alexei_tm/iStock via Getty Images

Investment thesis

PetIQ (NASDAQ:PETQ) has demonstrated strong performance in its products segment, where it distributes pet medication, supplements, and wellness related items through retailers. This includes both PetIQ-branded as well as non-branded products. The company’s gross margins have substantially increased in recent quarters as its own branded products have outperformed.

The company’s services segment, on the other hand, represents a smaller portion of total revenue (~10%), and has recently undergone a strategic shift to focus more on pet wellness needs rather than veterinary services. Management has made several optimisations in this segment with the aim of driving margins higher.

The company is valued at an EV to adjusted EBITDA multiple of 9.4 and a Price/FCF multiple of 13.2, with management aiming to grow revenues above 10% in the medium term and reach EBITDA margins close to 15%. Certain headwinds have led to revenue growth expectations to be close to 6% this year, compared to 20% seen during 2023. The decelerating growth, despite increased marketing spending, combined with the company’s high debt load, leads me to a neutral rating on the shares.

Earnings highlights

Shares have rallied since the company’s Q1 earnings release, where revenue came in close to the high-end of the guidance range, while adjusted EBITDA exceeded the guidance range. The primary driver for the company’s margin expansion was the outperformance of its own-branded products, which have higher gross margins. The products business was further streamlined by the sale of the company’s foreign subsidiary, Mark & Chappell for approximately $4 million plus future royalties. Services segment revenue was nearly flat versus the prior year quarter, as increased revenue from its community clinics was offset by wellness center closures from the second half of last year.

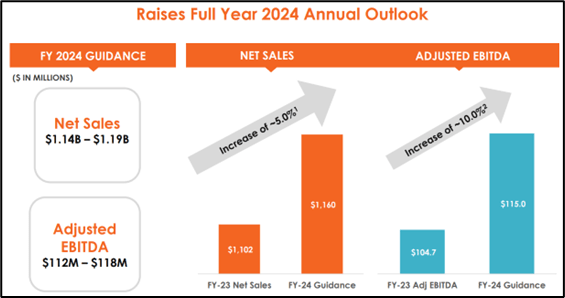

Q1 investor presentation

Following a strong start in Q1, management raised full-year guidance for revenue and adjusted EBITDA to $1160 million and $115 million respectively, as shown above. This implies a 0.4% increase in revenue and a 3.1% increase in adjusted EBITDA at the midpoint, compared to the guidance given during the previous quarter’s earning release. Despite the higher margins from its product revenue, the adjusted EBITDA margin is expected to be held back due to increased marketing spend, which I will discuss later. Nonetheless, the guidance for expected free cash flow was raised from over $45 million to over $50 million.

Key indicators for investors to look out for in upcoming earnings

Higher product margins

In addition to the gross margin improvement expected due to the higher proportion of PetIQ branded products, management also believes operational improvements in manufacturing will further add to margin gains as highlighted by the company’s Chief Financial Officer Zvi Glasman during the Q1 earnings call when he stated:

So in total, we feel really good about margins moving up and to the right this year. We had previously guided 50 basis points plus a margin improvement. We think it’s more like 75 basis points plus now.

Impact from the tick and flea season

The company’s products benefitted greatly from a record high tick and flea season last year. The company therefore faces a tough comparison this year. However, recent trends seem to suggest that growth could be around 4% to 5% from this product category, which is above the 3% that management had modeled in their guidance for this year. These recent trends and observations were described by the company’s President and Chief Operating Officer, Michael Smith who stated:

When we modeled the year, we call it a 5 on a scale of 1 to 10, kind of an average year. If you’re looking at the first three to four months of the season, we would say that the year-to-date score is more like a 6. And what we are projecting for the rest of the year would be consistent with that early read that we’re seeing on the season. So slightly favorable compared to our original modeling which had the category growing 3%.

Increased marketing spend

The company plans to significantly increase its marketing spend this year to raise awareness of its own-branded products. I estimate these additional expenses to amount to between $30 million to $35 million for the full year. Management, however, iterates that the return generated on this extra spending would contribute towards the future growth of the business, as explained by Cord Christensen, the company’s Chief Executive Officer when he said:

But I can tell you that, as we’ve said before, we are measuring it. We’re seeing the return while we’re exceeding our projections and the categories. And we feel good that we’re still going into the right amount of spend for how we can affect our Company’s brand and our sales and profits. So you definitely can see it in the numbers.

Strengthening balance sheet

The company’s net debt stood at $420 million at the end of Q1, up considerably compared to the end of the previous quarter. This is expected to a certain extent due to seasonality, as the company builds up its inventory. I expect its balance sheet health to improve in upcoming quarters as the excess inventory is monetised. Further strengthening of the balance sheet will provide the management team with more flexibility with regard to capital allocation. Acquisitions continue to be a key strategy for creating shareholder value, and this management team has a proven track record, exemplified by the successful acquisition of Rocco & Roxy last year, wherein the company was able to reduce the acquisition multiple by half following cost synergies.

Valuation

Based on management’s guidance for FY 2024 that was discussed previously, the company trades at an EV to adjusted EBITDA multiple of 9.4. This figure takes into account the $420 million in net debt, and is based on today’s share price of $22.25 with 29.7 million shares outstanding. Correspondingly based on the expected FCF of $50 million in FY2024, shares trade at a Price/FCF multiple of 13.2.

In my view, this valuation leaves room for further upside for investors given the company’s expectation to grow revenues above 10% in the medium term and raise adjusted EBITDA margins closer to 15% from around 11% this year. Chewy (CHWY), a significantly larger player in the pet industry, trades at a Price/FCF multiple of nearly 20, despite having comparable growth rates. Likewise, Freshpet (FRPT) which has a revenue growth rate above 25% but remains unprofitable, trades at an EV/Sales multiple of 6.9. In comparison, PetIQ trades at an EV/Sales multiple of just 0.93. According to me, the discounted valuation multiple given to PetIQ by the market is likely due to certain negative factors, which I will discuss in the next section.

Risks

The biggest risk facing the company is its high debt load, which consists of a $292.5 million loan due in 2028 and a $143.8 million convertible note due in 2026. The company’s net debt to adjusted EBITDA ratio is quite high at 3.65, though management expects to continuously deleverage through cash flows generated by the business.

The company has also seen a deceleration in its growth so far this year despite a significant increase in marketing spend. This is mainly attributed to the tougher competition it faces following a record flea and tick season last year. Furthermore, the loss of revenue from its foreign subsidiary and service segment optimisations are added headwinds to revenue growth. Altogether, management expects more than a 500 basis point negative impact to revenue growth this year due to these factors.

Conclusion

The company’s Q1 earnings showed strong growth in its own-branded products, which helped drive margins higher. Despite a valuation that appears attractive, I prefer to stay on the sidelines owing to the company’s decelerating growth with increased marketing spend combined with its high debt load.