LagartoFilm

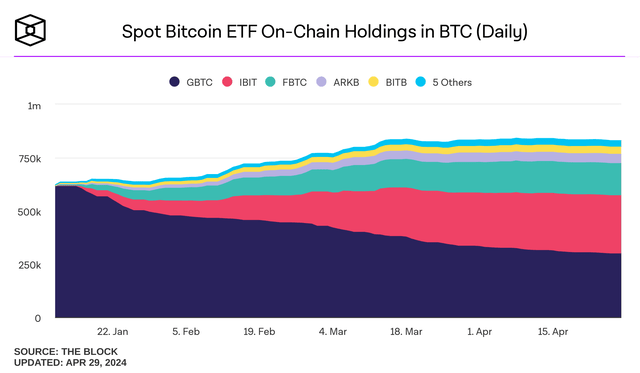

We’re now three months since the approval of spot Bitcoin (BTC-USD) ETFs in the United States market. I don’t think it’s a stretch to say these funds have been an enormous success from an AUM growth standpoint. Even after adjusting for the asset exodus from the Grayscale Bitcoin Trust ETF (GBTC), more than 214k BTC in positive net flow has come into these products in three and a half months. That BTC has a nominal value of over $13.1 billion as of article submission.

Spot ETF Holdings (The Block)

Despite all of the success, more recently the funds have endured a little bit of BTC net outflow from a handful of the spot ETFs as the market digests the halving and various other developments that could have an impact on Bitcoin’s demand.

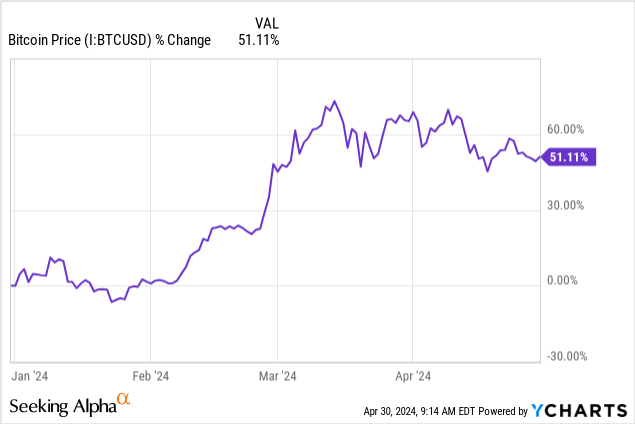

As speculators are seemingly taking off some risk following a tremendous start to the year from a price appreciation standpoint, I think it’s a good time to re-examine some of the important network metrics for Bitcoin and, as a byproduct of those metrics, the bull case for the Fidelity Wise Origin Bitcoin Fund (BATS:FBTC).

Major Catalysts in The Rearview

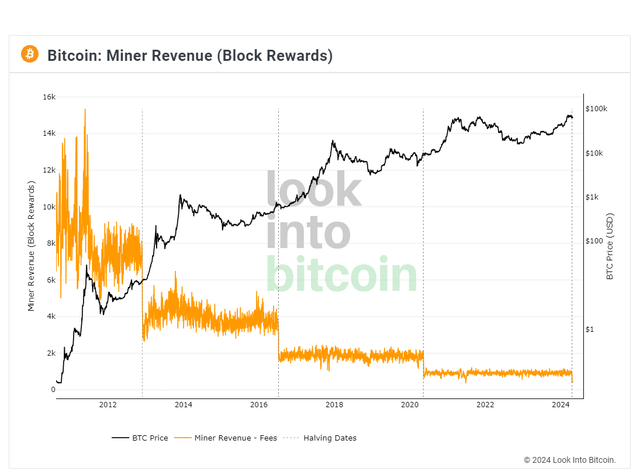

Of course, the approval of spot ETFs was an important catalyst for soaking up investment capital demand. The other side of the supply/demand relationship has also been impacted this year through Bitcoin’s block reward halving on April 20th. It’s been well-covered at this point, but to quickly summarize; Bitcoin was designed to only ever have 21 million coins. For validating transactions, miners have generally been paid through new coin issuance from that 21 million fixed supply – this is known as the “block reward subsidy.” Every four years Bitcoin’s block reward subsidy is cut in half.

