced positive results from a pivotal clinical trial that assessed Rinvoq’s safety profile and efficacy profile in treating patients with giant cell arteritis.

It met primary and secondary endpoints, including that Rinvoq was well tolerated and that 46% of adult patients taking AbbVie’s medication 15 mg experienced sustained remission, compared with 29% of patients receiving placebo.

Three months later, on July 12, the company announced that it had submitted applications to the EMA and FDA to seek approval for upadacitinib to treat people with giant cell arteritis. For those readers unfamiliar with this condition, it attacks the arteries of the head and can ultimately lead to permanent vision loss and aneurysm.

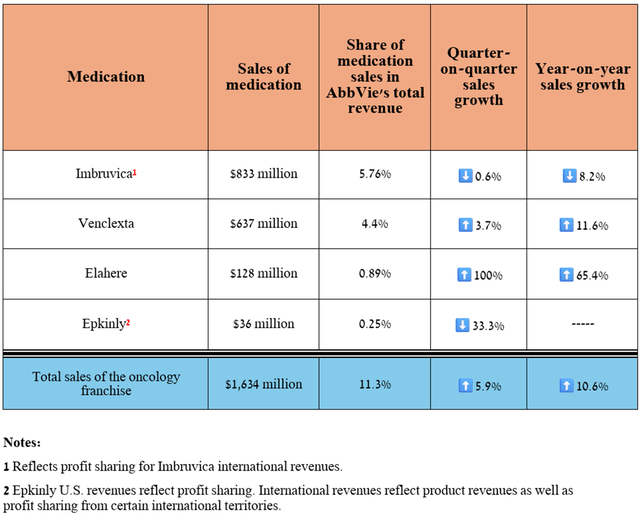

Let’s move on to a discussion of the company’s oncology franchise, which, in my opinion, in terms of volume and innovation of FDA-approved and experimental drugs, does not yet reach the level of the leaders of the global cancer therapeutics market such as Merck (MRK), Pfizer, and Bristol-Myers Squibb, even after completing the acquisition of ImmunoGen in mid-February 2024.

Overall, its total revenue was $1.63 billion in the second quarter of 2024, up 10.6% year-over-year, even as demand for Imbruvica (ibrutinib) declined due to the introduction of more effective BTK inhibitors into clinical practice, including AstraZeneca’s Calquence (AZN), BeiGene’s Brukinsa (BGNE), and Eli Lilly’s Jaypirca (LLY), which I discussed in more detail in the first article about AbbVie.

Source: table was made by Author based on 10-Qs and 10-Ks

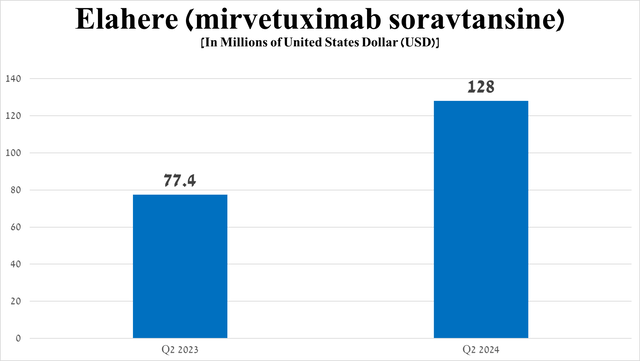

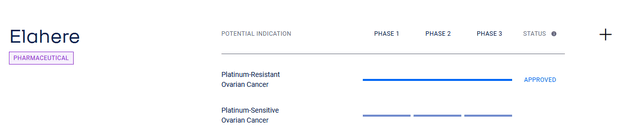

However, of the above-mentioned medications, Elahere (mirvetuximab soravtansine-gynx), which is the first FRα-directed antibody-drug conjugate, continues to pleasantly surprise me with its sales growth rate, amounting to $128 million in the three months ended June 30, 2024, an increase of 65.4% quarter-on-quarter.

Among the reasons that contribute to the increase in demand for it, I highlight the following, namely, increased marketing expenses for its promotion, improved awareness among doctors, as well as promising data from the Phase 3 MIRASOL study, in which the risk of death in participants with ovarian cancer who took Elahere was 33% lower compared to those who received chemotherapy.

Source: graph was made by Author based on 10-Qs and 10-Ks

On a more global level, further label expansion of its ovarian cancer treatment is expected. What are the prerequisites for this?

On June 6, AbbVie delighted investors with encouraging data from the Phase 2 PICCOLO trial, in which a group of patients with platinum-sensitive ovarian cancer taking Elahere had a median duration of response of 8.25 months, while the objective response rate was 51.9%, which is a statistically significant result.

