spooh

Thesis

Lately I’ve seen several narratives that Enterprise Products (NYSE:EPD) will benefit from increased natural gas consumption associated with AI data centers. I am personally not a subscriber to this thesis based on EPD’s assets and business model.

So what I decided to do was update my previous thesis, which included the potential impact of the SPOT project. This time around, I analyzed the potential impact of the multiple projects in the NGL value chain. This is EPD’s most profitable segment representing 53% of the company’s operating margin.

The multitude of gas processing plants, fractionators, and NGL pipelines have allowed me to increase my growth rate projections for EPD. I project EPD is able to sustain a 5.5% CAGR in operating margin through 2028 giving investors confidence of future distribution increases.

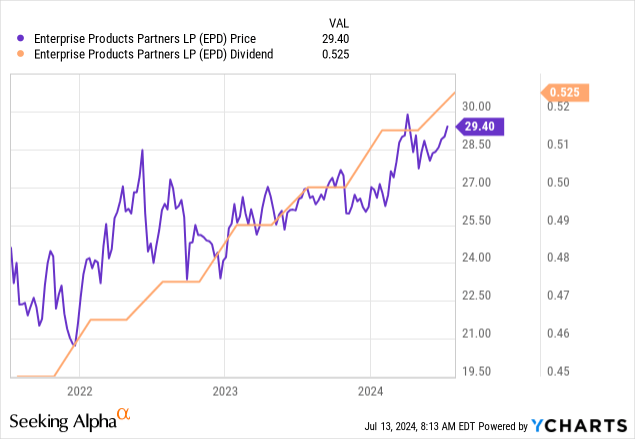

This analysis comes on the back of yet another distribution increase on July 10th. The quarterly distribution was raised by $0.01 to $0.525/unit, bringing the current yield to 7.2%. I expect the 26 year streak of distribution increases to continue thanks to many expansion projects in the NGL and crude value chains.

I continue to rate EPD as BUY and own units of the company for myself and my family.

EPD’s Bread and Butter

The NGL component of Enterprise generated 53% of its total operating margin in Q1. The NGL product stream starts at the natural gas processing plant which extracts the liquid components. This is a mixture of propane, butane and ethane. This product stream is simply referred to as NGLs. The NGLs then flow to fractionators to be separated into individual components for exportation or domestic consumption.

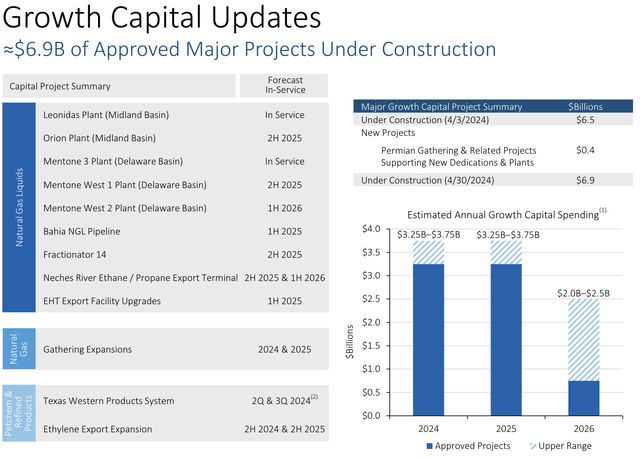

The company is investing heavily in the NGL side of the business to continue to exploit the high margins this segment can provide. Following the recent completion of the Leonidas and Mentone 3 natural gas processing plants, the company continues to push the envelope for its value chain in all aspects of the business.

There isn’t a single part of the NGL system that isn’t getting bigger. EPD has three additional natural gas processing plants, the Bahia pipeline, Frac 14, and multiple export terminals under construction.

Beyond just getting bigger, this strategy sets up a domino effect where each new asset feeds into another downstream asset. This allows EPD to extract value at each step in the process from the wellhead to the docks.

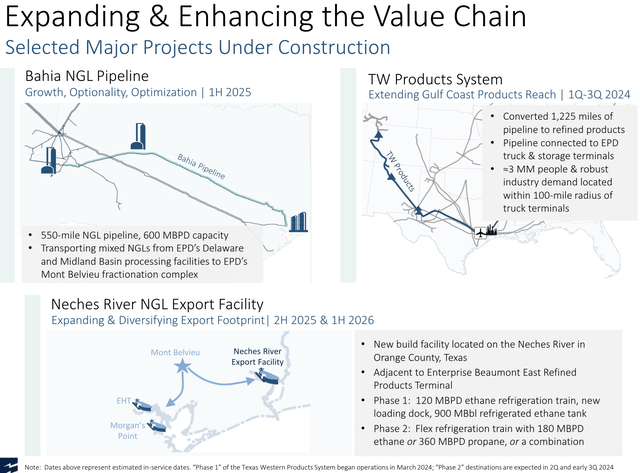

As highlighted below, the new processing plants will help fill the Bahia pipeline. 70% of the volumes on this pipeline are expected to come from an EPD processing plant. Then, the NGL stream stops at Mont Belvieu for fractionation prior to exportation at the Enterprise Hydrocarbons Terminal. In 2H 2025, EPD is expected to commission the Neches River Export terminal to give it a second location to export ethane and propane.

