Just_Super

Welcome to the Vanadium miners news.

April saw vanadium pentoxide prices and ferrovanadium prices slightly lower, remaining at very depressed levels.

Vanadium uses

Vanadium is traditionally used to harden steel. Chinese rebar standards are requiring more vanadium. Also Vanadium Flow Batteries [VRFBs] are becoming increasingly popular especially for commercial energy storage, most notably in China. Vanadium Pentoxide [V2O5] is used in VRFBs and Ferrovanadium [FeV] is used in the steel industry.

Vanadium spot price history

Europe & China Vanadium Pentoxide [V2O5] Flake 98% one year price chart – Europe = USD 5.00/lb, China = USD 4.89/lb

Europe and China Ferrovanadium [FeV] 80% one year price chart – Europe = USD 26.25/kg, China = USD 25.30/kg

Vanadium demand versus supply

In 2017, Robert Friedland stated: “We think there’s a revolution coming in vanadium redox flow batteries….”

An April 2021, Wood Mackenzie report stated (emphasis added):

Global energy storage deployment surged a remarkable 62% in 2020, with 5 GW/9 GWh of new capacity added. This brought the total energy storage market to more than 27 GWh. Furthermore, we expect the global (energy storage) market to grow 27-fold by 2030.

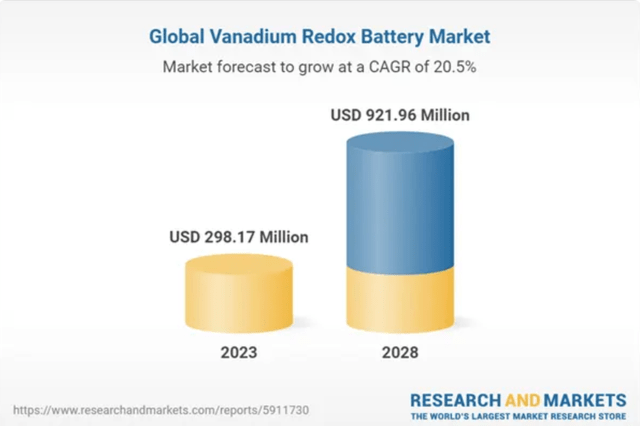

ResearchAndMarkets forecasts the global VRFB market to grow from US$298m in 2023 to US$921m in 2028, at a CAGR of 20.5% (as of January 2023) (source)

