vlastas

Uranium Recap

Since my last article on the uranium sector on January 22nd of this year, the price of U3O8 has fallen significantly. From peaking at over $100 per pound in late January, the spot price of U3O8 has fallen ~20% to $84 per pound. Year-to-date U3O8 is down roughly 8 %. Naturally, Yellow Cake plc (OTCQX:YLLXF) and the Sprott Physical Uranium Trust (OTCPK:SRUUF) have also fallen in price, as they are the only investment vehicles for retail investors to gain exposure to the spot price of uranium. However, they did outperform the spot price by ~ 5% YTD because the discount to net asset value has narrowed due to positive investor sentiment.

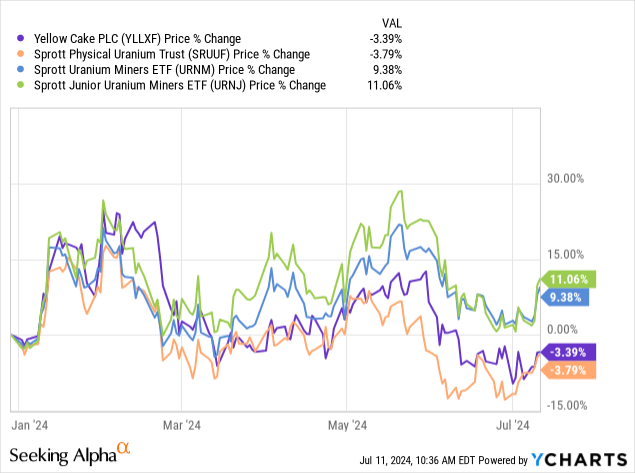

Year-to-date, miners have started to outperform the metal. The idea of Miners outperforming in the late stages of the bull run is something many investors have discussed beforehand. In my last article I have argued for the very same thing – although without too much of conviction. The Sprott Uranium Miners ETF (NYSEARCA:URNM) is up about 9% for the year. The riskier Uranium ETF (NASDAQ:URNJ) with an allocation towards smaller miners is up 11%. The best risk/reward trade YTD has been an allocation toward the largest tradeable miner Cameco (CCJ). The stock is up ~25% for the year and has been a significant contributor to URNM’s performance, offsetting some of URNM’s underperforming physical uranium exposure.

Price Action – The Spot Market Correction was Healthy for Now

In Q3 & Q4 of 2023, a significant and impulsive tightening of the spot market resulted in a doubling of the U3O8 spot price. A healthy sign of a long-term bull-market are reoccurring correction / distribution phases of moderate size. As spot prices reached above the $100-mark, retail investor sentiment was largely positive and the Uranium sector started to get attention from non-knowledgeable investors. Consequently, the move from $80 to $100 per pound of U3O8 occurred in a few 100,000 pounds of trading volume. The discount to NAV of the Sprott and Yellow Cake investment vehicles narrowed due to popular demand. It was largely retail that drove prices up to overextended levels, as usual.

I believe the recent run-up is comparable to the initial breakout phase in Q3 2021 – Q2 2022 when the popular investment vehicles were launched and began to attract attention. After the 30% correction that happened in May 2022, prices started to bottom out and form a stable uptrend. The spot market got ahead of itself at the time, rallying on very light volume and correcting towards the average of the negotiated floors of long-term uranium contracts – at the time around $60 to $65. Buyers stepped in with large volumes when the spot market reached cheaper levels than their floors.

I believe it would be a very healthy sign of a long-term bull market if the uranium spot price were to remain in a boring, slow sideways trend throughout Q3 and early Q4 of this year. The long-term floor prices negotiated between miners and fuel buyers are already around $80. I would view a stable price range above $75 – $80 per pound of U3O8 as a very healthy sign and an additional opportunity for investors to accumulate, as this price range represents the current long-term floors of newly signed U3O8 contracts.

Supply Growth is Still Insufficient

Investors need to understand that the early part of the bull market is over. However, just because the easy money has been made doesn’t mean there are no more opportunities. As of this year, every producing or developing company is eager to ramp up production as quickly as possible.

Paladin Energy Ltd (OTCQX:PALAF) has restarted Heinrich, Boss Energy Ltd (OTCQX:BQSSF) has restarted the Honeymoon project, enCore Energy Corp. (EU) has restarted all of its ISR mines. There are various smaller restarts of older projects or mines. Typically, this is a sign of a topping commodity bull market where high demand meets rising production and prices begin to fall. In other commodity sectors, supply is very flexible and can be increased or decreased if the price incentives are strong enough.