Major Projects In The EPD Value Chain (EPD Investor Presentation)

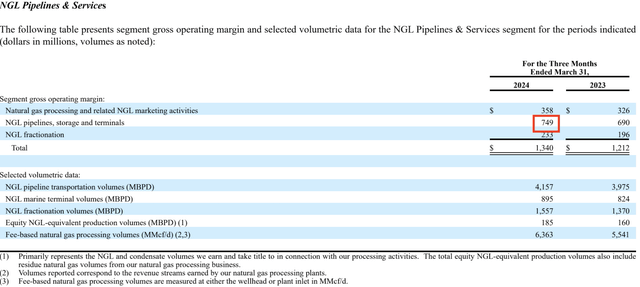

Digging further down, we can find that the NGL pipelines and terminals generate the highest amount of earnings in the NGL space, accounting for more than half of the total NGL value chains profit. This is shown by the red box in the figure below.

NGL Segment Gross Operating Margin (10-Q)

Why is this so important? First, let’s quantify how these projects will impact the volumes on the EPD system compared to Q1 volumes

- Fractionation capacity increases by 12% by adding 195 MBBLs/D from Frac #14

- Export capacity increases by 57.5% through the addition of the Neches River Export Facility

- NGL pipeline capacity increase by 13% via the Bahia Pipeline

- Processing capacity increases by 16% via five new processing plants

To get a financial grasp on what these projects are bringing to the table, we can extrapolate using a quarter over quarter comparison. In 2023, EPD brought online two processing plants and fractionator #12. The financial impact of these projects was presented in the Q1 earnings presentation (slide 10).

Using this data I was able to extrapolate the impact of the additional volumes through the EPD system. I also factored in a slight margin reduction to account for changes in processing and fractionation margins.

We can see that this adds approximately $1.3 billion in gross operating margin on an annual basis. This is significant enough to increase the entire company’s earning potential by 14% from 2023 levels.

| Estimated Project Impact (Quarterly) | |

| NG Processing (1,500 MMCF/d) | $100 million |

| NGL Pipeline Volumes | $39 million |

| NGL Fractionation | $39 million |

| NGL Export Terminals | $167 million |

| Margin Reduction | ($20 million) |

| Total Net Impact | $325 million |

NOTE: The Houston Ship Channel Dredging Project is expected to increase vessel traffic at EHT and Morgan’s Point Export Facilities. The company projects this will allow its terminals to increase volumes by 12-15%. This provides upside to the estimated returns listed above

More To Come

As you would expect from a great company like EPD, it is thinking multiple years down the road with each of these high value projects. The Bahia pipeline and terminal projects are all upgradable from the currently advertised capacities to provide for capital efficient growth opportunities. Justin Kleiderer, SVP Pipelines and Terminals, spoke on how the Bahia pipeline can be upgraded over time.

So you think about a metric of every new gas plant we put on, we yield about 40,000 barrels to 45,000 barrels a day of NGLs into Bahia. So we’re growing our footprint both in the Delaware and the Midland.

…we picked 600 for the reasons before, but you think of a 30 inch pipeline. If it’s fully horsepower, it could do upwards of a million. But we’re trying to be capital efficient about how we phase into it. So if our forecast are right and we need more than what we have today, we can add pumps on it to upsize it.

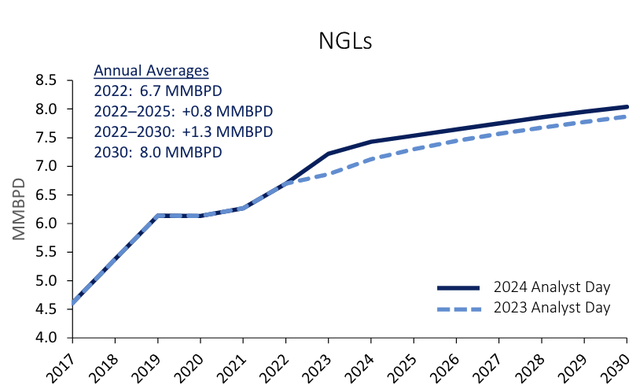

This implies the potential for the Bahia pipeline to have sufficient capacity (when upgraded) to accommodate several additional gas processing plants. This would also imply the need for at least one and possibly two additional fractionation facilities. This falls right in line with the company’s projection for NGL production in the later stages of this decade.