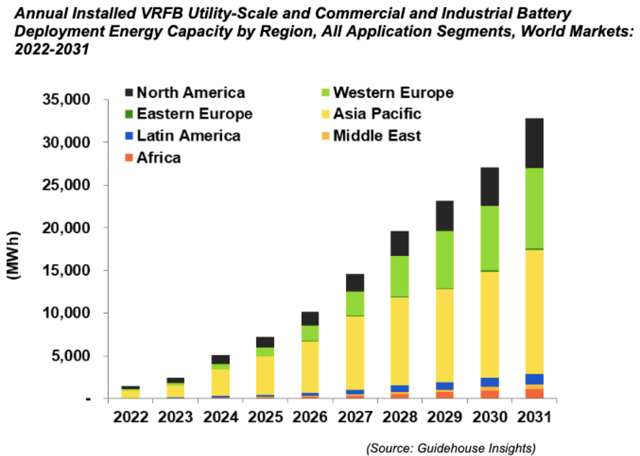

Global VRFB forecast growth by region 2022-2031

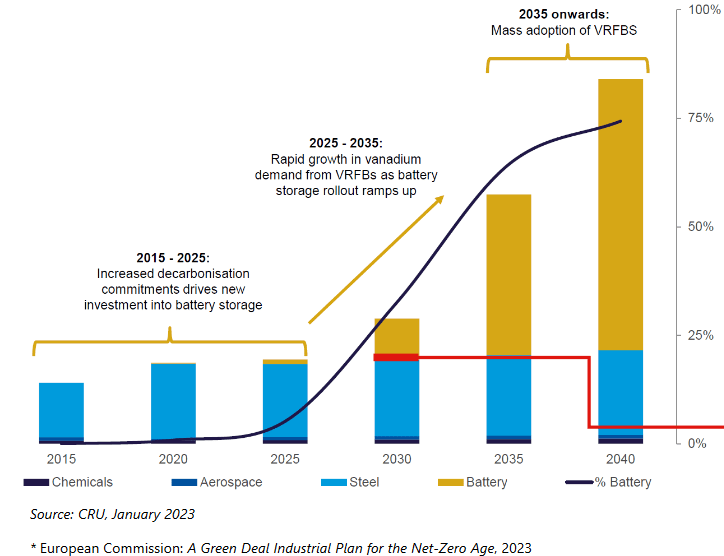

CRU forecasts vanadium demand to double by 2032 mostly due to VRFB’s (source) (As of January 2023)

CRU

Large scale global deployments of VRFB’s are becoming more common

Technology Metals Australia company presentation

Vanadium market news

Some news we missed – On January 31, 2024, Metal Tech News reported:

Vanadium batteries rival lithium-ion…There are currently over 200 VRFB projects in multiple countries, including the U.S., Canada, Japan, Italy, Europe and South Korea, which have been deployed or are under construction.

On April 24, Yahoo Finance reported:

The “Vanadium Market Report: Trends, Forecast and Competitive Analysis to 2030” report. The global vanadium market is expected to reach an estimated $3.9 billion by 2030 with a CAGR of 5.2% from 2024 to 2030. The future of the global vanadium market looks promising with opportunities in the automotive, chemical, and energy storage markets. The major drivers for this market are increasing demand of Vanadium in automobile industry, growing governmental efforts to find green energy alternatives, as well as, increasing knowledge of vanadium’s potential as a replacement in the production of other high-performance items.

On April 29, Energy Storage News reported:

California: ‘Energy storage revolution is here,’ says governor as US leader state surpasses 10GW. California now has more than 10GW of battery storage, with Governor Gavin Newsom hailing the state’s “energy storage revolution,” which is underway…“In just five years, California has increased its battery storage capacity more than tenfold.

On April 29, Oilprice.com reported:

Battery storage is the No. 1 energy investment playground…Battery storage was the fastest-growing energy technology in the power sector in 2023, with deployment more than doubling year-on-year, the International Energy Agency (IEA) has revealed. Strong growth was recorded for utility-scale battery projects, mini-grids, solar home systems and behind-the-meter batteries, adding a total of 42 GW of battery storage capacity globally…

Note: The IEA stated in its 2024 report:

“To facilitate the rapid deployment of new solar PV and wind power that is necessary to triple renewables, global energy storage capacity must increase sixfold to 1 500 GW by 2030.”

Note: Most of the battery stationary energy storage mentioned above was with lithium-ion batteries; however, VRFB’s are gaining in popularity, especially in China.

Vanadium miner news

Vanadium producers

Glencore [LSX:GLEN] [HK:805] (OTCPK:GLCNF)

Glencore is a large vanadium producer, but vanadium production represents only a small portion of their revenue.

No vanadium news for the month.

AMG Critical Materials N.V. [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

AMG Vanadium is a leading provider of products and services for the metals, manufacturing, refinery and petrochemical industries. AMG Vanadium produces ferrovanadium and related ferroalloys from spent refinery catalysts using a proprietary pyrometallurgical process. In January 2023, AMG announced plans to build a Vanadium Electrolyte plant in Germany, with production expected to start at the end of 2023.

On April 15, AMG Critical Materials N.V. announced:

AMG Critical Materials N.V. completes issuance of $100 million incremental term loan…AMG Critical Materials N.V. (“AMG”, EURONEXT AMSTERDAM: “AMG”) is pleased to announce that it has entered into a new $100 million incremental term loan, structured as a fungible add-on to the existing $350 million senior secured term loan. The $100 million incremental term loan has the same pricing, terms and 2028 maturity as the existing $350 million term loan. AMG will use the proceeds of the new incremental term loan for general corporate purposes and lithium resource development…

Bushveld Minerals Limited [LN-AIM:BMN] (OTC:BSHVF)

Bushveld is a diversified AIM-listed resources company with a portfolio of vanadium, tin and coal assets in Southern Africa and Madagascar.

