hirun/iStock via Getty Images

Written by Nick Ackerman, co-produced by Stanford Chemist

Healthcare is traditionally a defensive sector that can hold up relatively well during economic downturns. The reason is quite simple: even if the economy is performing poorly, people will still have necessary healthcare needs that won’t be interrupted. That said, there is a more cyclical industry within the healthcare sector, the biotech space.

Today, I wanted to explore a fund that invests with a tilt toward the biotech space, the abrdn Healthcare Investors Fund (NYSE:HQH). This was previously Tekla funds that abrdn has taken over as the fund sponsor, but the management team went along with the move. HQH carries over half of its portfolio in the more volatile biotech space, but that also leaves a sleeve of the more traditionally stable healthcare space as well.

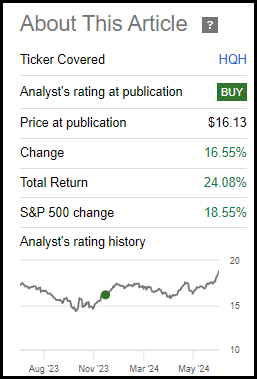

Since our last update, HQH has been on the move higher, outpacing the S&P 500 Index. Even though the S&P 500 is not an appropriate benchmark, it can still give us some context of what the broader equity market has done during this time though. The fund has been on a run higher more recently as the latest inflation data came in cool again, paving the way for the Fed to make a move on cutting rates.

HQH Performance Since Prior Update (Seeking Alpha)

HQH Basics

- 1-Year Z-score: 2.69

- Discount/Premium: -9.80%

- Distribution Yield: 12.51%

- Expense Ratio: 1.12%

- Leverage: N/A

- Managed Assets: $960.7 million

- Structure: Perpetual

HQH’s investment objective is “to seek long-term capital appreciation.” They will attempt to achieve this through “investing primarily in securities of healthcare companies.” More specifically, they will place “an emphasis on mid to large cap biotechnology and pharmaceutical growth companies with a maximum of 40% of the Fund’s assets in restricted securities of both public and private companies.”

Discount Narrows With Distribution Increase But Remains Appealing

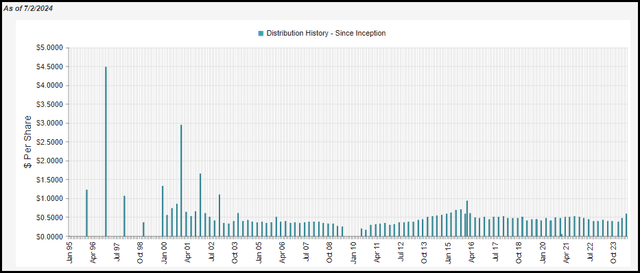

The biggest change since our prior update was an announcement of their managed distribution policy. The fund had previously targeted an 8% NAV rate annually. This was done with each quarter taking 2% of the NAV and paying that out.

That has now been ramped up materially to a 12% distribution policy. This was actually the second increase in the target as they had previously announced bumping it up to 10%, which only lasted for a quarter before they increased it again. With Saba Capital Management holding a position in this fund — and its sister abrdn Life Sciences Investors (HQL) — this could have certainly been one of the reasons for the increases.

Naturally, this saw the latest distributions move up quite materially. However, with this type of policy, it is important to know that this is being paid out whether it is being earned or not.

HQH Distribution History (CEFConnect)

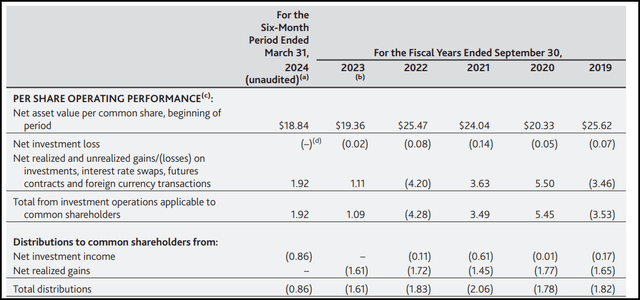

If they don’t have the income and capital gains to fund this distribution, there will be ‘destructive’ return of capital. In HQH’s case, the fund hasn’t produced any positive net investment income in years.

