carlosgaw

Introduction

Flowers Foods (NYSE:FLO) is a company that specializes in baking and marketing packaged bakery foods in the United States. Over the years, the company has seen low growth on the topline as one of the dominant players within its industry. More recently, the company’s margins have proved to be an issue as Flowers Foods has had to invest back into the business. With these investments, EBITDA margins have suffered, and the company has been unable to generate meaningful margin expansion. Given guidance for FY’24, I’m skeptical on management’s ability to reach these targets and don’t find the valuation compelling enough for me to buy shares.

Company Overview

Flowers Foods is a producer of packaged bakery food products selling fresh breads, buns, rolls, snack items, bagels, and tortillas. It is the owner of several different brands, which include Nature’s Own, Dave’s Killer Bread, Wonder, Canyon Bakehouse, Mrs. Freshley’s, and the Tastykake brand names.

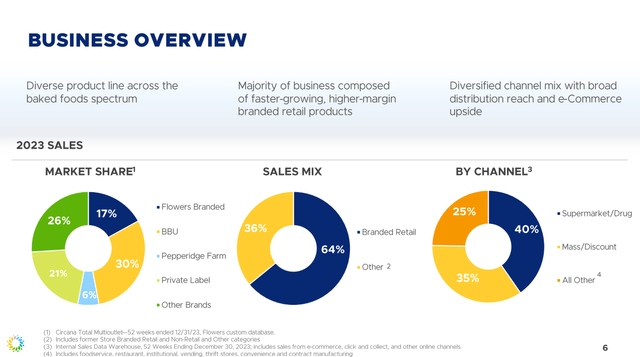

With a 17% market share in the United States, the company sells its products through supermarkets, drugstores, restaurants, discount stores, wholesale distributors, convenience stores, and more. About 64% of sales is branded retail. Founded over a hundred years ago in Thomasville, Georgia, the company does over $5 billion in annual sales and employs 9300 people.

Background

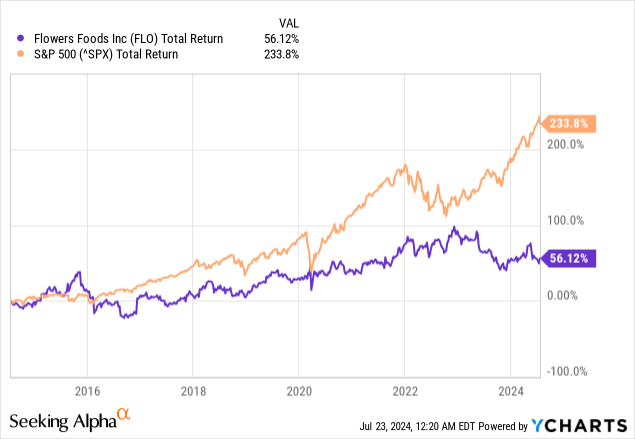

An investment in Flowers Foods has been an underperformer over the years. Comparing it against the S&P 500 which has returned 234% including dividends over the last decade, shares of Flowers Foods have only returned 56%, barely good enough for a 5% return.

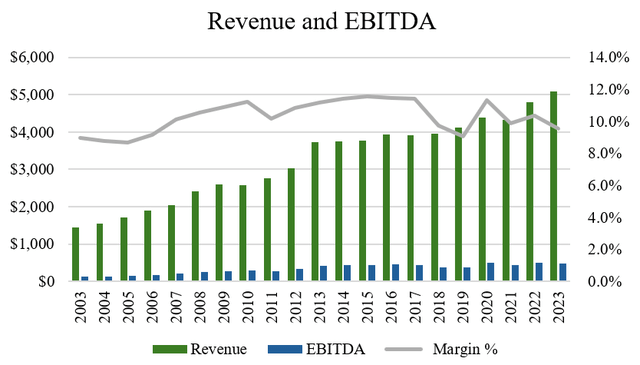

This underperformance relative to the market can be displayed through the company’s mediocre financial performance. For example, over the last decade, Flowers Foods has grown its revenue and EBITDA at CAGRs of 3.2% and 1.5%, respectively. More recently, in the last five years, the company’s revenue and EBITDA CAGRs are 5.2% and 4.8%, respectively (Source: S&P Capital IQ). With top-line growth barely above GDP growth and EBITDA margins unable to grow through margin expansion, Flowers Foods has been losing market share and has a lack of pricing power.

