libre de droit

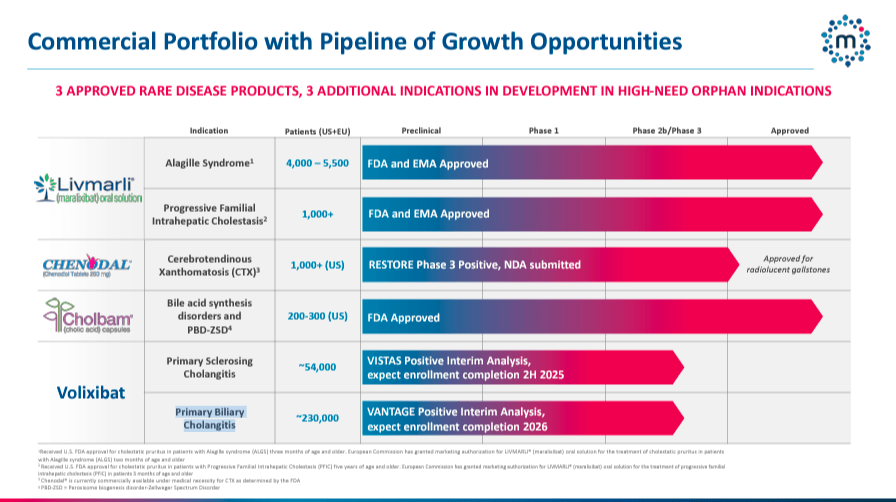

Mirum Pharmaceuticals (NASDAQ:MIRM) develops innovative therapies for rare liver diseases. It focuses on regulating bile acids to address cholestasis, inborn errors of bile acid metabolism, and cholesterol metabolism disorders. MIRM’s portfolio includes Livmarli for Alagille syndrome and progressive familial intrahepatic cholestasis, Cholbam for bile acid synthesis disorders and peroxisomal disorders, and Chenodal for gallstone disease and potentially cerebrotendinous xanthomatosis. Also, the company’s product pipeline includes Volixibat in Phase 2b trials for primary sclerosing cholangitis [PSC] and primary biliary cholangitis [PBC] with promising interim results. Chenodal also recently completed Phase 3 trials for cerebrotendinous xanthomatosis [CTX] with results that led the company to file its New Drug Application [NDA] submission. Overall, I consider MIRM a promising biotech for investors seeking exposure to rare liver diseases. The stock looks like a good buy on dips, so I rate it a “buy” for investors who understand the embedded valuation risks.

Rare Liver Diseases: Business Overview

Mirum Pharmaceuticals is a biopharmaceutical company founded in 2018 and headquartered in Foster City, California. MIRM develops treatments for rare liver diseases by regulating bile acid synthesis, secretion, and recycling. The company’s research programs include cholestasis, inborn errors of bile acid metabolism, and cholesterol metabolism studies. The common thread is that these diseases involve bile acid synthesis and transport disruptions, leading to serious liver and systemic health issues.

Source: Corporate Presentation. July 2024.

