kellyvandellen

There are two primary risks broadly speaking when it comes to bond market investing. The first is credit risk, which is related to the risk of default. The second is interest rate risk, which is tied to monetary policy. This bear market we just had in bonds? It was entirely an interest rate-driven one. Credit risk, with hindsight, incredibly never rose. And guess what? There were ways to buy bond funds that neutralized that interest rate risk.

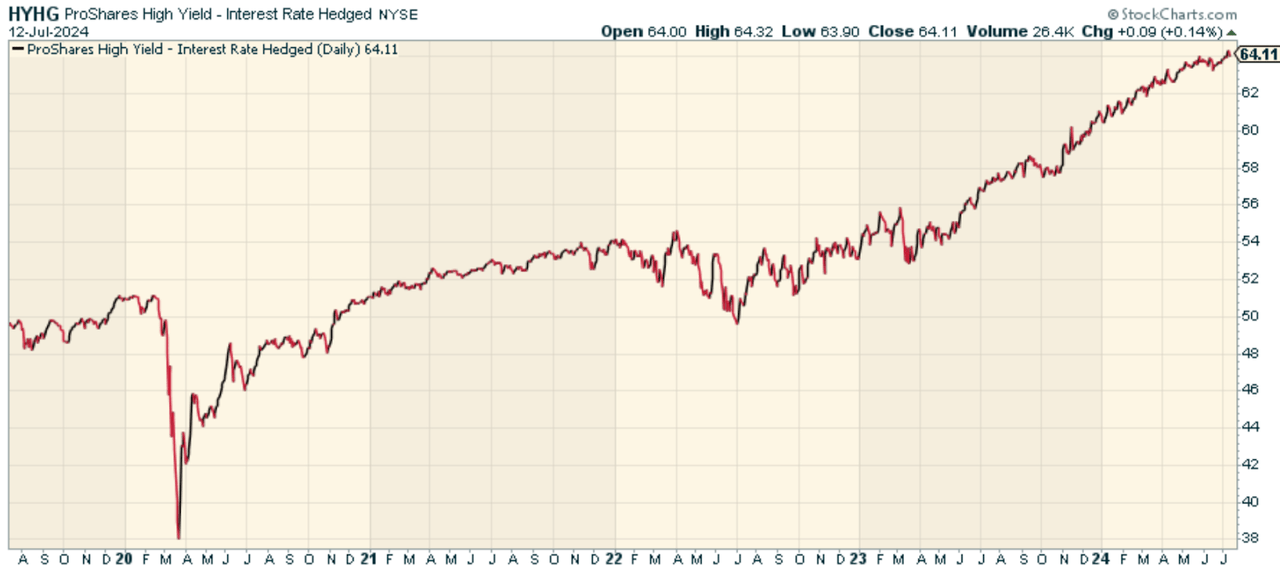

One fund that did that well is the ProShares High Yield-Interest Rate Hedged ETF (BATS:HYHG). The ETF combines the return potential of a broad portfolio of high-yield bonds with a hedge designed to blunt the effects of rising interest rates.

It clearly worked. HYHG total return looks nothing like long duration Treasuries that are pure interest rate risk with no credit risk.

A Look At The Holdings

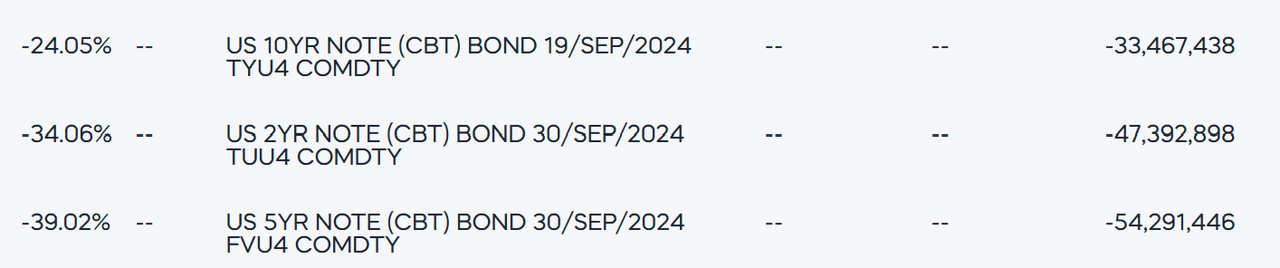

HYHG seeks to track the performance of the FTSE High Yield (Treasury Rate-Hedged) Index. This index takes long positions in US dollar-denominated high-yield corporate bond issuers and short positions in the US Treasury notes or bonds, to achieve an overall effective duration of zero. It’s effectively a spread trade internally in the portfolio to cancel interest rate movement and, as such, expose the investor only to the credit risk of the corporate issuers.

