DKosig

In June, an energy presentation at the inaugural Seeking Alpha investing summit offered a platform on which to crystallize my investment theses. This work seems to never end, with new investment themes added in the last couple of years even. Of late, a broad sweep of energy has been a primary focus – oil and gas, but also energy infrastructure and new infrastructure such as advanced manufacturing and decarbonization plays. I’m looking at what’s happening across the board, both what’s changing and staying the same. Most importantly, to make the cut for a “market,” energy must be affordable, reliable, and cleaner. As the energy transition ebbs and flows, various forms of energy hit-and-miss the cut, which is becoming more obvious as the market learns.

Energy fundamentals

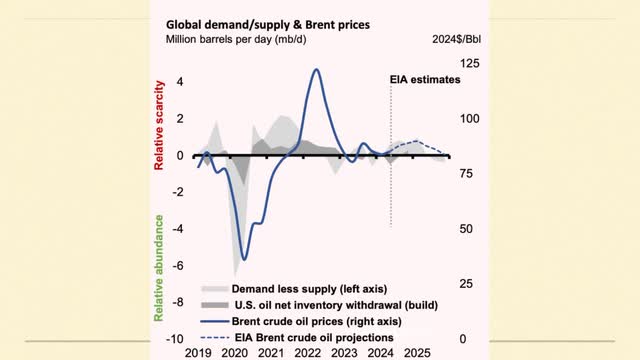

In discussions about global supply and demand fundamentals, a sustained tightness in the oil market is projected for some quarters ahead. This is instructive for pricing, given the apparent tailwinds in the macro environment. However, volatility in the form of the upcoming U.S. elections and geopolitical volatility exist. Conflicts in Russia-Ukraine and Iran-backed proxies in the Middle East, plus tensions that smolder in the South China Seas, continue.

Echoing the projections, according to a recent TXOGA chart, relative scarcity is observable, meaning more demand than supply. Supply is projected to be tight in light of their analysis as well. Some analytical outfits and agencies do not wish to express this likelihood; it’s not popular or populist. The U.S. is achieving record oil production, but record global demand is also expected for 2025.

Oil market supply-demand fundamentals (TXOGA)

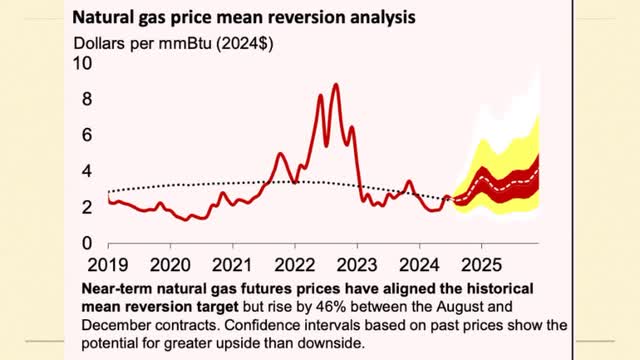

Natural gas futures prices are forecast to rise, a 46% rise between August to December futures contracts. It’s partly because of demand, but also because of natural gas producers throttling back some to be profitable, unable to produce at really, really low prices. Natural gas weighted firms such as Chesapeake (CHK), EQT (EQT) and others made that call last year.

Natural gas futures (TXOGA)

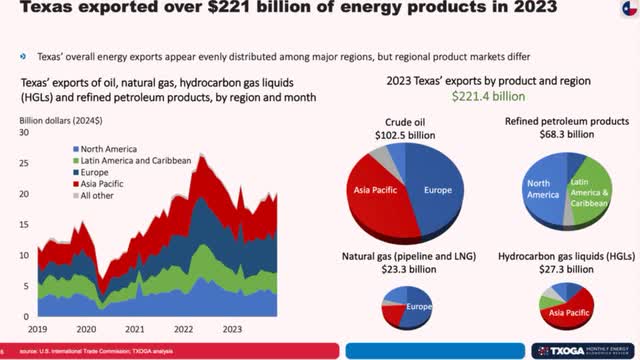

Texas hydrocarbon exports were $221 billion in 2023. Interestingly, in crude oil, the lion’s share of exports by dollar amount was split fairly between Asia and Europe. In natural gas pipeline and LNG exports, it’s a big Europe story, with some Asia. This can shift around, as we have seen between 2022 and 2023, which is instructive as to the whole export market from the United States point of view. Bottom line: It’s all on an uptrend, which speaks to global demand.