EPD NGL Projections Through 2030 (EPD Investor Presentation)

Don’t Forget About SPOT

In my last article on EPD, I really focused on what the potential impact the SPOT project could have for EPD long term. Since then, the project still has not reached official FID, but the company was able to provide additional details how contracting was progressing and when they expected to formally issue FID for the project during the Q1 conference call.

Brent Secrest – Chief Commercial Officer

We expect to have two contracts by the end of call it next month. And then we’re in ongoing discussions with other counterparties to commercialize that. But, yes, the mindset is, we’re not going to move forward on that project until we have the contracts to support that project.

I think we’d like to target before the end of this year to go forward on that project.

In a similar pattern to the domino effect created in the NGL value chain, SPOT has the potential to have the same effect in the crude pipeline network. I previously projected that SPOT has the potential to add $900 million in gross operating margin through 2028 (after the three year building period).

A Long Run Way For Distribution Increases

In my previous analysis I assumed the company continued its historical performance of achieving 13% ROIC from its growth projects. Using the NGL build out estimations provided above, I have updated this projection.

The projected performance of the NGL projects have increased my forward GOM projections by $550 million. This would allow EPD to sustain a 5.5% CAGR through 2028. This growth rate would exceed the company’s guidance to grow the distribution by 5%. To me, the provides a fair amount of safety margin, should certain assets underperform, that EPD can sustain its target of 5% annual distribution growth.

| 2023 Gross Operating Margin | $9,375 million |

| NGL Projects GOM Impact (2026) | $1,300 million |

| SPOT and Crude Pipeline GOM Impact (2027) | $900 million |

| Remaining CAPEX GOM Impact (2026-2027) | $650 million |

| Total | $12,175 million or 5.5% CAGR |

More importantly, one of my favorite things I like to highlight about EPD is that it’s not just yield play. Over the long term, the unit price follows the yield. Therefore, as the yield continues to grow, I expect the unit price to continue to appreciate in a similar manner to how the stock has performed over the last three years.

Valuation

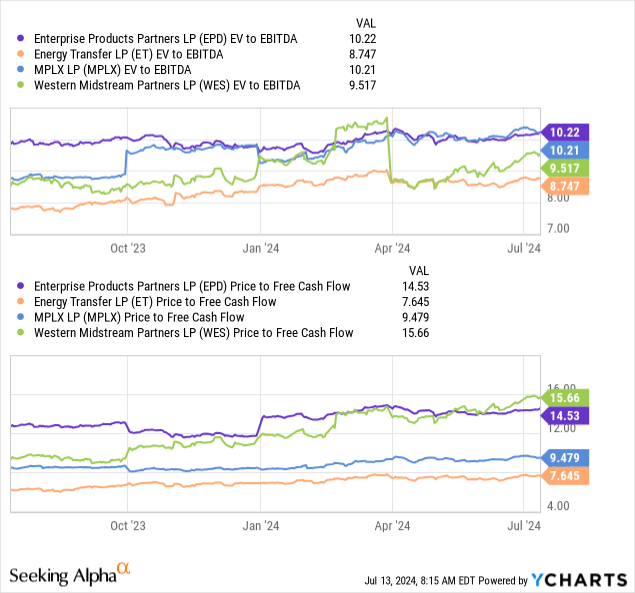

The outlook for the company, combined with a 26 year track record of raising the distribution make for a powerful thesis for ownership of EPD units. However, with consistent performance typically comes a higher price tag. When measuring the valuation metrics by both EV to EBITDA and Price to FCF, EPD is one of the more expensive options out there in its peer group.

NOTE: The peer group was selected using large cap master limited partnerships only. C-Corps were not used in the comparison.

EPD is also has the lowest yield of the four companies compared here. However, the track record combined with a high level of distribution coverage and my financial projections above give me confidence in EPD for the long term.

The company is conservatively managed and operated for on a multi-year horizon. I believe EPD still represents compelling value to long term value for income oriented and dividend growth investors alike despite the expensive valuation compared to peers.

Risks

The growth trajectory I have outlined here implies the successful completion of over $10 billion worth of capital growth projects that are in various phases of completion. There are any number of regulatory or physical challenges that could delay and/or drive up the capital costs of these projects.

In particular, the assumption of SPOT entering operating is the largest singular risk in this analysis. The project has not formally reached FID and construction is yet to begin. Should this project not reach FID or be meaningfully delayed, this would significantly alter the financial model provided above.

In this scenario, investors would most likely face a stunted distribution growth rate. The company would also potentially trade at a lower multiple due to lower growth expectations.

Investor Key Takeaways

1. The NGL value chain represents the bulk of EPD’s earning potential.

2. Significant growth can be realized from the current projects under construction in the NGL segment.

3. With the addition of SPOT, EPD should be able to maintain a 5% distribution growth rate through 2028.

4. The unit price usually follows the distribution. Investors can expect capital gains as well as yield with EPD.

5. I maintain my BUY rating for income and dividend growth investors.