courtneyk

Investment Thesis

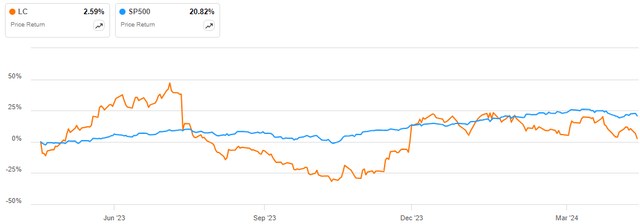

LendingClub Corporation (NYSE:LC) stock has gained about 2.59% over the last year underperforming the S&P 500 by a margin of about 18.23%.

Despite the relatively underwhelming performance, I am bullish on this stock in the long-term particularly due to its transformed business model which embodies several competitive advantages which I believe positions this company for sustainable long-term growth. Further, the company’s strong capital and liquidity position bodes well for its future growth which adds to my bullish stance. Given this background and considering that the stock is undervalued, I recommend this stock to potential investors at its current valuation.

Company Overview

This company stands as a major digital marketplace bank in the US and it offers a wide range of financial services and products aimed at helping its consumers to save on borrowing costs and earn more when saving. By utilizing more than $75 billion in loans and over 150 billion data points, its sophisticated credit decisioning and machine-learning models are used throughout the customer lifecycle to broaden access to credit for members while delivering attractive risk-adjusted returns for loan investors.

The company is very innovative and has solutions that deliver enhanced value and superior experience to its customers as will be discussed later in this analysis. LC transformed its business model from a peer-to-peer lending platform to a full-spectrum fintech marketplace bank which is part of its innovation.

Based on this brief overview, the company’s transformation of its business model is an indication of its forward-thinking approach that embraces digital transformation. Further, its emphasis on digitization such as data-driven decision-making and machine learning shows that the company is not only adapting to the modern financial landscape but also shaping it. In summary, its profile portrays a dynamic and progressive company with a clear vision for the future of banking something I believe positions this company for long-term growth which aligns with my bullish outlook on this stock.

New Business Model Harbors Competitive Advantages For Long-term Growth

Over time, LC has undergone a series of business model transformations ranging from expansion and diversification to peer-to-peer lending platforms. In this section, I will focus on its most recent transformation which I have been observing since it occurred to date. This company went through a significant business model transformation particularly when it acquired Radius Bank in February 2020. Since then, I have been keeping a close eye on this transformation, and in this section, I will discuss how transformative this move has been and why I believe it is a long-term growth lever.

The strategic move marked the transition from a peer-to-peer lending platform to a digital marketplace bank. This move entailed the integration of various lending businesses such as personal, auto refinance, etc. onto a single origination platform that focuses on membership acquisition. Following this model transformation, I find the new model with several benefits which I believe will serve as long-term growth levers. In this article, I will focus on two major competitive advantages arising from this transformation which add to regulatory benefits arising from the deal such as regulatory clarity, operational autonomy, and reduced dependency on their parties for loan origination.

The first one is the diversification of offerings. Following its transition to a digital marketplace bank, LC diversified its product range to several services such as personal loans, and debt consolidation, among other services. This diversity sets the company apart from peer-to-peer lending platforms that offer a narrow range of products. Most importantly, the diverse product offerings have been integrated into one originating platform which implies that LC is a one-stopover for several financial needs which ensures convenience for its customers hence improving customer satisfaction.

Secondly is technology and innovation. LC’s new model leverages advanced credit decision making and machine learning models which are aided by about 150 billion data points and about $75 billion in loans. The vast data enables the company to offer seamless access to credit while ensuring compelling risk-adjusted returns for loan investors. The technology also allows for dynamic pricing and same-day settlement of fully funded whole loans thereby reducing friction in the settlement process and enabling faster deployment of capital. In simple terms, the company is more efficient and effective with its technological innovations. I could discuss more on technology including the company’s expansion of investor’s access to personal loans through its LCX link but for this article, I will use the above example as a representative of the technological advancement in place. However, before I conclude on innovation, I will cement the company’s innovation with its innovative product offering. I will give an example of Embedded Finance Solutions. This innovation is part of a broader initiative to expand its service and offer new avenues for growth. It entails the development of financial wellness tools such as debt monitoring solutions currently being tested by select members. The innovation is aimed at providing members with improved customer experience.

