J Studios

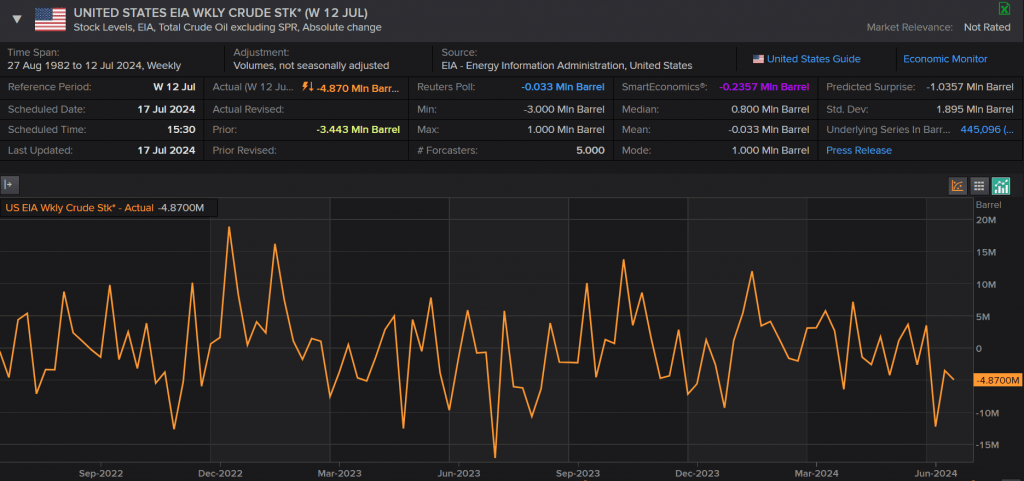

Oil prices are on the offensive this afternoon following US inventories data. In its weekly survey released on Tuesday, the American Petroleum Institute reported that U.S. oil inventories declined by 4.4 million barrels last week. This marks the third consecutive weekly decrease and significantly exceeds the consensus estimate of a 33000-barrel drop, as per a Reuters poll.

The Energy and Information Administration (EIA) released its data a short while ago and the story was pretty similar. EIA data had inventories falling by 4.9 million barrels as opposed to the API number and even more staggering compared to estimates of a 33000 barrel drop.

US EIA Weekly Crude Inventories

Source: Refinitiv

This is a welcome sign for oil traders following the concerning data out of China earlier in the week. Comments today around tighter trade restriction by the US also threaten to affect global trade and could by extension affect oil sales as well.

The CCP, China’s ruling party, is staging its third plenum, where key policy decisions are being discussed. Market participants will no doubt be hoping for a concrete plan on boosting growth and addressing concerns of market participants around the globe.

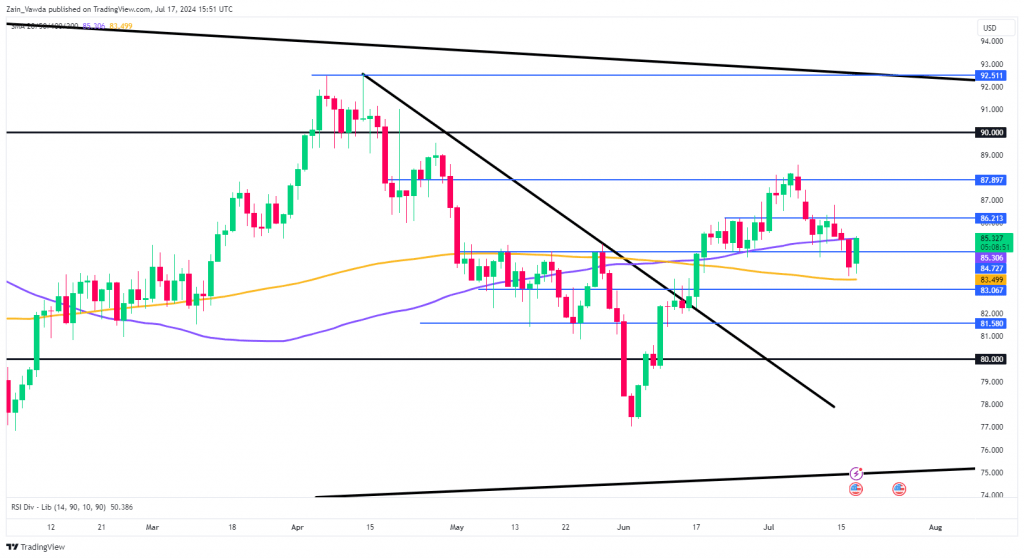

Technical Analysis

Oil prices are on course to snap a 3-day losing streak, while price remains trapped between the 100 and 200-day MAs. Inventories data proving to be the catalyst today, now whether that is able to keep oil prices at these levels remain to be seen.

A break above the 100-day MA brings resistance at 86.200 into focus, with the next resistance resting at 87.900. There is a very good chance that oil prices could remain trapped between the 100 and 200-day MAs.

Support

- 83.50 (200-day MA)

- 83.00

- 81.58

Resistance

Brent Crude Oil Daily Chart, July 17, 2024

Source: TradingView.com