lisegagne

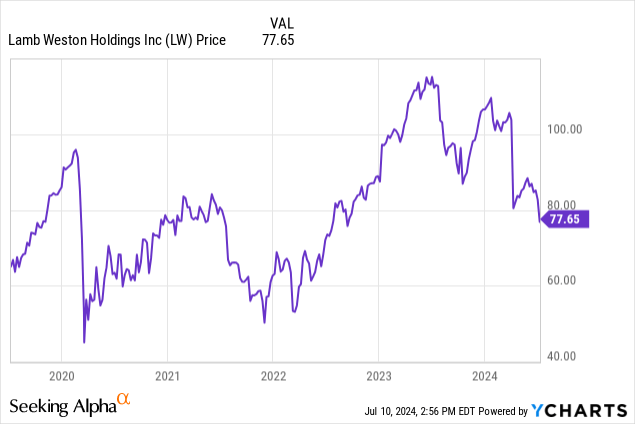

Shares of potato processing company Lamb Weston (NYSE:LW) plunged more than 20% on its most recent earnings report. And, after a brief bounce, the stock has resumed its downtrend, falling to new 52-week lows over the past few days. Additionally, shares are now back below where they traded back at the start of 2020:

Given my interest in the packaged foods space, Lamb Weston is the sort of company that might seem to be right up my alley.

I’ve never owned Lamb Weston stock or been especially keen on the company as a potential investment, however. I’m not convinced that there is a particularly large moat around the sourcing and production of French fries.

From my perspective, this looks like a classic commodity business that investors were assigning a premium multiple to because it sort of resembled a branded consumer products company.

That said, the company has this amusing slide about its history of innovation which I must include:

Lamb Weston’s history of innovation (Corporate Presentation)

In my opinion, despite breakthroughs such as “Grown in Idaho”, Lamb Weston is a commodity producer; it should generally trade more in line with other commodity food names such as the meat processors like Tyson Foods (TSN) or a Dole (DOLE) in fruits and vegetables.

My guess would be that French fry buyers such as McDonald’s (MCD) don’t care too much about the potato sourcing beyond which product is cheapest. That’s unlike something such as soda where Coca-Cola (KO) and PepsiCo (PEP) have proven they can maintain huge pricing premiums over generic versions of soda.

Has Lamb Weston Fallen Enough To Make The Valuation Compelling?

Back in 2020, I had no idea why people were paying such a high price for Lamb Weston. I found the valuation utterly baffling.

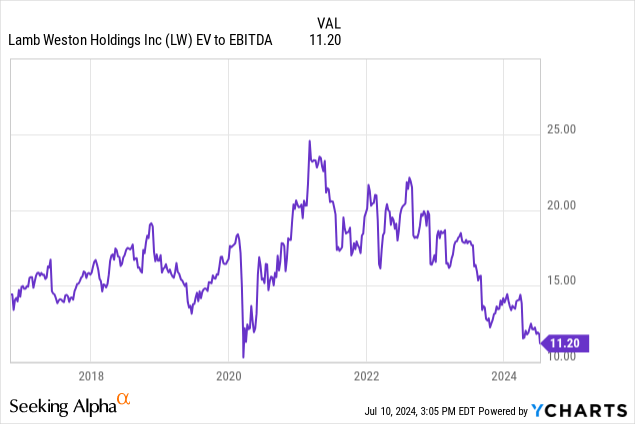

Since then, however, the company has grown revenues more than 50%, and profits are up considerably. On an EV/EBITDA basis, the stock is selling near its all-time low price:

At some point, the value hunters have to get interested, right? Sure, but I’m not confident it’s at the current price. The reason why: Profit margins.

Lamb Weston Has Already Recovered From The Recent Industry Slump. Its Peers Haven’t.

It’s no secret that many consumer staples companies in general and packaged foods companies in particular have been having a tough time over the past couple of years. Despite all the popular outrage around higher food prices and so-called “shrinkflation”, food companies in general haven’t actually benefitted from the current inflationary environment. If anything, many food and beverage companies saw their profit margins fall as the costs of inputs, labor, packaging, freight and so on rose more quickly than the price that the companies could, in turn, charge for the finished food products at the grocery store.