HQH Financial Metrics (HQH Semi-Annual Report)

This is because after deducting the expenses out of the total investment income, we are left with a negative figure. The fund did come quite close to breaking even in the latest semi-annual report, though I think it is probably pretty safe to assume that going forward, the entire or nearly the entire distribution will need to be covered through capital gains/return of capital.

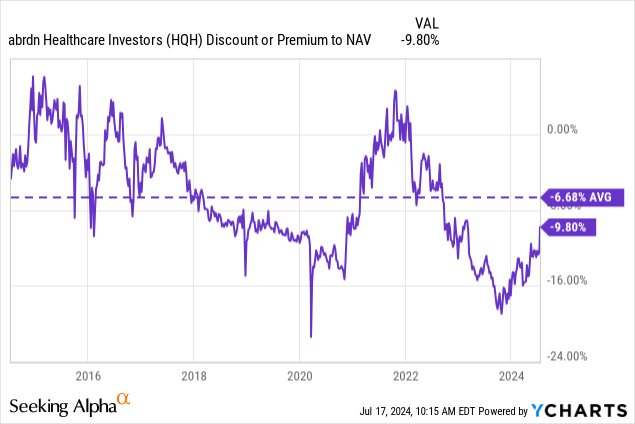

Thanks to this change in the distribution policy, we have seen the fund’s discount narrow quite significantly since our last update. That did go into helping drive the fund’s total returns higher, meaning that the underlying portfolio alone didn’t actually perform as well, it was that the discount was previously over 17% but now has moved down into the 11% range.

While we like to see wider discounts, that previous discount was some of the widest discount levels we’ve seen in this fund over the last decade. In fact, even the current discount looks quite appealing if we are looking at it relative to the average over the last 10 years.

Further, with that now higher distribution rate policy, that could get some investors interested in buying into this fund. The distribution might be difficult to cover, as they’ll need to earn 12% plus the fund’s expense ratio in order to maintain the current payout and keep NAV flat. That seems improbable, but not impossible.

At least historically, the fund has not been able to achieve those levels of returns over any period of time. Of course, the usual caveat applies, past performance doesn’t guarantee future results.

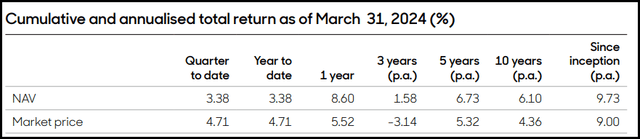

HQH Annualized Returns (abrdn)

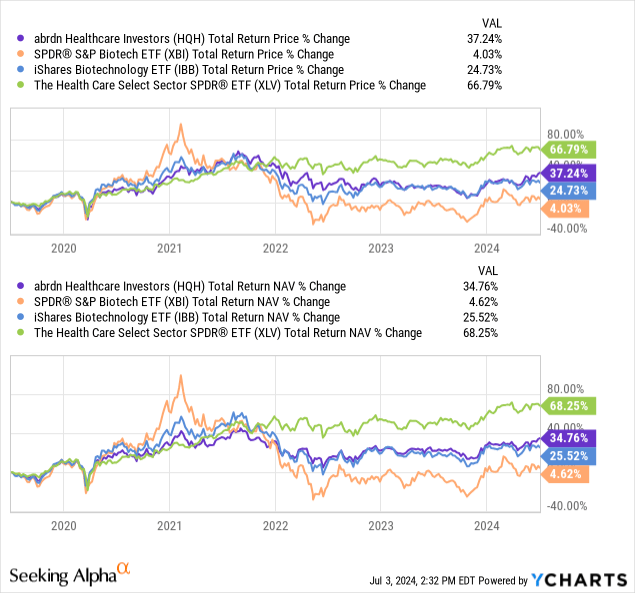

There certainly is some optimism that the future could be different. One of those is that biotech has been quite beaten down. That’s whether you look at HQH or other ETFs that invest specifically in the sector. HQH, over the last five years, has performed the best in comparison when being put up against its passive ETF peers, SPDR S&P Biotech ETF (XBI) and iShares Biotechnology ETF (IBB).

Helping HQH seems to be their sleeve of more traditional healthcare exposure; as can be seen below, the SPDR Health Care Select Sector ETF (XLV) had performed materially better. Interestingly, HQH seems to correlate more closely with IBB during this period of time.

