PM Images

Dear readers/followers,

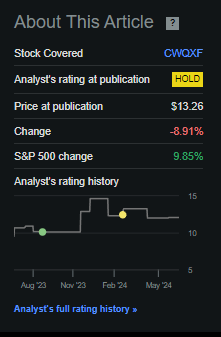

In my last article, I did something fairly noteworthy when I downgraded Castellum (OTCPK:CWQXF) (OTCPK:CWQXY) and my expectations for the company. Nonetheless, I believe myself a capable analyst when it comes to Swedish real estate and its fair value. I take comfort in the fact that my recommendation for the company resulted in at least a 4-year positive trend (relative to that recommendation), in that the company dropped almost double digits and underperformed the S&P 500 by double digits since that time.

Seeking Alpha Castellum RoR

I went ahead and sold my stake in Castellum a long time ago – when the company still traded well above 200 SEK for the native, compared to the 139 it does today. I sold some puts and options against the stock a year ago and made some money off that, but withdrew from that as well as the company went up above 110 SEK.

That’s where I stand today.

My reasoning for this was that the company has fundamentally changed, from a very safe dividend-yielding forever-stock to a somewhat riskier play under new management and following a management “battle”. New management seeks to, in my estimate, change how Castellum operates and the appeal of the stock, and my interest in owning a low-growth, 1-2.5% yielding Swedish real estate company remains very low.

Because that is where I believe Castellum is going.

Find my last article here – in this one, we’re updating on the company and where it might go.

Castellum – attractive fundamentals, but unappealing upside with an uncertain dividend potential.

First off, I believe there are better European real estate investments with better risk/reward ratios than Castellum. That’s why I no longer own any stock in Castellum – and I’ve been covering Castellum for a number of years, from when the company was still actually attractive.

Let me be clear; Castellum was a 5%-yielding stock when I owned it, and with a YoC of almost 6%. I do not believe Castellum will ever really go back to being that.

This doesn’t mean it can’t ever be attractive or investable again. Anything has a price where I would buy it (sometimes that price is negative – i.e., they have to pay me to take it), and in Castellum’s case, I maintain that this price is the native at double digits.

The company can still be seen as a “good business”, but there are now multiple caveats to that assumption that some make, or this “statement” (which some make it as). We have 1Q24, with the 2Q closing in and becoming relevant soon enough.

But even as of 1Q24, weakness is starting to show. While NOI is up and property management income is up, cracks are starting to show in the company’s bottom-line trends. I’m talking about an income decline, but I’m also talking about a near-1% change in property values on the negative side.

I’m also talking about the fact that Castellum, which once was the most conservative RE in Sweden, now has an occupancy of 91.6%. There are many office REITs in the US that sport substantially better occupancy rates – as well as healthcare REITs, apartment REITs, and many other European REITs and RE companies as well. Anyone in Sweden who is focusing on Castellum is blinding themselves to the appeal of a broader, more international market. That is my view.

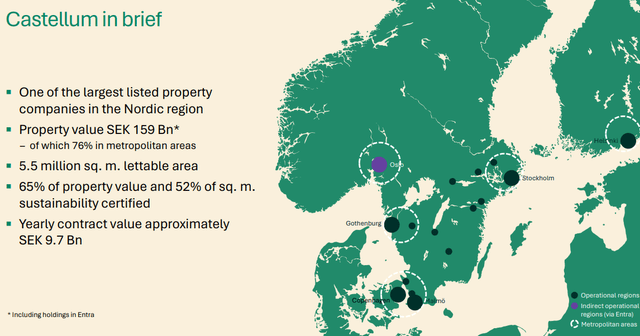

Castellum IR

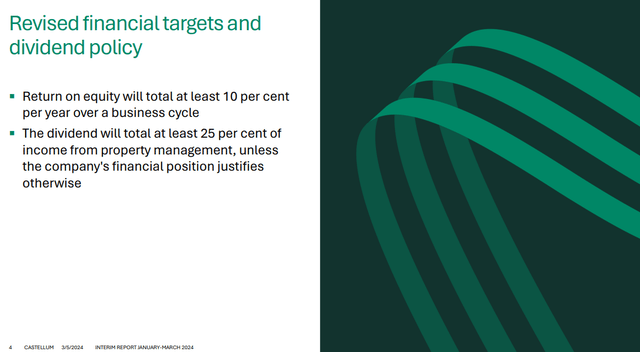

The company has now also declared its dividend goal – and it’s with that in mind that I show you my expectations for the targets.

