VisionsofAmerica/Joe Sohm

BP p.l.c. (NYSE:BP) is one of those companies that keeps announcing improvements, yet the company seems unable to let go of habits from the past. That can mean the future will be every bit as costly as was the past. I grew up with the old saying that “the players most likely to hit home runs are the ones with a lot of singles.” Many times, that was applied to industry. If they were the wrong singles (and BP has a fair number of those in my lifetime), then the possibility of a costly home run cannot be ruled out.

Management is often the biggest asset not on the balance sheet. But at times that asset is more of a liability than shareholders realize. If that is the case, then it is best to get out the popcorn and soda while enjoying the results from the sidelines, “just in case.”

BP Goals

The company listed its latest goals and objectives. Frankly, some of these should have been taken care of years ago.

BP Customers And Products Presentation (BP Website As Of July 9, 2024)

The improved safety shown above frankly should now be “maintain a great safety record.”

But for BP, that safety record seems to go in circles. The company and its partners appear to make progress, only to have something happen that puts the company back into the news. Shown next are some examples:

“Diamond Offshore Drilling rig pipe sinks to sea bottom in ‘equipment incident.'”

This particular incident involved Diamond Offshore Drilling (DO). The improvement was this time the well did not blow as well and no lives were apparently lost at the time. That shows improvement over the Gulf of Mexico spill also mentioned in the article a few years back that likely proved to be much more costly.

But the problem is that this should not be happening at all. There are numerous competitors in the industry operating without incidents like this.

“BP eyes March return to full production for Whiting refinery” – Reuters.

Now, I think the point needs to be made that some of this can happen to anyone. The issue here is that it “always” happens to BP. Put this down as yet another single, and it is a single that the company cannot afford to have happened, as it invites worse.

“Final report released in BP refinery explosion that killed brothers.”

This likely was something that Cenovus Energy (CVE) was considering when it made the offer to buy out the BP interest in the Toledo refinery before the fire. Cenovus has a remarkable safety record and has for as long as I have followed the company. Investors can just bet that incidents like this will be practically non-existent under Cenovus.

In my opinion, this is far more than what should be happening after that giant oil spill. Therefore, the danger of yet another “home run” in this area appears to be a good deal more significant than any other major integrated companies that I cover in this industry. With a record like this, the investment idea would at best have to be classified as speculative because you just cannot tell when another costly mistake will happen.

The Balance Sheet

There are signs of lax money management on the balance sheet as well.

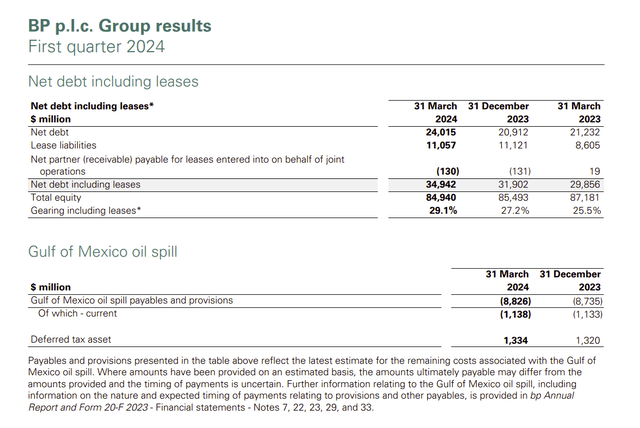

BP Net Debt And Gulf Oil Spill Payable Summary (BP First Quarter 2024, Earnings Press Release)

BP has always had a lot of cash on hand. Therefore, the net debt position itself is very reasonable. But if you look a little further, then things get interesting.

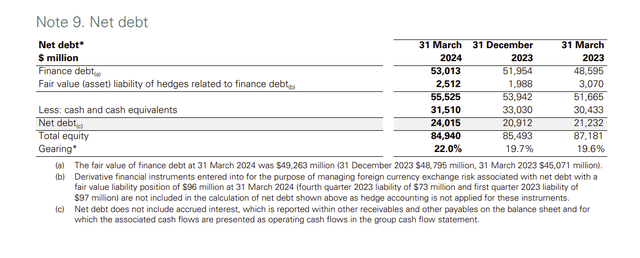

BP Net Debt Calculation (BP First Quarter 2024, Earnings Press Release)

As shown above, this company carries an incredible amount of debt offset by a big cash balance. There is every chance that this can be far more efficiently done (and likely save shareholders a lot of money) than the balances shown above.

It may not happen overnight, as something like this can be complicated to untangle. But a determined management should be able to get those balances down while calculating net debt.