However, the entire uranium sector is uniquely and inherently long-term oriented. Currently, almost all producing companies have contracted their pounds of uranium for 3-5 years. Therefore, new supply can only enter the market if new mines actually produce additional pounds to sell. Since increasing production by developing or restarting mines is a complex process, it may be several years before any significant additional supply enters the market.

NexGen’s (NXE) Arrow project will take several years to get into production, Denison’s (DNN) Phoenix project won’t be operational until at least 2025, and the Kazakhs are having trouble ramping up their supply as well, as expected. There is some incremental supply coming in from traders selling their pounds on the spot market, from utility inventories and from small miners who have produced some pounds on hand. However, for the next two years there will be no additional supply offsetting just the currently additional 25 million pounds per annum needed just because of the inefficacies of the underfeeding process described in my last article. Sufficient supply to rebalance the market can only be provided from greenfield, not brownfield. This will take two or more years.

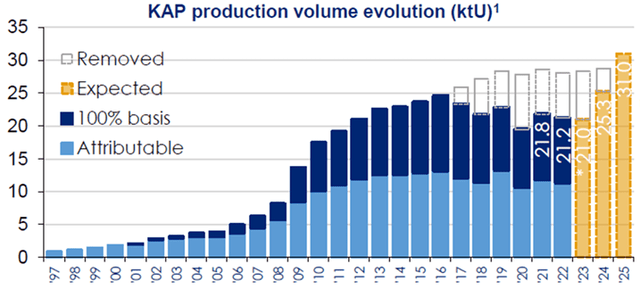

Kazatomprom remains by far the largest supplier of uranium, with a global market share of ~43%. In early 2024, the Kazakh company announced it would increase production to 25.3 tons of U3O8, an increase of about 8.6 million pounds from 2023. However, the Kazakhs are having serious problems obtaining sulfuric acid on the open market, which is needed for all restarts. Kazatomprom has now revised its 2024 target down to 21.0 to 22.5 tons of U3O8, a decrease of 11% to 17% from their original guidance. These levels are in line with the production of the past few years, adding to the current supply deficit.

Initial Production Outlook for 2024 will not be met (Kazatomprom Investor Relations)

In 2023 Kazatomprom founded a new partnership enterprise – Taiqonyr Qyshqyl Zauyty LLP to implement the construction of a new sulfuric acid plant to satisfy their own demand. However, the plant will take another 1-2 years to complete construction. In addition, Kazatomprom is actively engaged in discussions with sulfuric acid producers in neighboring countries.

The revised 2024 guidance comes as no surprise to the markets. As I noted in my last article on the Uranium Bull case, it was clear even in early 2024 that the Kazakhs would struggle with their optimistic guidance. For now, the largest supplier of U3O8 is still struggling to increase production. Kazatomprom’s potential supply increases need to be watched closely due to the company’s market dominance. If Kazatomprom can increase supply in the next few years, it may be time to start taking more significant profits. For now, I personally don’t see any significant supply glut hitting the market in the next 1-2 years.

New Unexpected Sources of Demand

Throughout the last year, however, there have been news about additional demand sources which are expected to widen the gap of supply and demand for the next years. The South Koreans have done a complete 180 – reversing their nuclear phase-out program, restarting construction of Sauel 3 & 4, and starting two new builds with more planned. France has committed to extending the life of most of its existing nuclear fleet and has committed to building fourteen new large EPR-2 reactors. The United States has passed the Inflation Reduction Act, which commits billions of dollars to clean energy production, of which nuclear power is a critical part, and provides incentives for closed plants to consider restarting. The U.S. is now moving rapidly toward new nuclear construction with bipartisan political support. Japan continues to restart its nuclear reactors after the complete shutdown that occurred after Fukushima.

Nuclear plant newbuilds typically take a long time and are announced well in advance. Therefore, uranium suppliers are well prepared for the new sources of demand. The market adjusts efficiently, and there will be no supply-demand gap forming. However, restarts and/or life extensions create immediate additional demand because utilities will only purchase pounds for the life expectancy of their reactor. If a life extension is granted, utilities will have to enter the market and secure U3O8 for several years into the future at once – creating the possibility of a demand shock in a tight uranium market.

In addition to the global political shift, more and more datacenters need an ever-increasing supply of clean and stable electricity, largely driven by the AI boom. In particular, the U.S., China, Japan, and the U.K. – all nuclear-dependent countries – are in need of cheap and stable electricity because of their large AI and data center needs. This may not be a short-term increase in demand, but I think it will be significant in the long run.

