Oselote

Introduction

Catching the artificial intelligence wave felt impossible after missing the initial surge. Stock prices surged almost too much, and valuations seemed high.

However, quality stocks with decent AI exposure kept going up and investors kept investing without caring for the price. A well-known example is NVIDIA Corporation (NVDA) which is up 161% year-to-date at the time of this article’s writing, after the 236% increase in 2023. The stock seemed untouchable in January and still seems so now.

However, this is not a good way of evaluating stocks. As long as companies are not priced accurately based on their projected earnings, there may be room to run for them. The reason all these companies surged so much in price was not purely hype, fundamentals have been significantly improving as well.

That is why I started having a look at these companies again. Amazon.com, Inc. (AMZN) was my first buy article in the AI space, and I highlighted my interest in companies building artificial intelligence infrastructure.

Today, we are discussing one of them. Super Micro Computer, Inc. (NASDAQ:SMCI) (NEOE:SMCI:CA) provides essential products to enable data centers and new, advanced technologies. Its stock has been on a strongly increasing trend since January 2023. With this article, we’ll discover if this trend may continue.

The company still benefits from strong tailwinds and is likely to continue to do so for the foreseeable future. Demand for data centers is still increasing, and the company remains a leader with innovative solutions.

However, based on my DCF valuation, I believe the company is priced for perfection and it is tough to find an upside with a comfortable margin of error. That is why it receives a “Hold” rating until a more comfortable entry point.

Understanding The Business

Although Super Micro Computer is a well-known name, I believe it is important to have a good understanding of the business and its drivers.

The company calls itself a “provider of accelerated compute platforms”. Underneath these words, there is a company selling server and storage systems for data centers, cloud computing, edge computing, 5G, and artificial intelligence (“AI”).

These products include servers, storage systems, blades, workstations, full rack scale solutions, networking devices, server sub-systems, server management, and security software. These solutions can be customized based on the customers’ needs.

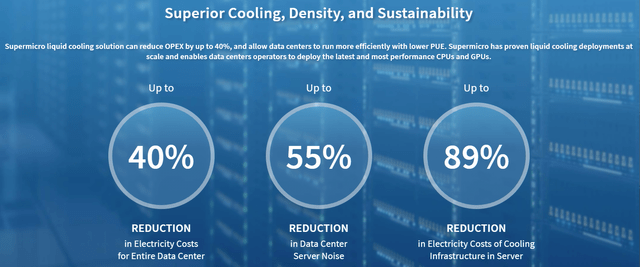

We’ll discuss this in more detail in the “long-term drivers” section, but one of the largest business propositions SMCI has is reducing the cost of operating data centers through cost- and energy-efficient products. This is a big motivator for data centers to choose SMCI’s products.

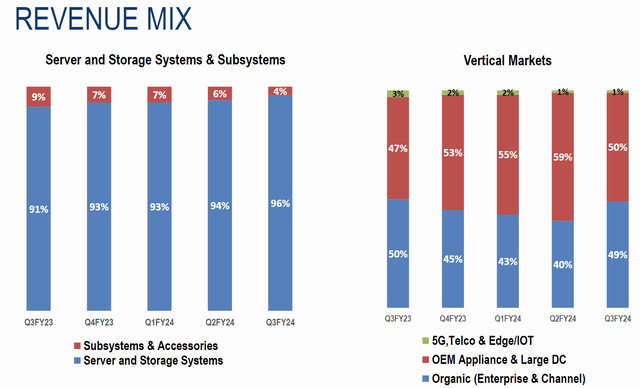

As of Q3 2024, 96% of the company’s revenue was generated through server and storage systems sales. Additionally, while sales to the communications sector were not significant, half of sales were to data centers and OEMs, and the other half were to companies investing in their IT capabilities, and other distributors and partners.

With the need for more data centers, SMCI has seen strong demand for its products. With this demand, its revenue jumped from $3.5 billion in 2021 to $7.1 billion in 2023, and its gross profit jumped from $530 million to $1.3 billion in the same period.

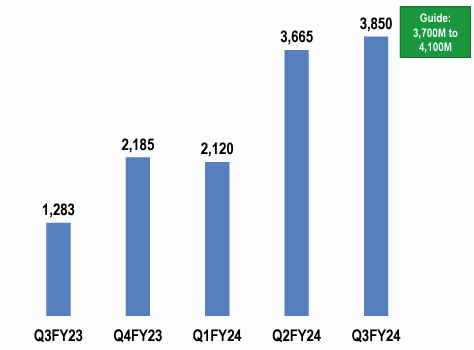

This trend continued this year. The company reached an impressive $3.85 billion in sales in Q3 2024, increasing 200% year-over-year.