Comparison To Exxon Mobil

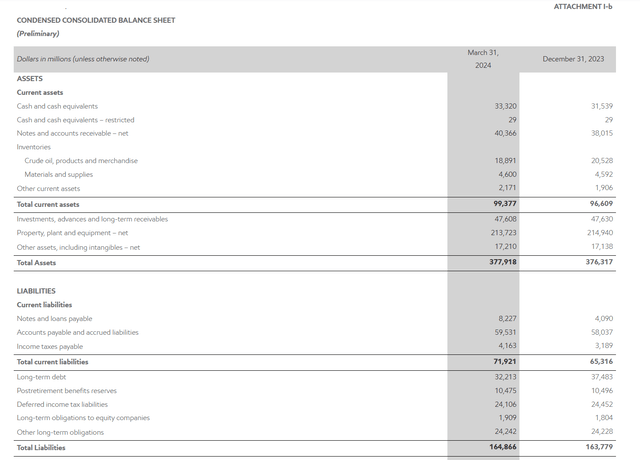

Shown below is the balance sheet for Exxon Mobil (XOM). This company has about the same cash balance but far less debt.

Exxon Mobil First Quarter 2024, Balance Sheet Exxon Mobil First Quarter 2024, Balance Sheet (Exxon Mobil First Quarter 2024, Earnings Press Release)

Notice that with Exxon Mobil (XOM) the total debt is $40 billion (both current and long term) while the cash balance is about the same as for BP. This could well mean that there are some balance sheet efficiencies that need to be worked on by BP. Exxon Mobil has actually decided to run with that cash balance because they were concerned about what happened with the commercial paper market during fiscal year 2020.

Both are international companies that likely have cash in more than one place. Handling a situation like that is a talent in and of itself. But it is a talent that should be mastered for shareholders.

Stock Price

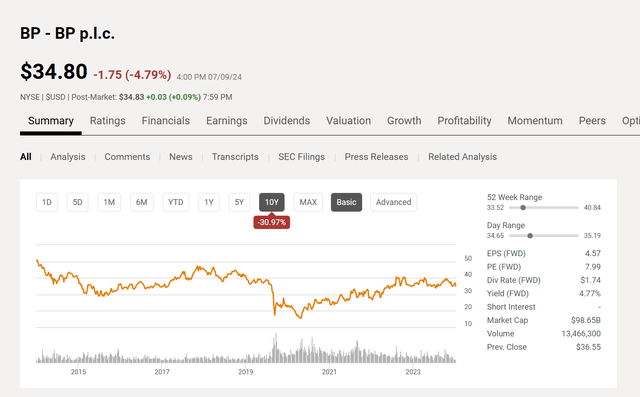

More importantly, the stock price has never really recovered from the oil spill.

BP Common Stock Price History And Key Valuation Measures (Seeking Alpha Website July 9, 2024)

Normally, one would think that the low price-earnings ratio would mark a bargain. But the constant barrage of “incidents” shown before likely has the market wondering when “the next shoe would drop.

Even the payables for the Gulf of Mexico oil spill shows a slight increase from the previous balance in an earlier slide. The whole thing appears to be a risky situation without a return that justifies the risk.

There is clearly a bounce back from fiscal year 2020. However, since then, the stock has really only reached the lower levels of the previous trading range. It is probably reasonable to expect that management would grow the business so that the stock would reach higher levels than before that big oil spill.

Summary

For as long as I can remember, BP has had a safety record that could use some improvement. That safety record has already cost shareholders once with the Gulf Oil Spill. But the incidents since then point to the fact that management does not seem to care enough about safety to prevent another major challenge.

Similarly, when one looks at the balance sheet management, it would appear that management can do better.

Evaluating management is done with what evidence is available. This is why driven (and detail-oriented) managements are so important.

The market is really not going to respond to good earnings, and it may disproportionately punish a poor earnings report when issues like this potentially overhang the stock for a while.

For these reasons, BP stock is probably for traders only, and those traders had better know what they are doing. For me, the risk of an unpleasant surprise is much too high unless this management changes its ways rapidly. Therefore, I would rate the stock as a sell, as I know plenty of companies with at least the same future prospects minus the issues discussed here (which are far more significant than the earnings report).

Risks

BP p.l.c. absolutely has to improve its safety record materially. One of the most material risks possible is an unpredictable loss caused by a less than adequate safety policy.

Asset management appears to be another area that needs improvement. Extra assets and liabilities on the balance sheet can add to unforeseen risks to shareholders. They also carry extra costs that hurt profitability.

A focus by BP on its core business is likely to result in a lot of these kinds of problems going away. Management may well be spread “too thin” for its capabilities, which results in some of what was discussed here and possibly a lot more to explore in the future.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.