Justin Paget

Dear subscribers,

It was about 4 months back that I updated my thesis on the shareholding in the Portuguese company, Energias de Portugal (OTCPK:EDPFY). At the time, the company was a 4.5%-yielding attractive utility with a good yield, and a solid investment in what I believe to be a chaotic overall market. The company has a lot of good fundamentals and a lot of upside as well – at the same time that it cannot really be called expensive by any measure. While the company has dropped since my last article, this doesn’t faze me (and the fact that it does not should not surprise you fif you follow my work).

The company was founded over 40 years ago as Electricidade de Portugal by the Portuguese government. What the government did was to merge 14 former national energy companies. The company then went through another very comprehensive restructuring in the mid-90s, which also included progressive privatization of the business, which is what has been happening over the past few decades.

The company has the unique appeal of having a very solid institutional shareholding with large players with skin in the game. 45% of the company is owned by a mix of Blackrock, a Chinese consortium known as the China Three Gorges Corporation, and Qatar. A few years ago, China tried to make a hostile takeover – but this was rejected, and a repeat of this attempt is as I see it, quite unlikely.

In this article, I’ll update EDP as of the 1Q24 and show you why I may invest more here.

Energias De Portugal – Why it is above average – and quite clearly

Whenever I look at a company and consider where to “place” it in terms of its performance, I try to pick the best of the best (first of all). I do this by looking at the sector, and where the company’s performance falls on a sector comparison. The fact that the company scores a 33%+ gross margin and a net margin of over 5-6% in a very pressured segment – utilities – shows us that it’s an above-average company.

Also, the company is a renewables leader and has been for quite some time. Already back in 2006, the company’s generation was 35% renewables, which was well ahead of any other utility in Europe that wasn’t pure-play renewables.

So you’re investing one of the few companies that was “renewable” early. And while the name itself implies that it’s a Portuguese utility, it’s actually a very global player with a wide appeal.

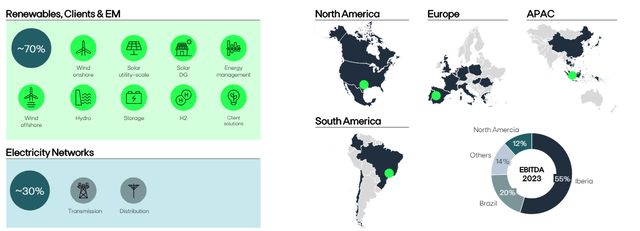

As you can see, with 70% renewables and 30% networks, this company is one of the cleanest businesses around. The company now has an installed capacity of 24 GW, up 2 GW since my last piece, and comes in an at an overall EBITDA of €5B per year, with a net profit of €1.3B. 13,000 employees and 9M clients make this company of the more attractive utilities that I own, and its assets are balanced with 40% inrgeated generation/supply, 35% networks, and 25% EDP renewables.

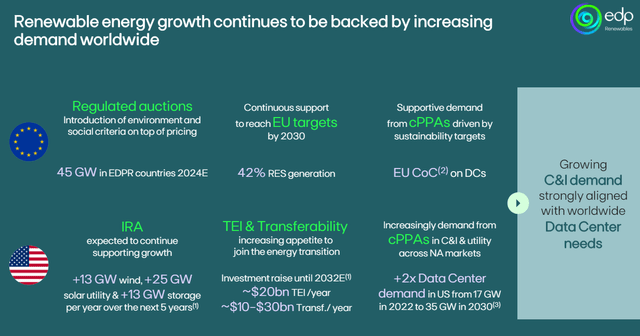

The company expects to add, at this point, 3GW of gross renewable additions every year for the next 2 years, with €17B of gross investments in that time, and expects 23 GW of wind and solar capacity by 2026.

The company expects to be coal-free by -25, all green by -30, and net zero by -40. These goals are goals I believe will be very achievable for this company.

This has lead to the company having a BBB credit rating, less than 20% FFO/net debt, and 80%+ of its EBITDA from high-rated markets, meaning EU and NA.