SMCI Q3 2023 Presentation

Competition

SMCI aims to be the world’s leading provider of solutions using accelerated, application-optimized compute platforms offering servers, storage, and networking. To say the least, this is a crowded space with many established players.

The company calls companies like Cisco Systems, Inc. (CSCO), Dell Technologies Inc. (DELL), Hewlett Packard Enterprise Company (HPE), and Lenovo Group Limited (OTCPK:LNVGY) competitors. However, SMCI has certain competitive advantages over these companies.

The largest advantage is the niche that SMCI focuses on. Cisco, for example, has lacked innovation and now finds itself overconcentrated on traditional IT spending, as I discussed in a recent article. Dell and HPE also suffer from the same problem.

SMCI, on the other hand, has shown its ability to innovate and offer leading solutions specific to data centers. Revenue mix from OEMs and data centers reached 59% in Q2 and fell back down to 50% in the most recent quarter. Its sales channels to data centers are active and generating massive earnings, unlike its competitors.

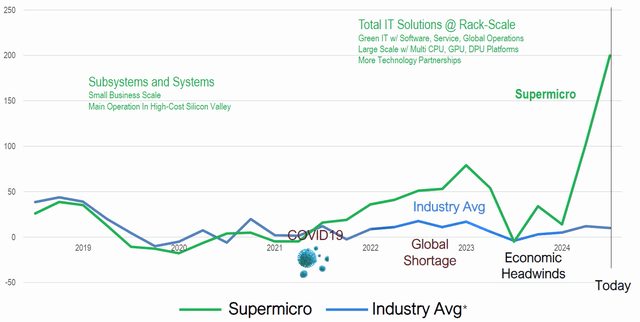

Thanks to this, the company managed to outperform its peers by a huge margin, especially in 2024.

SMCI’s focus on internal R&D and manufacturing is another advantage. All servers are tested and assembled in-house, and more than half of the final server and storage production is completed in SMCI’s facilities in California. The company continues to focus on innovating, which is crucial for industries supplying products for advanced technologies.

In addition, the company’s global footprint with offices and manufacturing capacity in the US, Taiwan, and the Netherlands provides a cost advantage, as well as proximity to potential buyers.

Long-Term Drivers Are Strong

With this strong competitive position, SMCI is poised to benefit from longer-term trends the most. I will discuss trends around data centers first, as the demand from them keeps increasing.

Simply put – the world needs more data centers. Technological advancements are pushing the existing capacity to its limits. Artificial intelligence models are trained on massive data sets that require more space to be stored and processed. As these models improve and users build more models, this space requirement will only get bigger.

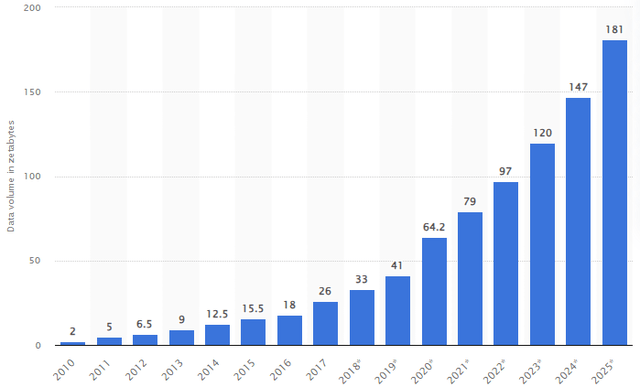

This data generation trend is not only driven by artificial intelligence. Using the internet, creating content, texting a friend, and sending an email all generate data that needs to be stored somewhere. The “cloud” is essentially a physical server operating in a data center. Even without technological advancements, it is certain that we need more data storage capacity. According to the latest estimates, we create 402.74 million terabytes of data every single day.

The annual data volumes and how fast it is growing can be found below.

SMCI is becoming even more essential for data centers thanks to its innovation. The company’s direct liquid cooling solutions can cut electricity costs and reduce server noise significantly. It is currently the only server company that can provide this solution, which is a huge short-term driver of growth.

Beyond data centers, SMCI’s products are essential for high-growth technologies like cloud computing, 5G, and edge computing. For example, edge computing is necessary to build more effective city traffic management. This may take years, but as we eventually transition to autonomous vehicles, edge computing will be part of our daily lives.

SMCI will still be there to enable all these technologies.

Bearish Scenario

Most consumer-exposed companies faced a common problem after the initial surge in demand post-pandemic. They built up inventory to supply the demand, but when inventory was ready, demand disappeared.