Author, based on data from S&P Capital IQ

Recent Results

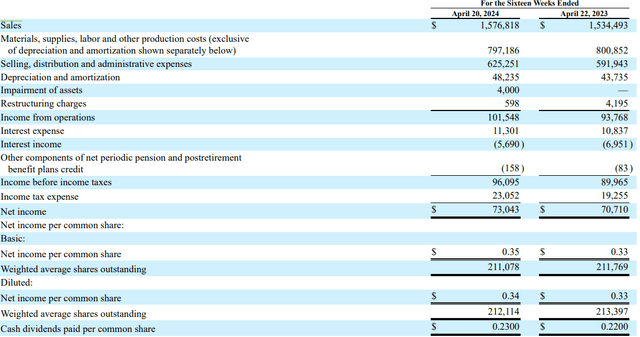

When looking at the latest results for Flowers Foods stock, the company reported revenue of $1.58 billion, which was up 2.8% year over year and came in line with analyst expectations. EPS clocked in at $0.38 missing estimates by 3 cents.

The market reaction to the news wasn’t the best; shares of Flowers Foods fell close to 5% the following date after the company’s Q1’24 results were released, mostly related to higher costs this quarter. In some ways, the market was already pricing in an optimistic quarter, with shares up 10% in the month prior to the results.

On the positive side, branded retail volumes finished positive, up 0.3% and branded organic growth of 2.9% similarly came in ahead. Moreover, gross margins of 47.8% were up 160bps year over year. However, EPS came in at only $0.38 versus street expectations of $0.41, despite a one-cent tailwind from lower interest expense/taxes, as higher SD&A (the result of stranded overheads, increased labor, and higher technology expenses) drove a -7.5% miss on operating income.

Looking ahead, management reiterated its full-year guidance of $5.091-$5.172 billion in sales, EPS of $1.20-$1.30, and adjusted EBITDA of $524-$553 million. This outlook assumes ongoing volume improvement, allowances for macro uncertainty, and potential negative impacts on consumer behavior and promotional activity. It also assumes expanded cost savings initiatives ($40-50 million savings vs. $30-40 million prior), with upside weighted to the back half of the year and greater-than-anticipated benefits from new business wins (also in the second half of the year).

In my view, the higher cost savings and new business wins should facilitate ongoing (if sequentially dissipating) gross margin expansion through the year, as well as reduced deleverage on fixed and stranded overheads. Still, my issue is that the upper end of the company’s EPS range looks increasingly ambitious given the starting-point cost trajectory established in Q1’24. It’s also noteworthy to mention that the company raised its projected capital expenditures to a range of $145-$155 million (up from $120-$130 million) driven by the supply chain optimization initiative (Source: S&P Capital IQ).

Given this, I see risk heading into the result of the year, noting that guidance isn’t likely to surprise on the upside. Rather, it should actually be quite difficult to even come on the low end of guidance, mainly on higher projected SD&A expenses. That said, I do see a few positives. For example, the company is starting to see good branded momentum with DKB and Canyon, has upcoming innovation launches, and has welcome reinvestments behind future technology and supply chain productivity.

But are these enough? In my view, there are risks to the investment thesis that I believe will put pressure on margins in the short to medium term. This includes a potentially weakening demand backdrop, higher operating costs (labor and technology), execution risks associated with the company’s ERP implementation and employment model transition, and capital allocation risks associated with prospective M&A. From a balance sheet perspective, the company has a Debt to EBITDA ratio of 2.2x, so there is some leverage embedded within the business (Source: S&P Capital IQ).

