Robert Way

Investment Thesis

I recommend buying Alibaba Group (NYSE:BABA) (OTCPK:BABAF) shares. China continues to be the leader in global e-commerce, and the Chinese company Alibaba is one of the main players in this market.

But despite its excellent margins, the valuation is extremely discounted. This is due to geopolitical risks, but in my opinion they are being overestimated given the company’s business and geographic diversification.

Introduction

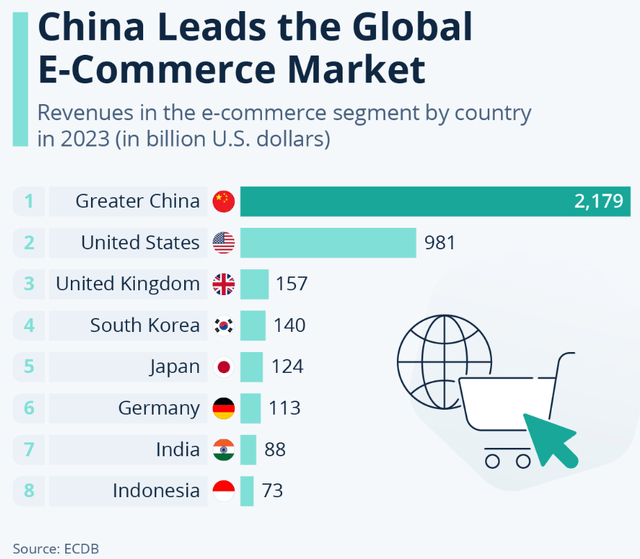

Projections indicate that the e-commerce market should reach $5.14 trillion by the end of 2024, and is expected to show a CAGR of 15% between 2019 and 2024. China remains the leader in this market, representing more than 50% of all e-commerce sales in the world.

The market is forecast to reach $3.3 trillion in 2025, with Alibaba being the pioneering and most relevant company in e-commerce to date, which supports my recommendation to buy. Let’s learn a little more about the history of Alibaba and its business model below.

History And Business Model

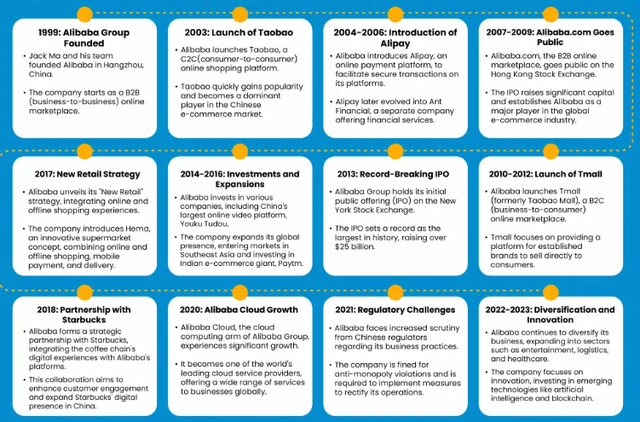

Alibaba was founded in 1999 by Jack Ma, and then I brought up the company’s timeline.

The business model is similar to that of Amazon (NASDAQ:AMZN), however, the company divides its business into several subsidiaries, as we will see below in the breakdown of its revenues.

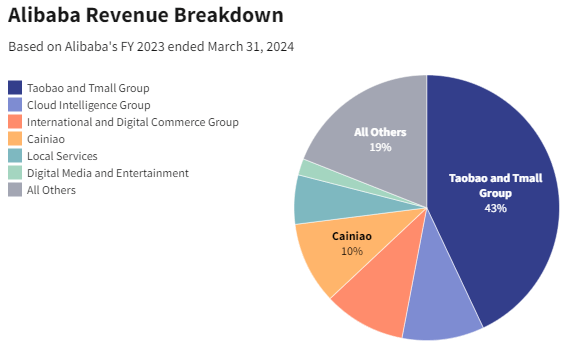

Alibaba Revenue Breakdown (Investopedia)

Let’s better understand each segment of the business:

Taobao and Tmall Group

Taobao is a platform whose business model is based on selling advertising. Sellers pay for advertisements to increase the visibility of their products. Tmall is B2C, that is, aimed at large brands, and monetizes by charging commissions per sale. These segments represent around 43% of the company’s revenue and have an operating margin of 46%.

Cloud Intelligence Group

Alibaba Cloud is the cloud computing segment, where the company offers data storage, big data, and AI solutions in a subscription-based compensation model. This segment corresponds to 10% of the company’s revenue and has an operating margin of 8.4%.

International and Digital Commerce Group

In this segment, we have AliExpress, Trendyol, Lazada and Alibaba. AliExpress is a B2C platform, that is, it allows consumers to buy products from local manufacturers, and the platform is remunerated with commissions, advertising, logistics and support. Alibaba is similar to AliExpress, but it is B2B.

Trendyol and Lazada represent the company’s international expansion. Lazada focuses on Southeast Asia, being one of the most relevant e-commerce in the region, while Trendyol has a greater focus on Turkey. The international segments represent 10% of revenue and have an operational margin of -11%.

Cainiao

Finally, among the most relevant businesses is Cainiao, which has 10% relevance to the company’s revenues and has an operating margin of 3.3%. This segment is responsible for storage, delivery, and transport services in more than 200 countries.