Although this may seem like poor demand planning, it is very difficult to avoid overproduction when demand is skyrocketing. I fear SMCI might face a similar problem.

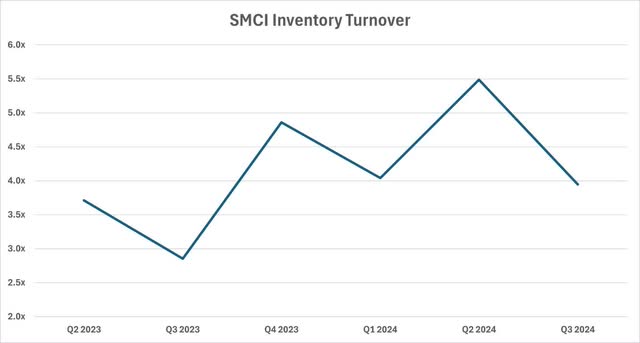

Although sales are up, inventory increased disproportionally. It jumped from $1.4 billion in Q3 2023 to $4.1 in Q3 2024. Although the inventory turnover is up year-over-year thanks to significantly higher sales, it fell below 4x in Q3 2024.

I do think that demand will be strong in the short term as investments in data centers and other advanced technologies continue. However, when demand slows down, I struggle to see a scenario where SMCI is not left with excess inventory at hand.

Additionally, expectations are now too high for the business. SMCI tripled its quarterly revenue and raised full-year guidance in Q3 2024, but even this impressive revenue was slightly below expectations. My second concern is that the company is priced for perfection, in which case it will be challenging for the company to beat estimates.

To understand market expectations, we need to dive deeper into valuation.

Valuation

We will use a Discounted Cash Flow (“DCF”) model for the fair value calculation.

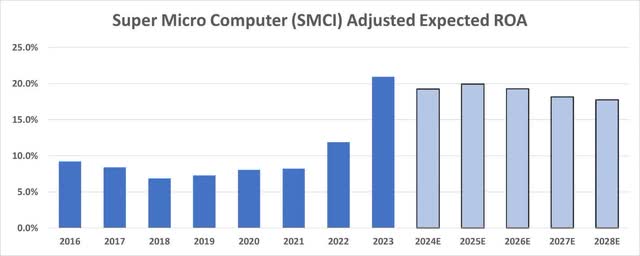

My approach to forecasting earnings involves trying to estimate how profitable the company can become and how fast it can grow. The company managed to increase its profitability significantly in 2023. I believe with current tailwinds, assuming that it will maintain these levels of ROA is reasonable. In addition, I model strong growth for the next five years.

I am using a terminal growth rate of 3%, slightly above long-term inflation targets due to strong growth tailwinds, a long-term risk-free rate of 2%, a market risk premium of 5.7%, and the stock’s 5-year equity beta.

I handle excess cash differently. Please refer to one of my older articles for a detailed description.

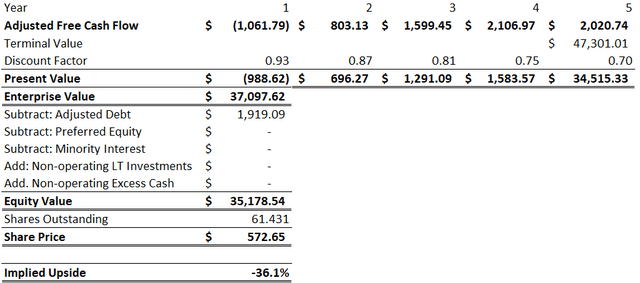

Using these earnings assumptions, we find an equity value of $35.2 billion, translating to a target share price of $572.65. This implies a downside potential of -36% at the time of this article’s writing.

Conclusion

SMCI is a leading provider of servers and other networking equipment to enterprises, original equipment manufacturers, and data centers. It differentiates itself from its peers thanks to its innovative technology and strong sales channels to data centers.

As we generate more data and need more data centers thanks to advancements in AI and other technologies, demand for SMCI’s products is poised to surge. Additionally, SMCI might take a larger share of this growing market through its newer offerings such as direct liquid cooling solutions.

I think the company will be more profitable and see higher growth going forward. However, current valuations make me pause. Even when pricing in strong growth and high profitability, the current stock price is significantly higher than my fair value calculation.

In addition, as high inventory became a problem for consumer-exposed companies after demand slowed down, I fear the same might happen to SMCI once data center investments slow down.

That is why SMCI receives a “Hold” rating. I would like to revisit this company once the price is within reasonable levels.