Castellum IR

This means that Castellum is turning into a much more conservative, much less shareholder-friendly business – as was my expectation after the takeover. The only shareholders that will enjoy the fruits of this, in this interest rate environment, are those with substantial assets to consider low single-digit yields attractive in context without good potential for capital appreciation.

I am not one of those.

The company is also facing issues with occupancy, as mentioned, and is focusing on retaining existing tenants and leasing vacant spaces. There’s also substantial talk of recycling capital through divestments. And let me assure you that CRE at today’s risk/reward and financial situation in Sweden is typically not being sold at a massive premium.

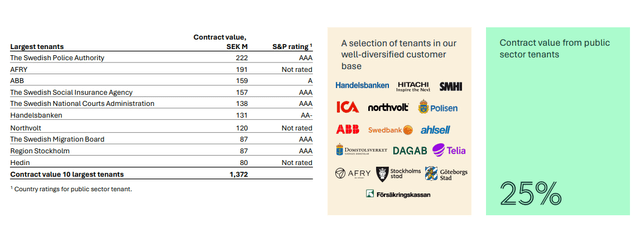

Once, Castellum was 35-40% public tenants. That is now down to 25%, and some of those are questionable as well (in how long they remain), given how much change has been going on in Castellum.

Castellum IR

P&Ls are not a pleasant read this quarter. Income is down despite operational efficiencies coming in. Most of the OpEx declines were electricity – not something the company had a hand in exactly – but the reduction in debt and loans has resulted in less interest expense – and this is of course a positive. It’s one of the few positives to take away from what Castellum has done – the leverage is now substantially reduced.

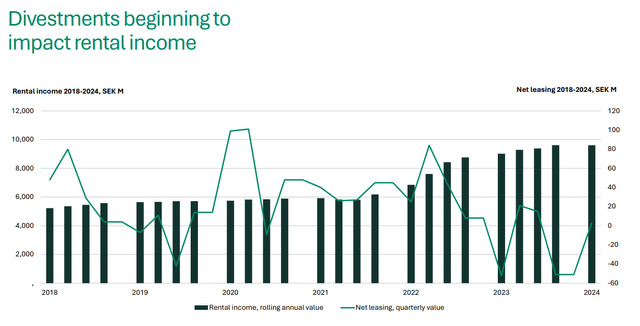

The aforementioned divestments are starting to impact the bottom line in rental income. This is also likely to continue on a forward basis – so, as they say, the “pain is not over” here.

Castellum IR

And it’s anyone’s guess when the company’s portfolio is “through” being revalued. Not now, at any rate, with the property portfolio value being down almost 1B SEK. While declines seem to have tapered off in some cases, the valuation yield is unlikely to grow, and value changes are likely to continue for some time.

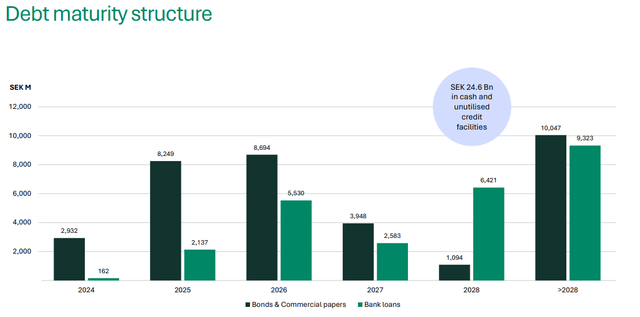

LTV is actually up YoY, with interest rates up to 3.1%, and a Baa3 stable rating and outlook. The company has short maturities even compared to most US REITs, at 4.3 years, and fixed interest at 3.3%. Only 64% is hedged, and the company’s debt is barely down half a billion, with 61.1B SEK of liabilities.

Debt maturities are not as good as some US REITs either, with close to 20B SEK between 2024-2026E.

Castellum IR

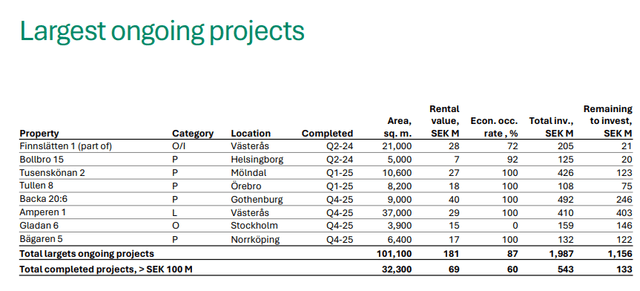

Obviously, the company is not in any fundamental danger at this time, but I also wouldn’t say that the company is in any sort of positive situation here either. The company’s new properties and projects are so-so attractive. Here is a list of them.