In my opinion, this diversification of businesses and geographies strengthens Alibaba’s business model, corroborating my purchase recommendation. However, I believe it is more viable to compare Alibaba with its global competitors, Amazon, MercadoLibre (NYSE:MELI) and Sea (NYSE:SE). Therefore, I will do a comparative analysis of the fundamentals of major global retailers below.

Alibaba Fundamentals

Below, we have a financial analysis of Alibaba against its competitors around the world.

| Ticker | BABA | AMZN | SE | MELI |

| Country | China | USA | Singapore | Argentina |

| Market Cap | $185B | $2T | $41B | $88B |

| Revenue | $30B | $143B | $3.7B | $4.3 |

| Revenue Growth 5 Years [CAGR] | 20% | 20% | 68% | 58% |

| EBITDA Margin | 19% | 16% | 4% | 18% |

| Net Income Margin | 8.5% | 6.3% | 0.3% | 7.2% |

| ROE | 6.3% | 20% | 0.8% | 41% |

Amazon and Alibaba have had equal revenue growth over the last 5 years; however, the magnitude of Amazon’s revenue is much greater, which shows that the American company has been dealing better with the “pains” of growth.

However, I highlight Alibaba’s extremely attractive level of EBITDA and net margin against its competitors. This shows that the company did not give up profitability to grow and corroborates my investment thesis. But is this in the price?

Valuation Is Extremely Attractive

To carry out the company’s valuation, I will use the comparative valuation method with P/E and PEG.

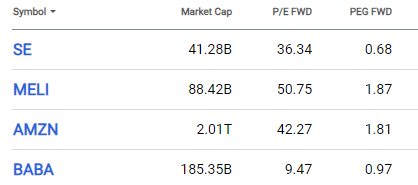

P/E and PEG (Seeking Alpha)

The company presents a relevant discount to peers in both P/E and PEG. The companies’ average P/E multiple is 38x, well above Alibaba. Therefore, we will base ourselves on the PEG, which considers the company’s growth.

In this case, we have an average of 1.33x PEG, which implies a sensible upside potential of 37% for the shares, corroborating my recommendation to buy. Now, let’s see what Seeking Alpha’s Quant tools tell us.

Alibaba According To Quant Rating And Factor Grades

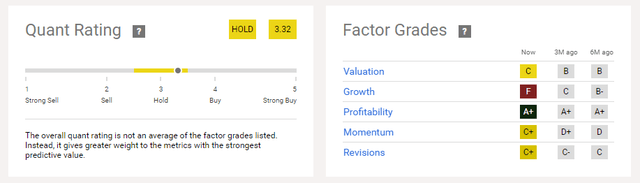

Below we have the grades, where the company earns an excellent grade only in profitability.

Quant Rating And Factor Grades (Seeking Alpha)

The Quant Rating recommendation is to hold the shares. This is due to the valuation grade, which I, personally, don’t agree with, as I showed in the chapter above. However, the terrible growth rating draws attention, and I will discuss this in depth in the risks chapter, but first let’s check what the company’s latest results have been like.

Latest Earnings Results

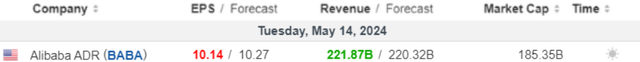

Alibaba released good results in 1Q24, even beating market revenue estimates, as we can see in the table below. Furthermore, Alibaba also repurchased $3.1 billion in common shares, another sign of how cheap the company’s shares are, corroborating my recommendation to buy the shares.

However, during the earnings conference call, when asked about the growth in customer management revenue, management advised analysts to be realistic with their projections due to the complex macroeconomic environment, and this brings me to the chapter on risks to the thesis.

The Big Risk For The Thesis

The big risk to the thesis is geopolitical issues that encompass the relationship between the United States, China, Taiwan and the upcoming presidential election.

It is important to remember that in his first term, Trump stated that he would honor the one-China policy, however what came after was a major Trade War with the Chinese.

In March 2018, tariffs were announced on Chinese imports worth $50 billion, and in July, the war intensified with new tariffs worth $34 billion, hitting Alibaba’s business hard.

In 2019, Trump increased tariffs from 10% to 25% on $200 billion in Chinese products, and what has happened to Alibaba’s share price since then?

We saw the price drop from $300 to less than $100 per share. Therefore, with Trump’s return in a scenario of even greater geopolitical instability than in his first term, there is a high chance of great volatility in stocks. Now, I will present other risks.

Other Potential Threats To The Bullish Thesis

Combined with the complex macroeconomic environment, even mentioned by the company’s management, competition is increasingly aggressive. The company faces competition from Pinduoduo, with a business model focused on group purchases, and Douyin, focused on content and e-commerce.

Although the Chinese market is gigantic, it is starting to mature. Therefore, the customer acquisition cost for Alibaba has increased over time, although it is still 17% lower than Pinduoduo.

Finally, there is a perception that Alibaba and its competitors’ products are of low quality, which makes it difficult to achieve greater penetration in markets with high purchasing power, such as America and Europe. The risks to the thesis are diverse, and investors should be cautious when analyzing the company.

The Bottom Line

Despite the possibility of Trump’s re-election, the company has taken several initiatives to diversify types of business and geographies, diversifying its business internationally and remaining competitive.

The company continues to be the leader in its market, and although China sees maturity in its market, this does not match the company’s attractive valuation and margins.

Based on this analysis, I recommend buying Alibaba shares. Current prices suggest a dire scenario for the company compared to its peers. In my view, it has a great risk-return ratio.