Bitcoin Miner Rewards (Look Into Bitcoin)

Historically, Bitcoin’s price increases to new all-time highs 12-18 months following a halving event due to diminishing supply while demand for BTC has generally risen through a price mania that ensues. The argument could certainly be made that much of Bitcoin’s post-halving price run already happened due in part to the approval of the spot ETFs. I’m personally not in the camp that the cycle highs have been made. However, I am in the camp that the cycle high will likely disappoint those looking for $400k-$500k BTC prices next year.

The Case Against Self-Custody

As a digital asset, BTC is designed to not require custodians or intermediaries. Spawning from cypherpunk ethos, self-custody is actually the entire point of Bitcoin. But as the years have gone on, the intended utility of BTC has morphed from peer to peer currency to “digital gold” that should be “HODL’d” rather than spent. We can certainly debate if this change in direction has been beneficial for long term adoption or not, but it’s the reality of the situation and the tradeoffs that come with custody versus self-custody play into decisions about Bitcoin that we make as individual investors and speculators.

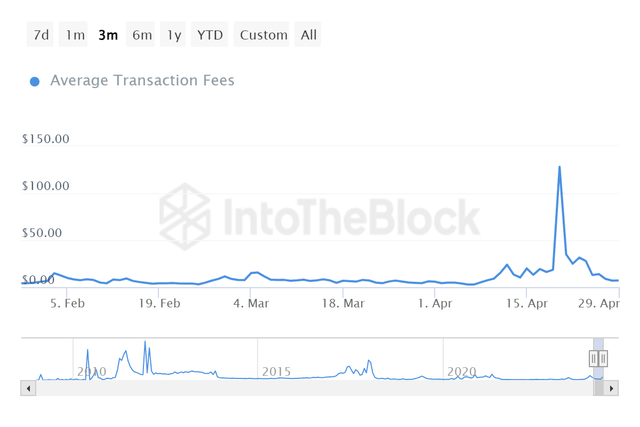

Consider that utilizing custodians has long been viewed as the risky way to own Bitcoin. “Not your keys, not your coins” being the mantra in recent cycles to show that blowups at centralized companies like Celsius (CEL-USD), FTX (FTT-USD), and Voyager (VGX-USD) aren’t indicative of Bitcoin’s failure but rather a failure of human decision making. I want to be clear about this; I am still of the view that BTC should be self-custodied if the individual holder has the means to do so. But we must acknowledge that if Bitcoin’s base layer isn’t going to scale for wider usage, average transaction fees will indeed rise when fees become the primary incentive mechanism for Bitcoin miners as the block reward continues to decline. This will have a long term impact on the viability of self-custody if truly decentralized scaling networks don’t (or can’t) reach a critical mass.

We’re already seeing what can happen with transaction fees during times of high network demand:

Bitcoin Average Transaction Fees (IntoTheBlock)

On April 20th, the average transaction fee to move BTC on the network was over $128 – up almost 600% from the prior day. This enormous spike was due to the launch of the Runes protocol on Bitcoin. The hype around that project has since subsided. Still, for the entire week following the launch of Runes, the average transaction fee was larger than $22. We didn’t see a single-day average transaction fee price under $10 until April 27th. And for some added context, the average fee between April 1st and April 19th was about $10.60.

All of this matters because moving BTC in and out of self-custody requires paying these fees. A $10 transaction fee is totally fine for larger value transactions. But for the majority of people to justify holding BTC in self-custody, these fees are high.

