Memorystockphoto

Dear readers/followers,

In this article, I’m going to be updating on and taking a closer look at the future potential of Fresenius Medical Care (OTCPK:FMCQF) (NYSE:FMS). The company has seen a bit of recovery in the share price, only to then crater and drop once again. There’s considerable volatility in the recent trends – even if the latest results reflect a confirmed organic growth thesis, successful execution of the turnaround plan, and better-expected earnings.

The company continues to chug along at relatively average rates of profitability – but there is upward potential here.

And as you all know, especially if you follow me, it’s what you pay for a company that matters. The best company won’t matter for your portfolio, if you overpay for that company, because you then enter the risk of underperformance relative to the market.

Reminding you, Fresenius Medical Care is a company that I’ve been covering for years, and investing in for years – but not in the standard way that most seem to be investing.

For certain parts of my position, I’m actually at a very impressive overall RoR. That is not the case for the entirety of my current position in Fresenius – and as before, my investment into the company is done using the larger Fresenius company, not the Fresenius Medical Care Arm. There have also been some changes that have changed the correlation of these two businesses.

Let’s see the upside following 1Q24, and updating for the first time since last year for this ticker. My last article can be found here.

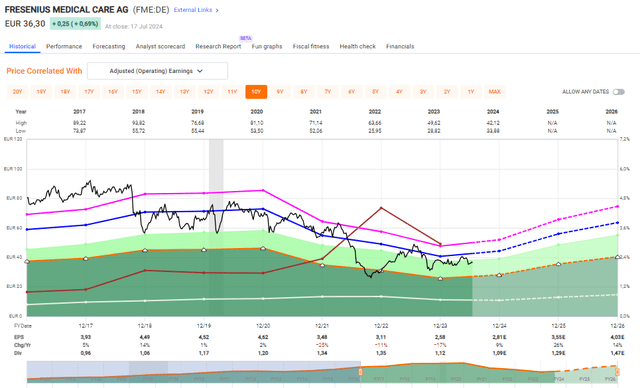

Fresenius medical care – there has been undervaluation for over 3 years

That Fresenius medical care is undervalued is not something that you need to follow me to determine or to understand – the company has been clearly determined by many analysts to be this for over 4 years (Source: Paywalled F.A.S.T Graphs link).

The company is an original spin-off from Fresenius, that treats end-stage renal disease patients. They do this using a dialysis clinic network across the nation/s, medical technology, and care coordination activities. This has allowed the company to manage a global leading position in the market.

The company was heavily COVID-19 impacted in trends, but the overall analyst expectation is that the company would see bottom- and top-line improvements based on demand in already-developed markets such as the USA, and growth from emerging markets such as China.

Why?

Because the global trend for so-called ESRD (end-stage renal disease) is a large market, that’s currently forecasted to grow at least at low to mid-single digits annually in the long run. The company would, however, need to get past inflationary and other challenges to manage this.

Fresenius Medical Care and Fresenius are fairly special companies in terms of investment goals. By following me, you also have a right and a responsibility to know and to understand what my goals are and what I invest in – such as this company. My goal for Fresenius Medical Care has never been to 10-20x my investment capital in a short time – instead, I’m looking for slow appreciation and dividends. This approach has, for me and over the past few years, averaged 15-25% per year for the past few years, and it’s more than enough for me (even above my expectations).

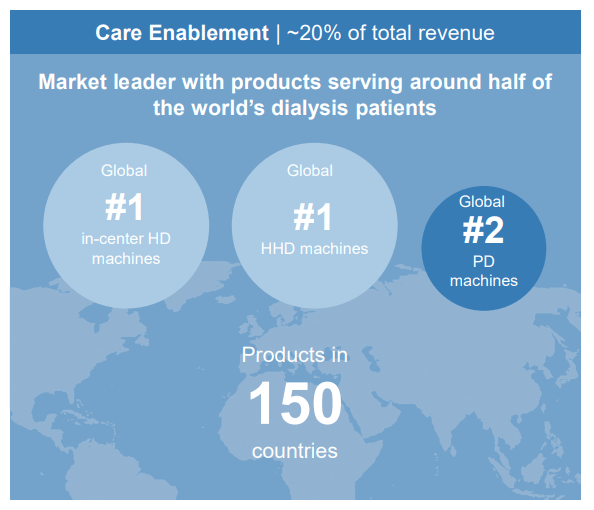

Knowing this, 1Q24 was a good quarter. Fresenius manages 80% of total revenue through its care delivery arm, with now over 325,000 patients sent to 3,900 centers across the globe.