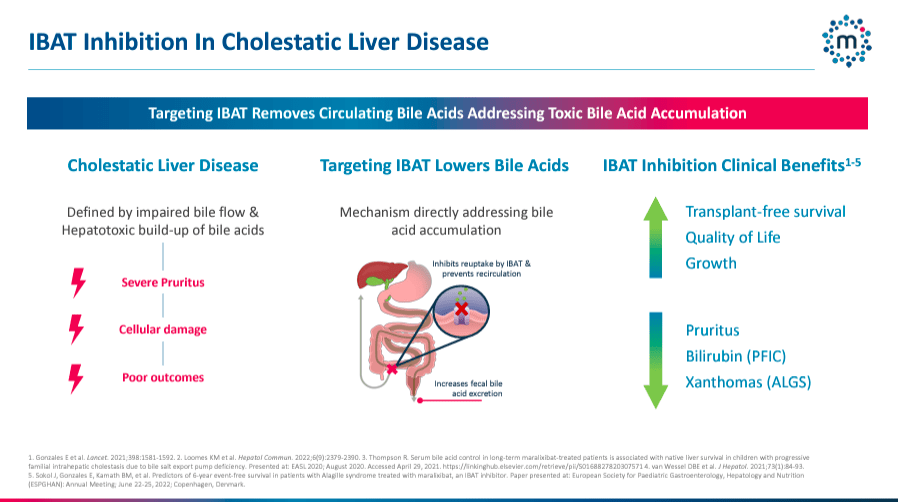

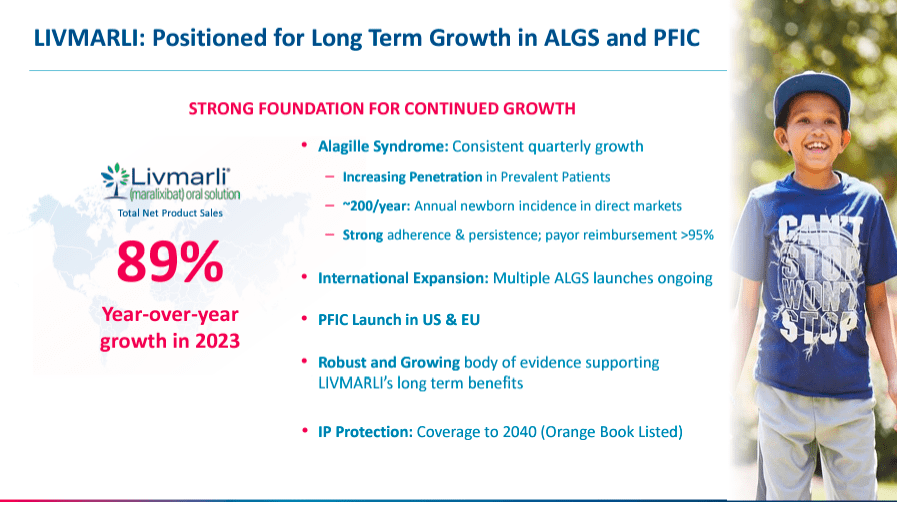

Currently, MIRM’s commercial medicines are Livmarli, Cholbam, and Chenodal. Livmarli is an IBAT inhibitor that treats cholestatic pruritus in ALGS patients by lowering bile acid levels in the liver and circulation in patients one year or older and PFIC patients. This ALGS therapy is approved in the US, EU, Canada, China, Israel, and South Korea. Additionally, Livmarli for PFIC is FDA-approved for US distribution. The FDA first approved Livmarli on September 29, 2021, for cholestatic pruritus in patients with ALGS. Then, on March 13, 2024, Livmarli was approved for cholestatic pruritus in PFIC patients.

Positive Data and NDA Submission

On the other hand, Cholbam was approved on March 17, 2015, as a cholic acid capsule used to treat diseases caused by the lack of the enzyme in charge of bile acid production and bile acid synthesis disorders. Additionally, this drug is used to treat peroxisomal disorders. Peroxisomal cell organelles play a vital role in lipid metabolism, bile acid synthesis, myelin membrane formation, and detoxification to protect cells from oxidative damage.

Source: Corporate Presentation. July 2024.

It’s worth noting that Chenodal (chenodiol) tablets are a synthetic oral form of natural bile acid used to treat cholesterol gallstones. Interestingly, Chenodal is also being considered for treating CTX. If approved for CTX, chenodiol would become a first-in-class drug for this condition, helping manage CTX by normalizing bile acid metabolism, reducing cholestanol accumulation, and preventing neurological and systemic effects. Moreover, MIRM reported positive data from the CTX Restore phase 3 trial in October 2023. Then, on June 28, 2024, the company submitted an NDA for CTX therapy based on these promising results.

Furthermore, MIRM’s pipeline includes Volixibat, a phase 2b drug for PSC and PBC. This medicine is an oral ileal bile acid transporter [IBAT] inhibitor, which reduces the reabsorption of bile acids and alleviates cholestasis and the associated pruritus and liver deterioration. The company reported positive interim data from the Vantage PBC and VISTAS PSC trials.

Source: Corporate Presentation. July 2024.

Lastly, MIRM is also working on PBC and PSC treatments. For PBC, trials showed a 3.8-point reduction from baseline in the primary endpoint of pruritus, indicating a significant improvement in reducing this primary symptom of PBC. For PSC, outcomes were also encouraging, preliminary meeting efficacy thresholds that need to be confirmed in further studies with 20mg daily doses.

Quality at a Premium: Valuation Analysis

From a valuation perspective, MIRM trades at a $1.9 billion market cap, which makes it a mid-sized biotech at this stage. Its balance sheet holds $302.8 million in cash and equivalents against $306.8 million in convertible notes. It has $652.0 million in total assets and $417.4 million in total liabilities, resulting in $234.6 million in total book value. This means the company trades at a somewhat inflated P/B multiple of 9.2. For context, its sector’s median P/B ratio is 2.5, so right away, MIRM appears relatively overvalued.