Texas hydrocarbon exports (TXOGA)

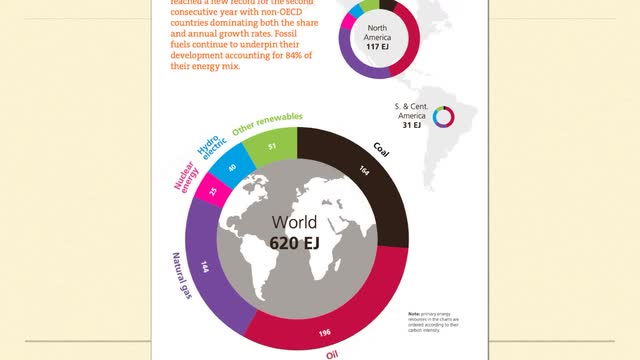

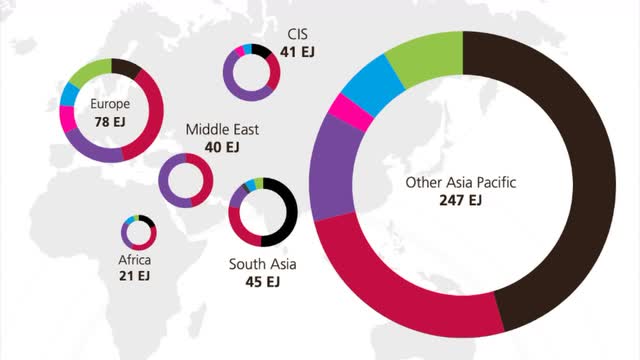

Zooming out globally, from the Energy Institute’s 2024 Statistical Review, formerly published by BP, it suggests that the energy transition, though evolving, is still largely a fossil fuel-driven world. In developing countries, the fossil fuel primary mix is 84%. The needle is moving however in renewables in advanced economies, and Central and South America comprised about 30% of the growth in 2023, the analysis window. The other interesting story is grid-scale batteries and China — which owns 50% of the 55.7 gigawatt market.

World energy use 2023 (Energy Institute)

A few other notable 2023 data points from the analysis are:

- LNG supply grew nearly 2% (10 bcm) to 549 bcm. The US overtook Qatar as the world’s largest exporter of LNG.

- China was the world’s largest LNG importing country, followed by Japan and South Korea, accounting for around 45% of global LNG trade.

- The Asia Pacific region saw an increase in oil consumption of over 5% to 38 million barrels per day.

- Solar and wind capacity grew rapidly, beating the previous year’s record of 276 GW by around 186 GW, a 67% increase.

- Solar accounted for 75% (346 GW) of the capacity additions, with China responsible for around a quarter of the growth.

- Prices for key metals and materials fell by around 26%: Cobalt (-47%), lithium carbonate (-32%); copper and natural graphite fell by 4% and 15%, respectively.

(These charts and others are discussed in the video: Global Energy Walkabout: Energy, Infrastructure and All That Jazz)

Global primary energy use (Energy Institute)

(Source: Energy Institute, Statistical Review of World Energy, 2024)

Another conclusion, in the United States and Europe, renewables growth is surrounded by volatility and politicization given the upcoming U.S. elections and past European ones. Though I’ve documented the politicized nature of the renewables versus fossil fuel debate, in consideration of investment outcomes, this is a first time to consider its volatility. More on that later.

New industrial

Related to other new industrial- and energy transition-themed investments, a recent Nasdaq index performance update pointed to several notable indices as below:

• Global AI and big data was a top performer. (NYGBIG)

• US large cap (NQUSL) then followed.

• Semiconductors (SOXQ) were strong.

• Cybersecurity (NQCYBR) has reasonable growth

• Copper (COPJ) and uranium (URNJ) junior miners had reasonable and interesting growth, but volatility and definitely more a long play.

As analyzed in the past, the reshoring and infrastructure thematic, which translates partly into the semiconductor ecosystem, is our latest and newest infrastructure buildout. This includes Samsung (OTCPK:SSNLF), Texas Instruments (TXN), Intel (INTC) and a diversified batch of players as in various ETFs. Importantly, U.S. energy infrastructure, the midstream sector, supports this new advanced manufacturing, with producers and infrastructure developers like Energy Transfer (ET), Williams (WMB), and Enterprise Products (EPD) playing a role.

Regardless of political outcomes, the U.S. plays in a global market for energy and technology. It’s not only policy that drives these developments. The semiconductor ecosystem, AI to a degree, and advanced manufacturing developments are catalyzed by policies post pandemic. However, the established energy market is demanding U.S. hydrocarbons, as the aforementioned numbers attest. On the energy front, oil and gas producers, and specifically first noted by ex-CEO Sheffield of Pioneer Natural Resources in 2021, are trying to smooth booms and busts by the shareholder policies they have adopted since the pandemic. In this November article, I discuss the dynamics at play and how the first waves of consolidation were occurring. Shareholders shunned the volatility they could de-risk.

The macro environment and secular trends associated with energy and related new and incumbent infrastructure have tailwinds. In my investment set, the implications suggest favoring major oil and gas producers and watching for emerging strong independents post M&A activities. The main risks on the immediate horizon are the policy risks that create uncertainty in business and geopolitics. It’s really our opportunity to lose — or gain. Investors will have to look longer and beyond the headlines for now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.