Shutthiphong Chandaeng

An emerging share cannibal

Nexxen (NASDAQ:NEXN), previously Tremor International, enters 2024 as a profitable company with the potential for accelerating growth and almost 35% of its market cap in cash. It has a highly competitive offering in the market, and now with its technology stack completely built out through acquisitions, the main use of its excess cash will be on buybacks. At its current valuation, buybacks are highly accretive and more than a third of the outstanding shares can be retired with existing cash and expected cash flow generated this year. I have bullish view on Nexxen’s future and therefore rate it as a BUY.

Nexxen’s competitive edge in the digital advertising market

Company investor presentation

Since 2017, Nexxen’s management team has successfully integrated multiple acquisitions as shown in the figure above. Now under the new Nexxen brand, they have constructed an advanced advertising technology stack. In its recent earnings press release, CEO Ofer Druker stated that the cumulative R&D investments by Nexxen and all the companies under its umbrella is estimated at roughly $1 billion, and has resulted in the creation of a unified technology platform which offers a broad range of advertising services. Nexxen’s differentiation when compared to other solutions in the market is its data platform, which is a bridge between its very own Demand Side Platform (DSP) and Supply Side Platform (SSP) as visualized below. This gives advertisers the invaluable ability to reach their target audiences without cookies.

Company investor presentation

The three key components within Nexxen’s technology platform as described by its Chief Product Officer Karim Rayes during their Q4 2023 earning call are its DSP, its Cross platform planner and its Discovery platform. Below I attempt to briefly describe them, along with their significance.

Nexxen DSP

The Nexxen DSP is a combination of its previously existing Tremor DSP and the Amobee DSP which it acquired in Q3 2023. The addition of Amobee’s DSP solution has further enhanced its existing DSP capabilities.

Cross platform planner

The Cross platform planning tool enables Nexxen’s customers to plan their campaigns across both linear and digital TV, as viewers and correspondingly ad budgets gradually move from traditional linear TV to digital.

Nexxen discovery tool

The Nexxen Discovery platform is at the centre of the platform with publishers and advertisers on either side of it. By acting as a bridge between the supply side and the demand side, it is able to use customer data from different sources such as the internet, social media, TV and other first-party data. This is a part of Nexxen’s solution to target users without the use of cookies.

My expectations for 2024

FY 2023 contribution ex-TAC for Nexxen landed at $314.2 million. This was considerable underperformance compared to their initial guidance for $400 million. Throughout the year, the business faced setbacks due to existing clients reducing spend on the platform by as much as 25% due to the overall macro environment. Moreover Nexxen also dedicated a lot of its effort on the Amobee integration and its go-to market strategy which impacted sales in the near term.

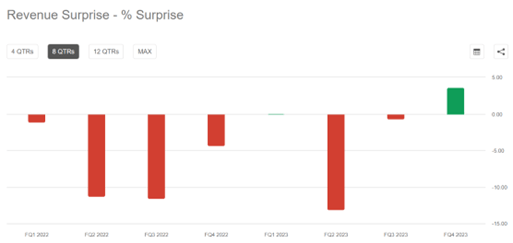

Seeking Alpha

As shown in the figure above, Nexxen has disappointed the market with a series of revenue misses and guidance cuts starting from 2022 and throughout 2023. In addition to losing confidence in the management team, this has led to the market also questioning how strong its core business is, and whether it was capable of achieving any organic growth going forward. Since Nexxen did not break down the contribution from Amobee, Q4 2023 marks the first quarter in which numbers presented were purely organic. Though year over year growth was at -11%, there were green shoots in the last quarter where Nexxen beat their guidance handsomely and provided guidance that suggests that the business will show accelerated growth starting from Q2 2024, as shown below.

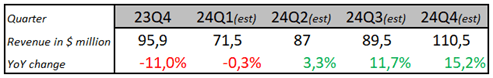

Analyst estimates from Seeking Alpha

This year Nexxen should benefit from advertising spend improving amidst a more favorable macro outlook. Being an election year, political advertising will also provide a strong tailwind for Nexxen, especially with its recent cross-platform tools for linear and digital TV. Moreover with the rebranding completed and their go to market strategy set, the focus can now shift more towards increasing sales.