On April 23, Bushveld Minerals Limited announced: “Vametco 2023 Mineral Resources and Reserves annual update.” Highlights include:

- “The total Ore Reserves have increased by approximately 10 per cent from the previous Ore Reserve estimate as at 31 December 2022. The Ore Reserves are reported as at the 31 December 2023 at 293,400 tonnes V2O5 in magnetite at a grade of 2.00 per cent V2O5 (in magnetite)…”

On April 23, Bushveld Minerals Limited announced: “Q1 2024 operational & corporate update.” Highlights include:

Q1 2024

- “Q1 2024 production of 855 mtV (Q1 2023: 943 mtV)…

- Q1 2024 weighted average production cash cost1 (C1) of US$28.4/kgV (Q1 2023: US$25.9)…”

Corporate

Update on Sale of a 50% interest in Vanchem and 64% interest in Mokopane to SPR

- “Following the announcement on 20 November 2023, regarding the sale of a 50% interest in the Vanchem vanadium processing plant for US$21.3 million and the sale of a 64% interest in a subsidiary that owns the Mokopane Vanadium project for US$3.7 million, the Company hereby announces that approval from the South African Competition Tribunal, initially anticipated for February 2024, is now expected to be granted at the earliest in July 2024. Following this, the sale of Vanchem and Mokopane will complete.”

Working capital position

- “Due to the delay in receiving funds from Acacia and SPR, production has been materially adversely affected in the current quarter, particularly at Vametco. Coupled with notably weaker vanadium prices (declining between 10 and 17% year to date across different markets), the Company’s working capital position is extremely tight. With the completion of the sale of 50% of Vanchem and its share of Mokopane to SPR being delayed, the Company is dependent on receipt of further funding to continue operations and is working with its stakeholders in this regard. The Group’s cash balance as at 21 April 2024 was US$2.22 million, should further funding not be secured in the coming weeks, the Company may have to suspend operations.”

Largo Inc. [TSX:LGO] [GR:LR81] (LGORF)(NASDAQ:LGO)

Largo Inc. is a pure-play vanadium pentoxide producer from their Maracás Menchen mine in Brazil as well as a producer of VRFBs.

No news for the month.

Energy Fuels Inc. [TSX:EFR] (UUUU)

Energy Fuels state they are “the No. 1 uranium producer in the U.S. with a market-leading portfolio,” as well as being a small vanadium producer.

No vanadium news for the month.

Ferro-Alloy Resources [LON:FAR]

FAR is developing the giant Balasausqandiq vanadium deposit in Kyzylordinskaya Oblast of southern Kazakhstan. FAR state: “The ore at this site has a significantly higher grade than all other primary vanadium extraction sites, which allows for much lower processing costs.”

On April 26, Ferro-Alloy Resources announced:

Q1 2024 production results increased Q1 production year on year… Commenting on the production results, Nick Bridgen, CEO of Ferro-Alloy Resources said: “The first quarter of the year always produces challenging winter weather, but we are pleased to see a solid increase on the same quarter last year despite more severe weather. We are hopeful that we will be able to build on the success of this quarter throughout the rest of the year.”

Western Uranium & Vanadium Corp. (OTCQX:WSTRF)

Western Uranium & Vanadium Corp. own the Sunday Mine Complex which is an advanced stage mine property consisting of five interconnected underground mines in Colorado, USA.

No vanadium news for the month.

Vanadium developers

Neometals [ASX:NMT] (OTCPK:RDRUY, OTCPK:RRSSF)

Neometals 100% own the Barrambie Titanium Vanadium Iron Project in Western Australia. Barrambie’s Eastern Band is one of the highest grade hard rock titanium deposits globally.