The challenges presented to the company and what the company needs to do going forward is to handle a significant downward trend in electricity pricing in Europe – this has been general since the end of 2023. But this should have been expected by all utilities and above all analysts, so I am not at all surprised by this. It’s a 30% decline in OMIE FW prices since 2023 November, which means that EDP estimates a forward price of roughly €58/MWh.

The company is hedged at Baseload volume hedges of 50% at €60 Mwh, and 80% at €90/Mwh for 2024. Another way to express this is unless prices increase until 2026, earnings are expected to flatline – as in, not grow much. It’s especially tricky for a company that’s CapEx heavy and with modes of generation that are relatively expensive, like the construction of some ESG-friendly generation (not to mention the load balancing during off-hours for things like solar and wind).

However, the fundamentals of the company remain very solid. The company has a strong balance sheet and good on-paper returns with a good capital allocation strategy. The company is also targeting rotation of assets, targeting over €7B in proceeds, with plans for Hydro Brazil and other of the company’s portfolio portions.

This leaves the company with a net investment amount of €9B between 2024-2026E. And this is now fully funded with BBB debt ratios – which is what I consider so compelling here. The company’s liquidity at over €9B is supported by an available revolver of €7B, which completely covers refinancing needs until 2027E and beyond. Almost 80% of the company’s debt is at fixed rates.

The company remains on track for complete coal-freedom in 2025, with significant steps this year already. The generation mix is vastly changed from 2005, when 60% of the generation was coal. At 2024, it’s less than 1%.

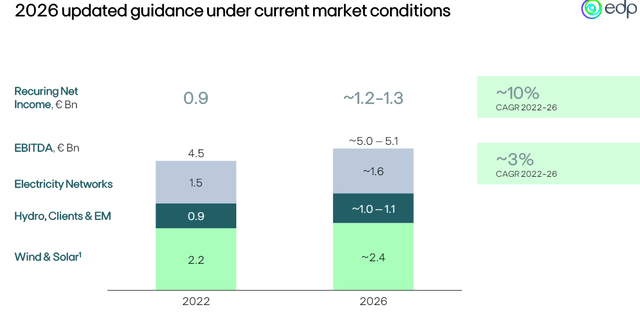

Here are the updated financial targets and guidance for 2026E.

The company also has updated its dividend policy and targets, including a floor of €0.2/share by 2026E, which turns the implied yield here to somewhere like 5%+, which no matter where you are, is something I wold consider attractive. The targeted payout ratio for the company remains at around 60-70%. I wouldn’t expect this to rise here – you should expect the company dividend to remain at current levels or projected levels, and this is part of the stability that EDP has been able to provide investors for going on 10 years, making this nearly bond-like in its safety.

The company has the ability to generate a baseline EBITDA of around €1.4B on a quarterly basis, which makes this an impressive player in the field – even if I do not believe it to be a player that actually will increase its dividend massively.

However, it nonetheless remains a very active player at the right price.

And what that right price is, that’s what we’ll look at when it come to valuation of the company.

Energias de Portugal – The company’s appeal is undeniable at the right sort of price

The company’s native ticker is on the somewhat difficult-to-trade Lisabon market. Even I with my EU access do not have perfect circumstances here, and only about 90% of withholding is recovered hassle-free. This influences how much of the company I typically “BUY” and I always compare it to what other alternatives are available.

However, it’s undeniable to me that the following statements are true:

1. The market is not taking into consideration the company’s increased earnings potential and appeal, despite the relative clarity in forecasts.