Castellum IR

Some of them at excellent percentages, but portfolio-wide at 87% with a WALT of 6 years. Again, there are better companies out there. I review many French and Spanish REITs – I consider them to be better positioned (by far) and more appealing than Castellum in every way here.

So – no – I still do not consider Castellum to be all that attractive here at the half of 2024 and going into 2024 2Q.

In fact, I consider one of the best moves over the past 5 years to be the sale of Castellum at 210.50 SEK, where I not only locked in substantial profits following COVID-19 but also avoided all of the drama and devaluation that occurred afterward.

The company might become more attractive in the future, but it would require a substantially lower valuation for me to be interested in purchasing its stock.

Castellum valuation – Still not much to like if we move conservatively and compare it to the rest of the market.

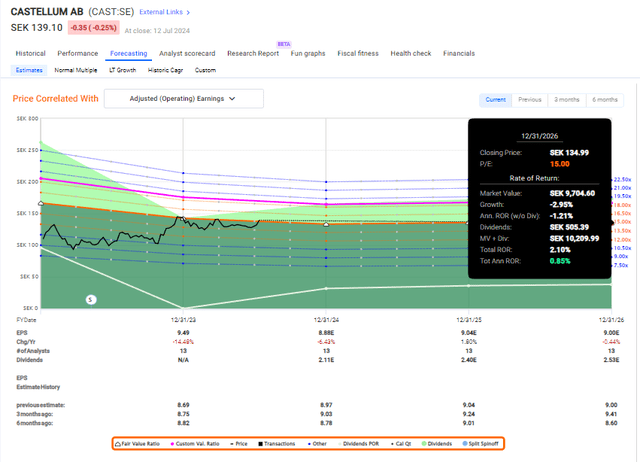

Castellum was at a PT of 140 SEK in my last article. The company has almost reached this. I was also very clear in that article that if it goes above 120, putting options or buy-writes is the way to go for me here. My current set will expire within a few months, at which point, I’ll be able to, if I want to, write new ones. Whatever common shares I bought below 120 SEK are now sold as well. Because my previous PT was 140, but I now hold a far more negative view on the company than before, I’m lowering my Castellum PT to 130 SEK, representing a 15x P/E for 2026E. P/E because Castellum is not a REIT – Sweden does not have REITs, and as such, evaluating them on that basis does not work the same way.

The current estimate for the dividend starting next year is 2 SEK (Source: Paywalled FAST Graphs link). That means that the implied yield at today’s price is 1.43%. Are you starting to understand why I’m not that positive about the company?

In fact, let’s say you were to estimate the company at 15x P/E forward, even with the supposed next-year dividend, that’s not even 1% per year.

FAST Graphs Castellum Upside

Again, it’s hard to find a nice upside here. In my last article, I said the following about Castellum and its dividend.

But when the dividend gets reinstated, I don’t see that level being close to 6 SEK or even 4 SEK, as is forecasted here. I would say a 1.5-2 SEK level, paid quarterly, is the most likely outcome as the company’s management has made their conservative approach very clear. That would put the company at a 2% YoC or less today.

(Source)

So this estimate, and my knowledge of how these companies and their management consider things, is something I know well. As before, I want to clarify that there is an earnings decline expected for Castellum as a result of the company’s asset recycling trends. We’re expecting a 5% earnings decline, followed by slight stabilization and 1-2 growth. Whatever dividend the company chooses to go by will not be enough to offset this. What’s worse, I believe this decline to be very likely.

For all of those reasons and the fact that we now have an official estimate backed by company data for the dividend, I choose to cut my company target here. It is now at 130 SEK, which at this time makes this company overvalued.

For that reason, my thesis is as follows.

Thesis

- I sold Castellum at a significant profit, and I am very happy that I did so. It was perhaps the best example of me following my “SELL”/Trim rules when a stock becomes overvalued. The capital I reinvested from Castellum has stayed relatively stable and has not declined over 45% since. The company remains a business with a solid asset portfolio but has taken damage from the management/trust perspective, and I am unwilling to move any closer here with my capital until I see some signs of things calming down.

- My later approach in 2023 involved writing medium-dated CSPs with strikes at least 15-20% below the current share price, and I did so successfully for 3-4 months without a single assignment.

- I am now bearish on the company at this price, and I would say put options are the way to go here if the price is above or around 120 SEK. The common shares work at this PT of 130 SEK/share long-term.

- I’m keeping “HOLD” in my rating for Castellum. I do not believe the company makes for an attractive play here, and I would look elsewhere.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I view the company as a “HOLD” due to the company’s results and outlook.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.