Attractive valuation in both relative and absolute terms

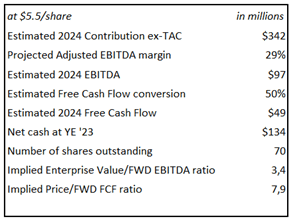

In my valuation model shown below, I have estimated 2024 revenue ex-TAC at the midpoint of management’s guidance. This implies an expected revenue growth rate of 9% for 2024 versus 2023. Management has guided for adjusted EBITDA at close to $100 which is roughly where Analyst’s estimates stand. Adjusted EBITDA to Free Cash flow conversion for Nexxen has historically been above 60% of EBITDA, but I have conservatively chosen a 50% margin, estimating that Nexxen will generate close to $50 million in Free Cash Flow this year.

Author’s estimates and valuation

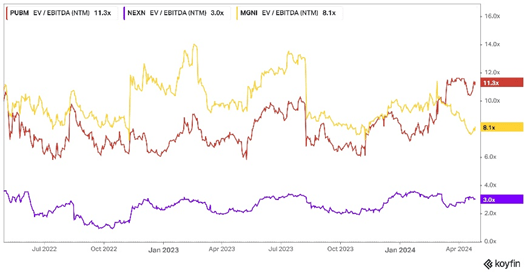

Due to the ongoing reduction in share count due to buybacks, earnings and FCF per share are expected to outpace revenue growth. With my conservative estimates, Nexxen is trading a Forward EV/EBITDA ratio of 3.4 and at a Price/FCF multiple of just below 8. This valuation is much lower compared to other relevant Adtech peers such as Magnite (MGNI) and PubMatic (PUBM) which trade at forward EV/EBITDA multiples of 8.1 and 11.3 as shown in the figure below.

Koyfin

Historically I believe the discount was warranted due to the lack of organic revenue growth at Nexxen. However going forward, this discount should shrink as Nexxen’s growth accelerates. Moreover, as highlighted by fellow Seeking Alpha contributor Michael Wiggins de Oliveira in this article, purely supply side platforms like Magnite and PubMatic are coming under threat due to large publishers and broadcasters directly dealing with demand side platforms like The Trade Desk (TTD). A major advantage for Nexxen is that it has both supply and demand capabilities within its technology platform. On the whole, I believe there is plenty of room for Nexxen’s valuation to grow and catch up with its peers.

Share buybacks as the core driver of this thesis

On their Q4 2023 conference call, management stated that there was no plan for any acquisitions in the near-term, as they believed that all the critical tech components the business needed were already in place. They further stated that besides investments in internal growth initiatives, cash generated from the business will be deployed towards share repurchases. At the prices where the stock trades at today, buybacks are highly accretive and more than a third of the outstanding shares can be retired with existing cash and expected cash flow generated this year. On December 20 2023, the company launched a $20 million share repurchase program which ended last week with the entire amount being spent. Management has a history of opportunistically repurchasing shares and I believe launching further repurchases at these prices is warranted and is something investors can expect from management at their next earnings call in May.

Risks to the thesis

No improvement in organic growth

As presented above, negative growth rates seem to have bottomed with the business inflecting towards organic growth in Q2. Investors should track that management continues to meet and exceed their guidance for the upcoming quarters.

Competitive threats

The AdTech industry is highly competitive and Nexxen has a competitive offerings with its end to end platform which positions it well against competitors which are more one-sided. However going forward, if Nexxen fails to grow and loses market share it could mean that their offering is not gaining traction in the market.

Poor capital allocation

During 2023, it become evident that Nexxen had overpaid for its $239 million acquisition of Amobee in 2022 (almost the entire enterprise value of Nexxen today). It was poor capital allocation by management as Amobee was unprofitable and its revenue had been shrinking. Management has recently highlighted that it is not planning for any acquisitions in the near term and will instead deploy its excess cash on buybacks. Therefore the risk is low that they still make an acquisition and end up overpaying for it.

Sensitivity to macro headwinds

As seen in the past couple of years, Nexxen’s customer spend is very macro sensitive and if the macro picture was to change in a negative way, it could affect Nexxen’s ability to meet its guidance this year.

Conclusion

Despite the business being on shaky ground in the last couple of years and the share price losing more than half its value, 2024 promises to be the year where the Nexxen finds its footing and delivers organic growth. Its strong cash position coupled with its expected free cash flow generation, leave room for a significant amount of share repurchases. Though some risks with regard to the business and management’s execution exist, I believe its attractive valuation gives investors a favorable risk/reward at this price.