YCharts

If the fortunes of the biotech space can turn around as opposed to struggling as they have been for the last several years, we could see the distribution better supported. A turnaround could be helped with a lower rate environment as this space tends to do better during those environments. That’s at least one of the reasons why we started to see this sector stabilize after 2022.

Either way, a higher distribution rate tends to push investors toward a fund. So even if the rate isn’t fully supported, it wouldn’t be too surprising to see the fund trade at a narrower discount in the future. This means that even the average discount we see in the last ten years could be narrower going forward.

HQH’s Portfolio

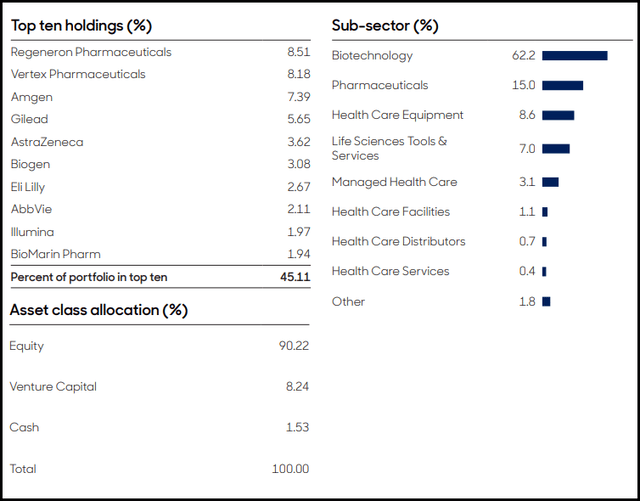

The fund continues to overweight an allocation to the biotechnology sector, and that has been a consistent theme with this fund’s approach. The fund also notes that they may invest in private or restricted investments, though that hasn’t been a particular focus for this fund since I’ve been following it.

HQH also carries a mostly equity portfolio, with just over 90% allocated to common stocks, with venture capital being the next largest segment at 8.24%. It should also be noted that the fund carries a rather concentrated portfolio, with the top ten making up slightly over 50% of the fund. Further, the top five alone make up just over a third of the fund.

HQH Portfolio Breakdown (abrdn)

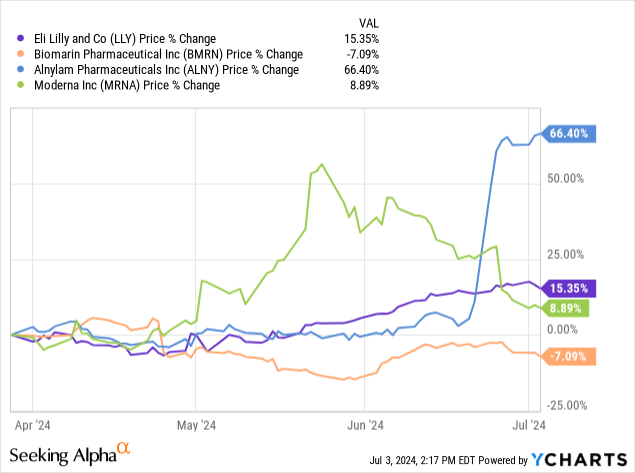

Similar to the sector allocations, the top ten positions here haven’t seen too much of a shakeup from our last report, either. Eli Lilly (LLY) and BioMarin Pharmaceutical (BMRN) have made their way up to top positions, which saw Alnylam Pharmaceuticals (ALNY) and Moderna (MRNA) fall off.

That said, these positions were as of the end of March 2024. If they continued to hold ALNY and not sell it out of their portfolio, it is quite likely that ALNY would be back into a larger position because the stock has surged more recently. Shares there were climbing significantly higher thanks to positive news out of a late-stage trial on vutrisiran. LLY has also continued to perform really well since the end of March, so it likely has maintained a top position in HQH.

YCharts

Conclusion

HQH invests a significant portion of its portfolio in the more cyclical biotech space of the healthcare sector. That can make the fund more volatile, but it could also lead to more potential total returns down the road. The biotech space had been performing rather poorly, but that could be ready to change with a lower rate environment helping. HQH also continues to trade at an attractive discount relative to its historical level. That was even after it had narrowed more recently by a meaningful level. One of the catalysts for the discount narrowing is likely the change in the distribution policy for this fund, as it was ramped up to 12% of NAV.