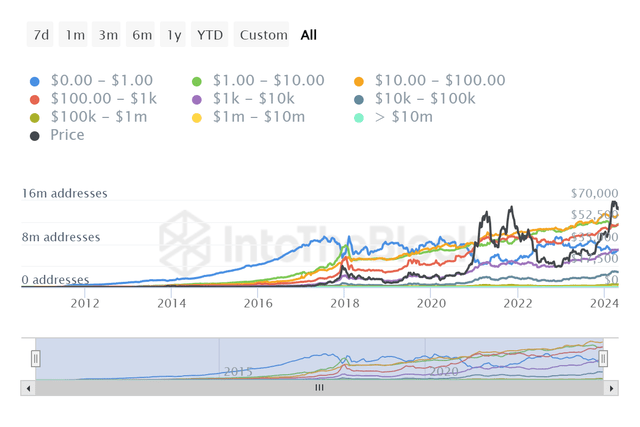

Bitcoin Address Value Cohorts (IntoTheBlock)

At $10 average fees, nearly 19 million of the 54+ million non-zero Bitcoin wallet addresses are paralyzed. At $100 average fees, nearly 60% of on-chain wallet addresses can’t move funds. This is serious risk and shows why the ETF option might actually make more sense for smaller-value HODLing.

Consider a speculator who wants to buy $5,000 in BTC. Doing so through an exchange will require an upfront fee and then an additional fee to take custody. If we use $10 as an our base case for average transaction fees and 25 bps as our base case for annual ETF expense, it takes five years to make self-custody more cost-effective than simply buying the ETF:

| Investor-Absorbed Fees | Self-Custody | FBTC |

|---|---|---|

| Coinbase (COIN) fee | $50.0 | – |

| Network fee | $10.0 | – |

| 1 yr Custody Charge | – | $12.5 |

| Total | $60.0 | $12.5 |

Source: Analyst estimates

Then if the self-custody holder wants to sell, they’re going to pay these fees again. The cherry on top of all of this is the FBTC allocation can easily be held in a tax advantaged account like a Roth IRA and pay no capital gains taxes on asset appreciation.

Reiterating My FBTC Buy Call

Though I like a couple of the other funds as well, I maintain that FBTC is my personal preference for Bitcoin ETF exposure. The fee waiver for FBTC is still live currently though that waiver will expire at the end of July. Following that waiver, the fund’s expense ratio will be 0.25%. This is not the cheapest expense ratio of the spot BTC ETFs. However, it is certainly still competitive and I suspect Fidelity’s fee may ultimately become the cheapest over time because it has a critical advantage over almost every other spot ETF manager – it doesn’t rely on Coinbase to custody the asset. This is what I said back in January:

While I have almost no concern about Coinbase from a blockchain competency standpoint, using Coinbase for custody does add an additional element of potential risk simply by nature of it being a third party. Again, I don’t view this as a significant risk, but I do think it gives Fidelity a long term edge since custody is being done in-house through a subsidiary business. Even though fees have become a bit of a race to the bottom for these ETFs, at a certain point that added layer for these other ETFs may ultimately require a larger cost to the investor.

My thinking goes like this; as more retail investors and/or speculators buy BTC through ETFs rather than directly through company’s like Coinbase, Coinbase will need to replace lost revenue from its retail exchange business. I suspect the company will look to raise custody fees on the asset managers who are relying on Coinbase for the purchase and storage of the BTC held in the ETFs. Since Fidelity is essentially self-storing, the risk of fee hikes down the line is likely lower compared to other ETF providers.

Closing Summary

There are big tradeoffs in going long BTC via ETFs like FBTC that are important to consider as well. The investor is at the mercy of market hours and can’t necessarily sell when they want to if an exit is desired during the weekend or during a weekday evening. Additionally, FBTC holders aren’t ultimately in control of the BTC represented by their shares. But there is no perfect solution to Bitcoin exposure in 2024, in my opinion. As I’ve illustrated, self-custody clearly has risks, particularly for smaller value holders, and it’s not difficult to see how it can be far more expensive to HODL on-chain. Given my belief that miners will require transaction fees to incentivize long-term network security and the possible tax-advantages of buying FBTC in a Roth account, I think FBTC is a solid option for long-term Bitcoin exposure.