Mindful Media/E+ via Getty Images

In the past few months, I’ve written several Seeking Alpha articles centered on Artificial Intelligence. Last month I wrote about Broadcom Inc. (AVGO) in a June 11 article entitled “Broadcom: Eyes On AI But 5G Outperforms On Revenue,” and NVIDIA Corporation (NVDA) in a June 17 article entitled “Nvidia: Why The Company And Its GPUs Will Dominate AI Processors.” In a February 27, 2024 article entitled “Qualcomm: Squeezing Competitors Out Of GenAI Smartphones At The Edge.“

In this article, I more or less combine the focus of these reports on Arm Holdings plc (NASDAQ:ARM) and its chips used in both smartphones and PCs, enabling advanced on-device AI capabilities as well as AI in Data Centers.

Data Centers

ARM is steadily increasing its presence in the AI data center sector. Major cloud service providers Amazon.com, Inc.’s (AMZN) AWS, Alphabet Inc.’s (GOOG), (GOOGL) Google Cloud, Microsoft Corporation’s (MSFT) Azure, and China’s Alibaba Group Holding Limited’s (BABA) Cloud, Tencent Holdings Limited’s (OTCPK:TCEHY) Cloud. And Huawei Cloud.

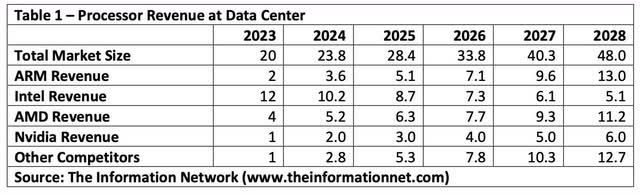

The projected compound annual growth rate (“CAGR”) for this market is 19.1%, growing from $20 billion in 2023 to $48 billion in 2028 according to The Information Networks’ report Hot ICs: A Market Analysis of Artificial Intelligence (AI), 5G, Automotive, and Memory Chips.

A key factor, which will be described later in this article, is ARM’s Neoverse platform, tailor-made for high-performance and scalable computing, providing ARM with advantages against Intel Corporation (INTC) and Advanced Micro Devices, Inc. (AMD).

I estimate that by 2028, ARM’s revenue in the AI data center market will reach $13 billion, representing 27% of the market, as shown in Table 1.

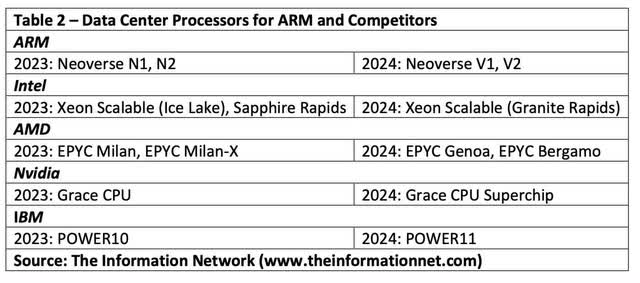

The processors for these companies in 2023 and 2024 are as follows in Table 2:

A key to the success of ARM at the data center is it offers an innovative alternative to traditional GPUs for data center workloads

The Nvidia Grace CPU built on ARM’s Neoverse architecture, is an alternative to traditional GPUs for data center workloads, excelling in high-performance computing (HPC) and AI tasks. By integrating the CPU with ARM Neoverse, the scalability makes it ideal for modern data centers. Unlike GPUs, which are power-intensive, the Grace CPU Superchip delivers complex computations with reduced power consumption, providing a balanced, efficient solution tailored for next-gen infrastructures.

According to Nvidia Developer:

“The Nvidia Grace CPU is the first data center CPU developed by NVIDIA. Combining Nvidia expertise with Arm processors, on-chip fabrics, system-on-chip (SOC) design, and resilient high-bandwidth low-power memory technologies, the Grace CPU was built from the ground up to create the world’s first superchip for computing. At the heart of the superchip, lies the NVLink Chip-2-Chip (C2C). The NVLink-C2C enables the Nvidia Grace CPU to communicate at 900 GB/s bidirectional bandwidth with another Nvidia Grace CPU or the NVIDIA Hopper GPU in the superchip.

PC Edge AI Market

Edge AI involves using artificial intelligence in an edge-computing environment. In this section, the edge device is the PC. By processing data at its source, PCs can make intelligent decisions quickly without uploading or downloading data from the cloud or data center.

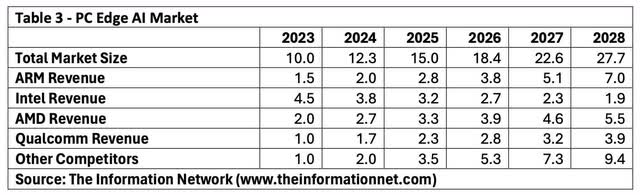

The PC edge AI market is set for outstanding growth, with an expected CAGR of about 20.3% from 2023 to 2028, as shown in Table 3, ARM’s architecture, through partnerships with companies like Apple Inc. (AAPL), has demonstrated its ability to utilize its processors for PCs and laptops. Enabling devices to make smart decisions quickly, without the need to upload or download data.

Apple’s M1 and M2, employing a customized version of Armv8 chips and the Armv9 in the M3, epitomize the potential of ARM-based processors to challenge Intel and AMD in the PC market. I forecast ARM’s revenue in this to rise from $1.5 billion in 2023 to $7 billion in 2028, representing a strong market penetration of ARM-based solutions in PC edge devices.