It remains a market leader and has the top position in most relevant fields for its care enablement segment as well.

Fresenius Medical Care IR (Fresenius Medical Care IR)

Despite headwinds, I believe that the future of the business is very much intact. It’s a song as “old as time” now, but the company is seeing advantage of a growing aging population, growing to 1.2B people over 65 from a current number of 750M, with a 40% growth in Diabetes in that time, as well as incidents of hypertension of dialysis. Currently over 3.7M people are on dialysis, with 7M expected in the next 15 years – meaning that the number is expected to almost double.

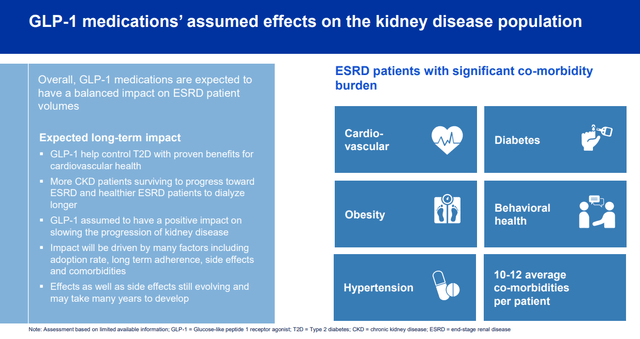

There’s a big argument currently being made with regard to GLP-1 medications and their assumed effects – but Fresenius has their own assumptions, and none of them are negative toward the ESRD patient volumes.

Fresenius Medical Care IR (Fresenius Medical Care IR)

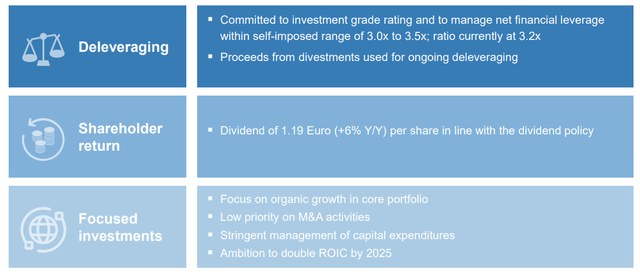

The proof is in the pudding, as they say. The company has exceeded its financial outlook for 2023/2024 and is now raising the company’s outlook based on performance. The company is also delivering savings – and is expanding the savings target to over €650M by next year, with more than half of that already delivered by the end of 2023. In 1Q, the company delivered an additional €52M in savings. These savings are coming from the G&A, CE, and CD of the company.

The company has also come a great deal of distance in terms of delivering according to current targets.

Fresenius Medical Care IR (Fresenius Medical Care IR)

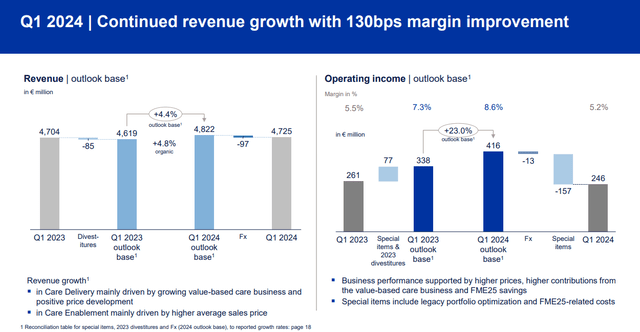

Solid revenue growth for the company came in at 4% for both segments, with operating income improving in both segments, as well as non-trivial improvements in margin.

More importantly, as I see it, the improvements in the portfolio are seen in the company thanks to divestments in tall LATM markets, Turkey, and the Cura Day Hospitals group in Australia. As such, Fresenius is streamlining and cutting out markets, and the results show the successes of this value-over-volume approach that is currently being applied. A 130 bps margin improvement is neither small nor irrelevant.

Fresenius Medical Care IR (Fresenius Medical Care IR)

So, 1Q24 was a very solid quarter confirming the overall upside for the company. The company’s position as a market leader in a key space is actually unique because the closest second place here only has 1,000 clinics compared to over 3,500 for Fresenius. The company also, as a result of this, has access to much better data and IT for these sorts of product developments/R&D. Not only Fresenius uses Fresenius technologies and machines – the company has 35% of the market in these machines/equipment/consumables, but services only 9% of total patients through its clinics – meaning that these sales go elsewhere. The company’s top competitor, DaVita, is actually one of Fresenius’s largest customers.

Perhaps an M&A target for the company in the future?

The company is seeing increased support and interest in at-home treatments, which is further supporting things here – and it’s targeting areas where other companies have traditionally held market-leading positions, including peritoneal dialysis, where Baxter (BAX) has held good market positions.