Moreover, I used MIRM’s quarterly TTM figures to estimate its latest cash burn rate. As of Q1 2024, MIRM’s latest quarterly TTM cash burn was $37.1 million if we exclude the purchase from Travere Therapeutics (TVTX) of Cholbam and Chenodal for $210 million. I exclude that figure because it’s presumably a one-time item and won’t be representative of MIRM’s cash burn going forward. Thus, using my cash burn estimate, MIRM’s cash runway is approximately 8.2 years, which means it has ample flexibility to assimilate its recent IP acquisition and fund its research for the foreseeable future.

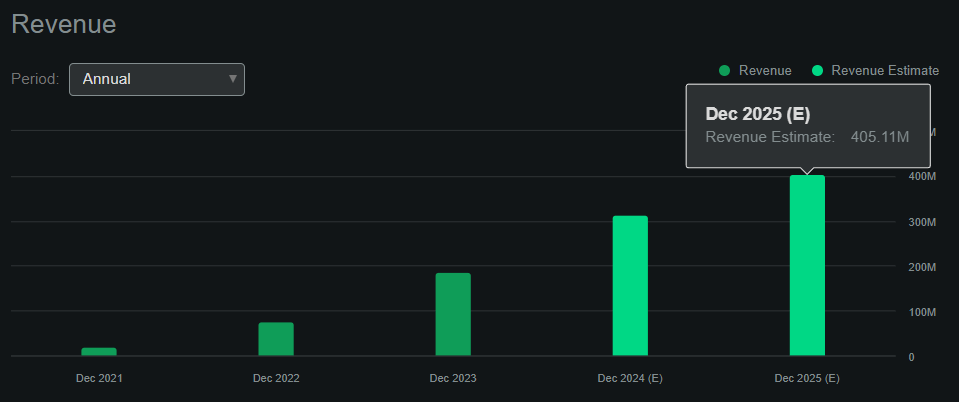

Source: Seeking Alpha.

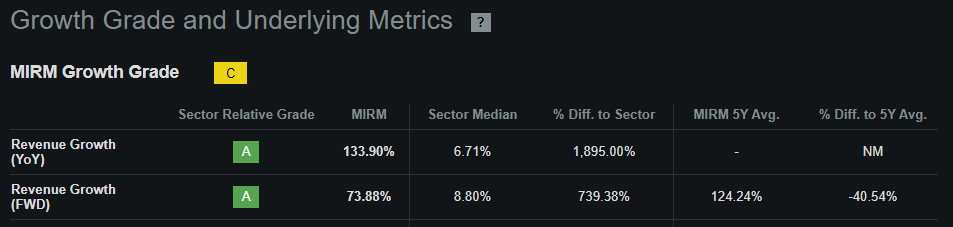

According to Seeking Alpha’s dashboard on MIRM, the company is projected to generate roughly $405.1 million in revenues by 2025. This means the company’s forward P/S ratio is 4.6, which is self-evidently slightly expensive again. For comparison, its sector median forward P/S ratio is 3.8. So, from multiple perspectives, MIRM appears to trade at a premium relative to its peers. However, since the company has historically grown its revenues faster than peers, and it’s forecasted to continue to outpace its sector growth, such a premium might be justified.

Source: Seeking Alpha.

Indeed, the recent acquisition of the Cholbam and Chenodal IP might be a game-changer for MIRM. Naturally, the initial revenue growth related to Cholbam might incur significant milestone payments to Travere Therapeutics shareholders, as they’re eligible for up to $235.0 million in potential sales-based milestone payments. Depending on annual net sales, MIRM will pay high single-digit to mid-teens royalty percentages on sales ranging from $125.0 million to $500.0 million. It was a good strategic fit as it complemented Livmarli, making MIRM a pure play on rare liver diseases. I also think such IP composition could make it an acquisition target for larger pharma players.

