shaun

Investment Thesis

In uncertain economic times, investors need to have a clear strategy that allows them to accumulate wealth. Following an investment approach that combines dividend income and dividend growth can be highly effective for investors aiming to steadily increase their fortune.

Adding companies with a long track record of dividend growth, competitive edges over competitors, a strong balance sheet, and positive growth outlooks can help you implement such an investment approach, and build wealth in uncertain economic times.

In this article, I will introduce you to two companies that can help combine dividend income with dividend growth, an investment strategy followed by The Dividend Income Accelerator Portfolio that helps to accumulate wealth over the long term.

While Chevron Corporation (CVX) can predominantly help you to increase the Weighted Average Dividend Yield of your dividend portfolio, given its Dividend Yield [FWD] of 4.18%, and to reduce the volatility of your portfolio (evidenced by its 24M Beta Factor of 0.66), Mastercard Incorporated (MA) could be an important key component to ensure dividend growth, evidenced by its excellent dividend growth metrics which I will further demonstrate within this analysis.

By combining both Chevron (for dividend income) and Mastercard (for dividend growth), you not only ensure a significant income for today but also increase this amount continuously year after year, allowing you to steadily increase your wealth even in uncertain economic times.

Chevron

Even though Chevron has significantly underperformed the S&P 500 within the past 12-month period, I am convinced the company can be an important strategic element for your dividend portfolio: while it has shown a Total Return of 1.53% within the mentioned period, the S&P 500 has shown a performance of 24.29%.

Chevron’s Current Valuation

Different Valuation metrics indicate that Chevron is presently fairly valued: Chevron’s P/E GAAP [FWD] Ratio of 12.38 is only slightly above the Sector Median of 11.90, supporting my investment thesis that the company is presently fairly valued.

In addition, it can be highlighted that Chevron’s present Price/Sales [FWD] Ratio of 1.44 is only 2.10% above the Sector Median, further highlighting the company’s currently fair valuation.

Chevron’s Dividend Yield and Dividend Growth Potential

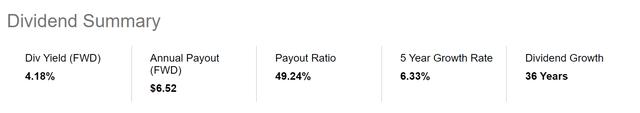

Chevron offers investors an attractive Dividend Yield [FWD] of 4.18%, coupled with a relatively low Payout Ratio of only 49.24% and a 5-Year Dividend Growth Rate [CAGR] of 6.33%. These metrics indicate the potential for future dividend enhancements.

Moreover, it is worth mentioning that Chevron has shown 36 consecutive years of dividend growth. All of these metrics underscore the company’s ability to combine dividend income and dividend growth, highlighting it as an attractive choice for long-term investors aiming to benefit from steadily increasing dividend payments to accumulate wealth over the long term.

Given Chevron’s combination of dividend income and dividend growth, its financial health (Aa2 credit rating from Moody’s), and competitive advantages, the company is a potential candidate for The Dividend Income Accelerator Portfolio.

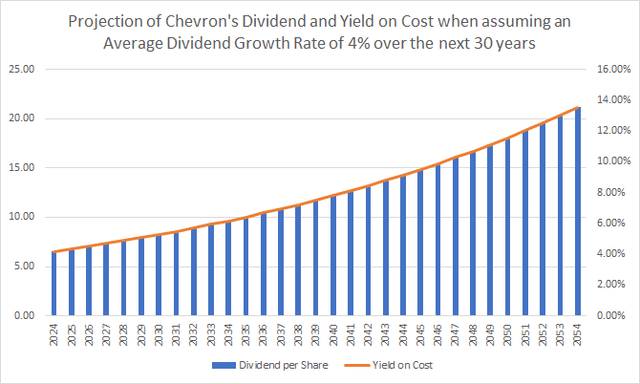

The Projection of Chevron’s Dividend and Yield on Cost

The graphic below demonstrates a projection of Chevron’s Dividend and Yield on Cost when assuming an Average Dividend Growth Rate of 4% for the next 30 years. This has been a conservative assumption, considering the company’s 5-Year Dividend Growth Rate [CAGR] of 6.33%. The chart shows that you could potentially reach a Yield on Cost of 6.17% in 2034, 9.14% in 2044, and 13.53% in 2054.