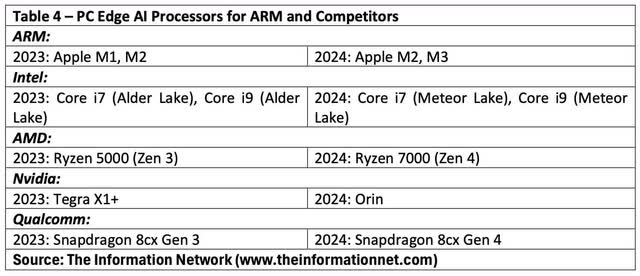

The processors for these companies in 2023 and 2024 are as follows in Table 4:

Smartphone Market

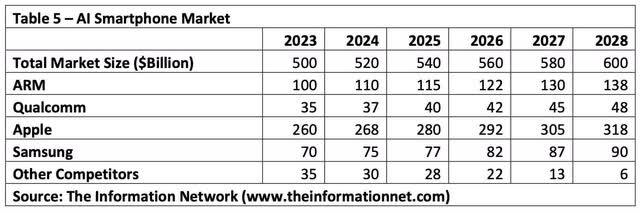

While the smartphone market is more mature, it continues to grow with increasing AI integration for increased functionality of the device. As ARM processors are in over 95% of smartphones globally, I forecast that ARM’s projected revenue from AI processors will grow from $100 billion in 2023 to $138 billion by 2028, as shown in Table 5.

The top two smartphone companies, Apple and Samsung Electronics Co., Ltd. (OTCPK:SSNLF), rely on ARM architecture for their processors.

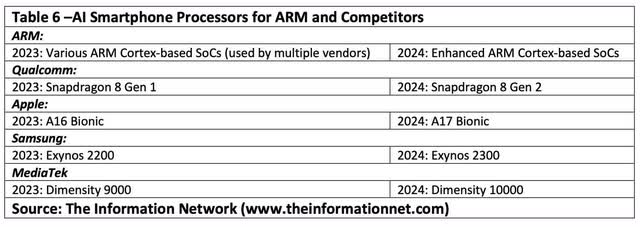

The processors for these companies in 2023 and 2024 are as follows in Table 6:

Arm v9 Architecture

The Armv9 architecture is central to ARM’s strategy across multiple markets, including AI data centers, PC edge AI devices, and AI smartphones, offering substantial enhancements for ARM processors. The broad adoption of Armv9 by leading industry players underlines its critical role and growth potential from 2023 to 2028.

Below are Armv9-based processors incorporated into the processors previously discussed:

AI Data Center Market

ARM Processors:

- 2023: Neoverse N1, N2.

- 2024: Neoverse V1, V2.

PC Edge AI Market

ARM Processors:

- 2023: Apple M1, M2.

- 2024: Apple M2, M3.

Smartphone Market

ARM Processors:

- 2023: High-end smartphones use the Cortex-X2 and Cortex-A710, which are based on Armv9.

- 2024: Upcoming Cortex-X3 and Cortex-A715 processors, part of the Armv9 family.

Integration in Competitor Products

QUALCOMM Incorporated (QCOM):

- 2023: Snapdragon 8 Gen 1. Contains Cortex-X2 and Cortex-A710 cores that are based on Armv9.

- 2024: Snapdragon 8 Gen 2.Will include advanced Armv9 cores such as Cortex-X3 and Cortex-A715.

Samsung:

- 2023: Exynos 2200. Contains Cortex-X2 and Cortex-A710 cores that are built on Armv9.

- 2024: Exynos 2300. Updated Armv9 cores such as Cortex-X3 and Cortex-A715.

MediaTek:

- 2023: Dimensity 9000. Armv9 contains Cortex-X2 and Cortex-A710 cores.

- 2024: Dimensity 10000. Advanced Armv9 cores.

Investor Takeaway

The AI market is on track for substantial growth across multiple segments, including AI data centers, PC edge AI devices, and AI smartphones. ARM’s Neoverse platform, which includes processors such as Neoverse N1, N2, V1, and V2, provides important improvements in performance and efficiency for data centers and cloud computing,

BofA anticipates that the transition to Arm’s v9 architecture, which could potentially double or increase royalty rates by 4-5%, alongside a complete compute solution that might quadruple or boost rates by 8-10%, will be significant growth drivers.

- Thus, I expect ARM will compete successfully with industry front-runners Intel and AMD. ARM’s revenue in the AI data center market is projected to rise from $2 billion in 2023 to $13 billion in 2028, leading to an increased market share of 27%.

- In the PC edge AI market, ARM’s relationship with Apple and the integration of Armv9 architecture in future M-series chips will be a catalyst for ARM’s strong revenue growth from $1.5 billion in 2023 to $7 billion by 2028.

- In the smartphone market, ARM continues to dominate, powering over 95% of smartphones worldwide, with expected revenue growth from $100 billion in 2023 to $138 billion by 2028.

As noted above Qualcomm with its Snapdragon series, Samsung with its Exynos chips, and MediaTek with its Dimensity processors all use ARM’s advanced cores.

Investors and readers of this article should not consider an investment in ARM as an alternative to NVDA, as they are not direct competitors and instead, their business models are complementary as noted above with the Nvidia Grace CPU built on ARM’s Neoverse architecture. Nvidia has also used ARM architecture in its Tegra processors.

Indeed, ARM’s architecture has been centered on its use in mobile devices, but is increasingly found in data centers. However, the synergy in collaborative ventures between the two companies, manifested in the Nvidia Grace CPU serves as a trend in the industry between the two companies.