2. The company is a good player in a stable field and unlikely to encounter fundamental issues in the near term.

3. The dividend yield is actually quite attractive here.

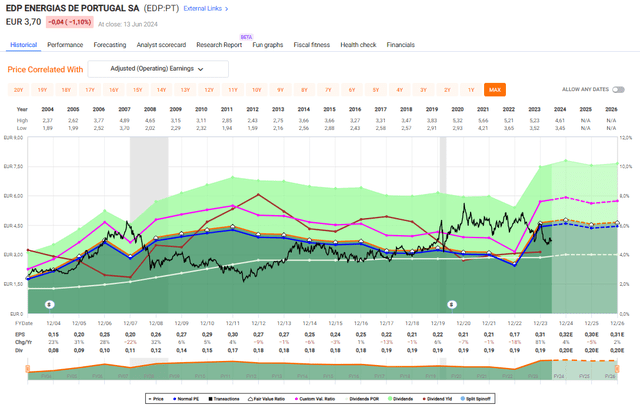

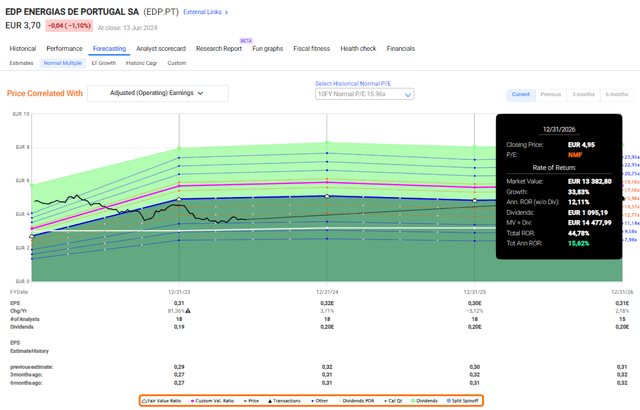

F.A.S.T Graphs EDP Valuation (F.A.S.T Graphs EDP Valuation)

EDP trades at 11.8x with a dividend yield of 5.27% for this year, around 5.4% for the 2026E period, but as you can see is unlikely to offer much of the way of EPS growth. However, when the company trades at a normalized P/E of closer to 9-10x, the company does not need to provide growth to be attractive – the income and value potential of the assets at this price is enough to compel me to continue to call this a “BUY” here.

Will this company make you rich? No, it’ll, if anything, make you richer. If you already have a fair amount of capital, then I would argue that your investment is safely invested in this company, and able to provide you with a good yield and a good upside.

Even if you forecast the company only at a 10-year discount of 15x P/E, compared to the 20x P/E 20-year average, you’re still getting a 15% annualized upside here.

F.A.S.T graphs EDP Upside (F.A.S.T graphs EDP Upside)

Furthermore, I actually believe that the company given its far-evolved generation mix could easily command far higher premia than this. It’s on par with NextEra (NEE) or other renewable-heavy companies – and thus I view the discounting of this company as mostly non-valid. The earnings trends are a bit worrying – any decline is never good. But it seems to me that this is likely to be mostly due in 2025 when the company hedges fall off and the company has to adjust to “new” income realities. This is not a bad thing – it’s a normalization. And a reversal to the mean is never a negative if we understand it and can act on it.

I act on it in the way that I “BUY” more EDP – now and forward. I considered lowering my PT only slightly to account for the changes in hedging and forecast declines – and decided to lower it to €5/share.

That still leaves an upside to around 15-16x P/E normalized at around €5/share with a 15.6% annualized potential CAGR, inclusive of that 5%+ yield.

Because this is income from electricity, I also view this as extremely conservative as an investment. While the market is a bit in turmoil as I am writing this piece, we’re seeing some very attractive prices for yield generators – EDP is one, and Orange (ORAN) is another.

None of these companies are bad – the market is taking a cue from the current temporary political instability – and I am reacting in kind, adding shares in companies I consider to be good.

Questions?

Otherwise, here is my updated thesis for EDP.

Thesis

-

EDP is a fundamentally attractive integrated utility, and the largest renewable utility play in all of Europe, in terms of percentage of renewable assets. This makes the company, with a solid credit rating, a 4.5%+ yield that’s well covered and set to grow to around 5%, a very solid income play for someone looking for a solid 5% with the potential for a double-digit annual CAGR with capital appreciation.

-

I view EDP as an attractive “BUY” at anything below €5.2/share, and the company currently trades well below this, at €4.12. That is why I as of today have started buying the company shares.

- I have been expanding my position in the company since my first article. I maintain my rating for the price target here, and I also rate the company as I have rated it prior to this article. The company comes in at a PT of €5.2/share, and with a “BUY” rating here.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

-

This company is overall qualitative.

-

This company is fundamentally safe/conservative & well-run.

-

This company pays a well-covered dividend.

-

This company is currently cheap.

-

This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

The company fulfills every single one of my investment criteria at this time, and constitutes a “BUY” from me as a rating as of June of 2024.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.