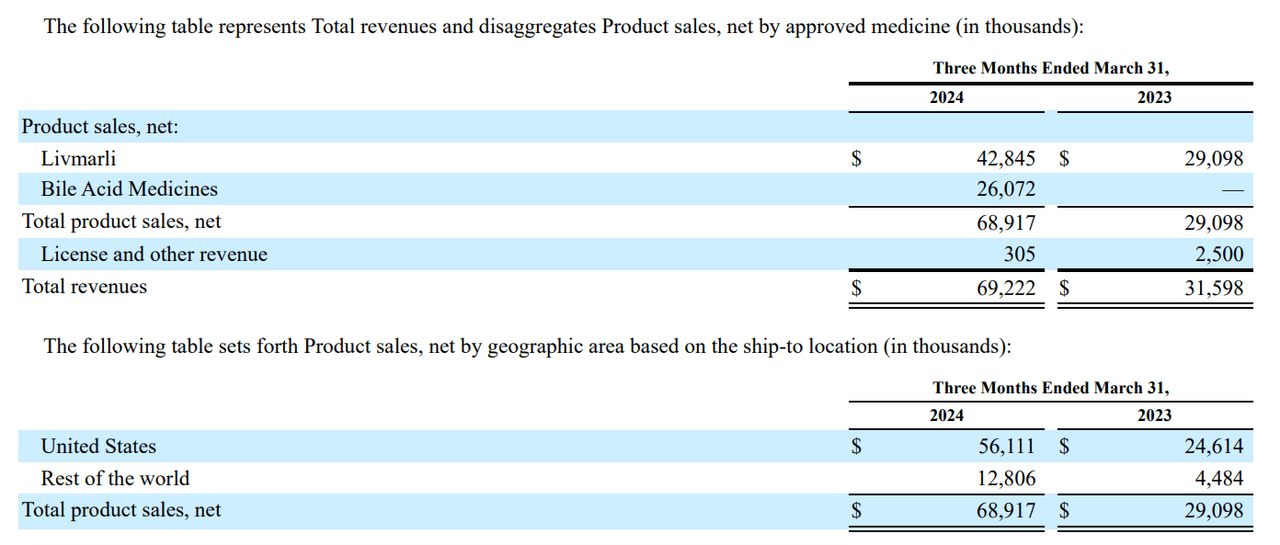

However, it’s worth highlighting that Cholbam targets a much smaller population, as it would only be a good fit for 200 to 300 patients. So it’s Chenodal for CTX, the main value driver from that acquisition, which could become a significant revenue contributor going forward. CTX has a 1 in 70,000 prevalence, so it’s a sizeable market in the US and worldwide. Moreover, MIRM seems to have plenty of room for future international growth, as its sales are still 81.4% from the US. Its post-acquisition revenue composition is now 62.2% from Livmarli and 37.8% from Bile Acid Medicines.

On a last note, MIRM once again reported losses for Q1 2024. However, the company’s cash flow was positive after non-cash adjustments like D&A, stock-based compensation, and changes in receivables. I estimate Q1 2024 generated $15.2 million in cash flow by adding its CFOs and net CAPEX. This and the forecasted revenue growth could signal that MIRM is transitioning into a self-sustaining company. Adding to its focused IP portfolio and cash balance, it positions it as a potentially attractive acquisition target. While I recognize that it’s trading at a slight premium relative to peers, I believe this is justified due to its strong fundamentals and market position, so I lean bullish on the company and its stock. Hence, I rate MIRM a “buy” for long-term investors seeking exposure to rare liver diseases.

Investment Caveats: Risk Analysis

Naturally, my investment thesis accepts that MIRM is trading at a premium. Ideally, we should look to buy MIRM on dips, but its price seems justified today by its strong fundamentals. However, jumping into MIRM today does imply valuation risks to some extent, so it’s something investors must consider. Moreover, I assume that MIRM will be able to realize its projected revenue growth. Still, if it fails to do so, it’ll likely translate into significant downside for investors because its valuation is pricing in considerable growth already. While I believe MIRM is a GARP stock, it’s not guaranteed to deliver on this promise.

Source: TradingView.

Moreover, Cholbam and Chenodal’s recent acquisition carries some integration risks, as transactions often fail at this stage. Assimilating acquired IP is not without execution risks, and failure could translate into higher-than-expected COGS and SG&A expenses, delaying MIRM’s promising transition into a self-sustaining company. This transaction might not fully realize the intended benefits, potentially destroying shareholder value in the long run. Nevertheless, I think MIRM’s prospects are exciting as it has a unique IP portfolio and revenue growth potential, still trading within reasonable levels, which positions it well as a potential acquisition target. Hence, I believe the pros outweigh the cons, but investors must consider these risks before committing their funds to MIRM.

Buy on Dips: Conclusion

Overall, I consider MIRM a promising biotech for investors seeking exposure to rare liver diseases. The biggest issue with MIRM is its valuation risks, as it seems the stock trades at a premium relative to peers. However, the company’s forecasted growth positions it well as a GARP stock, especially in light of its focused IP and ongoing transition into a self-sustaining company. I believe MIRM is a good buy on dips, and I’m optimistic about its long-term prospects. Hence, I rate it a “buy” for investors who understand the variables discussed in this piece.