Source: AbbVie

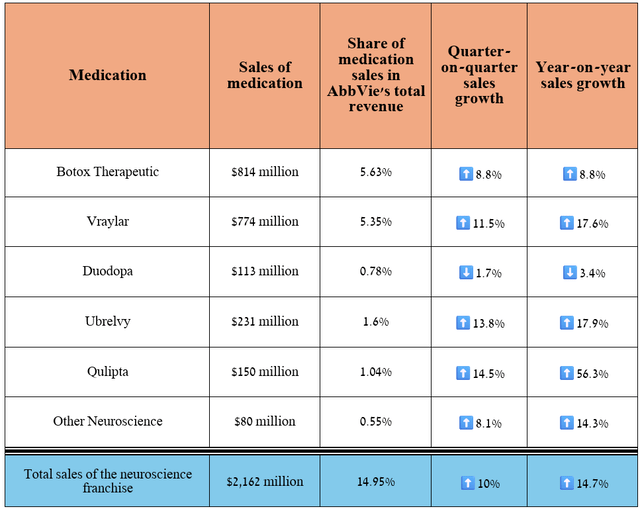

Before I discuss the risks that AbbVie investors need to consider, I want to highlight the progress of its neuroscience franchise, which, like immunology, is a significant part of its diversified portfolio of drugs.

Its total revenue was about $2.16 billion for the three months ended June 30, 2024, an increase of 14.7% year-over-year.

Source: table was made by Author based on 10-Qs and 10-Ks

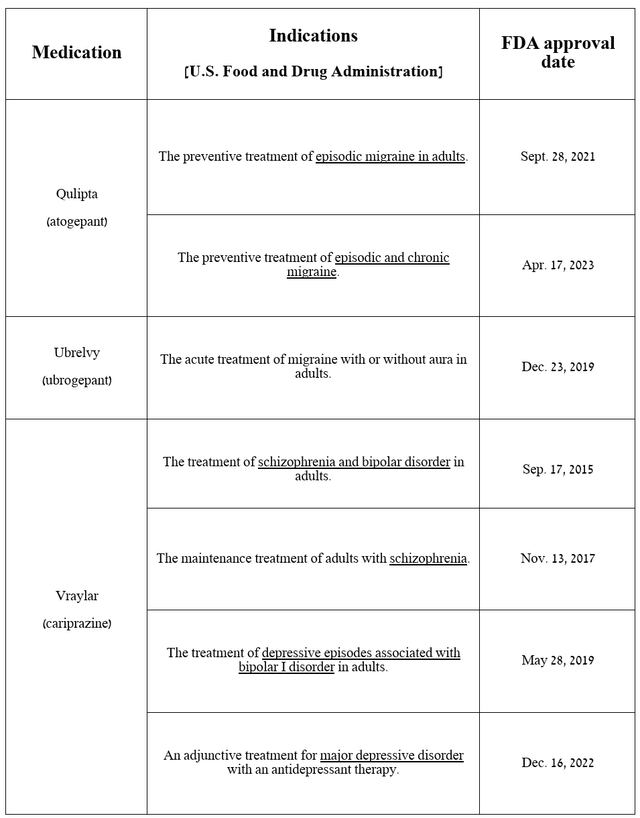

AbbVie’s neuroscience portfolio is primarily comprised of innovative medicines, the most commercially promising of which are Qulipta and Ubrelvy, which are becoming the “gold standards” in the migraine treatment market, and Vraylar, which has been approved by regulators for the treatment of bipolar I disorder, schizophrenia, and major depressive disorder.

Source: table was made by Author based on AbbVie press releases

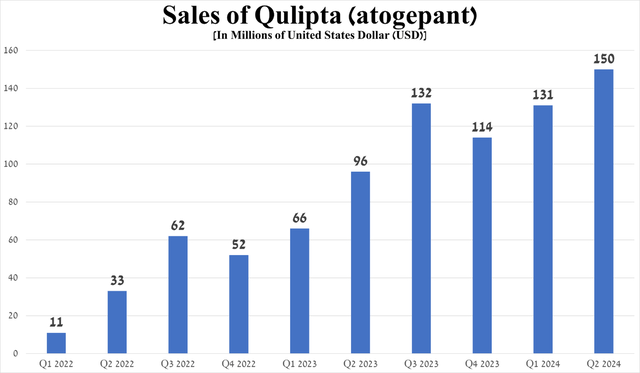

For example, sales of Qulipta, a CGRP receptor antagonist, totaled $150 million in the second quarter of 2024, up 56.3% year-on-year, primarily due to its oral route of administration, unlike Amgen’s Aimovig and Teva Pharmaceutical’s (TEVA) Ajovy, and the publication on April 12 of long-term results from the 156-week extension study, which further confirmed its high efficacy as a preventive treatment of episodic migraine.