Mastercard

Mastercard is one of my favorite dividend growth companies, which is reflected in my decision to include the company in both The Dividend Income Accelerator Portfolio and my personal investment portfolio, which has a strong focus on dividend growth and a long-term investment approach.

With a 10-Year Dividend Growth Rate [CAGR] of 21.88%, Mastercard complements a company like Chevron, which has a stronger focus on dividend income (due to its Dividend Yield [FWD] of 4.18%).

Mastercard’s Current Valuation

Mastercard presently exhibits a P/E GAAP [FWD] Ratio of 31.33. I believe that the company is currently undervalued, considering that its valuation stands below its 5-Year Average of 38.00.

In addition, it can be highlighted that Mastercard’s current Price/Sales [FWD] Ratio of 14.79 stands 12.14% below its 5-Year Average, further strengthening my belief that the company is undervalued at this moment of writing.

Mastercard’s Strength in Terms of Dividend Growth

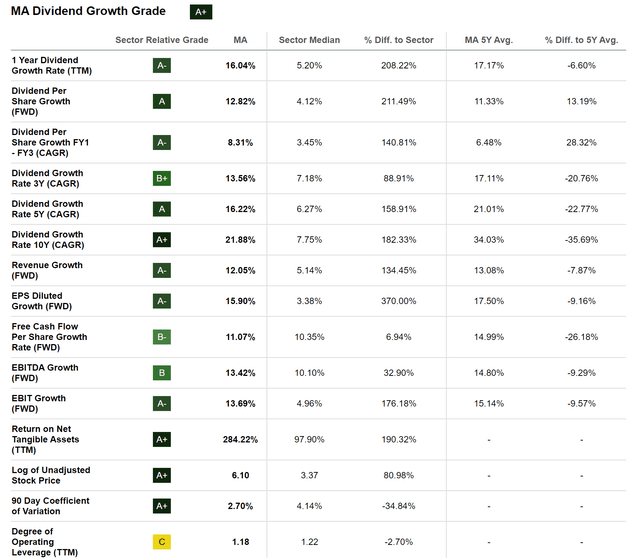

Mastercard’s impressive metrics in terms of dividend growth are underlined by the Seeking Alpha Dividend Growth Grade.

Not only does the company’s EBIT Growth Rate [FWD] of 13.69% stand 176.18% above the Sector Median, but its Revenue Growth Rate [FWD] of 12.05% lies well above the Sector Median of 5.14%. Furthermore, Mastercard’s 5-Year Dividend Growth Rate [CAGR] of 16.22% is significantly above the Sector Median of 6.27%.

These numbers underline my thesis that Mastercard can be an excellent pick to contribute to the dividend growth of your investment portfolio and for the accumulation of wealth when following a long-term investment approach.

Conclusion

Adding companies to your portfolio that are financially healthy, have strong competitive advantages, and have a long track record of dividend growth can help you build wealth even in uncertain economic times.

Both Chevron and Mastercard are such companies: while Chevron exhibits an attractive Dividend Yield [FWD] of 4.18%, Mastercard has shown impressive results in terms of dividend growth, evidenced by a 10-Year Dividend Growth Rate [CAGR] of 21.88%.

While the Chevron position could help you increase the Weighted Average Dividend Yield of your investment portfolio and reduce its volatility (evidenced by Chevron’s 24M Beta Factor of 0.66), Mastercard could help to ensure that your annual dividend income increases to a significant amount year-over-year.

Combining both companies allows you to not only generate significant income for today, but also to raise this amount constantly year-over-year while ensuring significant dividend enhancements in the future.

For both companies, I suggest a long-term investment approach that allows you to benefit from their steadily increasing dividends. By following this investment approach, both Chevron and Mastercard can be important strategic elements of your dividend portfolio, allowing you to increase your wealth in uncertain economic times.

Given that Chevron’s financial performance depends significantly on the price of oil while Mastercard’s performance is reliant on global economic conditions, I suggest setting an allocation limit of 4% for Chevron and 5% for Mastercard. This strategic approach allows you to decrease the company-specific allocation risk of your overall portfolio and to increase the likelihood of accumulating wealth over the long term.