Below we can see the short positioning which is the interest rate hedge.

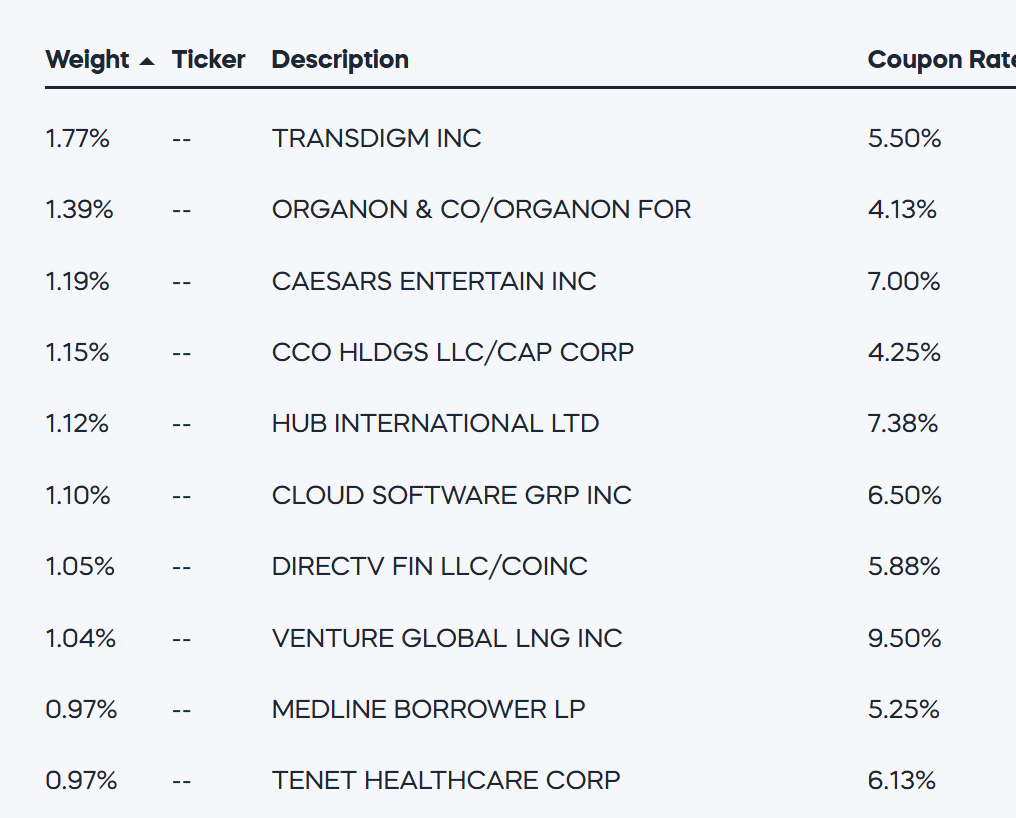

As to the long positions, no bond makes up more than 1.7% of the portfolio. This is well diversified overall.

ProShares.com

What are some of these issuers? TransDigm Inc. is a global aerospace components manufacturer and supplier of highly engineered aircraft components for use on nearly all commercial, regional, and business aircraft as well as advanced military aircraft and aircraft systems. Organon & Co. is a global healthcare company providing women’s health and biosimilar products. Caesars Entertainment Inc. is one of the largest casino and resort entertainment companies in the world. And DIRECTV is a well-known brand with a satellite TV service that reaches 20 million households.

Such individual positions are not only in diverse sectors such as aerospace, healthcare, telecommunications, entertainment, and technology; they also help to diversify within the high-yield bond portfolio.