Remember, this is a low-growth, highly competitive business that has a 17% market share in the U.S. Over time, margins have declined as a result of branded products representing a larger share of revenues for Flowers Foods. In addition, industry-wide pressures coming from the macroeconomic environment have meant that the company has needed to invest not to grow margins, but rather just to maintain them. As such, I think Flowers Foods faces considerable headwinds, and it will no doubt take time for many of these investments and initiatives to be implemented and for them to pay off down the line.

Valuation and Wrap Up

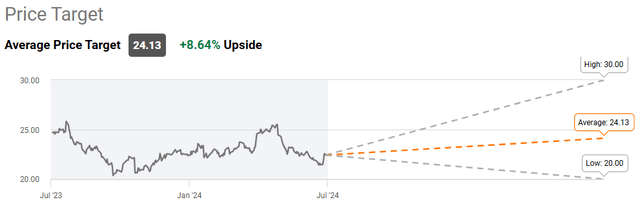

There are currently 8 sell-side analysts who cover Flowers Foods stock. One analyst has a ‘buy’ rating, one has a ‘sell’ rating, and the remaining six have ‘hold’ ratings. Collectively, the average price target is $24.13 with a high target of $30.00 and a low target of $20.00. From the current price to the average price target one year out, this implies about 8.6% upside, not including the current dividend of 4.3%.

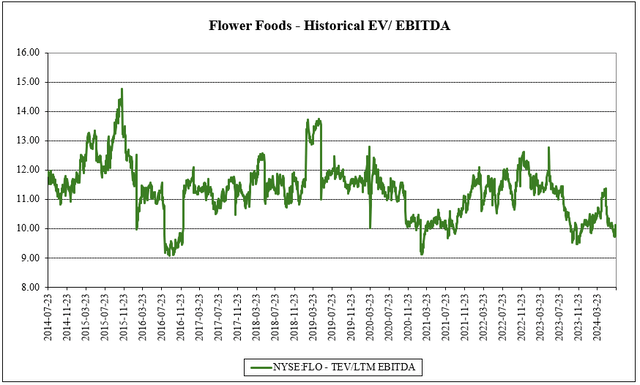

When looking at the valuation for Flowers Foods, the company has historically traded within a range of 9.1x and 14.8x EV/EBITDA (Source: S&P Capital IQ). At the current multiple of 10.0x EV/EBITDA, the company is trading at a 1-turn discount to its historical ten-year average multiple of 11.3x.

Author, based on data from S&P Capital IQ

Given that the sell-side only foresees 1.3% annual revenue growth and 4.2% EPS growth between 2024-2026, I think the discount to the historical multiple is warranted (Source: S&P Capital IQ). Recall that Flowers Foods revenue CAGRs are 3.2% and 5.2% for the last ten and five years, respectively. So given that these are above the 1.3% top-line growth for the next few years, there’s an expectation that Flowers Foods won’t grow as fast in the future.

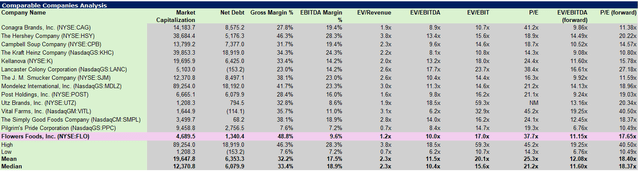

Comparing the company against its peers, Flowers Foods stands out as one of the cheaper companies in the group. These companies CAGRs as a group have higher expected growth over the next few years, so for the same reason as above, I’m willing to assign a lower multiple in a comps analysis when valuing Flowers Foods against other companies in the consumer staples space.

Author, based on data from S&P Capital IQ

Overall, Flowers Foods is a business unlikely to be disrupted given their dominance in the market. But that doesn’t necessarily mean they’ll outperform. While the company’s investments have the potential to payoff, I believe operational challenges and weakness in the broader macroeconomic environment remain headwinds for the company. Given the limited upside for EBITDA margin expansion, I have a cautious outlook on the company. So while the valuation may look attractive relative to its historical multiple as well as its peer group, I think the company deserves to trade at a lower multiple for now. As such, I rate the company’s shares as a ‘hold’.