Utilities Seem to be Missing the Big Picture – Do They Know Better?

Needless to say, sentiment towards uranium is very positive these days. The consensus among investors is very bullish. It’s not without reason, of course – the supply gap is evident, and the prices of the metal and the miners have risen sharply. Ceilings and floors on average long-term contracts are high. However, Utilities are not in a rush to contract new U3O8 for their reactors. This behavior would be rational if Utilities expect lower prices going forward, therefore delaying their purchases of Uranium. In 2024, only 28 million pounds have been contracted. Last year, 55 million pounds were contracted in the first quarter alone.

Nuclear utilities have not experienced a tight market in decades. The marginal cost of U3O8 compared to the cost of operating a nuclear reactor is still low (typically less than 5% of operating costs). Therefore, utilities are not making significant efforts to secure cheap metal – and they are simply not used to a tight uranium market. The lack of motivation to renew contracts is not surprising given recent price movements. However, if the utilities stop contracting new pounds for an extended period of time and the market remains tight, they may be forced to buy later, putting more pressure on the spot market, but especially benefiting the miners’ long-term contracts.

Politics – Further Arbitrary Tightening

President Biden recently signed bipartisan legislation to ban the import of uranium products from Russia, marking a monumental shift for the civil nuclear energy sector of the USA. The new rules go into effect in mid-August 2024. Until January 2028, U.S. utilities will still be able to import Russian material if they obtain a waiver. The requirements for obtaining a waiver are still unclear, but they are promised to be reserved for national security issues and not for bailing out companies because of financial difficulties. In addition, the Biden administration has passed a new $2.7 billion funding program for domestic uranium production.

The bill affects long-term contracts and the EUP and enrichment facilities in Russia. Utilities could be forced to sign additional contracts with Canadian and US producers if a waiver is deemed not to be a national security issue. This means an additional arbitrary tightening of the Western uranium market due to geopolitical inefficiencies.

Additionally, the Canadian companies Urenco and Orano want their feedstock (Uf6) up front while Russian enrichment contracts usually consist of a return feedstock requirement. This means that the Russians supply the EUP and then demand the Uf6 afterwards, while the Canadians want the Uf6 up front to supply the EUP to the utilities. The consequences are more near-term demand as Utilities have to go and buy the material in the near-term after signing the potential new contract with the western miners.

URNJ vs. URNM

I believe there is still significant room for further share price appreciation in the uranium miners and the spot market itself. In my previous articles, I argued for the better risk/reward of investing directly in the price of U3O8 through the Sprott Physical Uranium Trust (SRUUF) and Yellow Cake plc (YLLXF).

However, I don’t think the spot market has to go much higher to make the miners significantly profitable. In the later stages of a bull run, which I believe the uranium sector is in, the smaller miners typically outperform the larger miners, which in turn tend to outperform the appreciation of the metal. Speculators late to bull-runs tend to have increased interest in smaller miners with more upside but also more risk (i.e. more volatility and downside if the sector trend turns negative). While this risk dynamic is generally true for most mining industries, the last bull run for the Uranium industry happened more than 15 years ago. During that time other smaller mining companies were operating in the market. Additionally, investment vehicles for Uranium such as the currently available ETFs didn’t exist back then. Therefore the comparability of the two cycles remains limited.

There are two major ETFs from Sprott to choose from if investors want to gain exposure to uranium miners. The Sprott Uranium Miners ETF (URNM) and the Sprott Junior Uranium Miners ETF (URNJ). A large portion of URNM, currently over 43%, consists of the two largest miners, Cameco (CCJ) and Kazatomprom (OTC:NATKY), and a position in the metal itself through the Sprott Physical Uranium Trust. The holdings of the URNJ ETF are centered around Junior Miners, which are more out on the right side of the risk curve, e.g. NexGen Energy Ltd. (NXE:CA), Uranium Energy Corp. (UEC) and Denison Mines Corp. (DML:CA).

Both ETFs had a small correction in July and have underperformed the price of U3O8 since their inception. With the bull market entering a more mature phase, I believe now is a good time to accumulate a position in the uranium miners – especially those far out on the risk curve, the junior miners.

Personally, after taking profits out of the Sprott Physical Uranium Trust on February 26th, I will be deploying those profits into a new position in URNJ with the expectation of outperforming the price of U3O8.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.