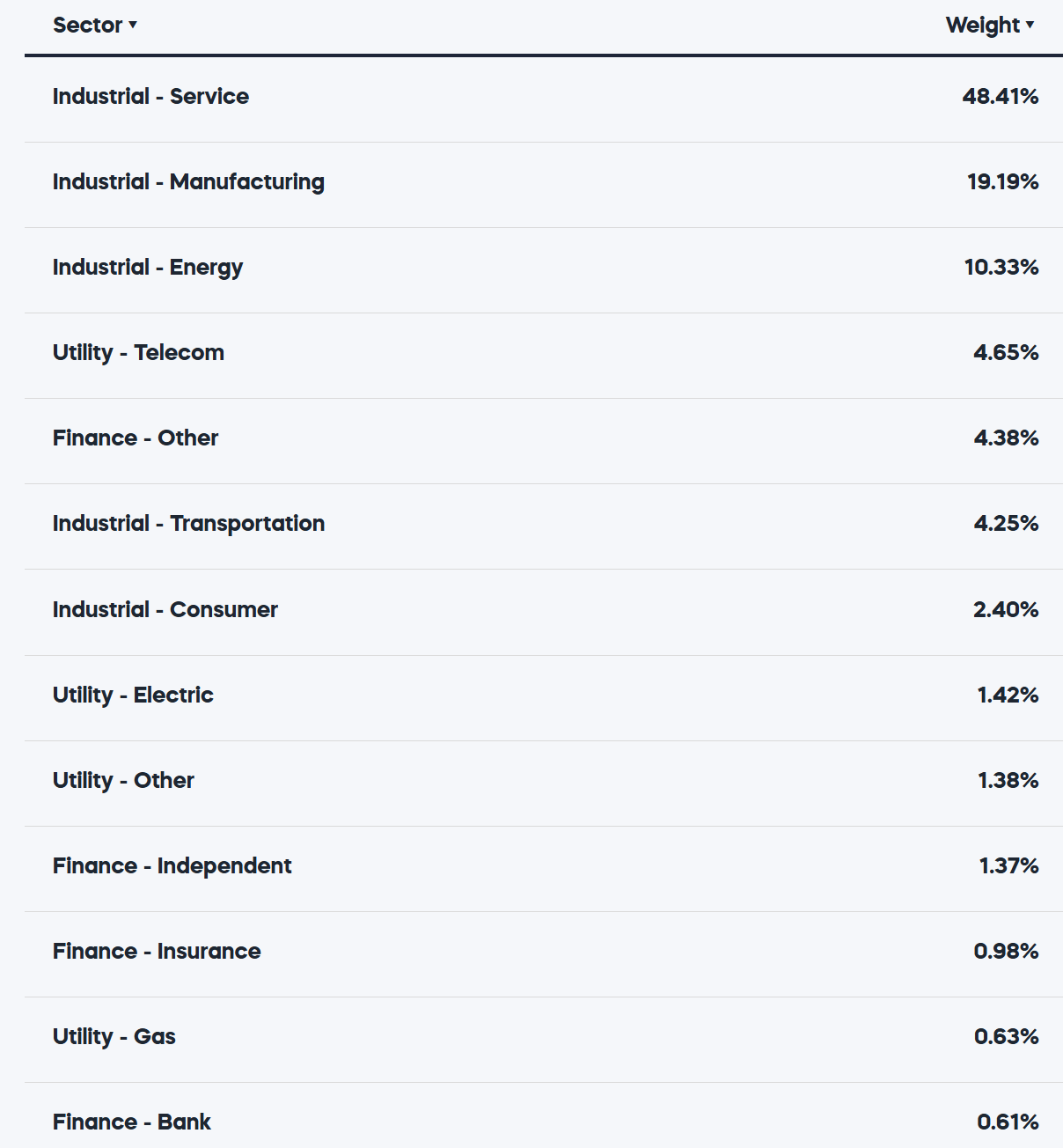

Sector Composition and Weightings

From a sector perspective, this is largely focused on Industrials. This is fairly common among high-yield bond funds. If the economy is strong, this does well. If not? Credit spreads widen and these areas take a big hit.

ProShares.com

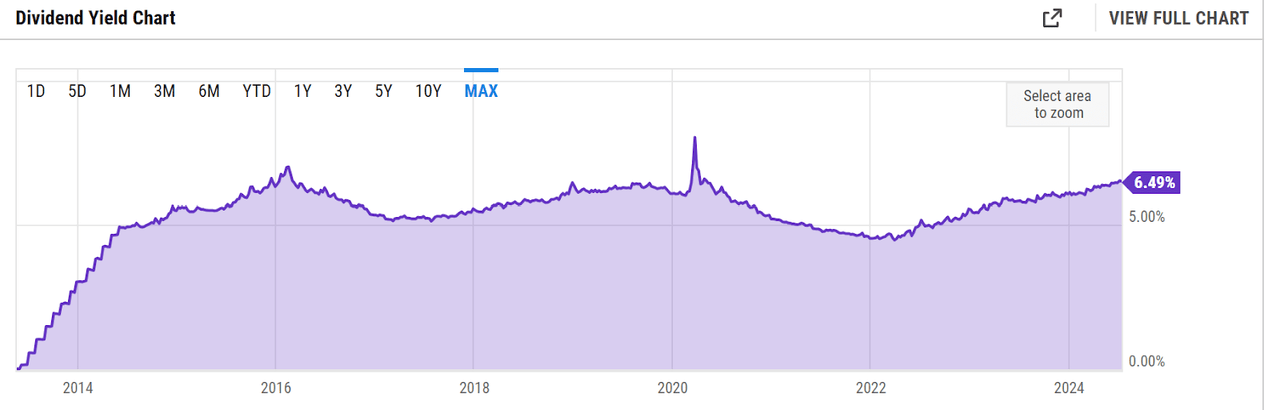

All of this has resulted in a nice overall yield and one that’s been fairly consistent.