On April 24, Neometals announced: “Quarterly activities report for the quarter ended 31 March 2024.” Highlights include:

Corporate

- “Cash balance of A$14 million, investments, receivables and inventories of A$17.3 million and no debt.”

Pre-Commercial Technologies

Vanadium Recovery (100% NMT via Avanti Materials Ltd)

- “Advanced discussions with potential licensees of the technology following decision not to construct Vanadium Recovery Project in Finland. Vanadium price remains down ~50% year-on-year.”

Upstream Mineral Projects

Barrambie Titanium and Vanadium (“Barrambie”) (100% NMT)

- “Tenement maintenance activities in parallel with preparations for asset divestment.”

Australian Vanadium [ASX:AVL] [GR:JT71] (OTCQB:ATVVF) – merger with Technology Metals Australia completed in early 2024

Australian Vanadium is an emerging vanadium producer focused on their Australian Vanadium Project in Western Australia. VSUN Energy was launched by AVL in 2016 to target the energy storage market for vanadium redox flow batteries [VRFBs].

No significant news for the month.

VanadiumCorp Resource Inc. [TSXV:VRB][GR:NWN] (OTCPK:VRBFF)

VanadiumCorp Resource Inc. 100% owns the Lac Dore Vanadium-Iron-Titanium project in Quebec Canada. The Company is looking to take a vertically integrated approach and is also developing leading process technologies ‘VanadiumCorp-Electrochem Processing Technology’ and “Electrochem globally patented Electrowinning” technology.

On March 27, VanadiumCorp Resource Inc. announced:

VanadiumCorp contracts metallurgical testing on Lac Doré bulk samples… Paul McGuigan, P. Geo., CEO of the Company, stated: “VanadiumCorp recognizes recent advances in the technology of Direct Reduced Iron [DRI] and Electric Arc Furnaces (EAF). Our top priority is to produce vanadium electrolytes from a decarbonized supply chain. Anticipated advances in hydrogen production promise a suitable, carbon-free reductant in the DRI process. Contingent on properly priced hydrogen supply, we will aim to process titanomagnetite with DR-EAF, yielding high-quality pig iron and EAF-slags. Historical tests of our VEPT process successfully demonstrated high recoveries of vanadium from EAF slags of a European producer of pig iron. This optional route effectively combines a known decarbonized pyrometallurgical process with a finish using VEPT hydrometallurgy.”

On April 24, VanadiumCorp Resource Inc. announced:

Production has commenced from VanadiumCorp’s First Electrolyte Plant. VanadiumCorp Resource Inc. (TSX-V: VRB) (FSE: NWNA) (OTC: VRBFF) (“VanadiumCorp” or the “Company) announces production has commenced from VanadiumCorp Plant No. 1, after four weeks of process optimization and commissioning. With the initial production of electrolytes, VanadiumCorp is on track to produce up to 350,000 litres annually, sufficient to store some 6.8 MWh of electrical energy in VFB installations annually.

Tivan Limited [ASX:TVN] (formerly TNG Ltd [ASX:TNG](OTCPK:TNGZF)

Tivan Limited is an Australian resources company focused on the evaluation and development of its Mount Peake Vanadium-Titanium-Iron project. The Mount Peake Project is located 235km north-northwest of Alice Springs in the Northern Territory of Australia. Tivan Limited is well advanced with a massive $4.7b NPV8%, but relies on titanium and iron with a lower grade vanadium by-product. Tivian 100% owns the Speewah Mining Pty Ltd (from King River Resources Limited [ASX:KRR]) the owner of the Speewah Vanadium-Titanium-Iron Project in WA.

No vanadium related news for the month.

Vanadium Resources Limited [ASX:VR8] [GR:TR3]

Vanadium Resources is a junior exploration company established with the purpose of exploring and developing gold zinc, lead, copper and other mineral opportunities. Vanadium Resources owns 86.49% of a globally significant vanadium project, the Steelpoortdrift [SPD] Project, in Gauteng Province, South Africa.