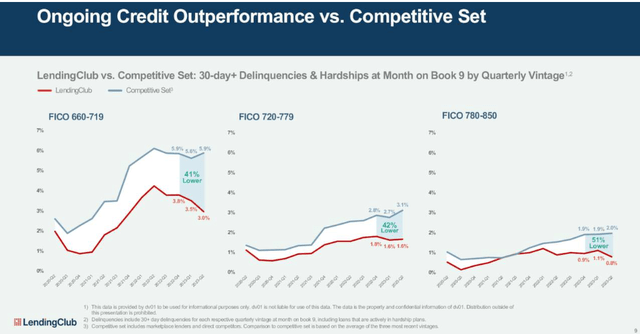

So, how is this competitive advantage? The company’s competitive advantage stems from its unique position as a digital marketplace bank which combines technology, innovation, and efficiency of a Fintech. These abilities enable LC to offer a range of products and services that are competitive with both traditional banks and other fintech companies. The new business model has seen the company build a tangible book value by approximately 2X and grow its deposits by almost 4X while delivering consistent credit outperformance.

In my view, the strong financial foundation coupled with ongoing innovations within diverse offerings positions this company to leverage significant opportunities in the financial market and build long-term shareholder value, which lends credence to my bullish stance.

As a conclusion, I believe it would make more sense to highlight some milestones the new model has helped achieve and this would support my assertion that the new model is a long-term growth lever. While the model was focused on customer acquisition, the company has grown its members from about 3.9 million in Q4 2021 to about 4.9 million in Q1 2024, marking a growth of about 25.64%. In addition, the company’s loan origination has grown from about $70 billion in Q4 2021 to about $90 billion in Q1 2024, while the company has improved its NPS from 78 in Q2 2023 to 80 in Q1 2024. From this background, it is apparent that under the new business model, the company customer base and loan origination are improving something which alludes to a growth story and given the company’s competitive advantages and overperforming credit above, it is reasonable to believe the future is bright for this company, hence my bullish outlook of this stock.

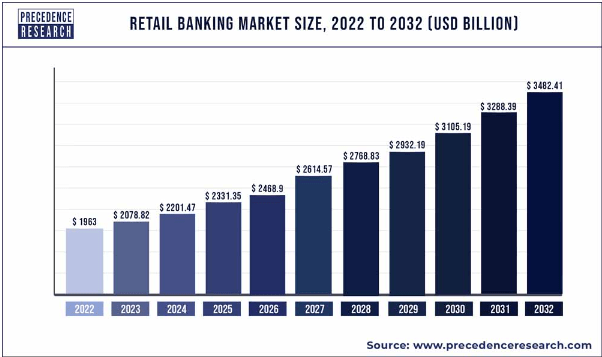

Most importantly, I find the new model to be very resilient due to two major aspects. First off is the recurring revenue which amounts to about 79%. Secondly is its stability of funding which entails lower cost deposits and diverse investor funding. The recurring revenue helps in maintaining a steady flow of income while the stable funding approach allows the company to tap into a wide pool of investors reducing reliance on any single source of funding. It should be noted that all these attributes are backed by a steady projected market growth which I believe this company will exploit better than competitors given its competitive advantages.

Precedence Research

Strong Capital And Liquidity Position

Another reason why I am optimistic about LC is its solid capital and liquidity position. To begin with, the company has a cash balance of about $1.25 billion which is about 12% of its total assets and covers its uninsured deposits by about 106%. This robust cash position shows that this company is financially stable and can cover its obligations without securing additional funding. Further, it speaks volumes about the company’s operational flexibility to invest in new projects and growth opportunities without relying on external funding, something that instills investor confidence.

More interestingly as per the Q1 2024 report dated April 30, 2024, $6.5 billion of the total $7.5 billion deposits were insured translating to 87% insured deposits compared to 56% average insured deposits for all FDIC-insured institutions as of Q4 2023. This adds a layer of security for deposits and it indicates the company’s strong and stable deposit base. In addition, the company has a solid capital buffer at 12.5% with consolidated tier 1 leverage. This figure suggests that the company is well-capitalized and has a cushion to absorb potential losses. Furthermore, LC has a borrowing capacity of $2.9 billion. This shows the company’s strong demand for its lending products and ability to raise funds when needed.

Given this background, LC has a strong financial footing which offers them flexibility to invest in growth opportunities. Its strong capital and liquidity positions signify that the company is well-equipped to navigate economic challenges, invest in growth opportunities, and manage risk effectively. These aspects paint a positive outlook on the company and are likely to be reflected in the bullish sentiments toward the stock translating to a high valuation.