The company currently comes with the following set of risks.

Risks and upside for Fresenius Medical Care

There’s no doubt to my mind that this company is less appealingly diversified than Fresenius (OTCPK:FSNUY).

However, the company has the following upsides. It includes a diversified sales mix and one that’s likely to benefit from growth in home treatments – which in turn lowers costs because it influences how long customers can continue to work and stay on commercial insurance plans. So this is a net win for both the system and the patient. The company also has a VC arm, which is investing in new ways to treat ESRD patients, which is keeping the company at the forefront of research and R&D here – yet another positive.

Negatives to the company’s thesis are quite manageable – but relevant. The company has significant exposure to commercial insurance trends – because almost all of these service profits are coming from that in the US. Run a few policy scenarios and see where this could take you in a negative scenario, and the risk overhang here is not trivial.

The courts have also ruled against DaVita in terms of pricing, and this could introduce pricing pressure mechanisms that would influence and pressure overall trends in the commercial insurance market. That’s also the biggest question mark with Fresenius Medical Care – if the company can actually boost its margins permanently and meaningfully. I say yes – but some say no, and given history I can see why.

Valuation for Fresenius Medical Care – The Upside to me seems a given

This company has been troughing for years at this point. We have in fact seen earnings decline since 2021, but the earnings growth had slowed down to near-zero in 2019.

Shareholders of this company have essentially been losing money since 2018 when the company was overvalued at almost 18-20x P/E.

But I believe shareholders and investors will walk away, or stay invested, both in this and in the Fresenius business as winners. I also believe it pays off to look at where the company went, and where it is estimated to go.

F.A.S.T Graphs Fresenius Upside (F.A.S.T Graphs Fresenius Upside)

As you can see, it’s a company that went from riding high, to riding very low indeed. I bought a small stake at the company’s trough you see here, but I have also been adding successively over time for the past few months and about a year.

Based even upon a very conservative 14.17x P/E for the 5-year basis, the company’s caupside inclusive of dividends here is no less than 22.6% per year estimating EPS growth at around 15% per year until 2026. Even at the lowest possible historical average of 12x P/E, the company still has an upside on an annualized basis of 16% per year.

As I see it, in any scenario here, the company has significant upside for investors, and that is why I buy more/might buy more here.

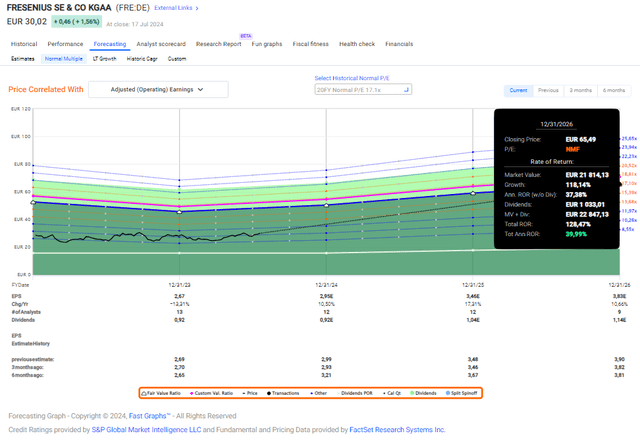

It’s also important for me to point out though, that the main company, Fresenius, remains the better choice, with this 20-year average upside until 2026E. That’s why my position in Fresenius is far larger than the one in the Medical Care portion.

Fresenius F.A.S.T Graphs Upside (Fresenius F.A.S.T Graphs Upside)

Comparing these two makes it easy to see which of the two is the better investment – at least to me. However, both are attractive, and it is with this in mind that I give Fresenius medical care the following thesis.

Thesis

- I view Fresenius Medical Care as a company to buy. It’s a leader in the kidney care sector and owns large parts of the dialysis operations in the US market as well as on an international basis. It’s BBB-rated, has an acceptable yield, and has a near-72% upside going forward to the next few years.

- The company is a very solid “BUY” here – and the recent decline due to the Ozempic trial results does not faze me in the least. I show you two reasons why this company is actually unlikely to see any sort of impact as of this, at worst we’ll see some delays in treatments.

- The recent company quarterly earnings report means that I am sticking to my price target for the company, as well as my stance – and I still consider it “cheap” despite not being as cheap as it was back in October.

- I give FMCQF, through FMS a PT of $34/share for the long term and rate it a “BUY”.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Because the company fulfills every single one of my criteria, it is a “BUY” to me here. I’m talking about both FMS and FRE here, but this article is on FMS.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.