On April 11, Vanadium Resources Limited announced: “Off-take MOU with large vanadium nitride producer.” Highlights include:

- “VANADIUM RESOURCES LIMITED (ASX: VR8; DAX: TR3) (“VR8” or the “Company”) enters into a Memorandum of Understanding (“MOU”) with Panjin Hexiang New Materials Technology Co., Ltd. (“Hexiang”).

- Hexiang is one of China’s largest vanadium nitride producers.

- The MOU envisions the purchase of 4,000 tonnes per annum of vanadium pentoxide (V2O5) for an initial 5-year term with an option to extend for a further 5 years.

- The MOU represents approximately 37% of VR8’s planned V2O5 production in Phase 1.

- This MOU underlines the continued demand for vanadium products in the mainland China market.

- VR8 is concurrently in discussions for further offtake MOUs and agreements with Chinese, Japanese, Korean and European end-users and traders for the balance of its planned production in Phase 1 of approximately 7,000 tonnes per annum.”

On April 29, Vanadium Resources Limited announced: “Quarterly activities report – March 2024.” Highlights include:

- “Significant offtake interest received from Chinese, Japanese, Korean and European end-users and traders and the Company is in discussions with several groups around offtake MOUs and agreements.

- FEED workstreams continued with a focus on re-design of parts of the plant, Capex re-assessments, preparation of overall site plans, engineering documentation and technical specifications for tender packages on an EPC basis for each part of the project.

- Environmental Authorisation granted for the Tweefontein SRL site, Social and Labour Plan feedback received from DMRE, remaining environmental and water applications progressing through approval processes.

- Project readiness workstreams progressed with fencing work commenced at Steelpoortdrift, completion of Rope Conveyor PFS, ESKOM application advances, interface risk assessments and investigations into complete power solutions.”

Richmond Vanadium Technology [ASX:RVT] (“RVT”)

RVT now owns 100% of the Richmond Vanadium Project. It has a global Mineral Resource of

1.8Bt @ 0.36% Vanadium Pentoxide (V2O5).

On April 24, Richmond Vanadium Technology announced: “Quarterly activities report for the Period Ending 31st, March 2024.” Highlights include:

- “Following a detailed review of initial results from all work programs and the current vanadium market, the Company extended the timeframe to complete the Bankable Feasibility Study [BFS] for the Richmond – Julia Creek Vanadium Project by 6 months to the June Quarter 2025.

- Forecast timing of work programs for 2024 – 2025 has been completed and includes further infill drilling, mineralogical and geological modelling, starting with a drilling program within the Rothbury Mineral Resource area.

- Work on the Environmental Impact Statement [EIS] continued, led by Epic Environmental Pty Ltd.

- Regulatory approvals and a final investment decision for the Project are expected in the September Quarter 2025.

- RVT continues to progress its ESG journey, including those focus areas outlined in the Company’s 2023 Annual Report.”

Phenom Resources Corp. [TSXV:PHNM] (OTCQX:PHNMF) (formerly First Vanadium Corp.)

The Carlin Gold-Vanadium Property hosts one of North America’s largest, richest primary vanadium deposits, located in Nevada. Its West Jerome project targets a large-scale high-grade copper and zinc deposit in Arizona. Carlin has a Historic Inferred Resource of 28Mt at 0.525% V2O5 (2010 SRK).

No news for the month.

QEM Limited [ASX:QEM]

QEM Limited owns the Julia Creek Vanadium and Oil Shale Project in North Western Queensland, Australia.

On March 26, QEM Limited announced: “Completion of sale of Julia Creek Renewables Project to… Green Power Australia Pty Ltd (EGPA)EGPA…”

On April 4, QEM Limited announced: “Vanadium pentoxide 99.93% purity recovered from industrial waste.” Highlights include:

- “The University of Queensland (UQ) successfully completes Circular Economy project for QEM, extracting high purity (99.93%) vanadium pentoxide (V2O5) from Queensland industrial waste.