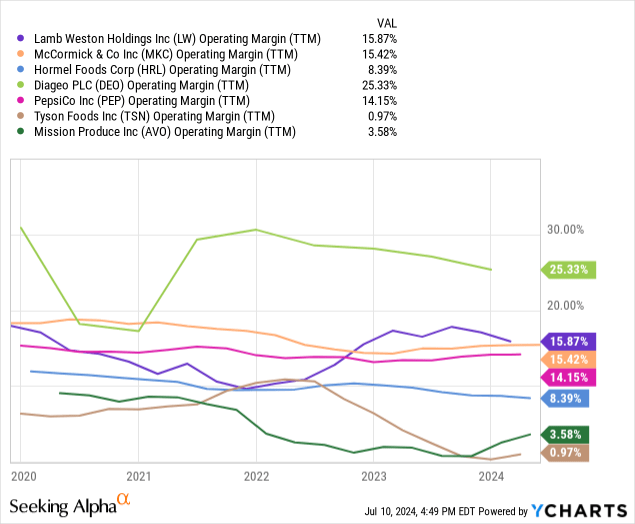

As it would turn out, Lamb Weston has already seen its profit margins recover from the pandemic-era downturn, whereas much of the industry is still seeing margins near decade-low levels. Here is operating margin for a broad spectrum of food and beverage companies from the onset of the pandemic through to the most recent available data:

As you can see, Lamb Weston (purple line) saw its operating margin dip from 17% to 10% and has subsequently recovered nearly all of that margin compression.

That’s in sharp contrast to firms like Diageo (DEO) and Hormel Foods (HRL) whose margins continue to dip, or a company like PepsiCo (PEP) whose margin has stopped falling, but which are taking a long time to recover to prior levels. And in the worst case, more commodity-focused firms such as Tyson (meat products) and Mission Produce (AVO) (avocados) saw their operating margins essentially disappear entirely in 2023 amid severe commodity price pressures.

Given this context, I’d argue Lamb Weston only appears to be cheap because it already clawed back most of its margin losses while its peers by and large have not. By contrast, I’d argue the real money will be made in buying the companies like Diageo, Tyson, and Hormel Foods that haven’t turned the corner yet and will have a much bigger pop in both earnings per share and sentiment once they inflect.

In the case of Lamb Weston, their sales are very much tied to fast food. Fast food and fast casual restaurants sell French fries, and so Lamb Weston enjoyed a swift recovery from the pandemic as that segment recovered more quickly than many other parts of the food and beverage ecosystem.

Furthermore, potatoes are relatively easy to grow, and the U.S. isn’t reliant on imports from Ukraine or other challenged areas and so the potato market never got as severely out of whack in the same way that many other commodities did.

Lamb Weston enjoyed a strong recovery and got their margins back up quickly and the stock hit new all-time highs in 2022 as a result.

That’s in sharp contrast to companies that make more expensive/nutrient-dense foods such as Hormel. Items like pork belly, almonds, or avocados cost much more than potatoes and are harder to source in bulk during a crisis such as a global pandemic or land war in a major agricultural region.

As such, Lamb Weston bounced back first and has already achieved nearly full margin recovery whereas companies with more intricate supply chains like Hormel and McCormick (MKC) are still working to adjust to the new market conditions.

With Lamb Weston, however, they’d already extracted the full margin recovery possible from where they were pre-pandemic. Investors going into the most recent earnings report were betting on things remaining essentially as good as they would get for this business. When that didn’t happen, that’s how you get Lamb Weston’s sharp year-to-date drawdown.

In addition to Lamb Weston’s 2023 margin recovery petering out, Lamb Weston also made a blunder with its new enterprise resource planning “ERP” system.

There’s an old adage on Wall Street. You should always be careful companies when they are installing a new ERP system. Frequently, some sort of big oopsie occurs. In this case, Lamb Weston bought approximately $90 million worth of potatoes beyond what it needed and had to eat the loss.

Lamb Weston’s Bottom Line

The bigger takeaway, though, is simply that consumer staples stocks are trading with a hyper-focus on quarterly earnings and profit margins at the moment. The sector is out of favor here, so investors will sell on any sort of bad headline. Lamb Weston had already bounced back to pre-2020 levels of profitability, meaning it had unusually high expectations compared to the rest of the industry.

In other cases, like Hormel, McCormick, and the alcoholic spirits companies right now, margins are temporarily depressed. And it’s my contention that there is a high degree likelihood that margins will go higher over the next 12-18 months. That sets up an asymmetric favorable situation.

On the flipside of that, I would be very cautious holding consumer staples company that are already earning their pre-pandemic margins. As we saw with Lamb Weston and also firms like Hershey (HSY) which have slumped over the past year, any decrease in margins is causing stocks to get walloped in the staples space.

For LW stock specifically, I have a cautious view heading into this next earnings report. I don’t think the stock is especially cheap at this valuation as compared to the brutal drawdowns seen across much of the industry. LW stock is cheap compared to its prior valuations, I’ll concede that, but so is the whole food and beverage space. I’m not sure if Lamb Weston has fully recovered from its ERP system blunder. And recent pricing data across the industry suggests that there is not much room for pricing increases in food right now, further limiting the near-term upside for Lamb Weston.