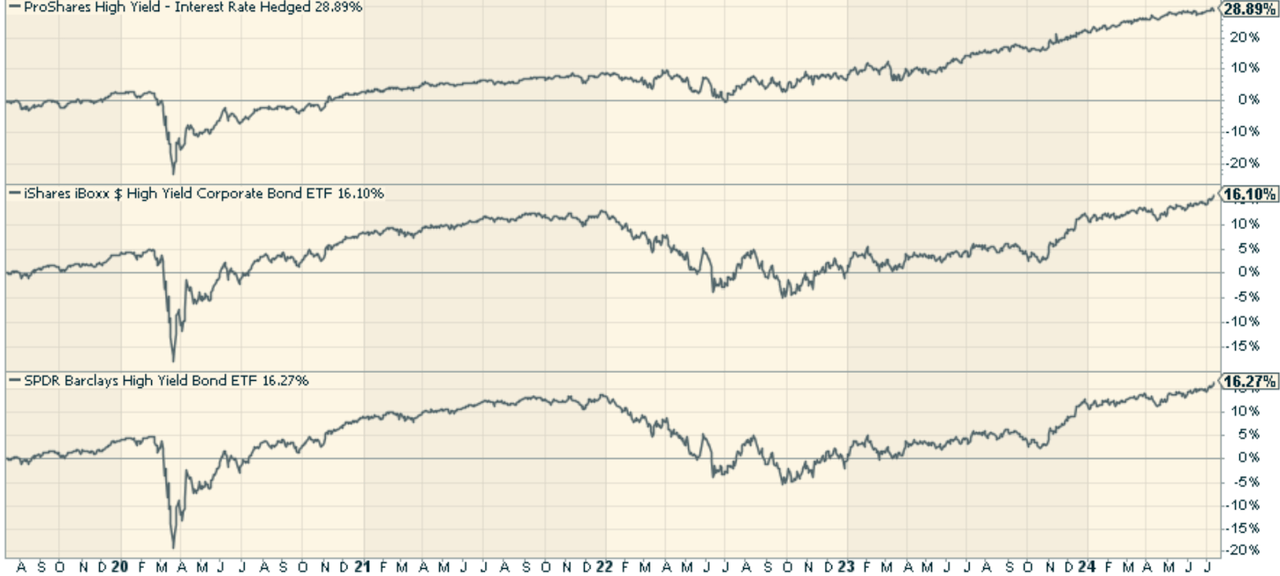

Benchmarking Against Peers: How Does HYHG Fare?

Two of the more significant competitors of HYHG are the SPDR® Bloomberg High Yield Bond ETF (JNK), and the iShares iBoxx $ High Yield Corporate Bond ETF (HYG). When we compare these funds to HYHG, it’s clear just how powerful the interest rate hedge was this last cycle. As a matter of fact, the performance isn’t even close.

Pros and Cons

On the positive side, investing in HYHG is advantageous because there is almost no interest rate risk involved and it generates a large amount of income, and it provides a proven strategy for building personal wealth. There is no doubt this was, with hindsight, almost the perfect way to own bonds in the past 3 years as the Fed embarked on the fastest rate hiking cycle in history. The fund is also on the high-yield bond side nicely diversified with a solid mix of different sectors and industries, minimizing concentration risk.

The downside? HYHG hedges against interest rate risk but not against credit risk or other factors that may affect the prices of high-yield bonds, such as the financial health of the issuers or economic conditions. This makes the fund volatile when conditions turn against it since high-yield bonds are subject to more risk than investment-grade securities.

Conclusion

There is a time and place for a fund like this, and I think that time and place has passed. The duration crisis appears to be over, and credit risk should matter far more on a go-forward basis as the economy slows and the Fed likely cuts rates. I think there are better places to position into the bond market now, and you may actually want to take on some interest rate risk in this part of the cycle. So if you benefited from the fund for the last 3 years, congrats. The next 3 years will likely be very different, in my view.

Get 50% Off The Lead-Lag Report

Get 50% Off The Lead-Lag Report

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Get 50% off for a limited time by visiting https://seekingalpha.com/affiliate_link/leadlag50percentoff.