- UQ confirms a technically viable method of recycling spent catalyst to produce high-purity V2O5, the essential component of the electrolyte used in vanadium flow batteries.

- The encouraging results lay foundations for optimization and pilot-scale work.”

On April 9, QEM Limited announced: “QEM fully repays unsecured loan facility.”

On April 30, QEM Limited announced:

Quarterly update for the period ending 31 March 2024. 2024 Resource Estimate shows 28% increase in Indicated vanadium Resource to 461Mt and 2,406Mt in the Inferred category JORC (2012)…Improved vanadium beneficiation techniques identified by The University of Queensland Sustainable Minerals Institute…First vanadium produced in Australia from industrial waste…QEM’s flagship Julia Creek Project (JCP) is one of the world’s single largest vanadium and oil shale deposits.

Graphite miners with potential vanadium projects

- Syrah Resources [ASX:SYR] (OTCPK:SYAAF, OTC:SRHYY)

- NextSource Materials [TSX:NEXT]

- DNI Metals [TSXV:DNI] [GR:DG7N] (OTC:DMNKF)

Other listed vanadium juniors

- BlackRock Metals (Private)

- Blue Sky Uranium [TSXV:BSK] (OTCQB:BKUCF)

- Critical Minerals Group [ASX:CMG]

- Currie Rose Resources Inc. [TSXV:CUI]

- Gladiator Resources [ASX:GLA]

- Golden Deeps [ASX:GED]

- Intermin Resources [ASX:IRC]

- Manuka Resources [ASX:MKR]

- Maxtech Ventures [CSE:MVT]

- Moab Minerals [ASX:MOM]

- Nevada Mining Vanadium Corp. [TSX:ELEF] (OTC:SILEF)

- New Energy Minerals [ASX: NXE]

- Pursuit Minerals [ASX:PUR]

- Sabre Resources [ASX:SBR]

- Santa Fe Minerals [ASX:SFM]

- Strategic Resources [TSXV:SR] (OTCPK:SCCFF)

- Surefire Resources [ASX:SRN]

- Trigon Metals Inc. [TSXV:TM] (OTC:PNTZF)

- UVRE [ASX:UVA]

- Venus Metals [ASX:VMC]

- Victory Metals [TSXV:VMX]

- Viking Mines [ASX:VKA]

VRFB companies

- Protean Energy [ASX:POW] [GR:SHE1]

- Enerox GmbH (90% Bushveld/10% Cellcube Energy Storage Systems)

- Invinity Energy Systems (LSE:IES) (IVVGF, OTCQX:IESVF)

Conclusion

April saw vanadium pentoxide prices and ferrovanadium prices were slightly lower.

Highlights for the month include:

- Vanadium batteries rival lithium-ion… There are currently over 200 VRFB projects in multiple countries.

- ResearchAndMarkets: The global vanadium market is expected to reach an estimated $3.9 billion by 2030 with a CAGR of 5.2% from 2024 to 2030.

- IEA report: Battery storage was the fastest-growing energy technology in the power sector in 2023, with deployment more than doubling YoY.

- AMG Critical Materials N.V. completes issuance of $100 million incremental term loan.

- Bushveld Minerals working capital position is extremely tight, the Company is dependent on receipt of further funding to continue operations.

- VanadiumCorp Resource production has commenced from the first Electrolyte Plant.

- Vanadium Resources announces off-take MOU with large vanadium nitride producer for 4,000 tpa of vanadium pentoxide (V2O5).

- QEM Limited announced vanadium pentoxide 99.93% purity recovered from industrial waste.

As usual, all comments are welcome.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

![Europe & China Vanadium Pentoxide [V2O5] Flake 98% one year price chart](https://static.seekingalpha.com/uploads/2024/4/29/37628986-1714443541133117.png)

![Europe and China Ferrovanadium [FeV] 80% one year price chart](https://static.seekingalpha.com/uploads/2024/4/29/37628986-17144436477753477.png)