MRQ Performance

LC reported its Q1 2024 performance on 30th April 2024. In my view, the performance was robust as indicated by the following highlights. The company reported a net income of 412.3 million which was significantly higher than the estimated $3.91 million. Its diluted EPS of $0.11 beats estimates by $0.08, while the total net revenue reached $180.7 million above the estimated $173.88 million. Notably, the company maintained a strong loan origination at $1.6 billion which signifies resilience against seasonal pressure.

Interestingly, the company’s Q2 guidance reflects its growth ambition with PPNR projected to be at $30-$40 million and loan origination projected to be between $1.6 billion and $1.8 billion. From these highlights, I have several takeaways. First off, the company was able to exceed expectations indicating the company’s operation efficiency and robust business model. Further, with positive net income, the company has demonstrated its ability to be profitable which a positive sign is for investors and stakeholders and hence investor confidence in the company. In addition, the consistency in loan origination is a sign of a growing customer base and trust in the company’s services amidst economic volatility. Most importantly, the company’s forward guidance reflects confidence for continued growth and profitability which I believe is possible given the projected market growth and the company’s competitive advantages.

In summary, the Q1 2024 performance is an indication that the company is not only performing well currently but also has a bright outlook which could potentially make it an attractive option for potential investors leading to higher demand for its shares hence higher valuation and therefore my bullish trajectory outlook.

Valuation

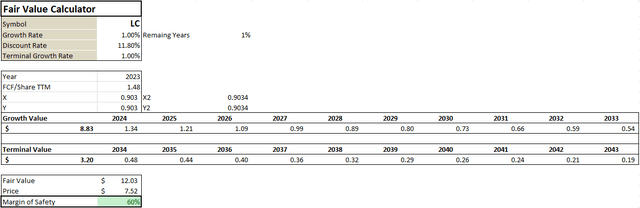

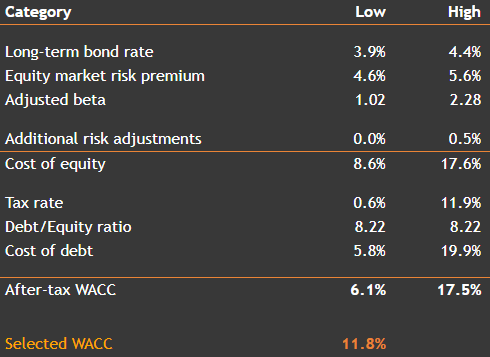

To value this stock, I used a DCF model with several assumptions. Firstly, I assumed a growth rate of 1% because the company’s 5-year unlevered free cash flow CAGR is negative. I used 1% because I expect the company to leverage its competitive advantages to leverage on the projected market growth thereby improving its cash flow generation. Secondly, I assumed a discount rate of 11.8% which is the company’s WACC as shown below.

Value Investing

Given these assumptions and using the trailing unlevered free cash flow of $1.48 billion as my base case, below is my model output.

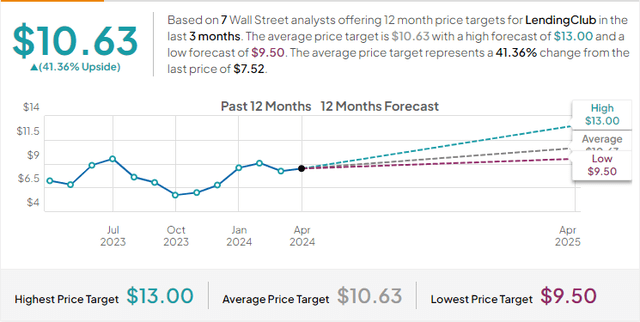

According to my model output, LC has a fair value of $12.03 which translates to an upside potential of about 60%. This implies that this stock is undervalued with a significant upside. My output is in line with other analysts according to tipsrank as shown below, lending credence to my undervaluation assertion.

Risks

Given that LC is 75.3% owned by institutions, one of the unique risks of investing here is the potential for a crowded trade scenario. This is a situation whereby multiple institutions own a stock and may compete in selling it quickly if the trade goes wrong which can result in significant share price volatility. For this reason, individual investors should be aware of such a risk before investing here.

Conclusion

In conclusion, LC is a good investment opportunity with long-term competitive advantages which I believe will act as growth levers amidst projected market growth. Further, the company has a solid capital and liquidity position which bodes well for its future growth. Given this background and its double-digit upside potential, I recommend the stock to potential investors.