Source: graph was made by Author based on 10-Qs and 10-Ks

Risks

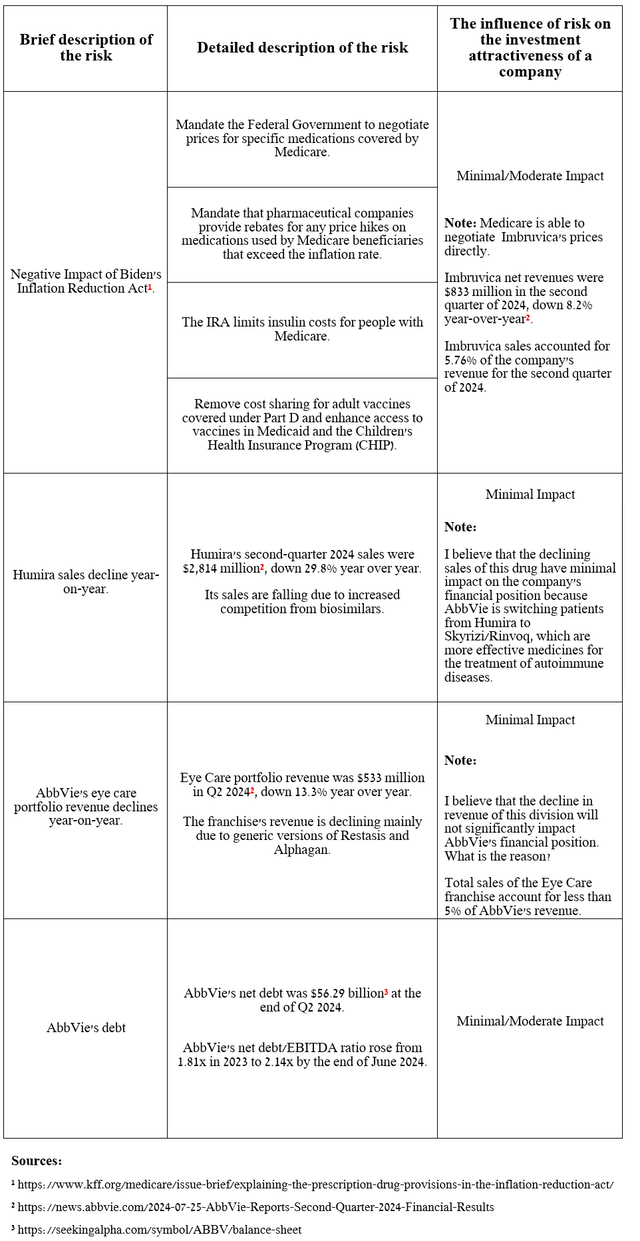

I would like to note the following risks that may negatively affect AbbVie’s investment attractiveness in the medium and long term.

Source: table was made by Author

Takeaway

This article provided an analysis of AbbVie’s financial results for the second quarter of 2024, as well as its progress in developing its immunology and neuroscience franchises, which, in my opinion, will continue to make a fundamental impact on improving the company’s financial position, including helping it reduce debt after the acquisition of Celsius Therapeutics, Cerevel Therapeutics (CERE), and ImmunoGen, as well as increase operating income margin.

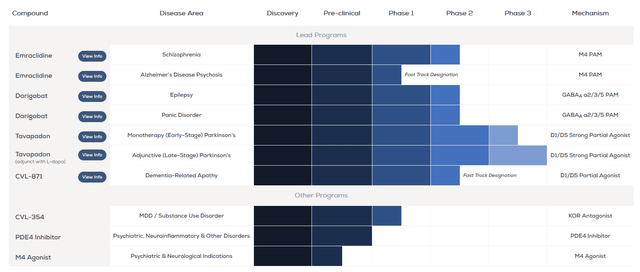

So, Roopal Thakkar, AbbVie’s executive vice president, pleased me with a statement on the quarterly earnings call about the progress made in the $8.7 billion acquisition of Cerevel Therapeutics.

As Rob mentioned, we remain on track to close the Cerevel transaction soon and we look forward to welcoming the team into our R&D organization. The emraclidine pivotal studies in schizophrenia remain on track to begin reading out near the end of this year. We’ll also see data from two additional Phase 3 studies for davapidon in Parkinson’s disease later this year. We look forward to providing updates on these programs once the transaction has closed and data are available.

The deal will allow AbbVie to partially reduce its dependence on sales of its immunology portfolio, as well as significantly strengthen its neuroscience pipeline, mainly due to emraclidine and tavapadon, which have the potential to become the “gold standards” for the treatment of schizophrenia and Parkinson’s disease.

Source: Cerevel Therapeutics

In addition, AbbVie raised its 2024 financial guidance, anticipating adjusted diluted earnings per share to be $10.71–$10.91 instead of the previously forecast $10.61–$10.81.

Consequently, I continue to cover AbbVie with a ‘Buy’ rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.